The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

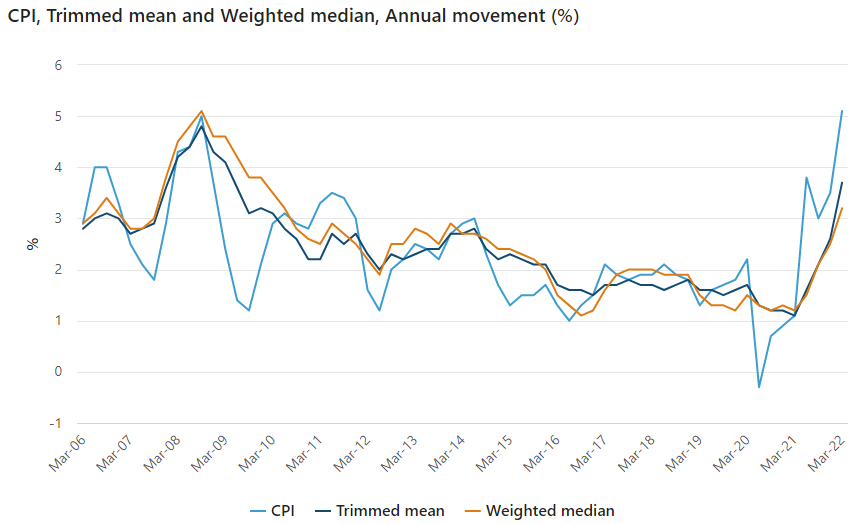

Last week's higher-than-expected 'trimmed mean' or 'core' inflation rate of 3.7% and the coming higher interest rates will test the resolve of investors who focus on the long term in their share portfolios. The Reserve Bank Governor has waited too long to tap the brakes on the cash rate, with his preferred measure of inflation now well outside the target 2 to 3% range. He was so confident that inflation was under control that he berated traders for pricing in rate increases, and now the questions are May or June and by how much. Some borrowers who relied on Philip Lowe's oft-stated view that cash rates would not rise until 2024 will pay the penalty for not fixing at around 2% last year.

The list of negatives for the market continues to lengthen ... global growth forecasts downgraded this week by the IMF, a 20-year high inflation result, the end of easy monetary policies, the rise of autocratic powers, geopolitical risks in the Pacific, reduced globalisation amid supply blockages, surging energy prices ... and both sides of Australian politics handing out stimulatory spending to contradict the aims of tighter monetary policy.

It's useful to remind ourselves at times like this of the words of Howard Marks of Oaktree Capital which we summarised previously in this article:

- The world is more uncertain today than at any other time in our lifetimes.

- Few people know what the future holds much better than others.

- Investing deals entirely with the future, meaning investors can’t avoid making decisions about it.

- Confidence is indispensable in investing but too much of it can be lethal.

- The bigger the topic (world, economy, markets, currencies and rates) the less possible it is to achieve superior knowledge.

- Our decisions about smaller things (companies, industries and securities) have to be conditioned on assumptions regarding the bigger things, so they, too, are uncertain.

I agree with Marks which is why I rarely make market forecasts, but I broke my rule in December 2021 when I wrote:

"However, while I recommend anyone with a long-term investment horizon should stay substantially invested in equities, I am starting to reduce some equity exposures as I personally believe the market will experience a decent fall sometime in 2022."

***

It is often said that the first casualty of war is the truth, and we also know that the first winner in elections is hypocrisy. Both sides are guilty, with minor point-scoring and a fear of saying anything of substance that might alienate a voting block. Claims and counterclaims on taxes, cashless credit cars, visas, Medicare, energy costs, climate change and wages. The media encourages the farce by reporting numbers and promises with little critical analysis.

The hypocrisy meter crossed the red line when Scott Morrison said:

“The Labor Party is frightening the pensioners about something that is a complete and utter lie.”

Plenty of form here. The Liberals were doing their own scary work in March and into April on Facebook and Instagram. If this is not an attempt to 'frighten the pensioners', what is?

Labor has its own versions, with Anthony Albanese jumping on the proposal to appoint Anne Rushton as Health Minister and a comment she made seven years ago, claiming she:

“... has made it very clear that, if we have an election of the Morrison Government, we will see more cuts to Medicare, more cuts to Medicare over the next three years”.

This point-scoring actually generates the wrong type of points, with The Australia Financial Review/Ipsos poll finding this week:

"Both Mr Morrison and Mr Albanese are tied at a record low 42% in terms of overall competency, the lowest level for either a prime minister and Opposition leader in 27 years."

This week, in our Reader Survey, we'd like to learn what you think are the major issues, who will win, who you will vote for and any other points you wish to raise. Results will be published next week, as well as comments, provided they are constructive and not abusive or personal. All contributions will remain confidential. At the start of the weekend, we had already received around 600 responses so it will be a good sample.

At least the Australian Electoral Commission manages to keep a sense of humour about a great Aussie tradition.

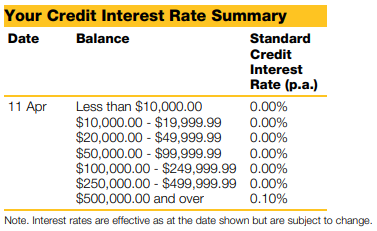

With interest rates likely to rise in the next month, and the bank bill rate already above 0.7%, there is a prospect of savers actually generating some income from cash soon. Take a look at the rate on your savings and you can see why bank share prices have been rising. The table below is the rate schedule on my SMSF's main transaction account. Thank goodness the rates have a tiering to reward higher balances. The rates will not rise at the same speed as cash rates while increases are passed on in loans. It's good for margins. I have sat on the Pricing Committees of three banks over many years and across the tens of billions in these accounts, the Reserve Bank actions will feed into commercial bank profits.

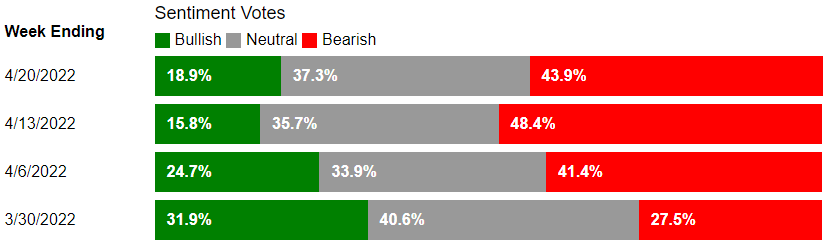

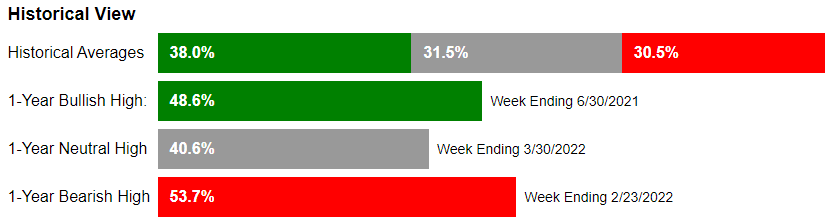

Regardless of how much we focus on Australia for our own investments, it is the US market which sets the tone for all others (it comprises 56% of the market cap of global stock markets). Even if you do not invest directly in the US, it's worth knowing how US investors view the market. A long-term data source is the American Association of Individual Investors (AAII) Sentiment Survey, which provides a spreadsheet of sentiment data since 1987. The 'percent bullish' was the lowest last week that it had been since 1992.

Direction Members Feel The Stock Market Will Be In The Next 6 Months?

Although investors are sitting on mountains of cash, inflation, recession, war and rates are playing on their minds.

This week, I use the example of Hyperion Asset Management, a recent Morningstar Fund Manager of the Year, to look at the dilemma facing investors when a leading manager with a strong 20-year track record hits a rough short-term patch. As Warren Buffett said: "The stock market is a device for transferring money from the impatient to the patient."

Graham Hand

Weekend market update

From AAP Netdesk: The local bourse has ended April with a bang, recovering from the brutal three-day selloff that began last week with its best two-day rally since early in the pandemic.The benchmark S&P/ASX200 index closed on Friday with a last-minute surge to finish up 78.1 points, or 1.06 per cent. The broader All Ordinaries index climbed 82.4 points, or 1.08 per cent, to 7,724.8.

The gains on Thursday and Friday were the ASX200's best back-to-back days since May 25-26, 2020, although Tuesday's sharp selloff meant the index still closed out the week down half a percentage point.

Tech stocks led the market on Friday, collectively rising 2.25 per cent, following big gains overnight by their US counterparts. Computershare added 3.1 per cent, Wisetech Global gained 2.1 per cent and Block advanced 0.6 per cent. Nitro Software soared 20.2 to a three-week high of $1.37 after the digital document company announced cash receipts in the first quarter had risen 42 per cent to $US17 million, on the back of several key customer wins.

Kogan.com sunk 13.9 per cent to a more than two-year low of $3.91 after announcing gross sales were down 3.8 per cent in the March quarter compared to a year ago. Chief executive Ruslan Kogan said "market conditions are challenging at present" and the online retailer would focus on recalibrating inventory levels, after mistakenly preparing for continued strong growth this year.

After trading as high as $24 in October 2020, Kogan shares are at their lowest level since the start of the pandemic.

From Shane Oliver, AMP Capital: Share markets had another volatile week with worries about central bank rate hikes and Chinese covid lockdowns depressing global growth but generally good earnings news. Despite a fall back to March lows US shares managed to find support there and rose slightly for the week but European, Japanese, Chinese and Australian shares fell. The fall in Australian shares was led by sharp falls in IT, resources and health stocks. Global bond yields pulled back a bit from recent highs but they rose further in Australia. Oil prices rose, but metal and iron ore prices fell albeit they remain very high. The $A also fell as the $US continued to rise.

Despite the pull back, the Australian share market remains a relative outperformer - thanks to its high exposure to resources shares and low exposure to tech stocks - being virtually flat year to date compared to falls of 10% in US shares, 12% in European shares and 7% in Japanese shares. While the pullback in commodity prices from overbought levels in the short term may weigh, Australian shares are likely to continue to outperform over the medium term as the commodity super cycle continues and as higher bond yields compared to the pre-covid era weigh on tech stocks.

Our base case for investment markets remains that US, global and Australian recession will be avoided over the next 18 months at least and this will enable share markets to have reasonable returns on a 12-month horizon. However, the past week provided a reminder that short term risks around inflation, rate hikes, the war in Ukraine and Chinese growth remain high which of course saw more volatility in share markets with US shares falling back to their March low and Nasdaq and Chinese shares making a new low.

Also in this week's edition ...

Picking up on the inflation theme, Tim Davies says Russia's invasion of Ukraine will trigger a long bout of sustained inflation that will impact commodity and food prices and keep inflation high over the next decade.

Also on inflation, Russel Chesler believes a global inflationary environment will see the Australian sharemarket, dominated by miners and value shares, outperform the US as commodities soar.

ESG. A topic that was once considered niche is now an enduring component of the investment decision-making process. Evan Reedman covers the fundamental investment approaches and strategies that consider ESG.

Ahead of Berkshire Hathaway's annual meeting on Saturday, Lewis Jackson looks back on the Oracle of Omaha’s latest letter to shareholders. It's full of lessons for investors, including waiting for value, keeping a buffer, trusting the quality of your investments and recognising new and important trends.

Finally, Blair duQuesnay explains 'inception date roulette' and warns that any financial adviser presenting you with a beautiful chart of past performance is a red flag.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Morningstar analysts have identified TPG telecom as the most undervalued telecom stocks in the ASX 200 detailing multiple catalysts for earnings recovery and growth, writes Nicola Chand. And in an exclusive interview, Ollie Smith speaks with Hermitage Capital Management CEO Bill Browder on Putin, Russia, and the next six months for Ukraine.

Our white paper this week is from Franklin Templeton on the performance of equity and other asset class allocations in the wake of recent geopolitical events.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website