Scott Bessent, the US Treasury Secretary, recently responded to sharply declining investment asset prices across US capital markets by trying to explain the true rationale behind the Trump Administration’s proposed disruptive trade policy settings. This was prior to this week’s agreement with China for a 90-day tariff reprieve and his further statements that were partly consistent with his earlier musings.

Noting that US capital managers and businesses are driven by capitalistic instincts that are occasionally checked by a swaying tolerance to risk, clear communication is always needed. US equity markets by mid-April had slumped by 15%, and ten-year US bonds touched 4.6% following the so-called Trump Liberation Day.

The ‘Trump play’ that challenged investor confidence and led to market gyrations, now appears to be taking the following course:

- Forcibly disrupt the world order and security settings – attack NATO.

- Announce extreme and confronting tariff policy changes – attack everybody.

- Pivot to disrupt both direct individual trade responses and the development of non–US trade alliances.

- Negotiate aggressively before the dust settles and claim victory – no matter what the real outcome is.

- Tactfully refrain from discussing the real US problem – the massive US fiscal imbalance.

So, what has Bessent communicated to the capital markets?

Across a range of recent presentations and interviews, some public with some private and leaked, Bessent outlined the logic of the trade or tariff changes proposed by the Trump Administration. Underlying most of the commentary was a focus upon the US trade deficit with China and their major manufacturing affiliates such as Vietnam, Thailand, and Cambodia.

Bessent’s comments can be summarised as follows:

- China manufactures too much and under consumes.

- The US does not manufacture enough and over consumes Chinese manufactured goods.

- China should no longer be granted the status of being a “developing or emerging economy”, by either the IMF or WTO.

- Europe needs to be stimulated to increase Government expenditure and towards its own defence capabilities. This will support European economic growth and promote trade with US defence manufacturers.

- The suggested increased tariff rates will ultimately be negotiated down (to a 10% base ex China), but always dependent upon the existence or the perception by the US of enduring export incentives and/or of currency manipulation by trade partners. He noted that there are about 18 countries who primarily account for the $1.2 trillion US trade deficit. Notably, China directly accounts for about US$300 billion whilst President Trump claims it represents a trillion dollars of US economic losses.

- Significant tax incentives (immediate write offs) are proposed for the mobilisation of US capital towards import replacement. Also, red tape will be cut to support US production of both manufactured goods and energy.

- Whilst there is an ongoing review of US Government expenditure (DOGE) there is no likelihood nor is there an intention to reduce the US fiscal deficit to below 3% of GDP in the current Trump term.

- However, the Trump Administration aims to grow GDP at greater than 3% to reduce the debt to GDP ratio. It therefore does not intend to pay down US Government debt, rather to continually roll over debt as it matures.

It is my view that whilst Bessent’s presentations have been informative they lack a degree of credibility. He merely touches, in passing, upon the great fiscal imbalance of the US Government, suggesting that trade deficit is the root cause – which it is not. Nor has he shown how the trade deficit can be sustainably reduced through the export of goods that the US has a comparative advantage in producing and despite an inflated USD.

In essence, Bessent claims that the US will grow its way through its debt and stabilise the debt to GDP ratio which sits at about 105%. Thus, a reset of the world trade order is a necessary first step for this to occur.

However, a review of the last 50 years suggests that a US trade deficit has neither slowed nor affected its growth. The intransigent trade deficit may be a concern, but it is the fiscal position of the US that is a far greater problem.

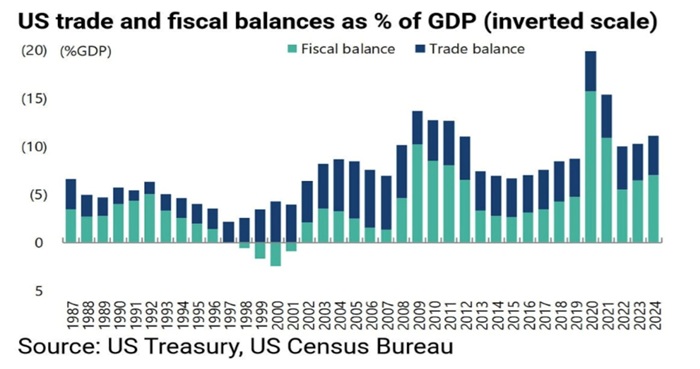

As the following chart shows, the US has not had a trade surplus over the last 50 years. So why is it a problem now? Indeed, the trade deficit has been stable over that period (at about 3% of GDP), whilst the fiscal deficit has grown out of control and has been on a clear upward trajectory from 2014.

My thoughts on Bessent’s message

I believe that Bessent’s messages (prior to the China meeting) were a call (a plea) for US capital markets to not panic and to trust the Trump Administration. Whilst the US stock market is a sentiment indicator of US investors, it is the US ten-year bond yield that is the bellwether of international capital support. Quite simply, the Trump Administration will fail if bond yields rise whilst it is rolling most of its US$34 trillion of debt over the next four years. The debt may not be Trump’s fault, but his policies have increased the risk that the US economy becomes threatened by inflation, recession, and therefore a higher cost for Government debt.

At this point, US capital market participants, including some of the largest Investment Banks and Pension Funds will have been asked to hold their nerve, present a brave face, and to support the economic plan. This will also support the sentiment of foreign capital providers to ensure (hopefully) that they do not lose confidence and drift away from the US.

It is a great game of bluff but Trump and Bessent do hold one wild card - Quantitative Easing (QE). Indeed, I suspect that major US investment groups have a belief that QE will be utilised in the future if needed. Could it be a ‘Trump Put’?

Will the QE wild card be used? Absolutely, if necessary to bring down bond yields. I suspect the looming battle between the US Federal Reserve (Fed) and Trump/Bessent could become the defining moment in the direction of US economic policy settings. China’s trade deal will be important, but it cannot solve the US debt problem.

Indeed, the US has now entered a period of elevated inflation (tariff created), supply disruption (China induced) and a concerned bond market (the Fed inactive). After a decade of unprecedented revaluation, the true value of the USD is suddenly under the microscope. The bloated US fiscal deficit must be addressed.

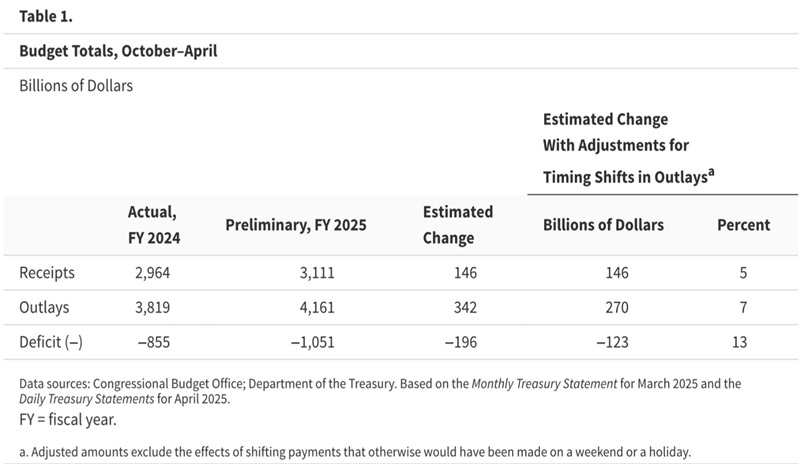

This presents the background to a key point that Bessent has briefly mentioned, but which US capital markets are tactfully or bravely ignoring. As the following table shows, the US fiscal deficit is already US$200 billion worse over the 7 months to April then the previous year’s corresponding period. The Biden forecast deficit of US $1.9 trillion for FY25 (October end) will be exceeded with a US$2 trillion deficit or 6% of US GDP now likely in FY25.

The US cannot balance its budget today, and the Bessent target of a 3% deficit (against GDP) suggests that the US never will. Further, the funding of the US fiscal deficit is highly reliant on confidence being maintained in the US bond market. A weakening USD heightens the risk that foreign capital will exit the US and certainly the US bond market.

It will not be surprising if trade negotiations include a covert understanding for US bond market support from allies such as the UK, Europe and Japan.

A significant QE program, like that utilised in Japan under Shinzo Abe from 2012 onwards, may well be needed to support bond prices and reduce yields because the US interest bill is rapidly rising. Indeed, Bessent recently said that when he was a hedge fund manager, that he had met with the Japanese PM and was most impressed with Abe’s strategy to manage the Japanese economy and its government debt crisis.

Remember in that period Japanese bonds yields were negative under Abe’s direction. It became known as ‘Abenomics’ with ten-year bonds pushed by QE to negative 1%. Further, the Japanese Central Bank pushed out foreign creditors and today owns 53% of all Japanese bonds on issue. It is notable that today the FED today owns about 22% of US Government debt.

On average the US Government is currently paying about 2.5% p.a. for its debt (some US$800 billion of interest). As this debt is rolled over and with a trillion dollars (a least) of new debt created each year, this cost will rise towards 4% pa. The interest bill on this basis will lift by US$0.5 trillion p.a. and so all the work done to reduce the ‘pre interest fiscal deficit’ or ‘underlying deficit’, through tariffs (revenue) and DOGE (lower costs), will be lost.

The funding of the proposed Trump US tax reductions becomes extremely difficult unless bond rates decline and that is where the direction of the Fed and a substantial QE policy come into play. More so when the US Government hits its next debt limit.

In the meantime, and over the next decade, it will be crucial for the US to regrow its manufacturing base and to significantly grow its exports. Reducing imports is far less important and the US should not aim to close out imports from sources that have competitive advantage. To do so will merely create both inefficient and high-cost US economy. Such a policy will not support the US from generating economic growth that grows faster than its debt.

The Trump Administration has embarked on an ambitious plan to restructure the US economy, but the true target is the ‘out of control’ fiscal position. The tariff negotiation and upheaval are a smokescreen to the real Trump play.

So, what could QE mean for investors?

- US bond yields, being the ‘risk free’ rate of return are driven lower and below inflation readings.

- Negative real yields become a feature across US interest markets and flow across other economies.

- This sustains the PER rating for the US equity market, but it does not guarantee strong economic growth – remember the stagnating periods that inflicted Japan and Europe post the GFC when interest rates were set around zero.

- A brief period of asset inflation occurs but it will be checked at some point as economic reality sets in.

- The USD weakens with QE and whilst this creates export potential it does potentially lift inflation.

- The weakening cycle of the USD acts to push foreign capital out of the US as the likelihood of both moderate capital gains and extremely low income returns becomes clear; and

- Gold, precious and industrial metals, revalue against a weakening USD.

John Abernethy is Founder and Chairman of Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

For more articles and papers from Clime, click here.