This time last year we were scrambling to figure out how best to explain the hybrid market’s performance. From 2 March 2020 to the close of business on 23 March 2020 the broader market, as represented by Elstree Hybrid Index declined by a material 15.7%. By the month’s end the index had managed to claw its way back such that it was down, over the month, by a relatively pedestrian 6.2%.

Wow, that was some 12-month period!

On the 12-month anniversary of the biggest drawdown since the GFC, it's an interesting time to reflect.

Most risk markets, hybrid markets included, bottomed on or around 23 March before rallying strongly on coordinated government and central bank intervention. The rally that ensued produced extraordinary return outcomes – we might even go so far as to say ‘ridiculous’ return outcomes.

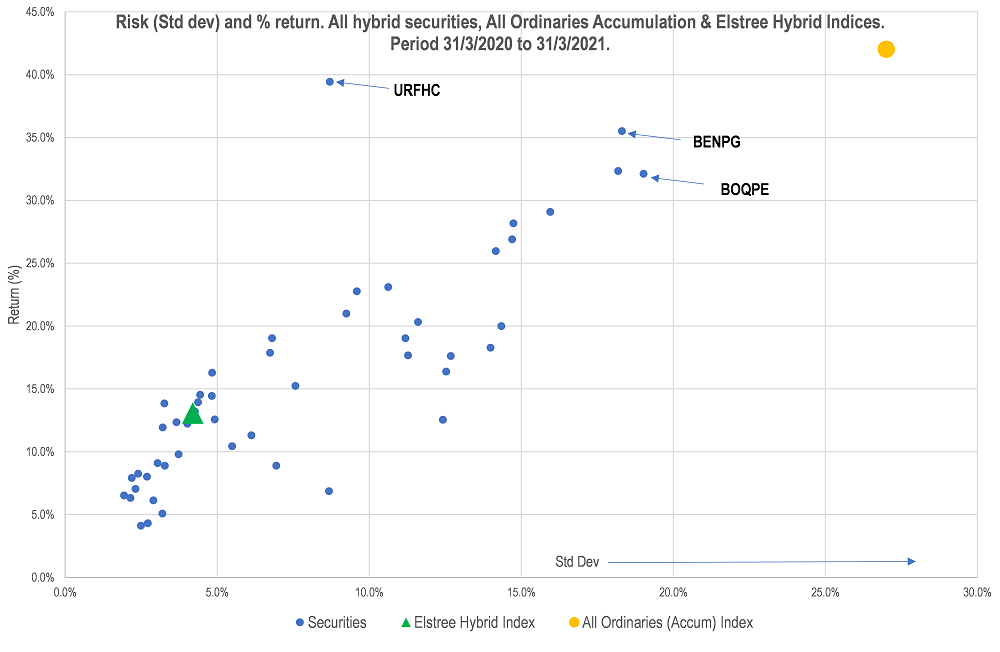

Over the year to end 31 March 2021 the hybrid market as represented by the Elstree Hybrid Index returned 13.32%. This compares (now) with an expected hybrid market return of cash +3% (i.e. 3%). Investors certainly should not expect those hyper-inflated return outcomes again any time soon. The chart below shows the returns on individual hybrids (vertical axis) and the standard deviation (horizontal axis). We’ve also shown the Elstree Hybrid and All Ordinaries Accumulation indices.

What does this tell us?

- Almost everything did well but the non-major bank hybrids did best with many producing around 30% returns.

- Volatility was relatively subdued given the return outcomes. Pretty much everything went up in a straight line.

- If you produced the same chart but started it at 28 February 2020, you would get different outcomes with hybrids still producing an acceptable return and risk profile with equities displaying more risk and less return.

What were the fascinating days?

- The hybrid market’s worst day was a -6.1% decline on 23 March 2020. This was the day that the NAB announced that they were converting their maturing NABPB hybrid into shares via a VWAP (Volume Weighted Average Price) agreement with UBS. This ‘option’ is present in almost every hybrid document and it allows the issuer to raise $1-$2 billion of equity capital without the usual complexities. In this instance investors received their $100 (for the note) and then the NAB ‘on sells’ the note to UBS and NAB then issues ordinary shares to UBS. The market erroneously interpreted the cleansing statement issued by NAB to mean that the maturing NABPB holders would not get $100 and instead would receive NAB shares at an estimated 30% premium to the last traded price. Investors sold everything including equities. NABHA fell 12%, AMPPB fell 11% while the broader equity market declined by just under 6%.

- The hybrid market’s best day was a mere two days later on 25 March 2020 resulting in a 3.8% return. This was the day investors realised they had sold for the wrong reasons and bought back the stocks they had sold. The market had a net gain of 3.9% for that week.

Probably the biggest lesson is that many investors don’t understand the structures, and in a crisis, everyone panics first and thinks later.

Campbell Dawson is an Executive Director of Elstree Investment Management, a boutique fixed income fund manager. The Elstree Enhanced Income Fund delivered 18.7% in the 12 months to end March 2021. This article is general information and does not consider the circumstances of any individual investor.