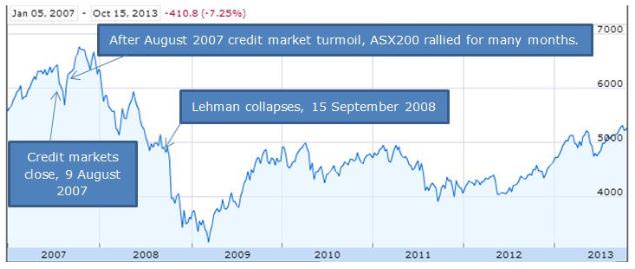

The collapse of Lehman Brothers in 2008 is often seen as the catalyst for the Global Financial Crisis, which wiped trillions of dollars from global markets and shook confidence in financial systems across the world. The GFC actually started a year earlier in the global credit markets, but the equity markets ignored the warning signs. With hindsight, everyone had the chance to exit shares at elevated prices with plenty of notice, as the credit markets were screaming for all to see, in every part of the world.

As Graham Hand tells Gemma Dale of nabtrade, panic hit the multi-billion dollar borrowing programme he was managing a full 13 months before the Lehman crisis. In this fascinating and timely podcast, Graham discusses:

- How global funding markets effectively closed overnight

- The warning signs as a subprime debt crisis swept across the Atlantic

- How equity markets ignored the signals for over 12 months before collapsing, and

- What he learned, including steps he takes to protect his investments from similar risks in the future.

S&P/ASX200 January 2007 to October 2013, including GFC.

The equity market reached new highs after the August 2007 close of credit markets, and even kicked up again towards 2008 mid-year.

You can access this and previous episodes of the Your Wealth podcast from nabtrade on iTunes, Podbean or at nabtrade.com.au/yourwealth.

nabtrade is a sponsor of Cuffelinks. For more articles and papers from nabtrade, please click here.