Commercial real estate is an asset class in which the range of outcomes varies by subcategory, and outcomes can tighten or widen depending on the inflation outlook. Fundamental research and ongoing engagement with management is a critical input in the investment decision-making process.

The hybrid features of REITs

To place them in their proper context, Real Estate Investment Trusts (REITs) are a hybrid of asset class that resides somewhere between equities and bonds. They’re viewed by investors as equities due to their potential for real capital growth, but also as bonds because of their income streams and focus on consistent capital return through dividend income.

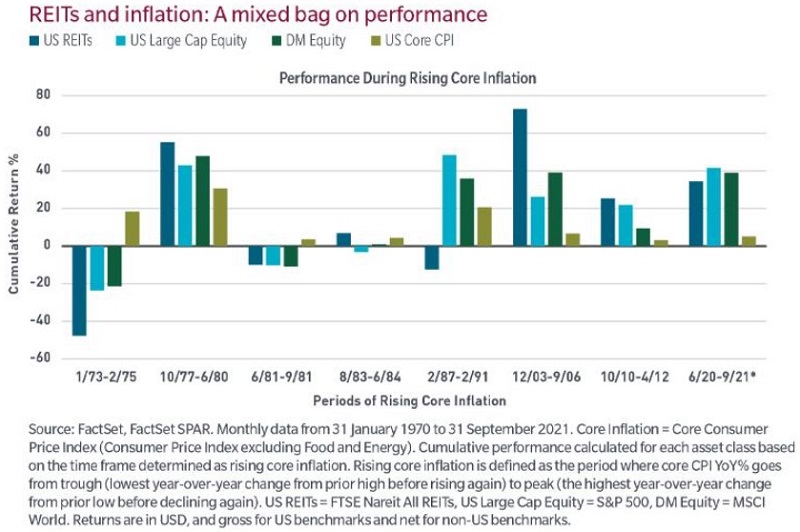

Inflation matters in this asset class, though REIT performance during inflationary periods has been mixed.

The illustration below compares the performance of REITs in the US market (with more data points, liquidity and history than A-REITs) with that of equities during periods when core inflation is rising. While the type and level of inflation matters to the performance of REIT securities broadly, we think the fundamentals — the heterogeneity of the subcategories within the sector and the quality of the management teams and the assets they manage — are more important.

Inflation and different types of REITs

The simplest way to think about REITs is that they are landlords. Because they’re owners and operators of properties for rent, building-specific details such as location, regional supply and demand dynamics and the tenant mix matter. Things like lease structures, including duration of contracts, inflation indexation and replacement costs are also important.

As a general rule, REITs with shorter leases offer greater inflation protection than those with longer ones. Hotel and accommodation REITS, for example, have the shortest leases because hotel room rates fluctuate daily. While they can adjust prices to absorb higher costs, pricing power is a function of supply and demand. Currently, lodging fundamentals are mixed, with leisure demand on the rise but business travel impaired.

While lodging may not be mission critical, having a place to live is, and housing and apartment REITs have become a large part of the public REIT equity universe in the US. It is expected to grow in Australia.

As with lodging, labour and materials inflation are risk factors. At the same time, if replacement costs for comparable assets are rising, which often occurs during inflationary bursts, the intrinsic value of housing or apartment REIT portfolios is likely to appreciate too. Furthermore, if rents rise because of increased tenant demand amid tight housing supply, given relatively short lease durations (typically one year), apartment REITS should be able to pass that asset inflation on via higher prices, as they’ve been doing over the past 12 months.

Short lease lengths are a feature of self-storage REITs too. This industry has been a beneficiary of the pandemic as the work-from-home dynamic has caused many to declutter. The combination of increased demand and short leases equals price hikes and the potential to better absorb higher costs.

Conversely, long-lease subcategories such as grocery, freestanding retail and office landlords are more at risk. While grocery and retail have benefited from a stimulated consumer, office property fundamentals remain challenged. Vacancies are rising, with more tenants cutting back their space requirements as companies allow their employees to work from home. However, there are nuances, and office fundamentals vary by region and country.

While REITs have underperformed equities since the outbreak of the pandemic, strengthening fundamentals have pushed capitalisation rates down and valuations up, making REITs the market darlings of 2021.

However, we believe their continued recovery will be mixed and uneven. Tenant demands were changing before the pandemic and have only accelerated since. Occupancy costs matter more than ever, and efficient tenants will seek out space with the best value proposition. Against that backdrop, we favour landlords in mission-critical industries such as hospitals, medical offices, labs, residential, storage, data centres, industrial and fulfillment centres, among others.

'Just in case' replaces 'just in time'

What we’re hearing from companies is that 'just in time' supply-chain management is being replaced by a 'just in case' approach as many trade efficiency and margin for dependability and market share. The shift is inflationary. After years of labour cost suppression leaving workers feeling left behind, the demand for labour is now outstripping supply. Labour is taking more control from capital, workers are demanding higher compensation and getting it. That, too, is inflationary.

We believe there will be a tug-of-war between secular disinflationary forces such as technology and excessive debt that plagued the last business cycle and the aforementioned sources of the current cyclical upward price pressures. Regardless of where investor’ views fall on this continuum, everyone is thinking about inflation, and particularly how much of it there will be. Too much would have different implications than too little, but the implications of either eventuality would be negative for markets and society.

Like any other asset class, REITs are impacted by inflation, but the impacts vary depending upon the type of inflation and the REIT subcategory. To us, fundamentals and security selection, regardless of the economic and inflationary environment, matter most.

Robert Almeida is a Portfolio Manager and Global Investment Strategist, and Matthew Doherty is a Research Analyst at MFS Investment Management. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.