Weekend market update: Friday was a tough day at the office for the S&P/ASX200 index, down 161 points or 2.3%. The fall for the week was 1.8% to close February with a 1% gain. In the US on Friday, NASDAQ clawed back 0.6% while the S&P500 fell 0.5%. Bond rate rises worried share investors relying on heady company valuations with the week's loss in the US at 2.5% and heavier falls in Asia. The yield on the US 10-year bond is up about 1% from its lows of 2020 and 1.3% in Australia.

Bitcoin fell again and is now down 22% since its peak, and while still at highly-elevated levels, 22% in a few days shows it does not have a realistic place in a retirement portfolio for most Australians. All it takes is an Elon Musk tweet and it's off to the races.

***

There's a favourite phrase that climate change sceptics like to use, that ‘the science is not settled’. It's powerful because it's easy to find a qualified scientist who disagrees with 95% of his or her colleagues. Investing is even worse, because it is more open to personal interpretations and subject to behavioural biases. The science is certainly not settled.

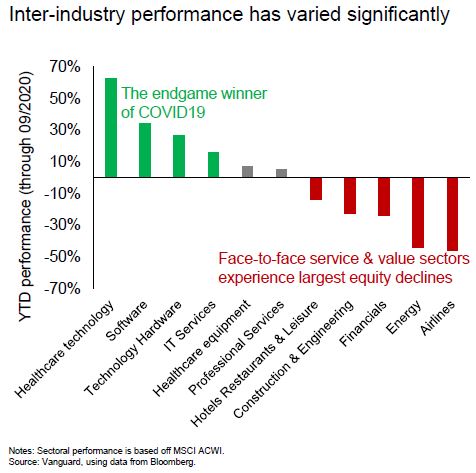

So one minute, a leading investment analyst says we are in a stockmarket bubble and then the next, another reports it's the best conditions for equities ever. Confusing? While there are parts of the market where stocks are priced for perfection, the shares of other companies have struggled. Consider the sectors which have done well during COVID, and those which have lost.

While many US experts such as Jeremy Grantham and Stanley Druckenmiller are predicting market doom, a leading Australian investor, Chris Stott of 1851 Capital told the AFR on 22 February 2021:

“So the data over the next 12 months should look pretty spectacular, some of the best economic prints we’ve seen for well over a decade if not longer. I think the outlook for the economy today is a lot stronger than what it was pre-COVID. And the sharemarket’s still just shy of its pre-COVID peak, so when you marry all that up the outlook for the equity market looks as good as we’ve ever seen it.”

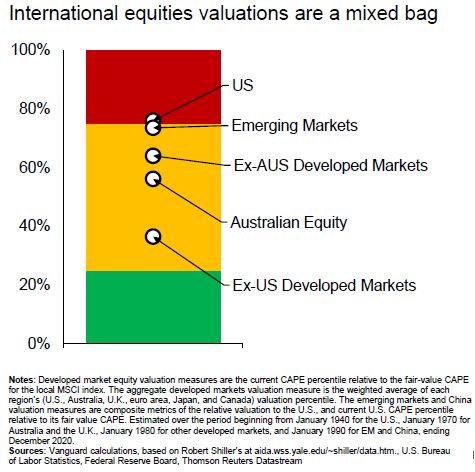

Strong stuff. "As good as we've ever seen it". Chris invests in Australian stocks, which have not seen as much of the frothy excess of the US. This Vanguard chart shows current equity valuations (based on Price/Earnings measures) relative to fair value, and Australia looks reasonable.

This week on LinkedIn, Bridgewater's Ray Dalio asks the question, 'Are we in a stock market bubble?' and he uses his systemised 'bubble indicator' for a perspective on the US market. He concludes:

"In brief, the aggregate bubble gauge is around the 77th percentile today for the US stock market overall. In the bubble of 2000 and the bubble of 1929 this aggregate gauge had a 100th percentile read ... There is a very big divergence in the readings across stocks. Some stocks are, by these measures, in extreme bubbles (particularly emerging technology companies), while some stocks are not in bubbles ... the share of US companies that these measures indicate being in a bubble is about 5% of the top 1,000 companies in the US, which is about half of what we saw at the peak of the tech bubble."

So when anyone asks if the market is in a bubble, ask which market they are talking about. Take care, for example, with long-term fixed rate bond issues for corporates in the current rising rate environment. Spreads are very tight.

The other complication in assessing value is that many companies are coming out of COVID much better than expected. If anyone should be able to predict the health of corporate Australia, it is the CEO of a major bank, but ANZ's CEO Shayne Elliott said this week:

"Look at the results of corporate Australia. It's pretty staggering in terms of profitability. What we didn't count on was the level of government support and the impact of really low interest rates."

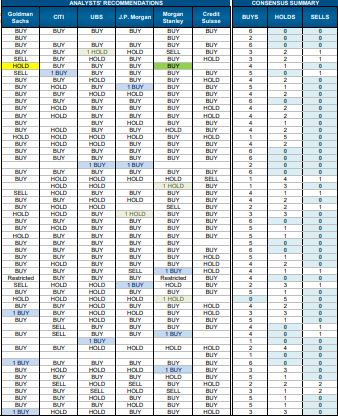

As we head into the final days of the February 2021 company reporting season, Marcus Padley takes a look inside the frantic world of stockbrokers and their struggle to cope with dozens of companies releasing results each day. He explains why so many broker forecasts tend to a consensus level.

If you think Marcus is exaggerating, consider this chart of broker stock recommendations for the Dow Jones Global Titans 50 Index which covers multinational companies in the Dow Jones Global Indices. The companies are mainly listed in the US, and many are tech companies identified as driving a bubble. Look at the Consensus Summary columns. Of the 50 companies in the so-called bubble market, only 12 sells across the six biggest brokers among 300 recommendations. 'Holds' are more common but both are overwhelmed by 'buys'. What generates such optimism?

Drawing out this theme of Australian versus US equity performance, David Bassanese explains why the markets differ, the impact of currency and which he expects to perform best in future.

Then Reece Birtles pitches in with his take on 'value versus growth'. It's another example of the stocks left behind in the rally, and the cycle is already showing signs of turning. Value's time in the sun will come.

A major change in the investing landscape hit the markets in 2020 with the rapid increase in participation by younger investors. Gemma Dale documents the trend including what they are investing in, and it's not what most people assume. The newbies have started well on the investing journey.

Back to the US success stories and the big tech stocks, Ishan Ghosh makes a surprising claim that their exceptional performance is not unusual compared with big companies of the past, and in fact, many large US tech companies have done poorly over the last year. So those themes we think are running hot are harder to pick than we might think.

Rachel Lane is a leading policy influencer in aged care, and she explains the changes needed to a poor system. Anyone who has been through the tedious detail will sympathise.

And Alastair MacLeod focusses on a problem facing many people, especially retirees, that their 60/40 portfolio is dragged down by low bond rates, and he suggest alternatives in 'defensive equity' strategies.

In this week's White Paper section, something different with a new podcast recording with Hamish Douglass of Magellan. He speaks to Morningstar in the US on their The Long View programme about how Magellan started and how he builds compounding portfolios.

And the Facebook thing? I didn't realise so many people receive their news via a social media feed. And don't the news organisations post their content and links onto Facebook so more people will read them? That's what Firstlinks does and we benefit from traffic directed back to our website, so it's not clear to me why Facebook should pay for it.

I'm old school in paying subscriptions for news I want, reading the website, app or newspaper directly. For Firstlinks, only 2% of our users come through social, with 98% of readers directly accessing through our website, the newsletter, search or referrals. We have developed our direct audience for nearly 10 years and do not rely heavily on Facebook. Treasurer Josh Frydenberg was speaking as if the only way to view web sites was via Facebook when he said on Channel 7's Sunrise about his call to Mark Zuckerberg:

"We spoke yesterday morning and I expressed my deep disappointment as to what Facebook had done ... we view those actions yesterday as unnecessary, as heavy-handed, as wrong and as damaging the reputation of Facebook here in Australia. To restrict access to the New South Wales Fire and Rescue or to restrict access to the Royal Children’s Hospital or other important sites, is very problematic and it was a heavy-handed tactic."

Restrict access? Does Facebook control access to web sites? Don't people know how to find web sites on the internet? We welcome any comments on this issue ... what proportion of the news you read or watch do you receive on Facebook?

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Webinar: Tuesday, 2 March - Global Equities: Is 2021 the year of living dangerously? with Hamish Douglass, Magellan Chairman and CIO. Click here to read more and register.

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Latest LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website