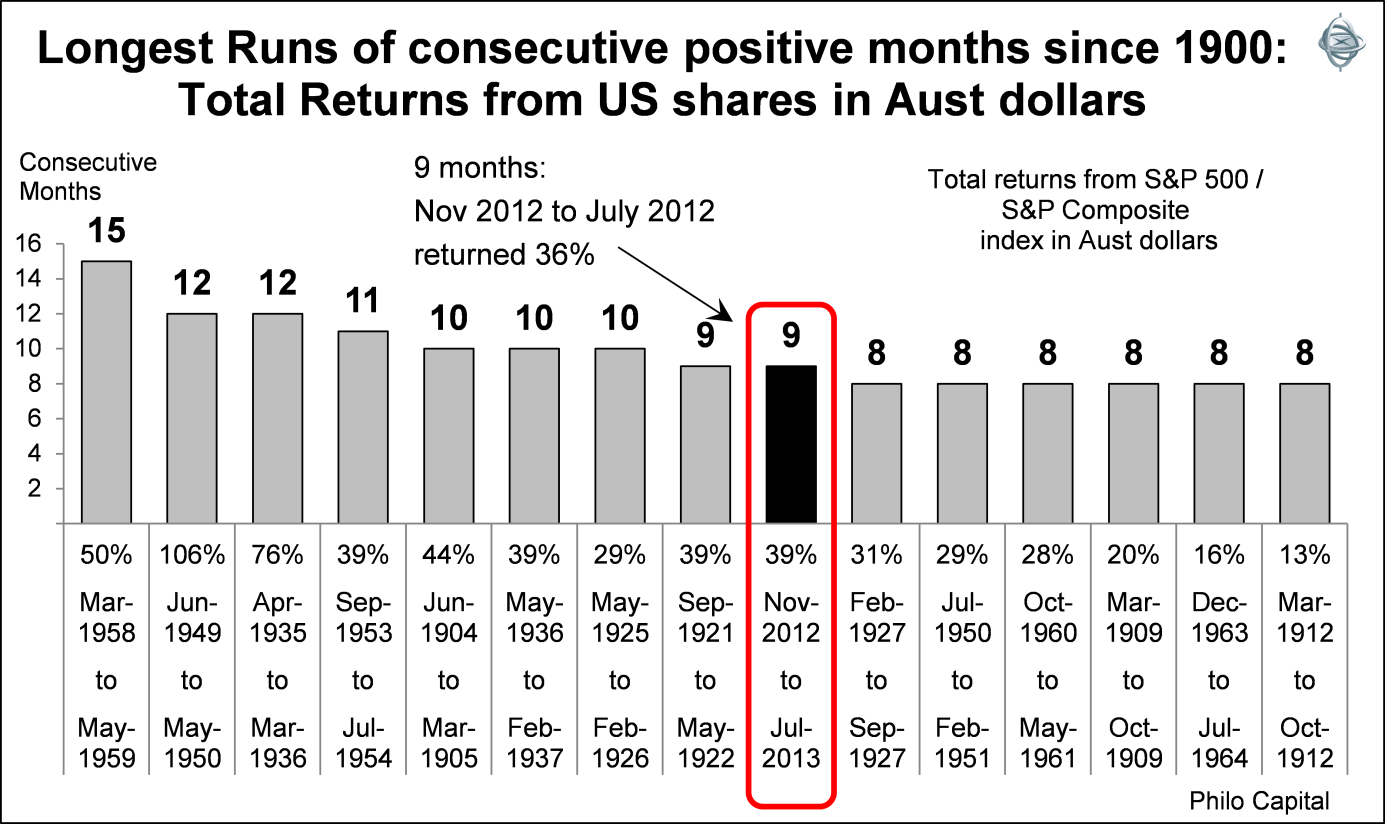

Investors look for high returns as well as consistency. That is what the US stock market has delivered this year for Australian investors. The S&P500 index has generated positive total returns in Australian dollars for nine consecutive months from November last year to July 2013.

This run of 9 positive months makes it into the list of top 10 longest runs of positive returns from US shares in Australian dollars since 1900. It has been the longest positive run since 1958-59, which ran for a record 15 months. There have been only three positive runs longer than 8 months since WW2 but they were all before I was born (just!), so I never saw them.

Not only has the US market returned 39% in Australian dollars over the past 9 months, volatility has not been lower since the mid-2000s. It has been the best run of consistent, high returns in my lifetime. So much for the so-called ‘high volatility, low return, new normal!’

This does not imply that the run will continue of course, but it does show the value of ignoring the media hype and focusing on the facts.

The currency effect helped the performance. The Australian dollar fell by a total of 13% against the US dollar during the period, including declines in six of those nine months – in December, February, April, May, June and July. This currency effect greatly assisted in keeping the returns positive for Australian investors, especially when the US market fell in US dollar terms during the great Bernanke ‘QE-taper’ scare in May and June. Australian investors in US shares sailed through the crisis because the falls in US share prices were more than offset by falls in the Aussie dollar, leaving un-hedged Aussie investors ahead.

Contrary to popular myth, this foreign exchange component of investing in foreign shares actually lowers portfolio volatility and helps smooth returns for Australian investors in un-hedged foreign shares.