The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

A new report on SMSFs indicates the Division 296 tax will have far greater tax implications than expected.

When the tax was first announced in 2023, Treasury predicted that the tax would generate $2.3 billion in its first year.

However, SMSF administration software provider Class' 2025 Annual Benchmark Report suggests that this may be a lowball figure.

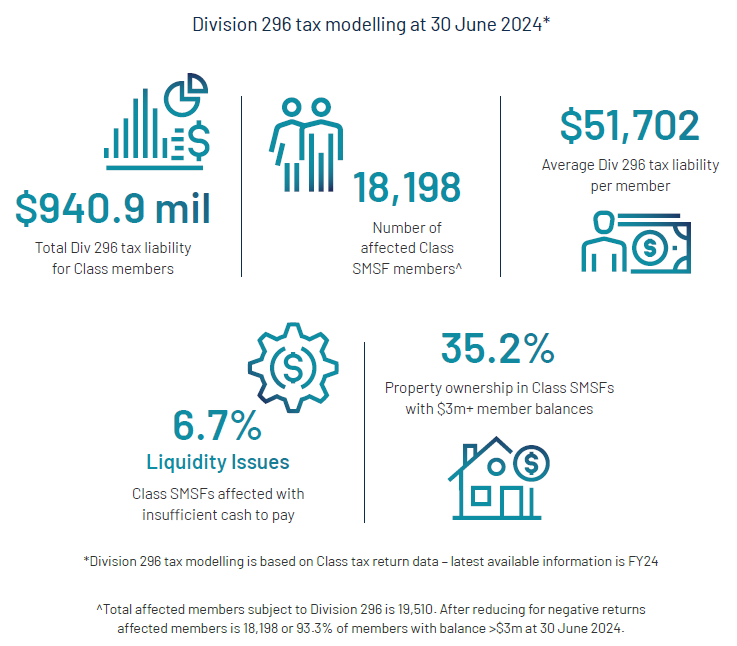

The report finds that if Division 296 had been enacted in the 2024 financial year, Class members would have received a total tax bill of $941 million. About 18,200 Class members would have been impacted, with an average tax liability of $51,702.

Given Class administers about 35% of SMSF assets, extrapolating those figures indicates that SMSFs alone would have had a tax burden of $2.7 billion. That’s $400,000 more than Treasury’s estimate from the entire super sector.

And, if you assume SMSF values grew by 10% in the 2025 financial year, the tax raised from SMSFs alone would rise to $3 billion.

Some SMSFs don’t have the liquidity to pay the tax

The report estimates that 6.7% of affected Class SMSFs have insufficient liquid assets to pay the Div 296 tax.

That’s because more than one in three SMSFs hold direct property, making the tax particularly problematic given the illiquid nature of these assets.

A lot of the SMSF holdings in property are in commercial real estate rather than residential real estate. The former accounts for 12% of total SMSF assets, while the latter is just 5%.

The report says the potential liquidity issues are worrying given that without indexation of the $3 million cap, more SMSFs are likely to be captured over time and liabilities will rise.

SMSFs continuing to thrive

If the intent of Division 296 was to drive people out of SMSFs, it clearly isn’t working.

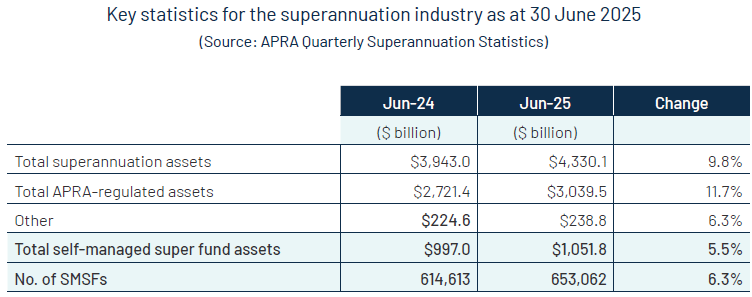

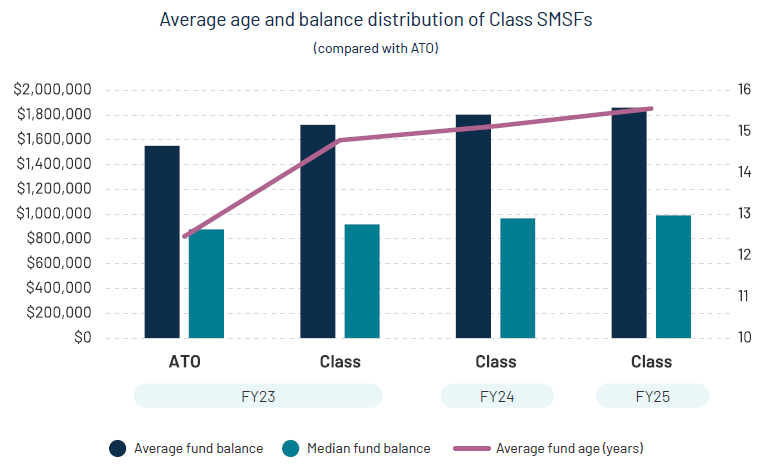

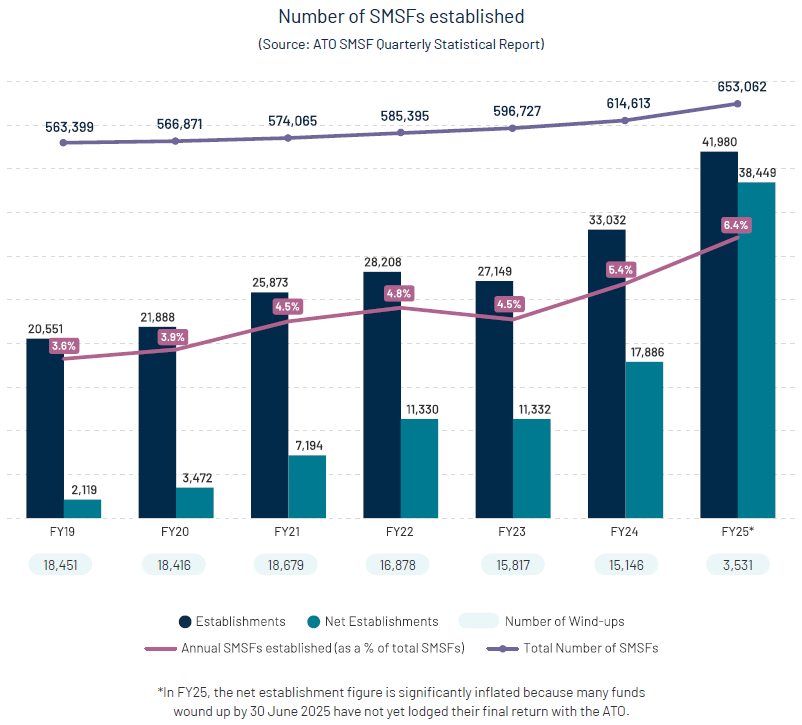

The report indicates the number of SMSFs grew at their fastest pace in eight years in the year to June 30. The total balance in SMSFs rose to $1.05 trillion and the average member size of an SMSF increased to $1.9 million.

About 42,000 SMSFs were established last financial year, up from 33,000 the year prior. Net new establishments were 17,886 in FY24, an increase of 5.4% on the year before.

The growth in new SMSFs principally came from people aged 45 to 59 (49%), followed by those aged 30 to 44 (37%).

Popular shares, managed funds and LICs in SMSFs

Some of the more intriguing data from the report comes from the asset allocation of SMSFs.

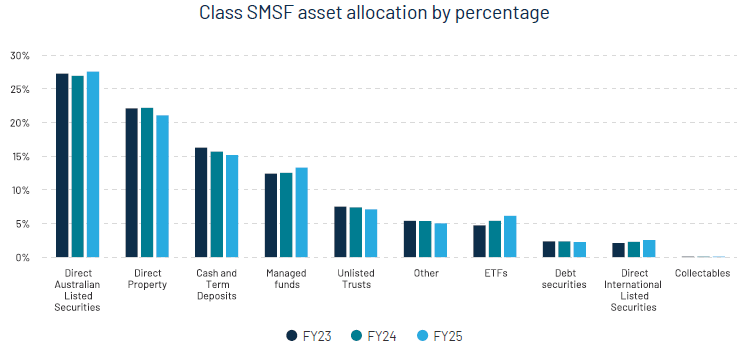

Listed Australian shares remain the most popular asset, accounting for around 27% of SMSF assets, following by direct property at 21%.

Direct property saw a slight decrease in the year to June, likely because of people preparing for the Division 296 tax.

Cash and term deposits saw a second year of declining exposure from SMSFs.

Managed funds picked up some of that money, as did ETFs.

Meanwhile, direct international-listed stocks remain a small percentage of assets in SMSFs. Even if some of that exposure is through ETFs, it remains a tiny proportion.

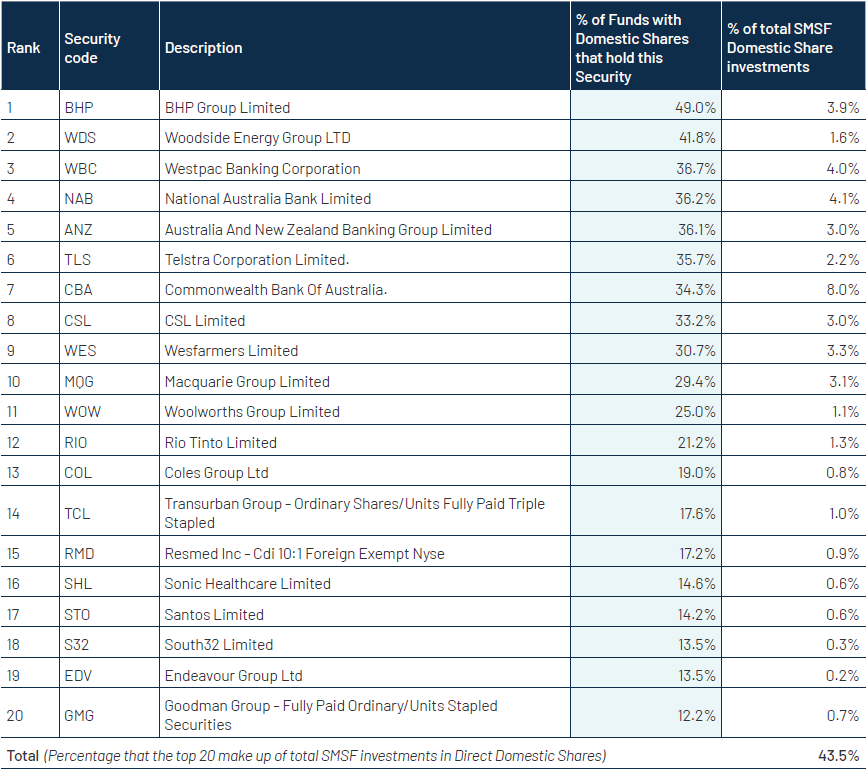

Of equity exposure, BHP is the most popular stock, with 49% of SMSFs holding it, followed by Woodside at 42% and Westpac at 37%.

In terms of the weights of individual stocks in domestic equities allocations, SMSFs are generally underweight most of the leading stocks. For instance, they have an 8% exposure to CBA, compared to the 10.6% weighting of the stock in the ASX 200 index. From this, it seems that SMSFs have greater exposure to ASX stocks outside of the top 20.

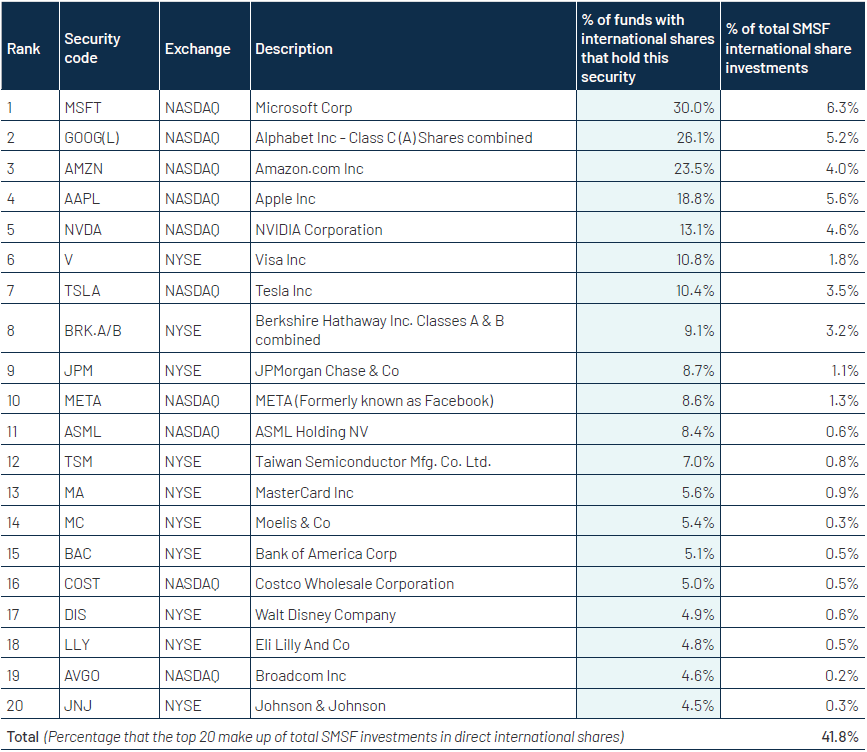

Of direct international share holdings, technology stocks account for 77% of the top 20 international shares by market value. Microsoft is the most popular international share followed by Alphabet. From the data, it appears SMSFs like international tech exposure, albeit it remains small versus their domestic stock holdings.

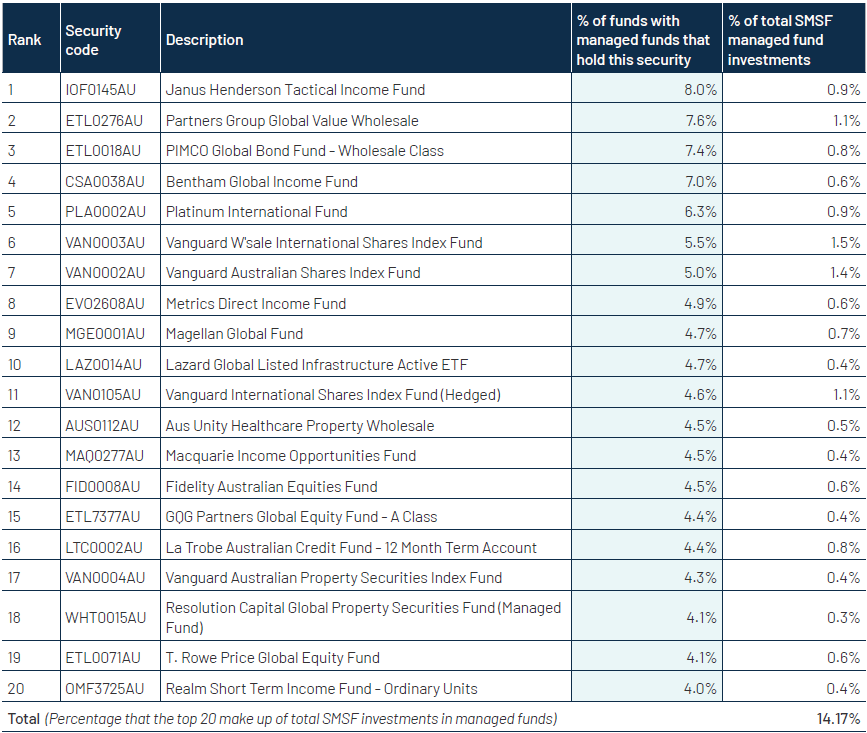

Of managed funds, income funds such as Janus Henderson’s Tactical Income Fund and the Bentham Global Income Fund remain popular. SMSFs also seem to be looking for more exposure to private assets, through vehicles such as the Partners Group Global Value strategy.

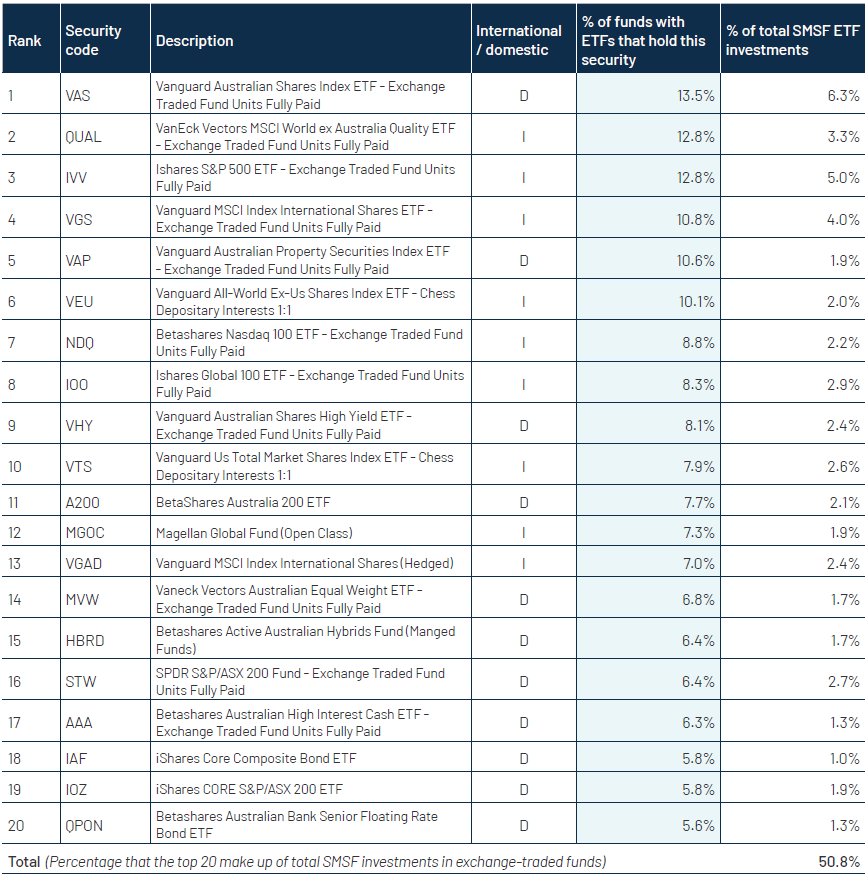

When it comes to ETFs, Vanguard, iShares, and VanEck occupy the top five holdings for domestic and international ETFs.

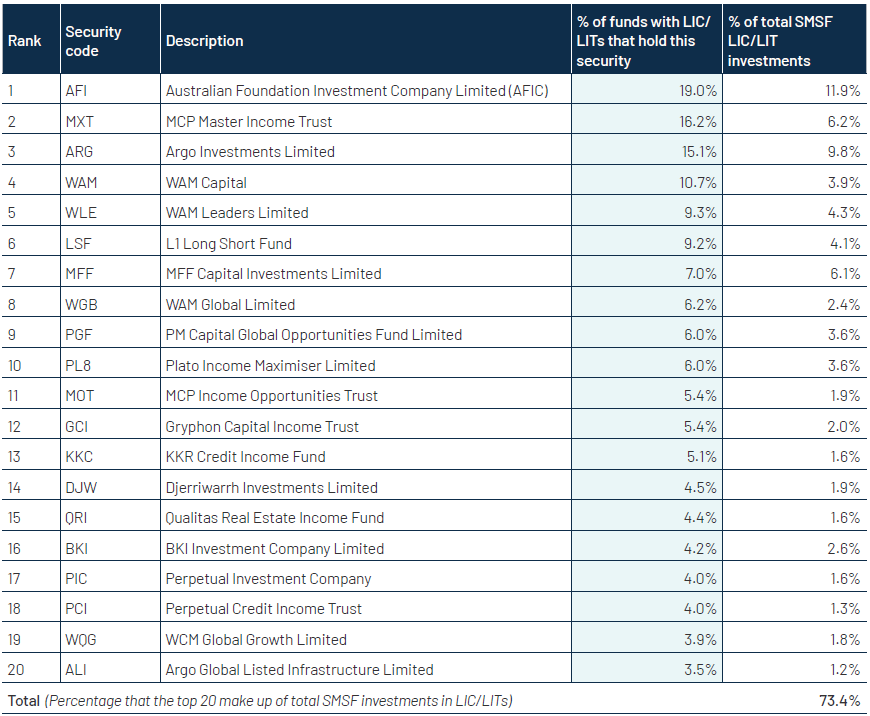

Finally, of listed investment companies, AFIC, ARGO and Wilson Asset Management are most popular with SMSFs.

James Gruber

In this week's edition...

On every valuation metric, the US appears significantly more pricey than Australia. However, Ashley Owen notes that American companies are also much more profitable than ours, which means the ASX may be more overvalued than most think. As usual, Ashley provides plenty of charts and detail to illustrate his case.

Outside of the pandemic, government spending as a proportion of GDP is at multi-decade highs. What is Labor doing about it? It doesn't seem a whole lot. Julian Pearce and Ross Guest argue governments of all persuasions need to be held accountable on public spending and an empowered budget office may be one way to do it.

Dan Haylett believes that traditional retirement is an outdated concept rooted in the industrial era and no longer suits a modern, knowledge-based society where people can and should continue working in ways that bring purpose and freedom. He suggests 'retirement' should be redefined as a later-life phase of reflection, with earlier years focused on exploration, contribution, and leveraging accumulated wisdom.

Markets have rewarded the AI front-runners, but the risks of rising capital intensity and fierce competition are mounting, according to Orbis' Eric Marais. He says the more compelling investment opportunity may be in the overlooked manufacturers quietly enabling the AI revolution.

With major changes to aged care rules coming on November 1 2025, it’s more important than ever to plan ahead — both financially and emotionally. UniSuper's Brooke Logan says early planning can ease the transition, minimise costs, and help secure the right care at the right time.

Vanguard founder John Bogle is one of our favourite investment thinkers and writers. It's apt that Vanguard has penned a piece on five of his most famous quotes and how they may be more applicable now than ever.

ESG investing has fallen out of favour with many investors, and Trump's anti-green policies haven't helped. Yet, renewables investment is still surging, and Magellan thinks that could prove a boon for infrastructure companies.

Two extra articles from Morningstar this weekend. The team has added AGL to its global best stock ideas list, while Angus Hewitt investigates Eagers' foray into Canada.

Lastly, in this week's whitepaper, Vanguard explores how Australians are preparing for and experiencing retirement.

****

Weekend market update

The US market retreated from a record on Friday but held on to solid weekly gains despite a government shutdown dragging on for a third day. The broad market index closed little changed while the Nasdaq declined 0.28%.

Stocks were knocked down a bit in afternoon trading by declines in key technology names like Palantir (-7.5%), Tesla (-1%) and Nvidia (1%).

Still, the three leading indexes saw a positive weekly finish. The broad market S&P 500 rose around 1.1% on the week, along with the Dow, while the Nasdaq increased 1.3%.

From AAP:

Australia's share market is within striking distance of record highs as 'Goldilocks' market conditions continue to fuel investors' buy orders. The S&P/ASX200 rose 0.46% to 8,987.4, on Friday.

Eight of 11 local sectors traded higher, led by IT stocks, health-care plays and with decent upticks in the heavyweight financials and materials segments.

The raw materials sector finished the week 2.6% higher and is hovering at its highest level since the beginning of 2024, after gold reset its record value multiple times and copper soared to a two-month high.

BHP has clawed back most of its losses since reports of a Chinese blockade on some of its iron ore cargo prompted a $5 billion (down 2.5%) sell-off on Wednesday. It is now trading roughly 1% short of Tuesday's close at $42.08 per share.

The bourse's largest gold miner Northern Star shaved 1.7% to $24.41, but was up 7.5% for the week and has swollen by more than half in 2025 to a market cap of $36 billion.

Financial stocks rallied 3% since Monday, snapping a two-week losing streak and edging the sector within roughly 0.3% of its record close, which originally raised eyebrows over potentially frothy bank valuations when it was reached back in mid-August. The segment is currently valued at more than $950 billion and accounts for almost a third of the Australian share market's total value.

Energy stocks and utilities have been under continued pressure ahead of an OPEC+ meeting at the weekend, with markets betting on further output hikes and sending oil prices to four-month lows.

Health-care stocks snapped a six-week losing streak to bounce more than 4% since Monday, but the segment has lost roughly a sixth of its value since blood plasma giant CSL's disastrous earnings call in August.

Shane Oliver, AMP:

Share markets rose strongly over the last week, with optimism for further US rate cuts offsetting the start of another US partial government shutdown. For the week US shares rose 1.1%, Eurozone shares rose 2.7%, Japanese shares rose 0.9% and Chinese shares rose 2%. Helped by the strong global lead the Australian share market rose by 2.3%, with investors appearing to conclude that while the RBA may not cut rates much more this is okay if its due to better economic growth. The gains in the Australian share market were led by health, financial, industrial and material shares more than offsetting a fall in energy shares. 10-year bond yields rose in Japan but fell elsewhere. Oil prices fell 7.4% on indications that OPEC will further boost supply and the iron ore price fell slightly on reports China had temporarily “banned” the purchase of iron ore from BHP. But metal and gold prices rose providing support for Australian miners. The $A rose back to around $US0.66 as the $US fell, helped along by more hawkish RBA commentary.

The RBA left rates on hold with a more hawkish tone – we continue to see more rate cuts but there is a high risk that they will be delayed into next year and that we are at or nearer the bottom than we thought. After a run of somewhat higher than expected inflation readings and stronger economic data the RBA’s more hawkish commentary wasn’t really that surprising. But it adds to the uncertainty regarding when and by how much rates will fall any further. RBA Governor Bullock still retained an easing bias noting that at the November meeting it will decide “whether its down again or…hold again” for rates but this is substantially watered down from its easing bias at the last two meetings and is now very dependent on the September quarter CPI to be released at the end of the month and the RBA’s revised economic forecasts to be released with its November meeting.

Is the RBA preparing the ground for another round of macro prudential controls to slow risky housing lending? This looks to be the case with its reference in the Financial Stability Review that “a sharp rise in investor activity from already elevated levels could lead to a build-up in financial vulnerabilities if it significantly amplifies the housing credit and price cycle” and that it supports APRA efforts “to ensure a range of macro prudential tools could be deployed in a timely manner if needed.” Housing credit growth appears to be taking off again, reflecting the pickup in home price growth – and for investors is nearing the boom time levels last seen in 2014-15.

Source: ABS, AMP

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Monthly Investment Podcast by UniSuper

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website