Advertisements for superannuation funds usually come with an obligation to add “past performance is not a reliable guide to future returns”. This is certainly true on a year by year basis, where the pecking order of classes of assets and fund managers have some volatility. Indeed, when it comes to asset classes, it is rare for the same class to top the ladder year after year.

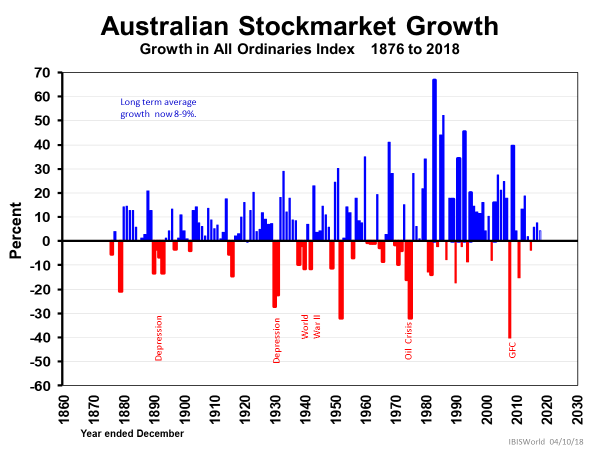

The volatility of Australian shares over the past 150 years is evident in the chart below.

Indeed, the amplitudes of rises and falls is alarming. Of compensating solace is the fact that the All Ordinaries Accumulation Index continues to climb, and the combination of dividends and capital gain has been rewarding to long-term investors for a long time.

So, what are our investment choices?

The main asset classes are:

- Shares (local & international)

- Property (real and trusts)

- Bonds

- Cash

- Precious metals (gold, silver, gemstones etc.)

- Collectables (art, stamps, vintage cars etc.)

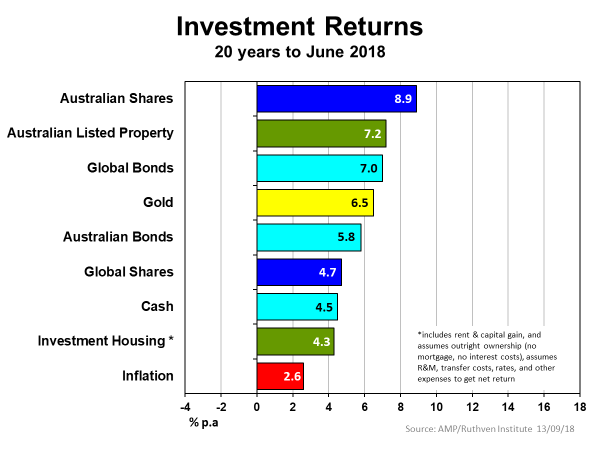

How have these performed over time? The following charts show the returns over 20 and 10 years.

While riskier assets (shares) should always yield better returns than more passive (or defensive) assets (bonds, property, collectibles and precious metals), they don’t necessarily do so. Global shares in the 20 years since 1998 were impacted by the dot-com bubble and meltdown in 2000, and the GFC in 2008. Less so Australian shares, which missed out on both crashes. Gold did much better than usual, being a panic metal these days but a perceived safe-house over this period.

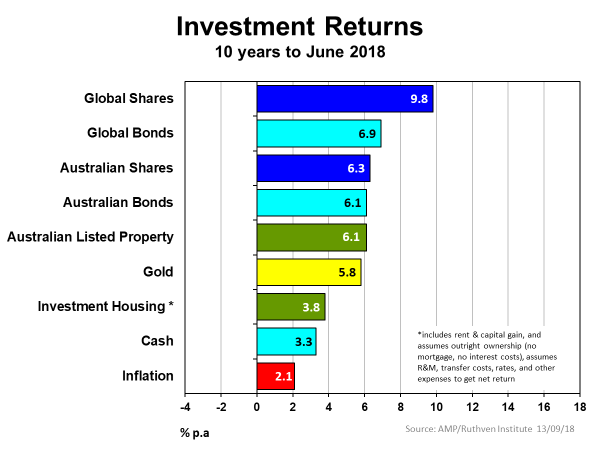

There was a different story over the past 10 years as we see below.

Global shares did best, with Australian shares in third place, sandwiching listed property which has done well over both time periods. Gold resumed its normally low position, along with investment housing which consistently performs badly over long periods.

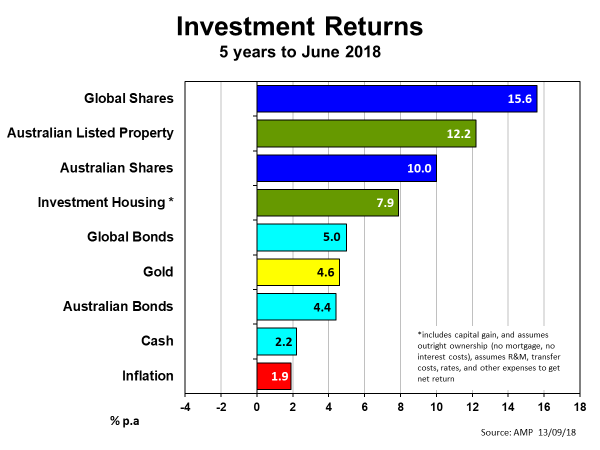

However, when we take a short period – say 5 years, as shown in the last exhibit – and combine that with some extraordinary developments, some surprises emerge.

Alarm bells are ringing

Firstly, global shares have done extraordinarily well in an environment of record-low interest rates. But with P/E ratios nudging 20:1 (with a small reversal last week, but longer term, compare to a safer 14:1) across the world, alarm bells are ringing for returns over the next five years. Ditto investment dwelling prices and returns in Australia, where bubble prices in Sydney have been experienced, accompanied by one of the highest mortgage debt to GDP ratios in the world.

All that said, it seems shares and listed property classes are the consistent best performers over long periods. Perhaps online shopping could dent listed property returns in the future.

However, if shares, as the riskiest active-class investment of the lot, don’t stay at or close to the top, it's because the economy is in bad shape via:

- a depression

- an asset crash from excessive exuberance, or

- underperforming businesses.

Fund managers and SMSFs usually choose to be conservative by having around half their funds in active (riskier) assets while taking out insurance via other assets and cash. Just in case.

Phil Ruthven AM is Founder of IBISWorld and is recognised as one of Australia’s foremost business strategists and futurists. This article is general information and does not consider the circumstances of any investor.