The 2022-23 Budget provides a “magic election pudding” of more spending but lower deficits. The additional spending relates mainly to this calendar year and given the strong economy is more motivated by politics than economics. “Fiscal repair” kicks in for the medium-term but this takes the form of restrained spending growth in contrast to the last two budgets rather than austerity.

Despite this, the Government is able to announce lower budget deficit projections thanks to a budget windfall from faster growth and higher commodity prices which is resulting in faster tax collections and lower welfare spending.

This is very much a pre-election Budget with few direct losers (eg, tax avoiders) and lots of winners – including low- and middle-income taxpayers, welfare recipients, motorists, first home buyers, parents with young children, older super members, apprentices, builders, small business owners, defence industries, transport users, tourism operators, Koalas, etc.

The Budget has a bunch of things to commend it:

- medium-term structural spending is no longer being ramped up faster than the economy;

- most of the budget windfall from stronger growth and higher commodity prices is being put to deficit reduction and hence long-term debt stabilisation (unlike last year when it was mostly spent);

- and the annual addition to infrastructure spending along with measures like the Apprenticeship Incentive Scheme will provide some boost to productive potential.

However, at a micro level the Budget may be criticised on the grounds that:

- The temporary fuel excise reduction is bad economic policy in that: it may be very hard to reverse if oil prices keep rising or stay high; it will make no sense if oil prices fall back on say a Ukraine peace deal; and it sets a bad precedent.

- Many welfare recipients are arguably getting compensated for “cost of living” pressures twice – via the one of payment and via the indexation of payments to inflation.

- The housing measures continue to focus more on demand than supply which will result in higher than otherwise home prices (even though they are unlikely to prevent the cyclical downturn in prices now starting) & will boost debt levels.

At a macro level there are two big risks flowing from the Budget.

- First, the pre-election cash splash (which is about 1% of GDP in terms of new stimulus in the Budget for this calendar year, but is actually a bit more if spending of the $16bn in “decisions taken but not yet announced” in MYEFO are allowed for) risks overstimulating the economy at a time when it is already strong, further adding to inflationary pressures and adding to the amount by which the RBA will have to hike interest rates.

- Second, the reliance on growing the economy to reduce the budget deficit and debt is unlikely to reduce debt quickly enough and is dependent on interest rates remaining low relative to economic growth. 10-year bond yields have already gone up more than four-fold since their 2020 low warning of a sharp increase in debt interest payments beyond the medium term. And economic growth is unlikely to be anywhere near strong enough to reduce the debt burden like it did in the post-WW2 period unless there is another immigration boom or 1980s style focus on boosting productivity - both of which look unlikely. In the meantime, the strategy would be highly vulnerable if anything came along to curtail the commodity boom. So at some point tough decisions are likely to be required either to reduce spending as a share of GDP or raise taxes.

Implications for the RBA

We expect the first rate hike in June and the cash rate to reach 0.75% by year end and 1.5% next year. The extra stimulus in the Budget increases the chance that the first rate hike is 0.4% rather than 0.15% (taking the cash rate to 0.5%), with the cash rate reaching 1% by year-end.

Implications for Australian assets

Cash and term deposits – cash returns are poor but they will start to rise as the RBA starts hiking from mid-year.

Bonds – ongoing budget deficits add to upwards pressure on bond yields. The rising trend in yields resulting in capital loss mean that medium-term bond returns are likely to be low.

Shares – more fiscal stimulus, strong growth and still low rates all remain supportive of Australian shares but rising bond yields & RBA hikes will result in a more constrained & volatile ride.

Property – more home buyer incentives are unlikely to offset the negative impact of poor affordability and rising mortgage rates in driving a cyclical downturn in home prices.

The $A – strong commodity prices point to more upside.

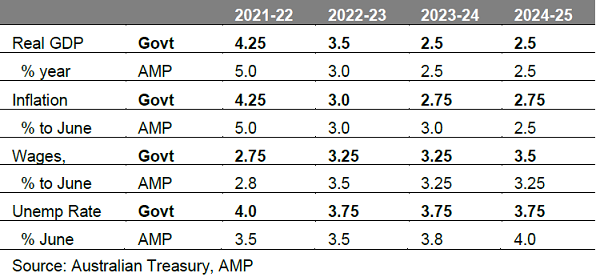

Economic assumptions

The Government revised up its growth forecasts for this financial year (from 3.75% to 4.25%) and kept 2022-23 GDP growth unchanged at 3.5%.

Unemployment is expected to fall to 3.75% by June 2023 (down from 4.25%). Inflation and wages forecasts have also been revised up significantly. We are a bit more optimistic on near-term growth but also see higher inflation and wages growth.

The Federal Government sees net immigration (estimated to be +41,000 this year rising to +235,000 by 2025-26) becoming more of a growth support.

The Government pushed out its $US55/tonne iron ore price assumption to September quarter 2022. With the iron ore now around $US135/tonne, it remains a source of revenue upside.

Economic assumptions

Source: Australian Treasury, AMP

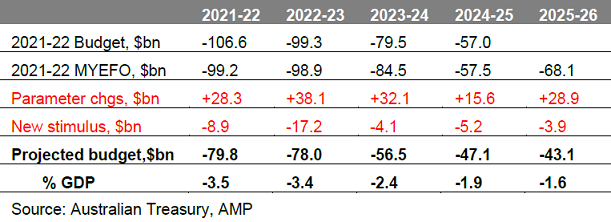

Budget deficit projections

The Government’s revised budget projections are shown in the next table. A budget windfall resulting in a boost to revenue and savings in spending from faster than expected economic growth and inflation, alongside higher commodity prices, is estimated to have reduced the budget deficit since the December Mid-Year Economic and Fiscal Outlook by $28.3bn for this financial year and by a total $142.9bn out to 2025-26 (see the line called “parameter changes”). This is being partly offset by extra stimulus (labelled “new stimulus”) of $8.9bn this financial year, $17.2bn next financial year and a total $39.3bn to 2025-26. But as a result of the budget windfall exceeding the new stimulus the budget deficit is projected to be substantially smaller in the years ahead than seen in December.

The unwinding of temporary pandemic support measures and the stronger than expected recovery is seeing the budget deficit fall sharply from the record $134bn recorded in 2020-21 (which itself is well down from the $214bn first projected in the 2020-21 Budget).

Underlying cash budget balance projections

Source: Australian Treasury, AMP

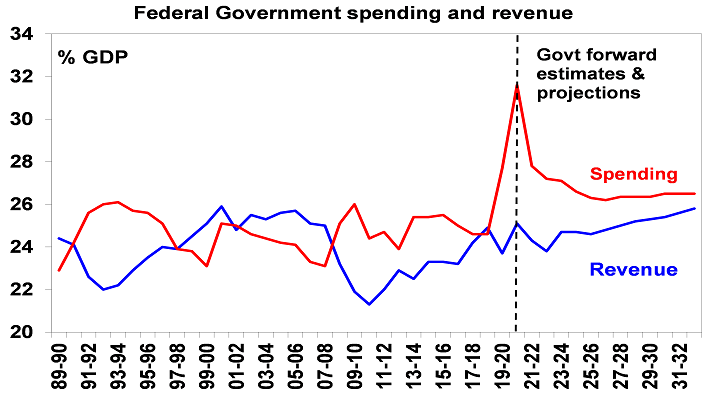

Out to 2025 the deficit is projected to fall rapidly as covid programs phase down. However, spending is still expected to settle about a high 26.4% of GDP. This is well above the pre-covid average of 24.8% and reflects higher health/NDIS and defence spending. Rising revenue with a growing economy is assumed to do all the deficit reduction heavy lifting from 2026.

Source: Australian Treasury, AMP

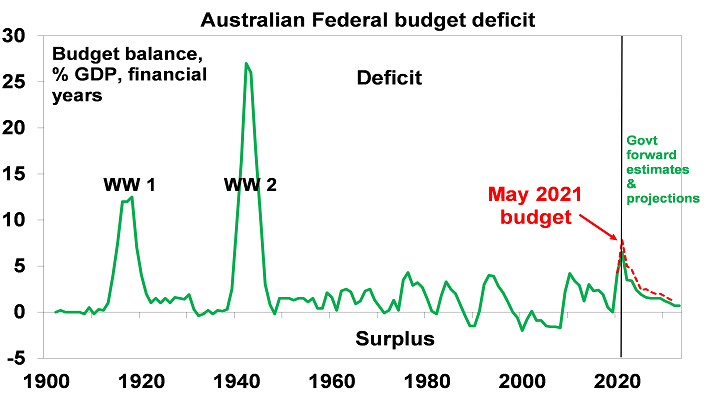

The Government still doesn’t see a surplus in the next decade.

Source: RBA, Australian Treasury, AMP

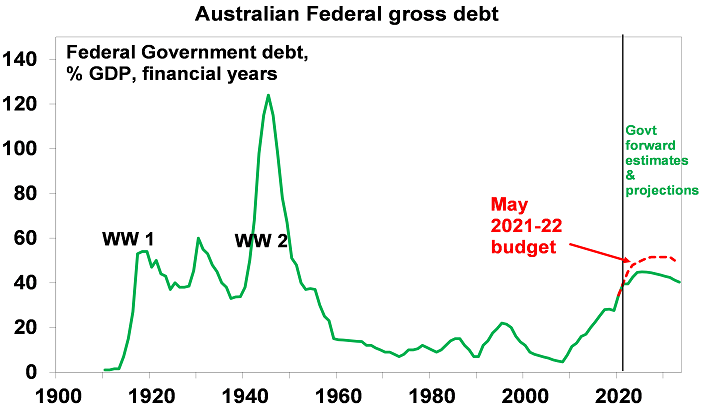

Because of stronger nominal growth, gross public debt as a share of GDP – which is at its highest since the early 1950s - is now expected to peak at around 45% of GDP in 2025, which is lower and earlier than previously expected. Gross public debt is expected to reach $1tn in 2023-24. Net public debt is projected to peak as a share of GDP by the middle of the decade.

Source: RBA, Australian Treasury, AMP

Dr Shane Oliver is Head of Investment Strategy and Chief Economist, and Diana Mousina is Senior Economist at AMP Capital. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice.