Editor's note: the bond investments mentioned in this article are only currently available to wholesale or sophisticated investors, not 'retail'. However, the Government Report, on the 'Development of the Australian Corporate Bond Market: A Way Forward' was released this week with 12 recommendations to enhance the development of the Australian bond market. The Report says:

"We need to do this for two people: working Australians who are approaching retirement and need to regularise their retirement incomes, and growing businesses that want to stay in Australia but have little or no access to venture capital."

-----

As Sydney and Melbourne emerge from lockdown, there are some reopening trades in the Australian credit market which eligible investors should consider as part of their fixed income portfolios.

The outlook for the Australian economy is looking increasingly optimistic with consumers and businesses starting to see light at the end of the tunnel. Opportunities are coming from bonds in sectors hit hard by lockdowns that are trading relatively cheaply compared with their valuations based on a normalised operating environment. The main sectors include travel, shopping centres, gaming, airports, hotels, and distressed credit players.

Opportunities emerge as business opens

If these bonds are trading relatively cheaply, then there are incremental returns to be made as the bonds migrate towards their fair value. Provided a company’s prospects have not been permanently impaired (that is, idiosyncratic risk remains quite low for the credit), then a focus should be on companies which are high-quality, have good balance sheets and are industry leaders. These will benefit the most from the reopening as COVID-19 becomes less of a threat.

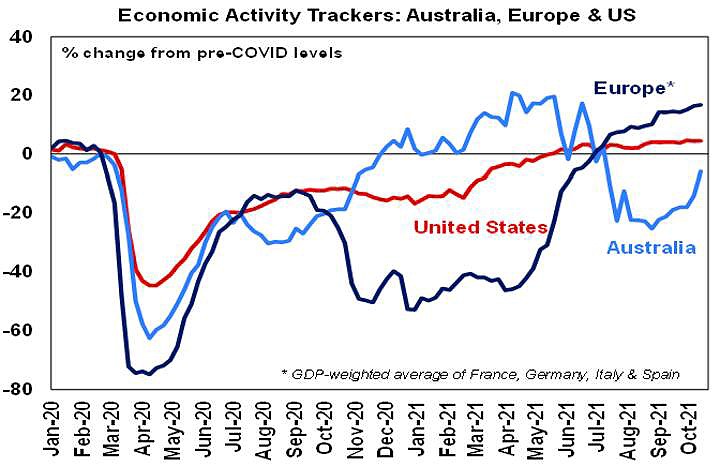

Chart 1. Economic Activity During Peak Covid Era

Source: AMP Capital, covid19data.com.au

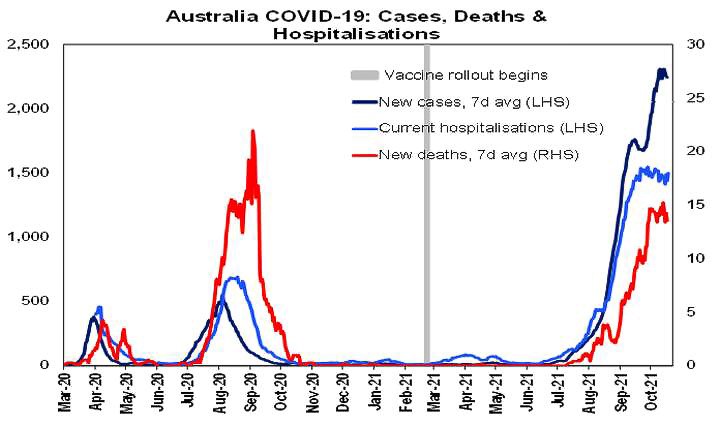

Chart 2. Covid-related Hospitalisations, Cases, and Deaths in Australia

Source: AMP Capital, covid19data.com.au

The AMP Capital Australian Economic Activity Tracker has risen strongly as the Australian reopening gathered pace. All components within that tracker rose, with the key ones being restaurant bookings, transactions, and mobility. The main risk in Australia remains a resurgence in new cases in NSW, the ACT, and Victoria after reopening, not unlike what has been seen in the UK, Israel, and more recently Singapore.

In the investment-grade space, our top ideas are:

Qantas: 5.25% 09/09/2030 (Yield-to-Maturity YTM of around 4%)

The outlook for Qantas has improved significantly following recent updates to the long-anticipated travel restart. This has seen the intended take-off date for international travel brought forward from 1 December to 15 November, to (more recently) 1 November 2021.

Overall, increasing vaccination rates across Australia, along with the relaxation of border and quarantine policies, have lessened the risks for the airline, giving us conviction in the company’s earnings will rebound with free cash flows (FCF).

Scentre Group: 5.125% 24/09/2080 (callable 24/06/2030, with YTM of around 4%)

Scentre Group is supported by a portfolio of high-grade retail assets that have traditionally been very high performers. While Australian retail property centres were impacted by COVID-19, rents picked up in H1 2021 and are likely to start ramping up over H2 2021 as restrictions continue lifting — making this a good ‘reopening trade’.

Scentre Group is a world-class owner, manager, and developer of retail assets. Asset values have started to stabilise, and the company’s net operating income (NOI) appears to be rebasing to a level higher than expected.

Sydney Airport: 3.12% 20/11/2030 (inflation-linked bonds, real yield of around 3-4% depending on inflation assumption)

With interest rates as they are and the many analysts arguing that the unprecedented COVID-19 economic stimulus will create ongoing inflationary pressures, it is prudent to include some form of inflation-linked bonds in your portfolio.

Supported by increasing vaccination rates across Australia, we’re getting closer to a normalised operating environment, and that will be good news for airports, hotels, and tourism/travel in general.

In the high-yield space (where returns come with more risk so extra caution and research is needed), our top ideas are:

Capital Alliance Investment Group (CAIG): 10% 21/10/2025 (YTM of around 10%)

There are several key credit milestones on the horizon for CAIG, starting with the opening of the Marriott in late October, which should coincide with the 80% vaccination threshold in Melbourne. CAIG also has good cash on hand from the Marriott residence sales and residual stock facilities which will be received by the end of this year. By the start of 2022, there will be three operational hotels that will be ramping up occupancy and cashflows following the completion of AC Hotels (Normanby).

Pioneer Credit: 22/03/23 Note (YTM of around 9%)

As more purchased debt portfolios (PDPs) are released to the market, Pioneer Credit is positioned to acquire assets at attractive discounts. Concurrently, improving employment conditions for underlying borrowers will improve recovery values. At this time, Pioneer Credit strikes us as a unique proposition, leveraged to a COVID-19 exit that the market has largely overlooked to date.

Crown Resorts: 23/04/2075 (YTM of around 10%)

With Sydney and Melbourne coming out of lockdown, there’s an opportunity to buy into the Crown ASX hybrids at a relatively cheap entry point. Despite the regulatory risk that comes with casinos and negative public sentiment on account of recent problems at both Crown and The Star, casinos should do well once lockdown restrictions are lifted. Crown is well positioned for a rebound, and the recent inquiry into its operations has given its Melbourne casino two years to correct its poor corporate governance.

For now, we maintain a constructive stance on corporate credit due to favourable fundamentals and supply/demand dynamics. We favour certain cyclical sectors, including travel, shopping centres, gaming, airports, hotels, and distressed credit players, complemented by a higher-quality bias in less cyclical sectors that provide defensive characteristics to portfolios.

Should we see a resurgence of market fear that leads to a material widening in credit spreads and yields, then we would be looking to add to these cyclical sectors which offer high income and total return potential.

Matthew Macreadie is a Credit Strategist at Income Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor. Please consider financial advice for your personal circumstances, including eligibility for these investments.

For more articles and papers from Income Asset Management, please click here.