Property investors are always looking for ways to reduce their tax liability. One way of reducing the taxable income from your investment property is by claiming depreciation deductions on items such as carpets, appliances and fixtures.

There are some important rules imposed by the Australian Tax Office (ATO) that apply when it comes to claiming depreciation.

What is property tax depreciation?

Before delving into the details relating to Division 40 and Division 43 assets, it is important to have a foundational understanding of what property tax depreciation is and how it can benefit you.

As your building ages, it becomes subject to general wear and tear. Each year, the value of the building and its attached assets decrease, and this is known as depreciation. Depreciation applies to two different types of assets:

- Capital works (Division 43 assets)

- Plant and equipment (Division 40 assets).

But depreciation isn’t necessarily a bad thing for property investors. The ATO allows investors to claim this loss in value as a tax deduction provided they are generating an income from their investment.

Claiming depreciation on Division 43 assets

Division 43 or capital works refers to the depreciation of the structure of the building. You can also claim capital works deductions on the cost of:

- structural improvements

- construction and extensions, and

- earthworks for environmental protection.

Examples of items where a capital works deduction can be claimed include:

- fencing

- driveways

- garages

- roofing

- paint

- tiling

The structure of residential and commercial buildings generally has an effective life span of 40 years. It's possible to continue claiming capital works deductions for 40 years from the date of construction provided income is generated from the property.

In circumstances where investors do not know the construction costs, a qualified Quantity Surveyor will be responsible for estimating the cost of the building.

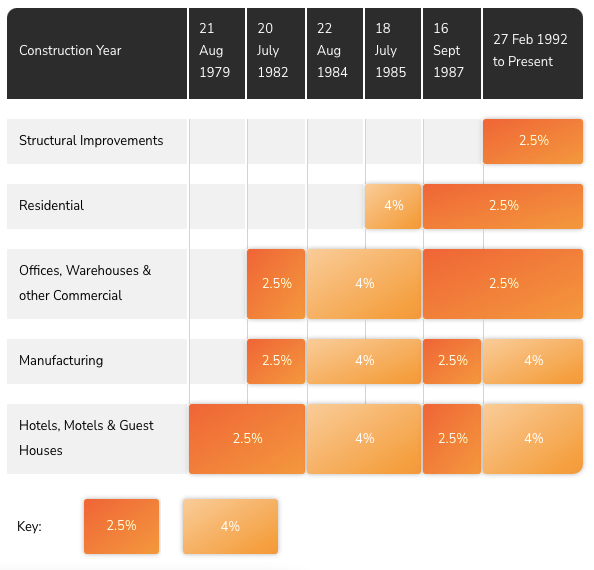

Whether a building qualifies for capital allowances is dependent on when it was built and the type of property.

Source: Duo Tax

What are Division 40 assets?

The term Division 40 refers to the plant and equipment assets found within the investment property. These assets are generally easily detachable from the property.

Unlike capital works which depreciate over 40 years, plant and equipment fixtures depreciate at a rate according to the ATO’s Asset Effective Life Schedule, which gives guidance on how many years an asset is effective before it’s worn out. The ATO recognises more than 6,000 different assets that investors can claim tax deductions on.

For example, a carpet, which is subject to wear and tear, has an effective life of eight years. Other examples of Division 40 assets include:

- air conditioning unit

- oven and rangehood

- blinds

- carpet

- light shades

- ventilation fan

Depreciation methods

Investors can use two methods to calculate the depreciation on plant and equipment assets:

- diminishing value method

- prime cost method.

Although the end value is the same, investors typically prefer the diminishing value method to allow for a higher depreciation deduction in the first few years.

For example, according to the ATO, a dishwasher has an effective life of 10 years. If an investor depreciates it using the diminishing value method at a rate of 20%, they can claim a deduction of $2,000 in the first year. In the following year, reduce the base value (i.e. $10,000) by your previous claim, so claim 20% on $8,000. And depreciation will continue until it reaches a value of less than $1,000.

When the value is below $1,000, the depreciation rate increases to 37.5% (as per low-value pooling).

A low-value pool is a group of assets that have a value of less than $1,000. Investors can pool low-cost assets (i.e. assets that cost you less than $1,000 to purchase) and low-value assets together and depreciate them at a much faster rate.

The ATO allows investors to write off eligible plant and equipment assets that cost less than $300 as a full deduction in the year the asset was purchased.

Changes to Division 40 claiming laws

After the Federal Budget in 2017, a few new rules were introduced regarding tax depreciation that would impact your claim depending on when you acquired the property:

|

Before 9 May 2017

|

After 9 May 2017

|

|

A property investor can claim depreciation on plant and equipment that form part of the property they purchased, according to a Quantity Surveyor’s assessment of the asset’s remaining life and value.

|

Depreciation only applies for costs on new plant and equipment you paid for and installed or plant and equipment that were included as part of the new property.

|

This means that investors cannot claim deductions on plant and equipment bought by the property’s previous owners.

Closing remarks

To maximise tax deductions on Division 40 and Division 43 assets, investment property owners need a tax depreciation schedule. It is a comprehensive report detailing the claimable deductions on an investment property.

The purpose of a tax depreciation schedule is to outline the value of both the Division 40 and Division 43 assets, as well as how much it has depreciated and will depreciate. This will include a calculation of tax deduction claims.

The tax depreciation schedule document is typically prepared by a professional quantity surveyor, who will inspect your investment property and assign a value to each asset. A single schedule provides 40 years of claimable deductions (or the maximum entitled years). It will help to reduce taxable income and realise a positive cash flow sooner.

Tuan Duong is the Principal and Founder of Duo Tax Quantity Surveyors. He is a professional member of the Australian Institute of Quantity Surveyors and a Registered Tax Agent, authorised to offer advice on matters related to depreciation. This article is general advice and does not consider the circumstances of any person.