After looking dubious for some months, President Trump's chances of winning the next election are roaring back, with his campaign focusing on law and order and re-opening the US economy.

With riots continuing to spring up across the US, law and order has become a powerful platform, particularly among female voters. Added to this, elections are often won or lost on the economy, and there is a growing desire in the US for the economy to open and for workers to return to their jobs. This becomes a stark choice for those idle workers voting to reopen versus remaining in lockdown.

We believe the mainstream polls underestimate Trump's support. The bipartisan divide in the US is strong, and many voters are unwilling to publicly admit their support for the President.

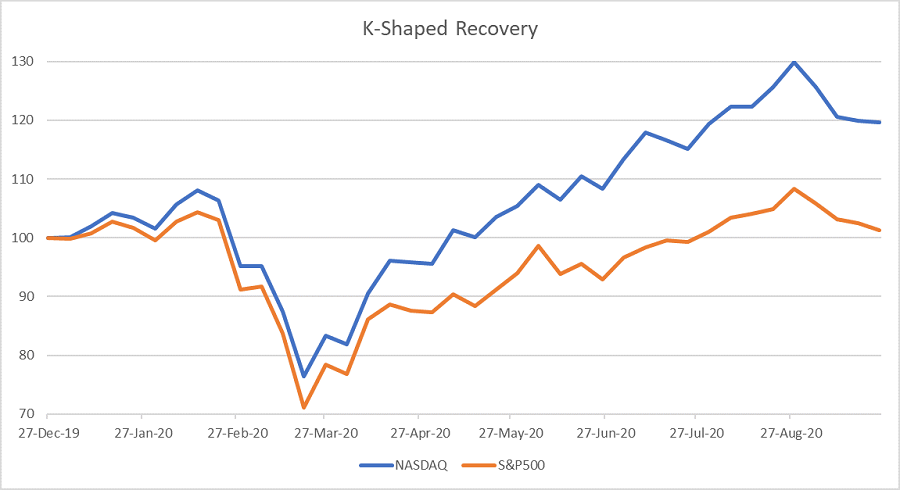

A K-shaped recovery?

Another factor likely to have an impact on the election outcome is, of course, COVID-19. Despite crossing the 200,000 milestone this week, US deaths relating to the virus have dropped materially from a peak weekly count of 17,000 (according to the CDC data) to around 5,000. It is a little surprising that the media has not focused on this statistic, instead preferring to focus on the infection rate. This too has been falling, with average new cases per day falling from above 60,000 in July to around 35,000 in mid September.

We are not sure COVID-19 infection rates will ever hit zero, but maybe they don't need to. If we can learn to live with COVID-19 while opening up business, we believe the economy – including ours in Australia – has a good chance of continuing its recovery.

The discussion about the ‘shape’ of this continues. Will it be a V, W, or U? Perhaps it will be a K – that is, good for some and bad for others. It is difficult to imagine a more conducive environment for e-commerce businesses, with large numbers of people confined to their homes for business, consumption and leisure. This has, therefore, created an enormous inequality between those businesses that are leveraged to e-commerce and those that are not.

Changes afoot at the Fed

The other key support for markets is US monetary policy, with the US Federal Reserve recently announcing a new framework. It's yet another evolution in thinking for the Fed, which has proven increasingly willing to use the tools at its disposal to engineer a recovery in the economy.

The framework suggests that monetary policy during economic expansions should aim for inflation moderately above 2% for some time, providing a boost to employment and economic growth. This contrasts to the Fed under Paul Volcker in the early 1980s, when interest rates were quickly raised to record highs to crush runaway inflation (which was running above 12%) and euphoric commodity, housing and bond markets. This current shift in policy towards a greater tolerance of inflation suggests lower rates will persist for some time, with no pre-emptive tightening; which should support gold, commodities and other inflation-benefiting stocks, as well as equity markets in general.

If history is any guide, when the Fed makes a change of this magnitude, it's worth paying attention. We have long believed that during periods of market dislocation, the actions of central banks are the key drivers of market returns. If a deal on a fiscal stimulus plan cannot be agreed between the Republicans and Democrats, it is likely that the Fed will continue to do the heavy lifting.

‘Unprecedented’ indeed

In February and March, COVID-19 and the subsequent economic shutdown spooked investors so much that they sent the market vertically down for a total drawdown of 36%. To be fair, no-one living today has experienced a pandemic on this scale.

As time has marched on, however, it is looking increasingly likely that the pandemic was more akin to an exogenous shock than a structural downturn – a black swan event which may see the economy recover faster than most expect.

Kristiaan Rehder is a Founder and Portfolio Manager at Kardinia Capital. This is general information only, and has been prepared without taking account of your objectives, financial situation or needs.