The key reason for concern about exposure to equity markets is the over-pricing in much of the market in the US, Europe and UK. The US stock market makes up more than half of the global market capitalisation and what happens in the US echoes around the world.

We have been relatively bullish on US shares since the start of the current ‘Quantitative Easing’ and technology boom, especially stimulated by smart phones, since 2012. It has been a tremendous rally, with the US broad market returning an incredible 140% in the past five years led by tech giants Apple, Amazon, Facebook, Google, Microsoft, and the like. The problem is not profits or dividends as both have been rising strongly during the boom, and the current profit reporting season has seen more double-digit profit growth. The problem is that everybody has come to expect double digit profit growth as the norm, but it is not sustainable and never has been.

Downside risk now dominates

Prices are so high and profit growth so strong that there is now little room for error. We are at a point where there is more downside than upside. The chance of share prices doubling in the next year or so is small, but share prices could easily fall dramatically and languish for years – as they have done several times in the past.

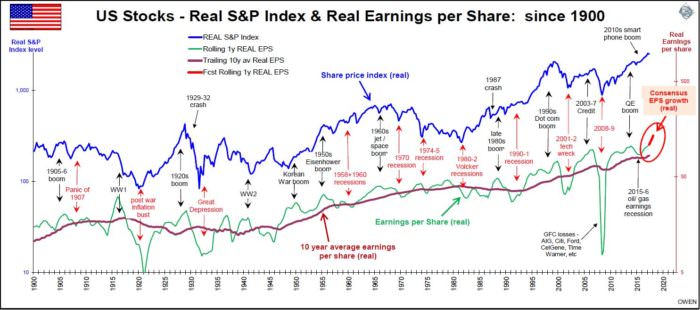

The chart below shows the broad US stock market index in real (inflation-adjusted) terms (blue line) since 1900. The green line shows aggregate annual company earnings (profit) per share across the market. Profits oscillate up and down wildly through booms and busts. The maroon line is the 10-year average real earnings per share. This is much smoother.

Real profit growth (maroon line) has averaged just 2% per year for the past couple of centuries. In that time, America has grown from being an ‘emerging market’ to the largest economy in the world in which its leading companies dominate most industries on the planet. Even in recent decades, real profit growth has still averaged around the same 2% per year.

Click to enlarge

Watch for complacency

Company profits (green line) rise strongly in booms as they are doing now. The problem is that whenever the green profit line rises too far above the maroon trend line as the booms progress, people become complacent and set their expectations too high. They expect double-digit growth to last forever. Whenever boom-time profits reach beyond about 30% above the long-term trend, share prices tend to snap back sharply in sell-offs. The last big sell-off was the 2008-2009 ‘GFC’.

The profit line is currently 30% above its long-term trend and that is on a par with numerous prior booms before sell-offs. So we are in dangerous territory. A further concern is that the current market expectations of profits for the next couple of years (red line on the far-right end of the green profit line) is for further astronomic profit growth, heading into the stratosphere.

For the current tech boom to continue at the same pace as it has been to date, Apple, Amazon, Facebook, Google, Microsoft, etc would need find a new planet, fill it with another 7 billion people and then sell phones, apps and software to them all within the next few years! Elon Musk at Tesla is doing his best, but it will not be quick enough.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.