Most Australians hold their superannuation in a balanced fund, often 60% growth/40% defensive or 70%/30%. Lifecycle funds are also popular, where the amount in defensive assets increases with age. Employees who are not engaged with their super (and that's most people when they start full-time work) simply tick a box for the default fund selected on their behalf by the employer.

For example, UniSuper, the fund for the higher education sector with 450,000 members holding $90 billion, says:

"Our Balanced investment option returned almost 6% in 2020. This is an important result because it’s our default investment option and most of our members invest in it."

Of course, 2020 was no ordinary year, and UniSuper also reports:

"The difference between our best- and worst-performing investment options was about 60%. The reason for this is that our best performer, the Global Environmental Opportunities option, focuses on technology and decarbonisation. Our worst performer, the Listed Property option, is heavily invested in shopping centres, which have suffered during the pandemic."

What an amazing difference for simply ticking the correct box in an application form from a major superannuation institution. That 60% variation in money to live on can make a massive difference in retirement standards, and it shows the importance of asset allocation and fund selection.

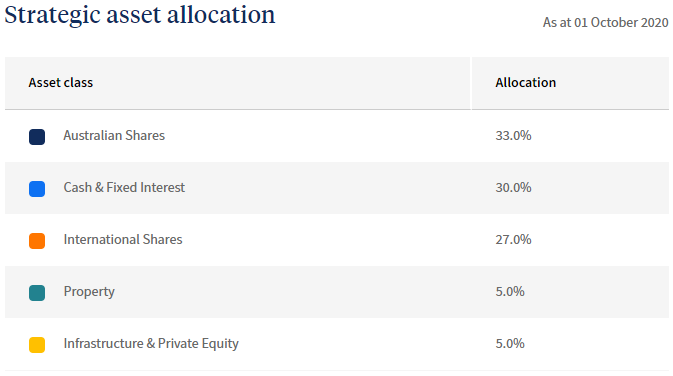

Here is the strategic asset allocation of the UniSuper Balanced option.

It is common for a balanced option to hold 30% to 50% in cash and fixed interest, but with high-quality bonds and term deposits earning 1% or less, the composition of the 'defensive' assets increasingly varies between funds. We have previously discussed how Hostplus uses infrastructure assets rather than bonds in its defensive allocation.

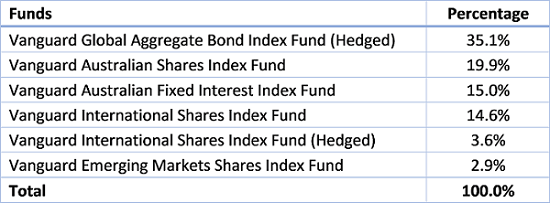

Take another example, Vanguard's Diversified Balanced ETF. Sounds perfect for superannuation, as 'diversified and balanced' is a recommended long-term savings strategy. This is more a 50/50 fund and gains its exposure by investing in the following Vanguard sector ETFs.

It's a solid retirement solution for many people, but let's delve deeper into the Global Aggregate Bond Index Fund, typical of where many super funds hold their fixed interest allocation:

Number of issuers: 2,488, average credit quality AA-

Number of holdings: 9,795 (That's what you call diversification. Negligible credit exposure to any one name, absolutely rock solid credit risk).

Yield to maturity: 0.92%

Effective duration: 7.5 years

Weighted average maturity: 9.2 years

With a duration of 7.5, if interest rates rose 1% across the rate curve, the bond fund would lose 7.5%. Or make 7.5% if rates fell 1%. Investors should know that a 1% rate move could wipe out 8 years of 0.92%. How many people in such a balanced fund realise half their allocation is earning less than 1%?

This is not a criticism of the product. It is typical and a reflection of current market circumstances. Anyone who wants returns needs to take risk.

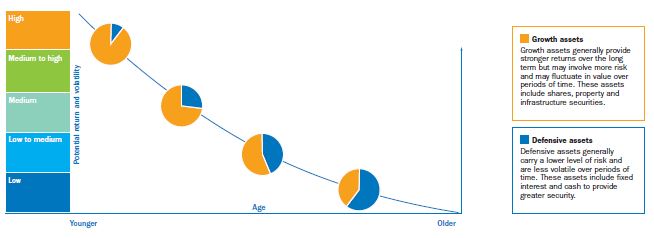

Elsewhere, Colonial First State (CFS) offers lifecycle funds rather than a single balanced fund, and here are the five asset allocations in their FirstChoice Employer Super or Commonwealth Essential Super. More defensive assets with age.

At the moment at CFS, the defensive allocation for the older cohorts is a mix of multi asset, alternatives, credit, emerging markets debt, and ‘total return’ fixed interest in addition to regular duration Australian bonds plus cash. It's worth checking with your super fund what is in the defensive bucket.

This edition focusses on the asset allocation problem we all face, especially bonds versus equities. Many people use the rule-of-thumb of 'your age in bonds'. That is, at age of 70, hold 70% in bonds. But low interest rates means income is insufficient for the lifestyle many retirees want, and hence the debate about spending capital that Firstlinks has covered in detail. The challenge is to find assets that deliver returns with acceptable risk, or adopt other strategies such as working longer or part-time.

The Reserve Bank's Head of Financial Stability, Jonathan Kearns admitted a few weeks ago that the values of all investments are vulnerable to a rise in interest rates, and bonds may not provide the traditional hedge for other parts of a portfolio:

"Because risk-free sovereign rates effectively underpin the pricing of all sorts of assets, if you have a rise in yields because of risk premia then that can affect the pricing of a broad range of assets simultaneously. Investors who thought they perhaps had a hedge through owning bonds and equities can find that all of their assets fall simultaneously and then that can have negative feedback for the economy through wealth effects.”

Three articles this week focus on the allocation issue, but first up, Ross Clare of the Association of Superannuation Funds of Australia (ASFA) says that contrary to the claims of the Retirement Income Review, the vast majority of Australians die with little or no superannuation. The issue of whether they spend their super or pass it to their kids is not relevant for most people.

Then Brad Dunn looks at how an investor might achieve 5% in the current market, showing how asset allocations have changed over time to reach this income level. One way a portfolio can boost income without stockmarket risk is in bank hybrids, and Campbell Dawson describes the extraordinary movements in this sector in the last 12 months.

With the last 12 months delivering the biggest difference between world equity and world bond returns for at least 50 years, Daniel Morris says investors are faced with a decision to rebalance if they are now overweight equities. It's not an easy decision as equities continue to run strongly and bond rates are so low, but by definition, rebalancing forces investors away from previous winners.

Then Craig Stanford shows how correlations between bonds and equities have changed. On the surface, falling sharemarkets suggest slower economic growth and lower interest rates (rising bond prices), such that bonds and equities should be negatively correlated. But where are we in these strange markets?

Obviously, no silver bullets for portfolio construction here, but this collection of articles at least gives you information to help your personal decision.

Moving on to other topics ...

It's hard to ignore the second-largest economy in the world and Australia's largest trading partner, and Martin Lau reveals five trends in China which are influencing his investing.

Then Lawrence Lam offers eight observations about selling shares, saying we focus too much on the buying decision. My favourite is the insight that when it comes to selling, consider why you bought the share in the first place and whether anything has materially changed, or are you just reacting to a short-term market.

In this week's White Paper, Franklin Templeton reflects on predictions of above-average economic growth, record fiscal and monetary stimulus and increased likelihood of inflation and says we are in an economic environment never seen before.

And check the latest BetaShares prediction on ETFs linked here as the sector officially exceeds assets of $100 billion.

For our Comment of the Week, I always enjoy the quality of the feedback we receive. They really are worth checking, especially those on last week's piece by Jon Kalkman which has received over 7,000 views.

Here is one from Peter Henery on Hugh Dive's article on residential property:

"As a long term resi prop investor I salute your analysis. Very few 'get it '....but you did pretty well. Here's what you missed! (1) You cannot save your way to wealth. You must use OPM (aka Other People's Money or leverage.) Name me one other asset where the banks 'fall over themselves' to lend you 80% LVR? (90%+ with LMI) And so long as you service the loan, won't make a margin call if the value falls! (2) Now work out the IRR when you only have 10-20% skin in the game and property rises just 3% per year. And that happens year after year and nobody bliks an eyelid! When we have a 'boom' year, the returns should be illegal! (3) Next, all the banks and all the gov't are 'in on the bet' and they are on your side. Just take VIC gov't income. Mostly land tax and stamp duty. Do they want property to keep going? What makes up the banks balance sheets? Do they want it to 'keep going'? The only game in town for dumb old Aussie battlers."

Peter is right about the leverage, but it's also the forced saving and compounding over decades which has made 'Aussie battlers' wealthy.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Australian ETF Review from BetaShares

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website