The recovery in oil prices during the past year, as measured by the price of Brent Crude Oil, has provided a welcome respite for investors exposed to direct commodities, energy-related stocks and high-yield debt, particularly for North American shale oil producers.

While short-term predictions are fraught with danger, futures markets provide context as to where market participants believe oil prices should be over the medium term. This article provides a deeper understanding of oil pricing dynamics and the prospects for crude oil prices [Editor's Note: a 'contango' is where the futures or forward price of a commodity is above the spot price].

Forward curve dynamics

Futures markets provide an insight into the incentive pricing for producers, hedgers, and speculators to act. The spot price is typically quoted on news and business channels, but futures markets provide price points for multiple tenors in the future which can be used by market participants to either hedge production, hedge-pricing risk for buyers, or take a position, as is the case for speculators.

Further ‘along the curve’ (looking at prices that are at least six to 12 months in the future), there tends to be less noise and more signals which are reflective of market fundamentals. If this were not the case, there would be an opportunity to arbitrage for those investors able to participate in both the physical (spot) market and hedge using futures.

Brent Crude Oil forward curve fair value per barrel in US Dollars

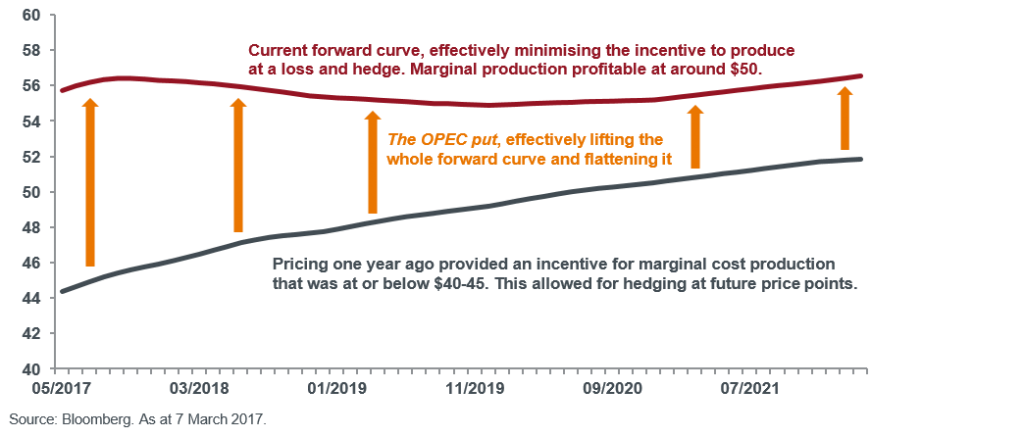

The chart shows forward pricing for Brent Crude Oil as of 7 March 2017 (the ‘forward curve’, shown in red) and compares this to the forward curve one year ago (shown in grey).

The chart provides a number of insights:

1. Oil markets are back in balance

Since the announcement by OPEC in late 2016 of production limits, oil markets have been rebalancing. While this doesn’t negate the effect of currently high levels of global inventories, the forward curves illustrate how the forward curve has effectively shifted up and flattened. This is historically associated with positive performance for the immediate future as there is less incentive to produce today and forward hedge (prices are flat for the immediate future).

2. Shale picks up market share, ‘ROPEC’ picks up revenue

The wild card in the oil market deck is now North American shale oil production. A combination of recent increases in rig counts and falling marginal costs for certain oil basins mean that OPEC shares swing production with US shale producers.

Current pricing provides an incentive for more marginal production to come on line in the US, so this will likely translate into higher market share for shale as a percentage of global oil production, while OPEC and Russia (AKA ‘ROPEC’) benefit via increased revenues, albeit at lower production levels.

3. Aramco IPO in the balance

It is in the interests of the Saudi Arabians to maintain prices around these levels. With the proposed IPO of Aramco in the next two years, its oil assets would be priced at the average price of the past 12 months. A major objective of Saudi oil production would be to maintain pricing at these levels to keep them low enough not to encourage a major increase in shale production, but high enough to provide a reasonable valuation on oil reserves. The Aramco IPO could potentially make it the largest listed oil company in the world, above Exxon Mobil Corporation.

Conclusion on the oil market

Current oil market pricing in the mid-US$50 range is a ‘sweet spot’ for all major oil market participants, including OPEC, Russia and the more productive and cost efficient North American shale producers. Barring unexpected events, oil prices will likely remain range-bound for the medium term, with an effective floor of around US$50 as the base case. The abyss oil markets experienced in early 2016 provided an insight into the instability created by an oversupply in energy markets, and this will be front and centre to ‘ROPEC’ in encouraging strict compliance with production quotas.

Andrew Kaleel and Matthew Kaleel are Co-heads of Global Commodities & Managed Futures at Henderson Global Investors. This information is general only and does not take into account the personal circumstances or financial objectives of any reader.