Weekend market update

The health of Donald Trump suddenly dominated news and markets on Friday afternoon Australian time. The President tweeted after midnight on the East Coast of the US that he and the First Lady had tested positive for COVID-19 and the S&P/ASX200 lost 50 points in the last hour of trade, down 1.4% on the day.

White House comments on his condition were confusing as it was first reported as mild, but then he was taken to hospital by helicopter and treated with the antiviral drug Remdesivir. At the time of writing, Saturday night in Australia, here is his most recent tweet.

The US market was resilient, with the S&P500 falling only 1% on Friday to leave it up 1.5% for the week. NASDAQ was weaker losing 2.2% on Friday. The poor close in Australia left the local index down almost 3% for the week, the worst five days since April.

***

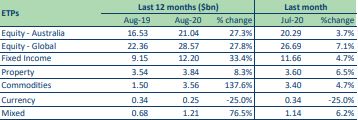

The most significant change in asset allocation by Australian investors in recent years has been the move into global equities. It's been a canny trade for those who focussed on the US, especially into tech companies such as Apple, Microsoft, Amazon and Google. Global equities experienced net inflows into Exchange Traded Funds (ETFs) of $722 million in August 2020 versus only $181 million for Australian equities. Global is now by far the largest asset segment at $29 billion in the $70 billion ETF (or ETP) industry.

Exchange Traded Products (ETPs), August 2020

Source: ASX

Source: ASX

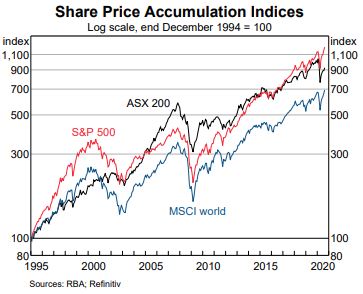

For two decades between 1995 and 2015, Australian shares (ASX200 below) held their own against the US (S&P500 below), which with the added benefit of franking credits, encouraged a home country bias. But since 2015, the decline of our banks and previous stalwarts such as Telstra and AMP left the heavy lifting to CSL and the miners. Showing it is a US story rather than the rest of the world, Australia remains well ahead of laggards in Europe and Emerging Markets (in MSCI World below).

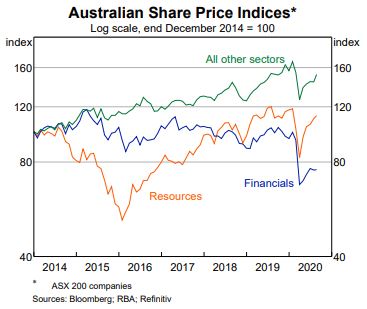

Focussing on Australia shares below, the headwind from financials is apparent since 2015, and resources was a disaster until early 2016. So in the investing world, the big winners are those who made a call to take a US focus and rotate out of banks a few years ago. Will this continue as a successful move for the next five years?

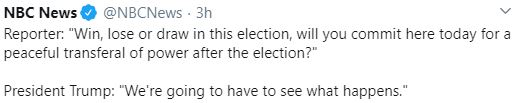

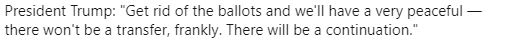

The US market's strength is in the wake of the uncertainties of the US election. Watching the debate was painful as the Leader of the Free World shouted down Joe Biden and the moderator. The President saying he may not accept the result has much potential to encourage anarchy and social unrest between the election on 3 November and inauguration on 20 January, and testing positive to COVID-19 adds to the tension. Here's what Trump said a few days ago:

Many topical issues to cover ...

After nearly 50 years as a portfolio manager, Claudia Huntington is calling it a day, and she summarises the major lessons revealed along her journey. Good investing is about people, leaders and cultures as much as numbers.

The union movement and Labor are rallying to preserve both the existing super structure and the legislated Super Guarantee increases. After former PMs Keating and Rudd weighed in recently, Bill Kelty hit the campaign trail this week. Read what one of the fathers of super says about our social commitment. With super balances falling, future returns under pressure and a loss of support for SG increases, is super at a critical turning point?

Still on super, Susan Thorp and her colleagues at various universities have done a deep dive into a survey by industry fund, Cbus, of thousands of its members, to answer a wide range of questions on why they accessed their super early. A lesson for governments next time.

In one of the most personal articles ever written for Firstlinks, Alex Denham uses the example of her marriage breakdown to show the ramifications for SMSF trustees. Since one-third of Australian marriages end in divorce, including a surprising number of long relationships, Alex is probably helping more people than she realises.

As most people talk about the disconnect between the stock market and the economy, Roger Montgomery explains why we are in one of those times where a strong case can be made for both the market rising and the market falling.

And what about residential property prices? Chris Bedingfield reports on the surprising resilience in the face of the pandemic. While the reduction in JobKeeper will bring out more sellers, the relaxation of bank lending rules will provide a counter. Can the market hang on until a vaccine?

Amid all these doubts, is there any part of global stock markets which still offers value? Shane Woldendorp makes the case for selected Emerging Markets stocks on both a relative and absolute basis versus Developed Markets. Like value investing, one day its time will come.

This week's White Paper from Realindex (manager of $27 billion within First Sentier) examines 'zombie' companies. These companies would normally go bankrupt but they are kept alive by favourable policies and low rates, kicking the default can down the road.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website