Some years ago, as my wife and I contemplated the transition to full retirement, we decided to take charge of our future and opted to manage our own super. One of the primary reasons for this was to ensure that the assets reflected our conservative nature; that is 100% shares. This may sound contradictory to many but after more than 45 years in the financial services industry, I had learnt some important lessons.

What does risk really mean?

The word 'risk' is bandied about but many do not understand the investment risks associated with retirement. Still today, the definition of investment risk remains the volatility of share prices. So, leaving our future hostage to an industry still wedded to this outdated dogma did not appeal to us. We refuse to accept volatility as a problem. Our primary risk is not losing money but outliving it.

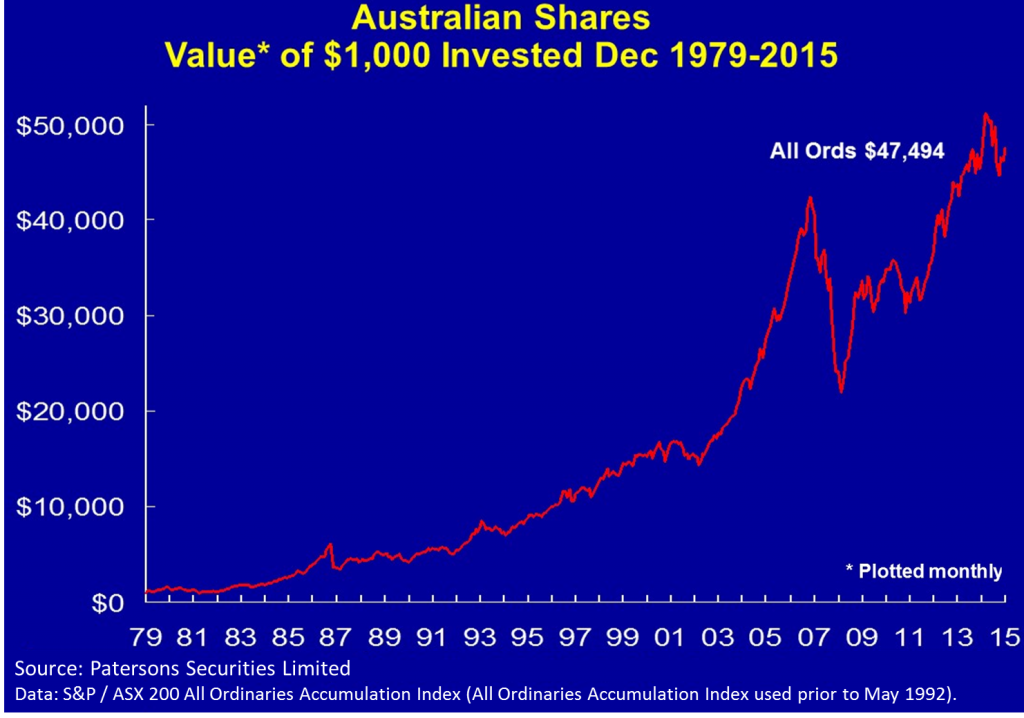

In many presentations I have tried to curb this unhealthy focus on prices by offering an alternative view. The chart below is the All Ordinaries Accumulation Index plotted monthly over 35 years. One can see the constant volatility which gives mindless speculators, day traders, hedge funds, computer traders etc. and the media, a fertile environment for spreading their germs.

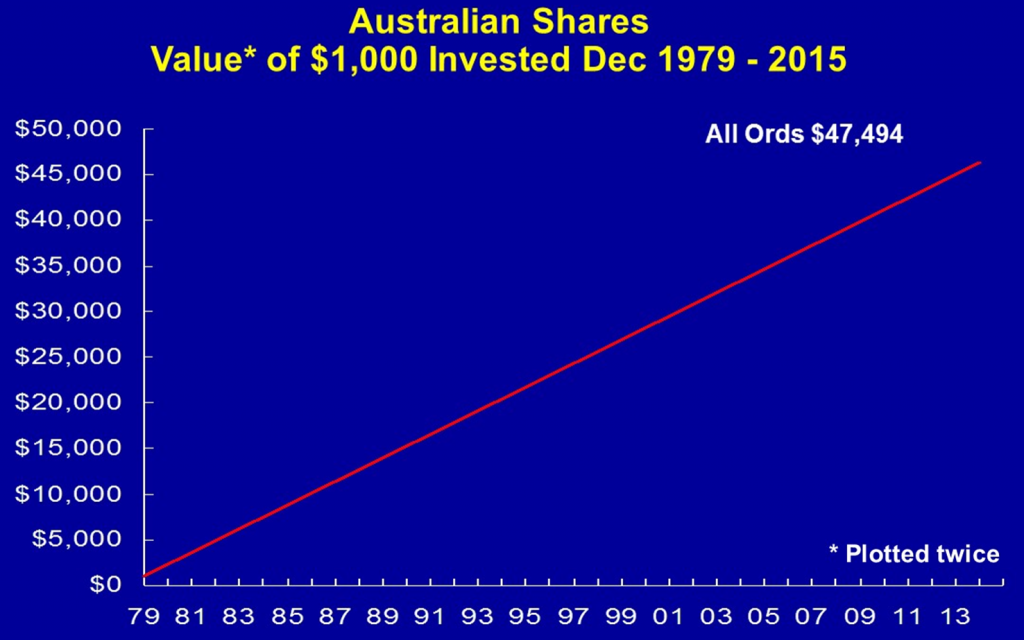

As 'perception is reality', consider my perception of this same picture.

You will note that in both cases we arrived at exactly the same point. I have simply chosen to ignore all the dead ends, shortcuts and deviations along the way! I know what I paid for the shares and I know what they are worth at the end of each day as every one of them is publicly 'auctioned'. The revelation for me, some years ago, was that all the noise in between purchase and today was just useless chatter. Unless of course you are a 'chartist'. It is difficult to draw trend lines on my chart and identify the 'double tops' and 'head and shoulders'!

In retirement, it’s income that matters most

When discussing whether we could afford my ceasing full-time work, the consideration was not how much money we had but how much income we needed. We looked at the three assets available (cash, property and shares), considered their income prospects both present and future, and opted for shares.

The income they generated would meet our immediate needs without having to rely on selling, thus maintaining the integrity of our asset base. Also, over the long term I knew that the dividends from a diversified portfolio of shares had and would grow in a relatively stable way and being linked to the productive efforts of the nation, they would be superior to the income from other sources.

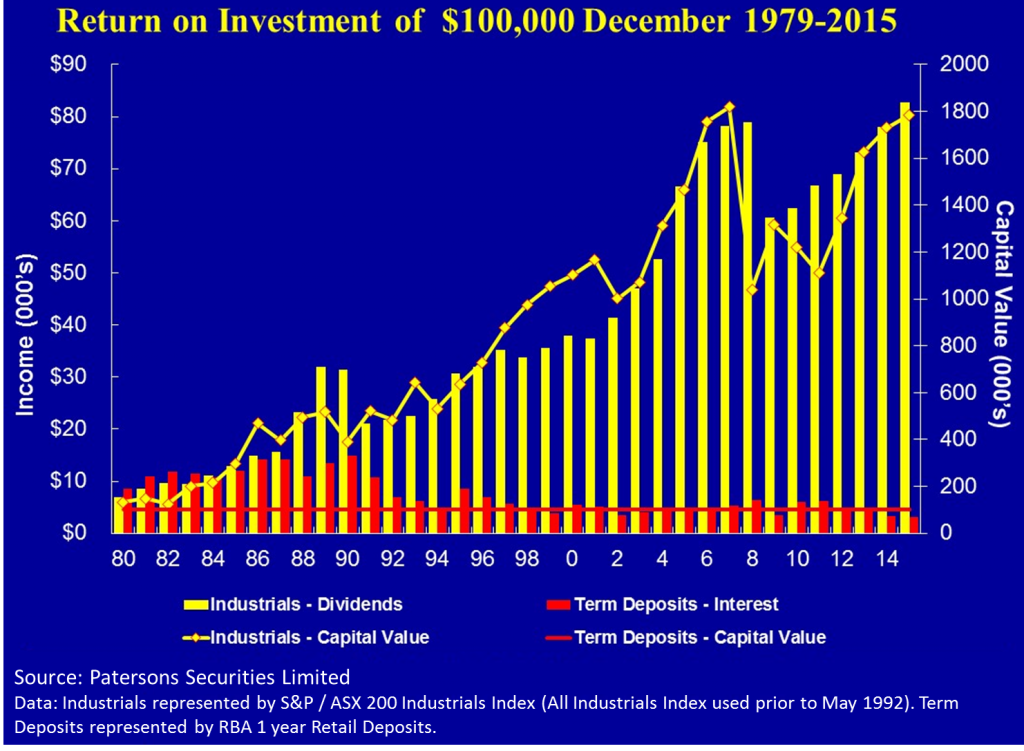

The chart below is worth a thousand words. This shows the Industrial Share Index and cash broken into their two separate elements, income and capital. The income streams (the vertical bars) have been available to every one of us for the last 35 years and beyond. It is regrettable that those people who required the most income often chose the asset (cash) that produced the least income because shares were classified as risky due to their price fluctuations.

The dividends, during the 80's and 90's whilst I was still working, were being reinvested. When I quit the industry and wound down my business in 2007/2008 it was simply a matter of redirecting the dividend stream from reinvestment to pension mode.

A real time test of the strategy

With nearly a decade behind us now and the GFC to add some spice, we can now look at our strategy being tested in real time. As painful as it was to watch our portfolio almost halve in value, the income only dropped by 20%. However, as we held enough in cash to cover two years’ worth of pension withdrawals, we simply followed our parents example who, when times were tough, tightened their belts.

Today, too many retire with too little, too early and leave themselves exposed to the disaster that is cashing assets to produce income when prices have retreated. As we drew down on our cash buffer the dividends replenished the account which avoided us having to cash any of the holdings. In fact, with cash available, we were able to take advantage of the turmoil generated by the GFC to modestly enhance our future income.

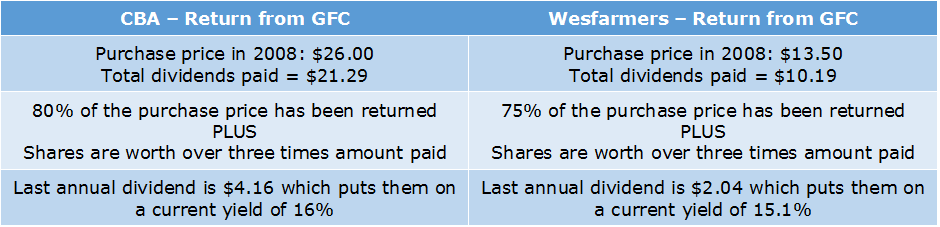

During the GFC, our biggest bank, CBA, fell from $64.00 to below $30.00. Credit markets had frozen so the only way companies could raise capital to bolster balance sheets was through a rights issue, usually new shares pro rata to existing shareholders, or a share purchase plan. CBA did this at $26.00 per share. Similarly, one of Australia's larger conglomerates, Wesfarmers, fell from around $40.00 and issued shares at $13.50. This was repeated with all of the major banks and many of the country’s leading companies.

The following table shows the current situation with those share parcels that were purchased.

Those and other new share issues that we were able to take up have paid off handsomely with their cash flow and continue to do so. These figures do not include the recently announced dividends.

Bearing in mind that we were able to purchase shares at the lowest point in the market, our personal portfolio benefitted substantially when compared to the cash versus shares comparison chart above. It is now seven years later and our income is above where it was and the portfolio value has more than fully recovered. The importance of never having to rely on cashing your asset base to provide income cannot be overstated.

Focus on the dividend flows

I can think of no better 'longevity' insurance than that indicated by the yellow bars above. How do we get people to stop following daily share prices and, more importantly, paying heed to mindless media commentary? By focussing only on the income and not the prices of our shares, we have avoided much of the angst associated with the GFC. Also, as longevity appears to be a potential genetic advantage that we enjoy I need to be sure that the asset base remains intact and the income stream will continue to grow for decades to come.

I have watched as my parents, in-laws and many of their peers were reduced to living totally on the old age pension because they had initially relied on bank deposits in what they thought was the 'safe' option. The nail in the coffin (no pun intended) as far as I was concerned was watching as the two respective family homes were sold as neither widow (the husbands having pre-deceased their spouses) could afford to maintain them.

As the probability is that my wife will outlive me, we will continue to invest solely in shares, the conservative option, as I am determined that she will continue to live with dignity.

Peter Thornhill is a financial commentator, public speaker and Principal of Motivated Money. This article is general in nature only and does not constitute or convey specific or professional advice. Formal financial advice should be sought before acting in any of the areas discussed.