Weekend market update: The S&P500 in the US rose strongly on Friday, up 1.6%, while NASDAQ recovered some lost ground, rising 2.3%. However, this was at the end of a losing week where the US gave up 0.6% and Europe was down even more on COVID-19 worries. France and the UK are struggling. Friday in Australia produced the amazing result that Westpac, fined $1.3 billion the day before, rose 7.4% on the Government's intention to loosen credit laws. Banks pushed the S&P/200 index to a gain of 1.7% over the week.

***

The US tech index, the NASDAQ, peaked on 2 September 2020 at 12,058 and closed three weeks later at 10,632. On the same days, Apple hit US$137.98 and then fell to US$107.12. These falls of over 10% and 20% seem high but both were simply returning to their early August levels. It's hardly a rout when a month's gains are given back, although Morgan Stanley analysts warned the sell off was only half way done.

The bigger question is whether such a stock correction will scare off the 'Robinhood' traders. Much of the demand for tech has come from new retail investors living the 'markets only rise' dream, buying US$500 billion notional value of stock options in August alone, or five times the previous monthly high. The options sellers who take the other side of the trade cover their exposures by buying the same shares, adding to demand. For the first time ever, options trades exceeded normal share trades on US stock markets in August.

What happens when these new players realise markets do indeed fall and their options are well out-of-the-money and likely to expire worthless? Perhaps they hang on for a rise. As we discussed in this article on retail investors, it is their impact on the actions of professionals that has the most impact on the stock market. The chart below shows the incredible growth (blue line, almost vertical) in 'small trader call buys', that is, stock options bought by retail punters hoping the market will rise. Apple's fall will test the mettle of many of them.

And yet amid the tech 'correction', an eight-year-old cloud-data software company floated with a value of US$70 billion. Snowflake's shares rose from its issue price of US$120 to reach a high on the first day of US$319. At its closing price, it was worth six times more than its last funding round as a private company as recently as February 2020.

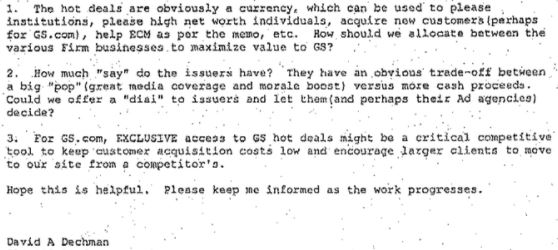

In case you are wondering who gets a piece of the action when first day trading leaves US$4.3 billion on the table, the answer is, those closest to the investment banks handling the deal. It's impossible to receive an allocation unless you know someone or are a big client, with Warren Buffett making a billion on the day. As David Dechman, once Head of Private Wealth Management at Goldman Sachs, confirmed in an internal memo written many years ago, the system allows the rich and connected to become even wealthier (sourced from Bill Gurley's Twitter feed via AFR):

"The hot deals are obviously a currency, which can be used to please institutions, please high net worth individuals, acquire new customers ..."

Does the same thing happen in Australia now? Of course it does. Winning the hot deals is not just about the fees the investment bankers earn. Having said that, the first day of trading on the ASX on Wednesday for the P2P lender Plenti (ASX:PLT, previously RateSetter) closed at $1.30 versus its $1.66 issue price. It hit a low of $1.16 on Thursday suggesting some buyers were there for the stag which never turned up.

This week, a focus on tech and innovation

We continue our Interview Series with Thomas Rice, who manages the innovation fund that delivered 43% in the last year by finding the best new ideas around the world. He describes his biggest positions and what he likes and does not like in global tech. How could you not love a job like that with a world of new tech to pick from?

Then in the high-profile Battery Week, a comprehensive review of Tesla looks at whether the current price can be justified. The market did not like Elon Musk saying major cost improvements could take three years, and Vikram Mansharamani takes a deep dive into the bubble of Tesla's share price.

Adrian Fyffe describes the impact of currency movements on a global portfolio, and ways that Australian investors can access the big US names like Facebook, Apple and Google while minimising costs in FX transactions.

Moving on from tech, Christine Benz takes an unusual look at retirees who have enough money and would rather protect what they have than push for more, while Wade Matterson shows how, even for relatively wealthy retirees, the current age pension provides a safety net if the market falls. It's a reassurance but financial independence is still the best outcome.

Are we facing a W-, V- or U-shaped recovery? Kristiaan Rehder thinks it's more likely a K, with some companies doing very well as the expense of others.

In the final three articles by Leisa on our Survey, she covers your views on the increase in Super Guarantee and fall in JobKeeper, how you have changed your investment portfolio and your economic outlook, and how COVID-19 has affected you including long-term consequences. There's a fascinating collection of hundreds of comments on how you think the world will change ... or not.

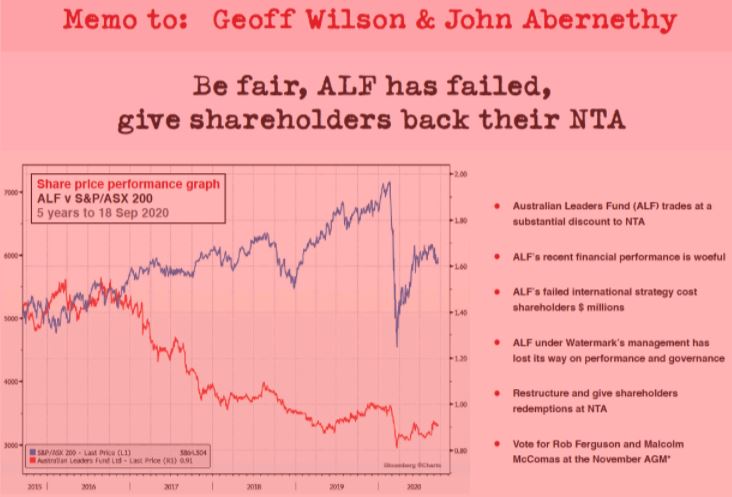

In a footnote to last week's article on how LICs and LITs are facing challenges, another conflict appeared in the media this week with high-profile bankers Rob Ferguson and Malcolm McComas running the following advertisement in The Australian Financial Review.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website