“He who pays the piper calls the tune.”

To state the bleeding obvious, sales people working for fund managers are biased towards their own product structures. It’s the job of Chief Executives, Chief Investment Officers and Business Development Managers, and anyone working in distribution for a fund manager, to promote their company’s particular structure. Another side of the job description requires them to point out the deficiencies of competitor structures.

So let’s focus on the biggies. What is the main criticism that Listed Investment Company (LIC) folk use against managed funds, and what do managed funds folk say to criticise LICs?

Main weakness of managed funds, as nominated by LICs

Managed funds are open-ended, which means existing investors can redeem (cash out) at times of market stress, forcing fund managers to sell assets into poor markets.

Main weakness of LICs, as nominated by managed funds

LICs are closed-ended, which means the only way existing investors can cash out is by finding a willing buyer on the stock market, and this could be at a heavy discount to the asset backing.

Guess what. Both are correct. The irony is that these are also the strengths in the right markets. Let’s consider each in more detail:

Managed funds are forced to sell in stressed markets

The harsh reality of the way many investors behave is that they invest more into the market when it is strong, expecting it to rise further, and redeem when markets fall, expecting further losses. The doom and gloom in the media prompts unfortunate investor reactions.

In extreme circumstances, managed fund redemptions may be suspended to prevent cash outflow, such as on mortgage funds around 2008 during the GFC. These products had a fundamental weakness. They offered next day liquidity, but their assets were both long-term and illiquid. There is no ready market for five-year mortgages at a time of distressed selling. Faced with a run on their funds, redemptions were suspended, and it was only recently, some seven years later, that the final mortgages were repaid allowing the last instalment to be returned to the investors.

Example of the problem: During the GFC, the only way the demand for cash from managed funds could be met was by selling assets. I remember one frustrated fixed interest manager telling me he could buy seven-year CBA subordinate debt (not hybrids) at over 9%, which he thought was excellent value (and indeed, it turned out to be), but he could not buy because he was desperate to sell anything to fund redemptions. Liquidity has a tendency to dry up when it is most needed.

Similarly, when markets are peaking, new applications are usually at their highest. Since most managers accept as much money as they can, they are either forced to invest when the market is toppish, or hold the money in cash and risk underperformance if the market continues to run.

So the LIC criticism of managed funds can be accurate at market extremes. But the main strength of managed funds is due to the same structure. Managed funds are open-ended, and existing investors can redeem (cash out) at the net asset value (NAV) of the underlying assets every day. They do not trade at a discount.

LICs trade at a discount

LICs are not required to sell assets as investors cash out because the buyer on the ASX provides the liquidity, and the number of shares on issue remains the same. This advantage is balanced by the dependence on the strength of the market bid to support the price, and especially for larger sales volumes, the price can be pushed down relative to Net Tangible Assets (NTA).

For example, assume a buyer subscribes for an initial issue at $1, and the NTA at the start is $0.97 (due to the cost of listing). If the fund manager has a poor start to performance, or the overall market is weak, or the initial issue was not firmly placed with end-holders, then the issue can drift to a further discount to NTA, and sometimes take years to recover, if ever.

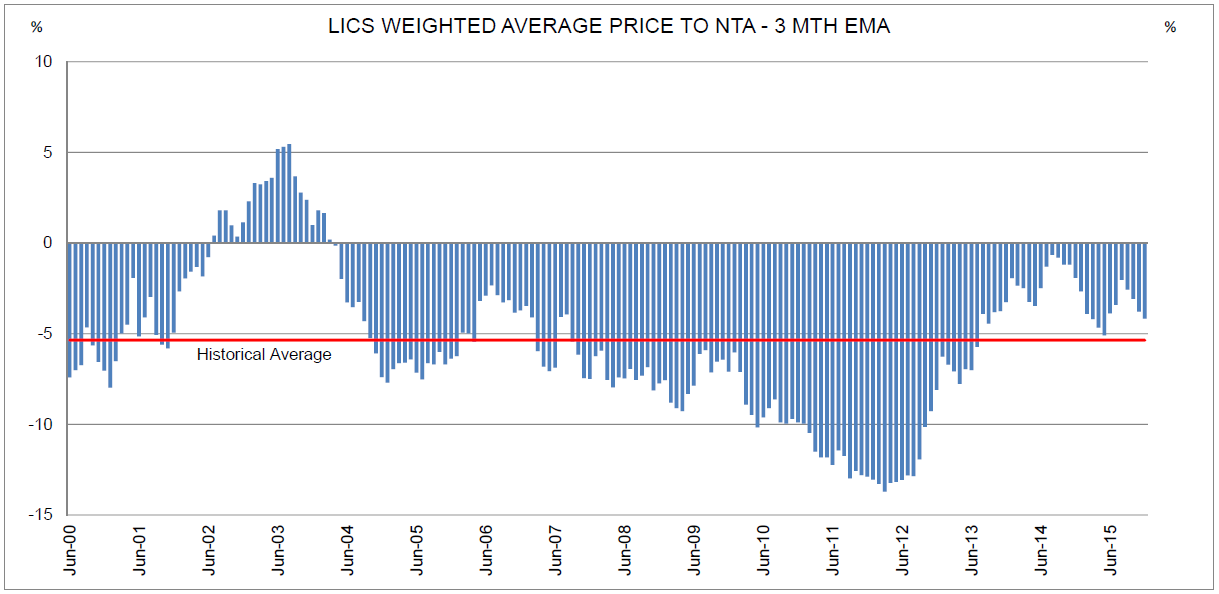

The table below shows the weighted average market price to NTA for all LICs in Australia, showing an average discount to NTA of about 5%, but it has been as high as 13%, with no positive average for the last 12 years.

Source: Patersons Listed Investment Companies Report, December 2015.

EMA = Exponential Moving Average, which gives more weight to recent data.

These are averages, and there are some well-established LICs which have performed better, often trading at a premium to NTA. These include Australian Foundation (AFI), Argo (ARG) and some of the Wilson funds, such as WAM Capital (WAM). But since the sector as a whole is at a discount, many are at severe levels of 20% or more, and perhaps up to 30%. Examples of large discounts include Flagship (FSI), Contango Microcap (CTN) and Hunter Hall (HHV). The investor has only two choices in these LICs: hang on and hope the discount is removed, or sell and realise the loss.

The main reasons why some LICs trade at a premium are that the manager or fund is well-known, highly sought-after and communicates well with investors. The flip side is that if the manager loses the confidence of investors, it can take a long time to recover. Investors need to be convinced the manager can add value. There is no mean reversion.

Looking at the graph, it might sound attractive to buy at a discount of 13% and then sell at a discount of 5%, but it is extremely difficult to know which manager’s reputation will improve, or even what caused the discount.

Example of the problem: Templeton Global Growth Fund (TGG) is a long-established LIC from a global brand with a market value of about $280 billion. Until a year ago, TGG had been trading at around NTA, with a 12-month high of $1.50, but is now at $1.13 against an NTA of about $1.30. The share price has fallen roughly twice the market fall. They recently held an investor update where a member of the public criticised the board for twice issuing new shares at a discount to NTA, diluting the value of shares for existing shareholders. The investor argued that the placement had contributed to the discount to NTA. A board member of TGG admitted they had underestimated the consequences of both the issue at a discount and the placement. He said their communication must improve, especially by better explaining their style and in what conditions it might not work (they are deep value, which has underperformed growth recently). It will take a lot of time and effort by TGG to remove the discount to NTA.

As with managed funds, the main weakness is also the main strength. LICs are closed funds, which means the manager is never forced to sell assets on market at times of stress.

Are LICs or managed funds better?

There is a lot more to the overall merit of these two structures than the two main points highlighted here. Consider the quality of the manager and investment team, the time frame of the investment, the asset class and the need for liquidity.

For investors who find high quality managers who put a lot of time and effort into nurturing their clients and who deliver consistent performance, LICs are a good structure. For investors who demand liquidity at market value and trust a large institution with a strong investment management business, managed funds can work well.

But next time you hear the predictable criticism of an alternative structure, ask about their own potential weaknesses.

Graham Hand is Editor of Cuffelinks. This article is general information only. Disclosure: Graham holds investments in both managed funds and LICs, including TGG, he is on the Board of a LIC (Absolute Equity Performance, ASX:AEG) and sits on the Compliance Committee of a managed fund business (Lazard Asset Management).