The Government claims the 'Your Future, Your Super' (YFYS) reforms that passed the Senate last week are “the most significant reforms to superannuation since the introduction of compulsory superannuation in 1992.” Considering how often superannuation rules change, that’s quite a claim. The legislation seeks to reduce the number of multiple accounts and hold super funds accountable for their performance. Both moves have supporters and critics, but how do they stack up?

This review of the legislation is in three parts:

- Industry structure and summary of changes.

- A transcript of the Minister responsible for superannuation, Senator Jane Hume, speaking on ABC Radio the morning after the legislation passed.

- An analysis of the likely impacts.

1. Industry structure and summary of changes

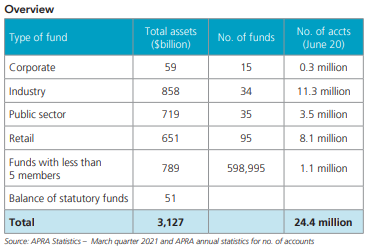

The $3.2 trillion in super is greater than Australia’s GDP of about $2 trillion and the market value of all Australian listed companies of about $2.6 trillion. As shown below, industry funds are the largest segment at $858 billion, followed by SMSFs at $789 billion, public sector at $719 billion and retail funds at $651 billion. The total in MySuper products, the initial target of YFYS, is $846 billion. Treasury estimates there are 6 million multiple accounts.

The stakes are high and the reforms affect the future retirement of millions of Australians.

MySuper products are 27% of superannuation funds but they are the only funds employers can nominate as defaults. At the moment, the performance tests exclude retirement funds where arguably the most protection of large balances is required. Coverage will extend to ‘trustee directed’ products from 1 July 2022 when Treasury believes 90% of APRA-regulated assets in accumulation will be included.

Here are some extracts from the Government’s media announcement:

- The passage of the Treasury Laws Amendment (Your Future, Your Super) Bill 2021 will save Australians $17.9 billion over 10 years.

- Having your superannuation follow you, preventing the creation of unintended multiple superannuation accounts when employees change jobs. This will commence from 1 November 2021.

- Making it easier to choose a better fund, with access to a new interactive online YourSuper comparison tool. This will commence from 1 July 2021.

- The Government will require superannuation products to meet an annual objective performance test. Those that fail will be required to inform members and persistently underperforming products will be prevented from taking on new members. Members will be notified by 1 October 2021 if their fund fails this test.

- Increasing transparency and accountability, with the Government strengthening obligations to ensure trustees only act in the best financial interests of members and provide better information regarding how they manage and spend members’ money.

2. Jane Hume interviewed the morning after the legislation passed

Senator Jane Hume was interviewed by Sally Sara on ABC’s Radio National on 18 June 2021 for 10 minutes from the 54.40 mark here. This is an edited transcript.

JH: We think that a huge number of Australians are going to take the opportunity to switch because now they've got an online performance tool comparison tool, so they can see their funds, compared to other ones. One of the great inefficiencies in the system is the fact that people are disengaged, that it's a compulsory system where essentially they give up $1 in every $10 of everything that they earn, and potentially quarantine it for 40 years. Our objective is to make sure that the super system works much harder for Australians.

SS: There are concerns that some people may run into difficulty with the life insurance that's attached to the super. What guarantees are there if people are changing jobs and changing industries, for example, going from a relatively safe industry to one that's more hazardous?

JH: We've tried to find some details on this and in fact it's been difficult because by far and away, the vast majority of superannuation funds have insurance policies attached to them that don't have any occupational exclusions at all. So it doesn't matter when you started life as a barista and ended up a crane driver. If you stay with the one fund you will still be covered with the life insurance and total permanent disablement. Now that said, we have charged Treasury with doing a review of all insurances within superannuation.

SS: But there are no safeguards in this legislation. Is that right?

JH: Well, there is no reason why anyone should feel that if they had life insurance within their superannuation, and they switch jobs, that they wouldn't be covered. They should be covered, there are no occupational exclusions.

SS: How many funds won't be covered by the performance benchmarking?

JH: The first challenge will be all the default MySuper products. Now, that is the vast bulk of products that are out there, certainly the vast majority of new inflows each year, because those are the default products. In tranche two in one year, we will be dealing with products that aren't default, but are trustee-directed. And that will cover 90% of superannuation money out there and certainly the vast majority of the flow.

There is one cohort of products that are harder to measure, and we have committed Treasury to working out a way to do that. They will be the final tranche. We want to make sure that every fund is serving (members), but these are non-MySuper products that came in for a lot of criticism under the Banking Royal Commission.

SS: Why delay?

JH: Because it's such a small amount of money in them. In fact, the vast majority of money is in the default of MySuper products. They're the ones where the data exists and APRA is already monitoring those.

SS: The Shadow Minister Stephen Jones has described these changes as a dog's breakfast. How can you guarantee that workers will be better off?

JH: We can guarantee that workers will be better off if their funds are better performing. We can guarantee that if your superannuation follows you and you don't get two sets of insurance premiums and two sets of fees, that you'll save around $2.8 billion over the next 10 years. And we can guarantee that without waste in the system through more transparency and accountability, we can save over a billion dollars, and by empowering members to engage better, this saves around $3 billion a year on Treasury estimates. Getting rid of the underperforming tail of funds that have been hiding behind the skirts of the good performing funds for so many years.

3. Likely impacts of YFYS

a) Insurance and member turnover

The basic principle of ‘stapling’ a fund to a person for life has appeal, to avoid multiple small accounts and fees for people who change jobs. Most young people are disengaged from super and did not know that they always had the ability to take their super to another fund.

In the interview, Jane Hume is underplaying the life and disability insurance problems. Some retail funds have occupational exclusions. A fund such as Mine Super, which draws members from the mining industry, has special insurance to recognise the dangerous work conditions. It might be better for someone starting in mining to transfer to a new fund for the improved insurance arrangements. Similarly, Cbus Super members mainly come from the construction industry, and CEO Justin Arter said:

"A Treasury review of unspecified outcome or timing will do nothing to mitigate the immediate impacts for workers in hazardous sectors. Within months workers in hazardous occupations are at risk of being stapled to a fund containing exclusions or unfavourable terms and conditions because their existing insurance cover has not been tailored to their new job. Despite paying insurance premiums, stapled members in heavy blue-collar occupations or people working at heights may not be covered. Members and their families will likely only discover these exclusions when tragedy has struck and they try and fail to make a claim against cover they believed they had."

There is also no guarantee that the old fund to which the member is stapled will perform as well as another fund. Superannuation defaults are selected by the employer not the employee. It is common for super funds to market and nurture relationships with employers, and there are many reasons why a fund is chosen.

It is also likely that not much will happen at the first performance warning date. Disengaged members are not likely to go to the APRA website and work out how to find a better fund. Many members will not be able to make an informed comparison, and different options carry different risks. Even at the second annual performance warning, many existing members are unlikely to act. Employees will remain stapled to underperforming funds.

Which means the heavily disengaged may be left behind as more-engaged members leave, with their redemptions funded by the sale of liquid assets. The remaining portfolio may be less liquid or otherwise impaired.

The YFYS legislation confidently states:

“The YourSuper comparison tool will be available on an interactive website designed to make it easy for beneficiaries to choose a superannuation product based on fees and performance information.”

To achieve the desired results, APRA will need to become active to move members from existing underperforming funds.

The inability to accept new members will be a massive problem for some super funds as it will cut off the inflows which usually finance outflows due to withdrawals such as pensions or from redemptions. There are around 25 funds expected to fail the performance test. Will these funds be allowed to explain why they ‘underperformed’ when they communicate with their members?

b) Measuring underperformance

The most difficult part of the YFYS reforms is determining whether a fund has genuinely underperformed or simply not matched the benchmark measurement. Investment performance relative to an index is affected by many variables such as a market timing or style rather than a fundamental shortcoming in an investment process. Styles come and go and there is a strong possibility that fund members will be encouraged to switch from a fund just as its style comes back into favour.

We only need to look at the style rotation from growth to value that is currently underway (although there are signs it is going back) to see how manager and style selection can have a major impact on performance. Some of Australia’s most prominent and experienced fund managers have struggled as their style has been out of favour for long periods, as explored in this article.

APRA explains how the comparison will work this way:

“Each year APRA will construct an individual benchmark for every MySuper product based on an individual product’s portfolio asset allocation, taking into account fees, tax and other relevant assumptions. Each product will then be compared annually against their benchmark.

Products that underperform their net investment return benchmark by 0.5 percentage points per year over an eight-year period will be classified as underperforming. For MySuper products that were in place from 1 July 2014, their first performance test will be based on seven years of performance data. On an ongoing basis the test will apply over an eight-year period.

To ensure funds are all held to the same standard, the test will be set in regulations by the Government and administered by APRA. APRA will publish the results of the test.

The new performance framework will now be the primary method for measuring underperformance in the superannuation sector and the APRA Heatmaps and the annual member outcomes self-assessment under existing law will be amended accordingly.”

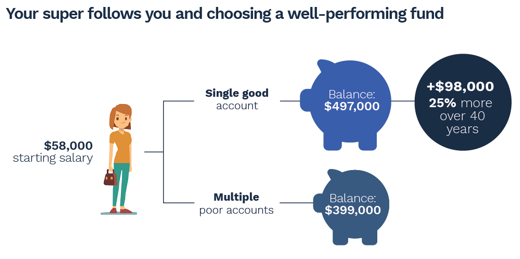

This illustration is wishful thinking. It assumes a person will find a single better fund for 40 years (!) and then be 25% better off. It will be more a matter of timing luck over such a long investing period if the first fund a person joins permanently outperforms through dozens of investment management and market changes. The team managing the money will rotate multiple times and take different views each time.

Let’s look deeper into the performance calculation itself, remembering that it only needs a fund to fall a small 0.5% pa under its benchmark to flash a warning and be required to advise members of its terrible efforts.

First, APRA has announced it will compare fund performance with the trustee-approved strategic asset allocation (SAA) of the fund. However, some funds don't have an SAA while those that do are often expressed in general terms, such as equities 50%, bonds 40%, cash 10%. In the comparison, APRA might take the equities weighting of 50% and compare actual returns against the S&P/ASX300 index. But tactical asset allocation (TAA) decisions in the fund might weight conservatively in an expensive market, allocating 40% to equities. The fund may do well in a falling market or poorly in a rising market. And vice versa if weighted at 60%. That does not mean the fund was poorly managed. The trustee might legitimately focus on protecting capital in an overvalued market.

The super industry believes, therefore, that funds are likely to report their actual asset allocation to APRA as the benchmark to judge against, rather than the SAA. But APRA says:

“Actual asset allocation is inherently unstable and is affected by market movements: using actual asset allocation to construct the benchmark portfolios will only measure a product’s performance relative to asset class benchmarks i.e. value added or detracted from asset class implementation only.”

The selection of the asset allocation used by APRA to benchmark the fund will be critical for the performance review.

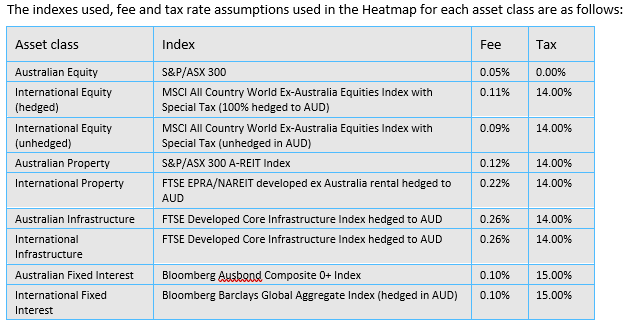

Second, APRA uses indexes for its Heatmap, as shown below, which might differ from the benchmarks traditionally used by the fund (the actual indexes used for the performance test might be slightly different than the Heatmap).

There are hundreds of indexes in the market, and choice of index might change the way a fund invests. The only Australian equity index fund is the S&P/ASX300 and for global allocations, there is no emerging market index. If a fund uses different benchmarks, there is a basis risk between the two indexes, such as small caps versus large caps, emerging markets versus developed markets, credit bonds versus sovereign bonds. Should a fund be pushed away from a small cap portfolio because the benchmark is the ASX300, dominated by large caps?

APRA will reduce the benchmark performance by the index fee, such that any super fund paying more than an index fee to an active manager will face a higher hurdle. For example, if the S&P/ASX300 index delivers 10% less 0.05% fee, the benchmark will be 9.95%. But a fund using an active manager charging 0.5% will need the manager to achieve 10.45% to cover the fee plus the index. It might push more trustees to index management.

There will also be an inability to check APRA’s calculations, as it cannot provide the index data:

“Index level data are subject to confidentiality under the terms of the licensing agreements with the index providers.”

Third, some funds are more focussed on protecting capital with defensive investments or operate a CPI-plus objective, rather than comparing themselves with peers or benchmarks. They may need to change how they invest. For example, Mark Rider was appointed CIO of Christian Super a year ago, and he told Investment Magazine:

“The performance of the fund, probably over the medium term, has been below expectations versus the Heatmap, or the proposed APRA performance test, where we’re outside of that 50 basis points of underperformance. One of the things about the fund, and this all predates me coming on board, was that the fund was focused very much on the CPI-plus objective and it had much more of an absolute return focus. One of the key things behind [this] was that the fund was set up … not really with a very close focus on peers and not with the type of reference portfolio which the APRA heat maps and the performance tests are about. That’s brought out a very significant change in the way that the fund thinks about portfolio construction, how it thinks about some risk in the portfolio.”

The performance test does not address absolute returns to members. A highly defensive fund could deliver a return of, say, 1% and pass the performance test while a growth fund could have a return of high single digits but fail the test.

Fourth, as noted by the work of The Conexus Institute, where risk and asset allocation can be separated into longer-term (strategic) and short-term (tactical) decisions, “Overall, this represents a multidimensional problem which makes performance assessment a complex exercise.” It cites research which finds:

- Asset allocation explains about 90% of the variability of a pension fund's returns over time.

- Asset allocation explains about 40% of the variation of returns among funds.

The Institute reports that allocating 10% more to growth assets rather than defensive over the last eight years would have added 57bp pa (0.57%) over that time, while allocating 10% more to global shares rather than Australian shares would have added 43bp pa (0.43%) for the eight years.

APRA also explains its assumptions about some listed and unlisted assets:

“There are multiple ways of investing in infrastructure and property assets, for example through listed vehicles (e.g. REITS) or through unlisted investments (e.g. the direct purchase of property). The method of investing in these assets has an impact on the types of exposure provided. Listed investments typically have a high correlation with equity investments and therefore offer limited protection in the event of an equity market downturn. APRA has accordingly classified these assets as 100% growth.

While unlisted real asset investments are sensitive to economic conditions, they also demonstrate some characteristics associated with defensive assets, such as income generation. To account for the slightly more defensive nature of unlisted assets, APRA has categorised these assets as 75% growth and 25% defensive.”

Fifth, the test focusses on performance but some asset allocation decisions are made to reduce risk rather than enhance returns. It also ignores improvements around governance, reducing implementation risk, sustainability and ESG principles.

Even APRA admits:

“The Heatmap does not provide the complete picture of the outcomes that a MySuper product provides to individual members and other aspects should be considered in determining whether a particular MySuper product is appropriate for an individual member.”

Final comments

Comparisons between funds and benchmarks rely on assumptions, and 0.5% could be more about noise than a poorly-managed fund. What happens when a fund starts to do well the year after it was prohibited from accepting new members and after existing members have been encouraged to leave? Ranking funds by returns also fails to recognise the risk accepted to make those returns.

One of the industry’s favourite disclaimers warns about using past returns as an indication of future returns. ASIC has an entire policy on why past performance may be misleading, such as:

“Where past performance information is used to support a claim about an entity’s skill or good performance (overall or in a particular sector), it may be misleading to use past performance selectively so as to exaggerate the entity’s success or disguise its lack of success.”

Yet here we have the future of many funds determined by their recent past performance.

This article is not saying poorly-performing funds should simply be tolerated forever but there is a better way to manage them out of the default superannuation system. APRA has the data and the ability to regulate super funds. It should be within APRA’s ability to closely monitor these funds and engage with trustees over a couple of years. This consultation process would give the fund a chance to explain why it ‘underperformed’, and if dissatisfied, APRA could then require changes or mergers. This process would be better than forcing the decision on to a disengaged and less informed public with unintended adverse consequences.

Graham Hand is Managing Editor of Firstlinks. This article is general information and is based on an interpretation of relevant legislation at the time of writing.

Thanks to David Bell, Executive Director of The Conexus Institute for comments on an earlier draft.