Financials are a topical sector among investors as we go into 2024. Following a series of moderating inflation prints and a more dovish Fed, the market has focused on the negatives of lower interest rates for the insurers, and the positives of a soft-landing scenario for the banks. We believe both views are overly simplistic and overlook some less obvious earnings dynamics. Below we outline why we remain firmly overweight the insurance sector and do not hold any of the Australian major banks in our High Conviction Fund portfolio.

The insurance trade is not over

The general insurers followed up a strong 2022 with further material outperformance over the first ten months of 2023. However, the sector struggled in November and December as bond yields fell 50 basis points or more across most major developed markets. We hold two of the three major Australian listed general insurers, QBE Insurance and Suncorp, and still see significant upside in these names over the coming years.

We believe the view that no upside remains in the insurers due to the peak in the interest rate cycle is overly simplistic for the below reasons.

1. Lower inflation is a forgotten positive for margins

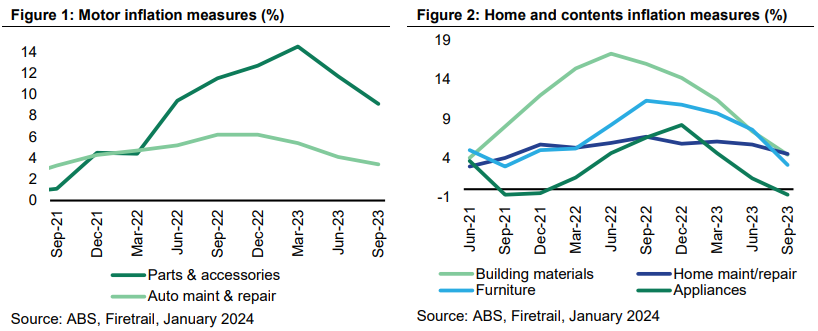

If interest rates are to come down meaningfully, it will be because inflation is also moderating steadily. CPI and PPI measures linked to Motor and Home claims are already showing some improvement, which can be expected to continue if general inflation is normalising.

Due to the lagged nature of revenues for insurance, margins tend to undershoot as inflation rises, and overshoot as inflation falls. The market is completely ignoring this dynamic at the moment.

2. Earnings forecasts do not need to be downgraded (yet).

The fall in 2-year Government bond yields over the past two months has removed upside risk from interest rates but is not implying any downside to consensus estimates at this stage. Note that every 50 basis points further fall in 2-year yields would reduce QBE’s earnings by 6% and Suncorp’s earnings by 4%. However, this should not be considered in isolation from the previous point on inflation.

Recent weather events in NSW and QLD will put some pressure on reported margins in FY24, but this doesn’t change our view that after a decade of under-provision the insurers have now established adequate allowances in guidance for events such as this.

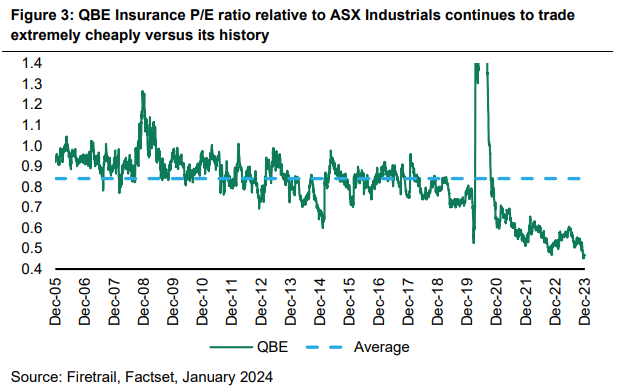

3. Valuations are extremely cheap, even on discounted earnings.

On current 12-month forward consensus earnings, Suncorp is trading at a 17% discount to its 10-year average, and QBE is trading at a 40% discount.

In a scenario where cash rates and bond yields fall to 2%, QBE’s earnings would be downgraded by 24% (conservatively assuming no offsetting benefit from lower inflation). On this basis, QBE would still be trading on only 11x earnings, and a 20% discount to its 10-year average PE-relative to the ASX Industrials.

Hard to find reasons to own Aussie banks

We believe the banking sector has downside earnings risk and is trading at an expensive valuation even if we were to believe the markets forecasts are accurate.

1. Profit 'jaws' are going in the wrong direction.

Bank net interest margins received a sugar hit through 2023 as mortgage rates followed the RBA Cash Rate higher and deposit rates lagged behind. However, margins are now coming down and look set to continue a downward trajectory over the next few years.

The NAB CEO supported this view at the FY23 result in November: “So, I think we're looking at it from a look-through perspective of thinking about 2021, 2022 and 2024. And sort of the blip in the middle of it all was 2023. It's nice to have had it, but it disappeared pretty quickly”.

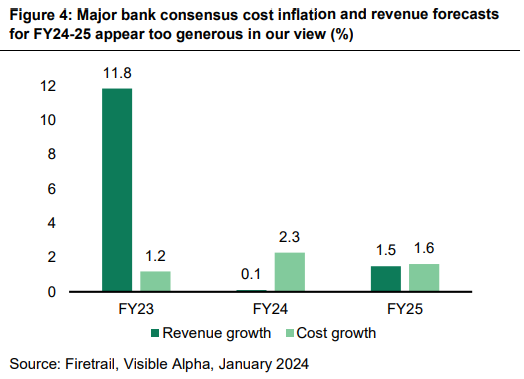

At the same time cost inflation appears embedded, with Enterprise Bargaining Agreements struck at 4-5% p.a. for the next few years. In that light, the below expectations for consensus revenue growth and cost growth appear too optimistic to us. We believe pre-provision profits will contract in FY24 and FY25.

2. Not even a moderate cycle is built into bad debt forecasts anymore…

As expectations for a soft landing have increased, the market has been steadily ratcheting down its forecasts for major bank bad debts. Current forecasts for 2024-26 are for an average bad debt charge equal to 42 basis points of non-housing loans (stated this way to remove the mix impacts of higher mortgage growth).

2024-26 forecasts are on par with bad debts reported during the relatively prosperous periods of 1998-2000, 2005-07 and 2014-19. However, we believe a moderate slowdown synonymous with what transpired in 2000-01 is more likely over the next few years. During 2000-01, unemployment rose by 1.2%, GDP slowed to low single-digits, and the RBA cut rates from 6.25% to 4.25%. Bad debts reached ~65 basis points of non-housing loans in 2001/02, 55% above consensus forecasts for FY24-26.

This is an edited extract from Firetrail's Australian High Conviction Fund December 2023 monthly report.

Scott Olsson is Portfolio Manager for the fund. Firetrail Investments is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers in Firstlinks from Pinnacle and its affiliates, click here.