Let’s say you have saved $1 million to buy a home in a year, or you’re a retiree who cannot tolerate losing any of the capital you live off. Where can you stash your cash safely and retain its purchasing power in real terms over short terms?

Sorry, there’s nowhere.

Investing was once relatively straightforward for highly-conservative investors. As recently as 2012, the cash rate was greater than the 4% annual minimum drawdown required from a superannuation pension account. Further back to the 1990s, periods of double-digit cash and term deposit rates avoided the need to go into anything riskier than term deposits, although inflation was higher.

Official cash rate, 1990 to 2019

Fast forward to now, as we enter the 2020s, there is nowhere to hide that gives capital security, a return greater than inflation and avoids a continual drawdown on a pension.

Many retirees cannot tolerate losses

Recent research by AllianzRetire+ reveals 79% of Australian retirees say they are responsible for their own finances and they need to feel in control of their money. However, only 44% feel secure in their current financial position, and:

“The response from current retirees is to assume a frugal and conservative retirement investment approach to fund their retirement (75%).”

The consequence is that two-thirds of retirees are spending only on necessities, worried about unexpected costs and illness. This lack of confidence leads to a high allocation to deeply-defensive investments, but what exactly is defensive in the current market?

A 2018 National Seniors survey called ‘Once Bitten Twice Shy’ shows a high 23% of older Australians cannot tolerate any annual loss on their portfolio, and only 25% can tolerate a loss greater than 10%. A decade on, the impact of the GFC looms large for many retirees, as the survey quotes a retired man aged 54:

“The main issue with the GFC for me was the reduction in my capital investments of approximately $30,000. Up until that point I would be considered a medium risk investor, however following my loss, I changed to a low risk investor and transferred much of my capital into cash. The income from the cash stream is considerably less than a shares portfolio however I was not prepared to suffer another loss of that magnitude. My attitude has not changed to this day.”

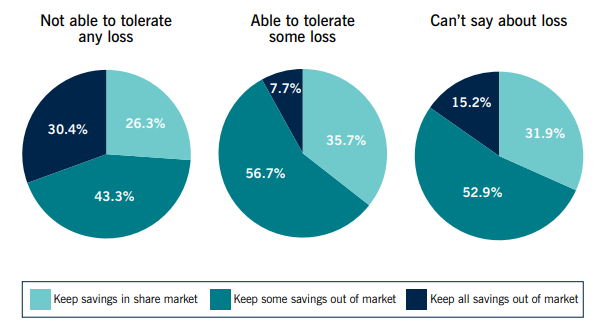

Another National Seniors survey from March 2019, ‘Feeling financially comfortable? What retirees say’, shows the intractable dilemma this creates. Over 30% of the ‘not able to tolerate any loss’ group keep their savings out of equities.

Although data on SMSF asset allocation is notoriously unreliable, they hold about 25% of their assets in cash and term deposits. That’s nearly $200 billion earning a negative real return, an extraordinary loss of retiree income over recent years. Little wonder some economists question the stimulatory impact of lower rates. An estimated $1 trillion of superannuation is in post-retirement accounts.

The current annual CPI inflation rate is 1.7% or 1.95% ‘excluding volatile items’. Many of the items in a retiree budget, such as health and utility costs, are rising faster than CPI. As the last two quarters have recorded 1.1%, let’s say a positive real return requires an investment return of over 2% a year. It doesn’t sound like much, only $20,000 on $1 million.

So what’s available, beyond the spin of fund managers, brokers and advisers dressing up risk with words like diversification and low volatility, and misleadingly quoting last year’s performance?

Current cash and term deposit rates

Three broad categories of short-term investments offer a high degree of capital protection:

1. Bank (or any Approved Deposit-taking Institutions (ADI)) term deposits

The government guarantee on ADI deposits is up to $250,000 ‘per entity per ADI’. Anyone wanting the highest protection on $1 million will need to invest with at least four different ADIs. According to Canstar, the highest term deposit rate for 12 months is 1.7% from a couple of small ADIs, ignoring the 2% from a new startup bank. The highest rate from a subsidiary of a major bank is 1.3%.

2. Online savings accounts

There is a wide range of online accounts paying around 1.5% and up to 2% with so-called ‘promotional and bonus conditions’. These include making a minimum number of ‘tap and go’ transactions a month, minimum deposit amounts with no withdrawals or using a related credit card. As they target genuine retail, there is sometimes a maximum amount, perhaps $100,000.

Anyone who can be bothered monitoring all the rules across multiple accounts can probably eke out 1.5% to 2%, after a heap of paperwork opening new accounts. Really, life’s too short.

3. Cash or short duration government bond funds

Dozens of ‘fixed interest’ funds are now listed on the ASX, but there are only a few genuine ‘cash’ and very short duration government bond funds. Obviously, if they are investing in cash or government securities and taking out their own fees, they cannot achieve much more than the current cash rate.

The largest cash fund in the listed market is the BetaShares AAA ETF, which holds a healthy $1.8 billion at a fee of 0.18%. BetaShares does not pretend it is anything other than: “competitive with ‘at call’ bank deposits and term deposits without the need for bank account opening or locking up capital”. The current interest rate is 1.22%. As with any fund, last year’s rate of 1.9% is irrelevant. What’s done is done, you can’t invest in the past.

If you want the certainty of capital protection with no credit or duration risk, that’s all you can invest in, folks.

What about all the other fixed interest products?

Surely, this is missing a wide range of products that have been launched recently and promoted as alternatives to term deposits. Fund managers have delivered a spate of Listed Investment Trusts (LITs), and bond funds and the like have been offered for decades.

For example, mortgage funds were widely offered as alternatives to term deposits even within the banks’ own branch networks. Funds with five-year mortgage assets offering same day liquidity were an accident waiting to happen. When the GFC hit and investors wanted their money back, the funds were frozen until the loan maturity dates allowed repayment. In most cases, investor capital was not lost but pensioners needing the money waited for years.

Many of the new LITs are worthwhile additions to diversified portfolios, and we have written about them here and here. But the added return is available for a reason, and the investments are fine if this reason is understood and accepted.

Many of the conservative investors who have pumped billions into the new LITs and fixed interest ETFs are the same investors who cannot tolerate share market risk. They have traded one type of risk for another, albeit with less downside and less upside potential. But critically, downside potential there is, and it’s not short-term capital preservation.

An adviser told me recently that some of his clients are using these funds for 'cash management purposes'. But how many retail investors understand ‘spread risk’, ‘duration risk’, ‘default risk’ or ‘liquidity risk’? And what does ‘mark to market’ mean? What can go wrong?

What is ‘mark to market’ and why does it matter?

A bond bought to yield 5% for five years and held to maturity will earn 5% each year for five years (assuming no default). What it says on the box is correct.

However, a bond fund is usually made up of hundreds of bonds, and funds offering daily liquidity must revalue the bonds every day to calculate the unit price or Net Asset Value (NAV). In the case of an ETF or unlisted managed fund, investors enter or exit at this price and there is no maturity date for the fund. If a bond is repaid, the fund manager buys another bond.

It is not possible to invest in a bond fund (other than a government bond fund with very short duration) or any of the recent LITs and guarantee that $100 now will be worth $100 in a year. It could be $105, it could be $100, it could be $95. This article is addressed to the large number of people who cannot accept the risk of $95.

Credit spread risk in corporate bonds

Most investors know about default risk, where a company cannot pay its debts when due. Many investors know about liquidity risk, where there is a poor market for the bonds in a portfolio and money cannot be withdrawn (or in the case of a LIT, buyers disappear). And there are other risks such as duration, where bonds of longer maturity lose more than shorter maturities when rates rise.

But for the purpose of illustrating the risk in many of the new LITs, let’s focus on the credit spread risk in the corporate bond and loan market.

Let’s say a fund manager buys a corporate bond yielding 5% for five years, and this is a spread of 4% more than a government bond. Even if interest rates do not move, a change in the market’s perception of the company might lead to a sell off, and the yield might rise to 6%. That’s a widening of the spread from 4% to 5%. The bond price would fall by about 5% (for simplicity sake, assuming a duration of five years, although duration is less with semi-annual coupons). It does not need the company to default for the bond to lose 5% of its value, and such spread widening for ‘high yield’ credit is common (non-investment grade or high yield bonds used to be called ‘junk bonds’ before the marketing people realised the obvious problem).

You may take comfort from the fact that the fund holds 100 companies, and a loss of 5% on one bond is only 0.05% on the whole portfolio. That is correct, but corporate credits spreads as a whole rise and fall depending on market factors.

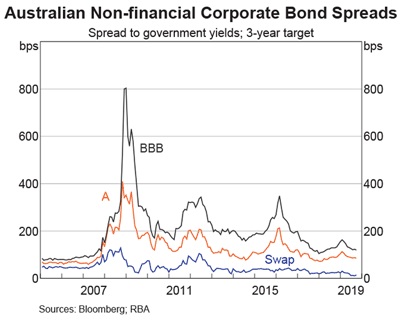

The Reserve Bank of Australia chart (from 6 November 2019) on non-financial corporate bond spreads shows BBB spreads are close to their lowest for 12 years, since well before the GFC, and they move around.

The BBB rating is the bottom level of Standard & Poor’s credit rating where the risk is still considered investment grade. The BB rating denotes ‘high yield’ or ‘speculative’. As many institutional investors are not allowed exposure below investment grade, there is often a big divide between spreads on BBB and BB names.

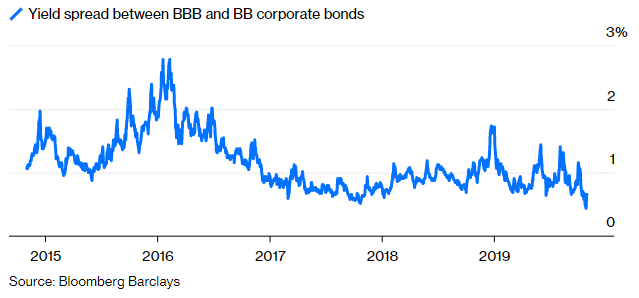

However, in the global search for yield, investors are increasingly heading into riskier investments they may once have shunned. According to Bloomberg, the margin between investment grade and ‘speculative’ grade was at a new low at the end of October 2019. It is a reward for taking risk, but investors are buying BB bonds at a spread of only about 40 basis points (0.4%) above BBB. At the start of 2019, it was as high as 170 basis points (1.70%) and almost 3% in early 2016, as shown below.

Back to ‘mark-to-market, the fall in both interest rates and spreads means bond funds which own BB securities have delivered excellent returns in 2019, and these results are often quoted in offer documents.

But this quoting of past returns is disingenuous on bond funds with rates and spreads at these historical low levels. What matters is the future risk of spread widening and interest rate rises.

The credit deterioration in corporate bond funds is not confined to non-investment grade. In the investment grade bond index, BBB companies now make up over half the index for the first time in a decade.

I stress that including some of these corporate bond funds as an allocation in a diversified portfolio may be appropriate. What is incorrect is to consider these funds as capital protection vehicles over a time period such as one year.

A specific example

Consider the recently-listed KKR Managed Fund (ASX:KKC) which has 60% exposure to ‘global credit’ and 40% to ‘European direct lending’. It launched with a minimum target of $200 million and accepted $925 million. KKR is a major global player in corporate debt with a 120 person global credit team and about US$70 billion in credit strategies.

As shown in the chart below, about 50% of the securities will be CCC-rated, and the vast majority will be sub-investment grade. That’s how the expected high returns are achieved.

KKR discloses the risks, such as this from their offer documents:

“A KKR Managed Fund may hold debt investments that may be classified as ‘higher-yielding’ (and, therefore, higher-risk) investments. In most cases, such debt will be rated below ‘investment grade’ or will be unrated. Borrowers of this type are considered to be at greater risk of not making their interest payments or principal repayments. The market for high yield securities has previously experienced and may in the future experience periods of volatility and reduced liquidity. The market values of certain of these debt investments may reflect individual corporate developments. General economic recession or a major decline in the demand for products and services in which the relevant issuer operates would likely have a materially adverse impact on the value of such securities. In addition, adverse publicity and investor perceptions, whether or not based on fundamental analysis, may also decrease the value and liquidity of these high yield investments.

Commercial bank lenders may be able to contest payments to the holders of other debt obligations of the same obligor in the event of default under their commercial bank loan agreements”.

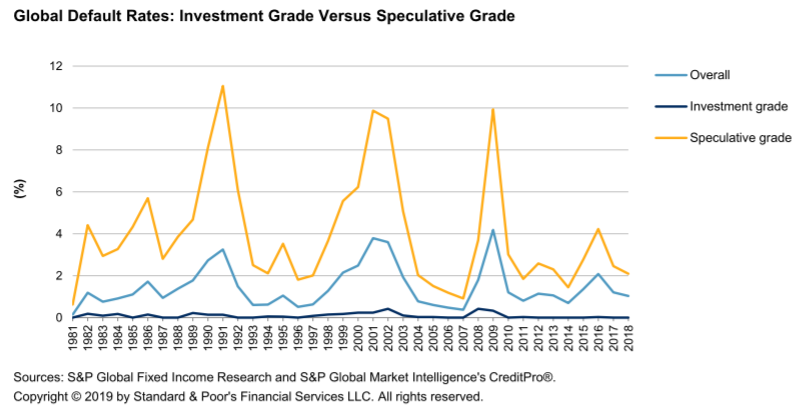

S&P Global Ratings for 2019 show the following default rates:

This chart shows a portfolio of ‘speculative grade’ companies can have a default rate of 10%. KKR is highly-experienced and may not see similar levels.

The fee structure includes a base management fee, a performance fee, a responsible entity fee, recoverable trust expenses and indirect costs, and in the example provided by KKR, it adds up to 1.58% per annum. In a low interest rate world, investors should consider if this is a disproportionate share of the return.

In the unlisted fixed interest market, in recognition that taking high fees from low rates is a hard sell, many fund managers are lowering their fees. In Australia in recent weeks, Nikko, Kapstream, Schroders, Legg Mason and Aberdeen Standard have dropped fees. Bond ETFs are widely available and cheaper.

Investors who take comfort from the current benign conditions in the bond market must accept conditions can turn quickly into a reinforcing spiral. As investors see capital values fall, more attempt to sell. During conditions of poor liquidity, prices fall as weaker investors panic.

I asked Anthony Doyle, a cross-asset specialist at Fidelity International, what he thought of retail investors buying low-rated corporate bonds. He replied:

“I worked on a bond desk for 12 years in the UK. I think that these high-risk asset classes do well until they don’t. It’s important for investors to understand the risks that are involved in investing in essentially one notch above default corporate bonds in CCC."

Why do advisers and brokers put their clients into these funds?

Every relationship between an agent and client is different, and often there is a significant difference in expertise and knowledge which requires the client to trust an adviser. In most cases, this trust is justified.

Reasons why these newer-style exposures are selling by the billion include:

- They are a legitimate part of a diversified portfolio. Fixed interest investments usually offer better defensive performance than equities, and the promise of 6% to 8% returns may be considered adequate compensation for the risk.

- The fund managers coming to the market are among the largest and most experienced in the world, and their experts perform extensive due diligence before investing. For example, KKR has a strong private equity heritage and is familiar with corporate credits outside investment grade. By combining money into one fund, a wide diversity of corporate or loan exposures is delivered in one investment.

- Some of the bond issuers are higher credit quality than KKR's fund, so the quality of the portfolio should be checked.

- Or the elephant in the room is conflicted remuneration, where fees are paid to brokers and advisers to place clients into certain funds. This is a major subject in its own right and will be covered in another article.

Fixed interest for protection and as a risk diversifier

The traditional role of fixed interest, especially government bonds, was to protect a portfolio while providing some income. Investors could be confident about the low or negative correlation with equities. However, it is possible if rates rise on bonds (and prices fall), then equities will also see price falls.

Similarly, non-government bonds are subject to credit spread deterioration and credit default in the face of a declining economy.

There is a role for corporate credit in a diversified portfolio, especially with term deposit rates below 2%, but do not equate 'fixed income' with capital protection. There’s a reason why short-term government bonds are called ‘risk free’. Other bonds aren’t.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.