A unique characteristic of high-quality, defensive listed infrastructure companies is their sustained investment profile through the economic cycle. With this in mind, we look to secular trends for opportunities to enhance real growth. One such trend is investment in renewable energy, which is sustaining robust growth despite political headwinds and appears positioned for strong ongoing gains.

Prior to the Russian invasion of Ukraine in 2022, markets were focused on energy transition, with decarbonisation of the energy supply a hot topic and growth in renewables investment booming. With the conflict, there was a pivot point in the narrative, with security of supply, energy independence and cost concerns seemingly shifting the pendulum back towards hydrocarbons. The second Trump presidency has deepened this apparent shift by expanding support for US oil and gas while rolling back large-scale tax concessions for renewable projects.

We take a contrary view

This is a compelling narrative but is not borne out in the data. In fact, what we see is renewable energy investment is growing apace. Even given the headwinds from changes in policy, and greater appetite for fossil fuels in market and political rhetoric, renewables investment growth has remained robust in recent years. For advanced economies, the clean energy investment share of total energy investment rose from an already-firm 58.6% in 2016- 2020 to 70.3% in 2021-20251.

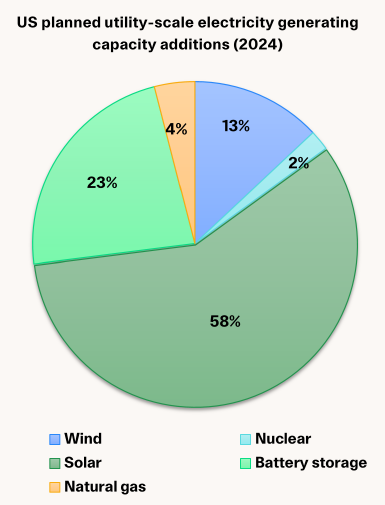

This strength is clear when looking at planned new additions to US electricity-generating capacity in 2024: 81% of this new, 62.8 GW of capacity was solar and battery storage, as shown in the following chart.

Source: US EIA

In 2025, momentum remains remarkably strong, with the June 2025 outlook from the International Energy Agency indicating that global clean energy investment is expected to reach US$2.2 trillion in 2025 (with solar predominant), double the US$1.1 trillion projected for fossil fuel investment. In the US, the US FERC estimates2 that of 133 GW of “high probability” additions expected to come online by 2028, 84% will be from solar (90 GW) and wind (23 GW). Gas is projected to make up about 15% of new-generation capacity (20 GW). Importantly, while there may be a perception from key events such as the recent rollback in the US Inflation Reduction Act (IRA) provisions for renewable energy investment that renewables growth is slowing or reversing, there is clear momentum in investment.

Three key factors have allowed for continued robust renewables growth in the face of a hostile US administration, which has reduced renewable incentives and promoted fossil fuels.

The first is the increasingly attractive economics of renewable energy investments; in particular, for solar. For example, even if we exclude any tax credits, the levelised cost of solar in the US is US$19.60-US$38.80 per MWh, which compares to US$54.40-US$83.40 per MWh3 for combined cycle natural gas. Furthermore, the cost of componentry for renewables is on a firm downward trend while equipment and material cost pressures are rising for natural gas. The IEA estimates that the price to manufacture solar panels is down as much as 60% from 2022-2025, while oil and gas input prices are set to increase this year. Supply is also a compounding issue, with lead times for gas turbines currently estimated at around three to four years, extending to as long as seven years4.

The second key factor is that policy support to expand renewable energy investment remains significant. While the end to the IRA withdrew substantial support from the US market, some specific interventions are still intact. We note that in the US, Battery Electric Storage Systems retain tax credits under the One Big Beautiful Bill Act (OBBBA). The Act also extends tax credits for fuel cells, geothermal energy and linear generators, and nuclear. While a net negative, tax credit rules for clean energy investment under the OBBBA continue to honour credits for projects that can demonstrate they have started construction by July 2026 or are fast-tracked for completion by the end of 2027. In Australia, there is a prospect of further support for renewable energy investment through

reported plans for the government to overhaul the National Electricity Market (NEM). An advisory panel recommended the creation of an independent agency to enter into long-term offtake agreements, which would give investors revenue certainty and enable the project to be financed. The agency would then on-sell the agreements to electricity retailers. Such policy settings can provide support to take a competitive technology and turn it into grid-scale investment.

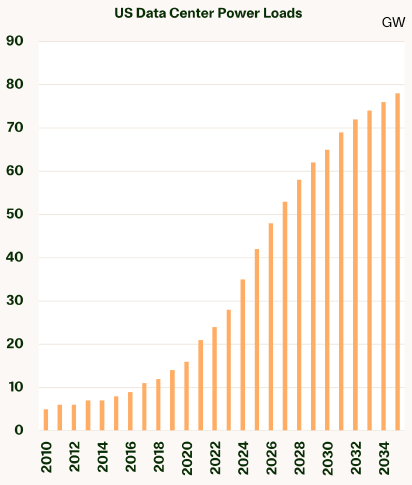

The third key factor is overall strong forecast growth in demand for power. In particular, this reflects surging data centre demand, which is expected to more than double from 2025 to 2030. Meeting such strong demand suggests more capex across the energy mix. Renewable energy is an especially attractive option for meeting some of this demand as it is relatively quick to bring online, while long lead times on new gas make it a less-ready option.

Source: Bloomberg

As a result, while the optics may be that investment in renewable energy has slowed, an important structural story is in play. This suggests that ongoing, solid growth in renewable energy capex should continue at regulated utilities over the coming years. This outlook is important to our thesis as it provides one clear plank for capital expenditure, which in turn drives growth in the rate base, and therefore earnings. For companies such as WEC Energy (US), Sempra (US), Alliant (US) and Redeia (ES), such investment is supportive for performance.

The risks appear manageable

This is not all blue skies and sun. Achieving delivery of renewable energy infrastructure at scale is a headwind to deployment. Fabrication and construction challenges are a barrier, with reported shortages of skilled labour, and some componentry. These obstacles can be expected to take some time to resolve; for example, in retraining or in securing a sufficient workforce. These headwinds can put a cap on the pace of renewables deployment. Furthermore, near term there are also administrative hurdles, with the imposition of more red tape for renewables projects in the US; for example, potentially slowing deployment.

Sufficient investment in firming capacity and grid infrastructure is also crucial. This is important because, as we noted in our recent report You can’t predict the weather, investment in the grid needs to “keep up” with renewable energy generation – through grid modernisation and expansion, and the ability to manage the energy system effectively, with the integration of volatile sources such as wind and solar. The ratio of grid investment to that in renewables needs to be commensurate.

This will be an important balance to strike, so service delivery remains reliable and the tide does not roll back from renewable energy.

Overall, for our investment thesis we see positive drivers in place for ongoing, solid investment in renewable energy across regulated utilities. Solid investment is critical to our strategy as it provides a catalyst for sustained capex. For regulated utilities, more capex increases their rate base, enabling them to earn an agreed rate of return on a larger set of assets. Ultimately, the allocation of this capex does not matter; it is increasing the rate base that is important. Expansion in renewable energy looks like one key contributor to returns this cycle.

Conditions are never static, however. Should there be some shocks to the system, including major outages or incidents or major shortages of componentry, for example, we could see a reallocation of future capex away from renewables and towards other investments such as gas-fired generation, for which there are also robust pipelines of potential projects. Such a rebalance would not mean worse outcomes for regulated utilities, given how they are compensated. Nonetheless, any such move would be important to watch, as it would mean a shift in our focus on indicators and policy signals for future capex growth.

1 International Energy Agency (IEA)

2 Federal Energy Regulatory Commission, August 2025

3 US Energy Information Administration, 2025 reference case for new resources entering service 2030.

4 S&P Global

From the Infrastructure Investment Team at Magellan Group, a sponsor of Firstlinks. This article has been issued by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.