More falls in cash and deposit rates and Treasurer Josh Frydenberg's advice to boards to stop paying special dividends and making buy backs would mean more income reductions for investors. The Reserve Bank hopes moving from 1% to 0.5% would somehow stimulate the economy, but what about the withdrawal of spending power from millions relying on their savings?

Josh Frydenberg told the Business Council of Australia:

"Share buybacks and capital returns are becoming increasingly prominent and the default option for corporates, but is a buyback always the best option for the future growth of the company and therefore the economy? Over the last 12 months, approximately $29 billion has been returned to shareholders in the form of buybacks and special dividends, compared to an average of $12 billion over the previous four years - a 140% increase."

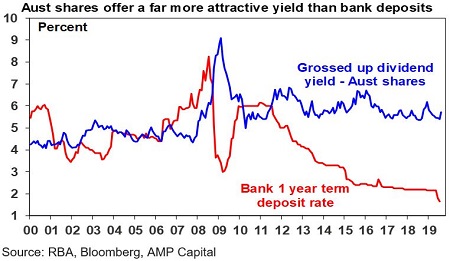

Already, investors need to factor in a future where secure deposits earn little or nothing. As important as the loss of income is the impact on investment patterns. Many investors can no longer tolerate negative real returns when the gap to fully franked dividends is the highest ever, other than during the GFC spike, as shown below. The fear is they will switch to shares at a time of market weakness which has punished investors with heavy falls since the 30 July peak.

Reserve Bank Governor Philip Lowe admits lower cash rates may be just another step to QE:

"We are prepared to do unconventional things if the circumstances warranted it."

This week, Shane Oliver explains what 'unconventional things' are and the vital implications for investors and sectors like property and infrastructure, while Kate Samranvedhya shows how low rates do not necessarily mean low total returns.

Further to the Treasurer's buy back argument, Anthony Aboud offers other reasons to question the motivations for share buy backs, with three examples where they were handled poorly.

Vihari Ross has been a member of Magellan's investment team since the start. In this exclusive interview, she explains how they grew to $85 billion under management while maintaining a consistent process. When are emerging trends an opportunity or threat?

I was on a panel at the Financial Services Council Summit 2019 this week, where we addressed trust in financial services including the impact of the Royal Commission on financial advice. I noted that Kenneth Hayne did not recommend a ban on vertical integration such as advisers using in-house products, and it can be done well. Simon Carrodus explains how advisers can manage conflicts, which some large institutions should have understood years ago.

Investors who study the metrics of companies such as P/E ratios or price-to-book often overlook critical inputs, and Joe Magyer says pricing power shows a company's ongoing strength.

What happened to inflation? Everyone, including central banks, thought massive liquidity injections would lead to rising prices. Nicholas Stotz finds six suspects in the killing of inflation.

The United Nations has released 17 Sustainable Development Goals, and this week's White Paper from AMP Capital explains their relevance in the context of infrastructure investing. As more investors use this sector for income, the ESG impacts are important to understand.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.