The most confounding thing about financial markets in 2020 was that, in totality, the mood of the global equities market seemed completely different than the mood of everything else happening to humanity – i.e., millions of lives lost worldwide, ongoing concerns for health and employment, political instability, racial injustice, and the list goes on ...

Market paying more for less earnings

The MSCI World Index in the calendar year delivered a positive return of almost 16% (trading in a 46% range after a year-to-date low of -30% at the end of March) while the annual earnings of companies within the index are expected to have fallen by 7%.

This represents a price-earnings (P/E) multiple expansion of around 25%.

During 2020, the price appreciation of public equities reflected a high level of optimism about the ability of the global economy to recover from the pandemic and come out stronger than before. In 2021 we believe that the listed price of publicly traded companies will more closely tie to the underlying near-term earnings trajectory and financial strength of those companies.

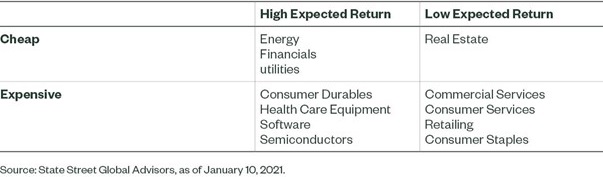

While valuation is an important theme when we select stocks, we find attractive stocks at both ends of the price-to-book valuation spectrum. There are cheap stocks we like, and there are cheap stocks we don’t like; expensive stocks we like, and expensive stocks we don’t like.

Among stocks that look expensive as measured by price-to-book ratio, we see a subset as attractive once we conduct a nuanced analysis of where they derive their value.

For example, in developed markets, tech hardware and semiconductors have average or slightly above average value scores according to our measures, despite being extremely expensive on price-to-book alone.

Figures 1 and 2 show that we expect high returns to be found among both cheap and expensive stocks.

Figure 1: Developed market sector return expectations by sector valuation

Figure 2: Emerging market sector return expectations by sector valuation

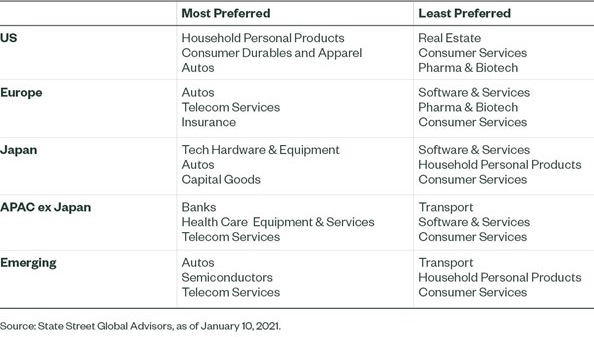

While highly-volatile stocks had a very strong rebound in the fourth quarter of 2020, we do not expect this to continue much into 2021. In both emerging and developed markets this means we will stay away from most stocks in the consumer services segment, where risks are still high.

Price momentum

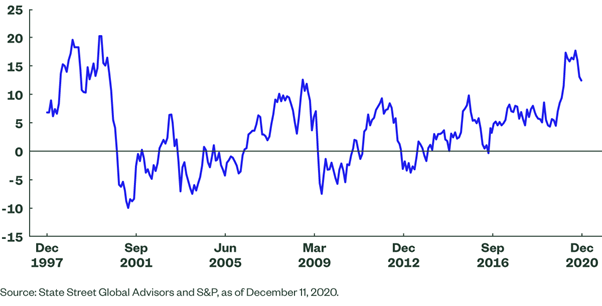

During 2020, we were concerned regarding market concentration in expensive and high-momentum stocks, and we are still concerned about companies that may, due to their size, impact market indices in aggregate if they pull back. Figure 3 shows that the embedded price momentum built into the S&P 500 over the past few months reached levels not seen since the height of the dot-com bubble.

Figure 3: Embedded price momentum in S&P500 Index (11-month return, lagged one month)

Opportunities in 2021

Since market concentration in expensive, high-sentiment stocks reached all-time highs last August, some out-of-favor stocks are showing signs of improving sentiment and creating better opportunities for us to find companies that tick all the boxes.

In aggregate, the following segments are where we see the greatest opportunity with a nine- to 12-month horizon.

Figure 4: Most preferred and least preferred segments for 2021 by region

The bottom line

After a year of high optimism in equities markets – an optimism that often seemed disconnected from the year’s many challenges – we believe that equity prices will increasingly reflect underlying fundamentals in 2021. Multiple expansion will not be enough. Although market concentration in stocks benefiting from extraordinarily high price momentum remains high, some out-of-favour stocks are displaying improving sentiment, widening the range of stocks that are attractive across multiple themes and dimensions of investment performance.

We stand on the threshold of a new investment reality as COVID vaccines roll out and monetary and fiscal conditions change in response to a global economic recovery.

Olivia Engel, CFA is Global Chief Investment Officer, Active Quantitative Equity at State Street Global Advisers. This information should not be considered a recommendation to buy or sell any security or sector shown. It is not known whether the securities or sectors shown will be profitable in the future. Characteristics are as of the date indicated, subject to change, and should not be relied upon as current thereafter.