The rapid increases in global interest rates this year came as a shock to many investors. While the interest rate setting for the world was way too low last year, it was also completely understandable. It seems nobody, including central banks, had anticipated how quickly economies would recover from Covid-19.

But once they did, spending rose and demand, combined with tightening supply for many goods, pushed prices up and necessitated the rapid increases in rates.

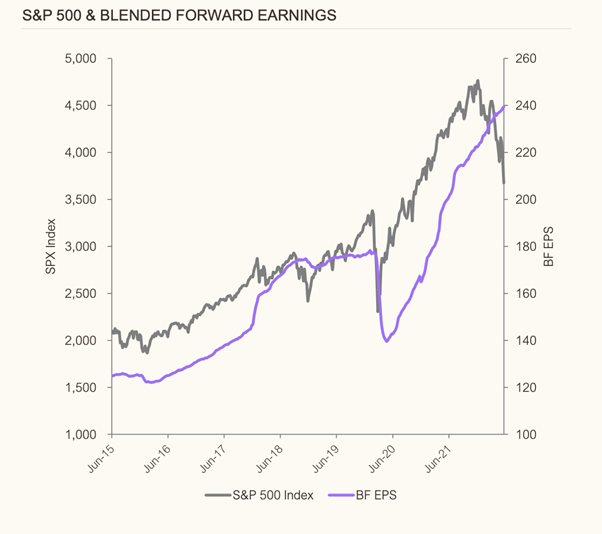

The good news is that we believe markets have now fully priced in interest rate hikes. The bad news is the majority of earnings downgrades are probably yet to come.

As investors we need to respect the history of bear markets - and the history of bear markets is they are normally worse than this. But there are still opportunities in this environment if you know where to look and we have been deploying cash even as we wait for earnings downgrades to play through.

The outlook

When considering whether ‘we are there yet’ in terms of reaching the market bottom, we believe there are three important factors to consider.

1. Interest rates

When interest rates rise, the price of everything generally falls. The multiple then comes out of the market and growth assets usually get hit first, which is what we saw in January 2022. Falls in other asset prices, such as housing and private equity, followed.

We think the market is now adequately pricing where cash rates have to reach, which is roughly 3% in the US and Australia. This is apparent from the bond market where short-term rates are still rising but long bonds are not, and the yield curve is inverting. The bond market is telling us that 3% is enough to get the desired outcome of slowing the economy.

2. Earnings

You cannot have interest rates rise at the speed at which they have and not have people and investors change their behaviour and spending decisions. Earnings downgrades in this environment are a function of factors such as over-ordering and subsequent discounting of inventory, and general falls in asset prices.

So, while we might be there on interest rate expectations, we are certainly not there on earnings downgrades which have just started and which we expect to continue for potentially the next two quarters.

Source: Munro Partners

3. Time

The other factor to include when considering if 'are we there yet' is time. The average bear market lasts 12 months and falls approximately 37%. This one has lasted eight months and has fallen about 27%. That is in the realm of an average bear market. But we could be in a mild bear market, an average bear market or it could be a bad bear market. Only time will tell.

In terms of those three things that we are looking for, we can tick off interest rates as peaking, earnings downgrades as just beginning, and when it comes to time, we could potentially only be halfway there.

What to do about it?

The market is forward looking so investors don’t have to wait for earnings to bottom before the market bottoms. Interest rates peaking is the most important factor. Earnings downgrades are harder to price. But at some point, in the next quarter or two, you'll be able to see the other side of the valley and the market will just move on.

If we are in an environment where interest rates have peaked but earnings deratings are occurring, then companies with more resilient earnings are likely to fare better.

Stock ideas

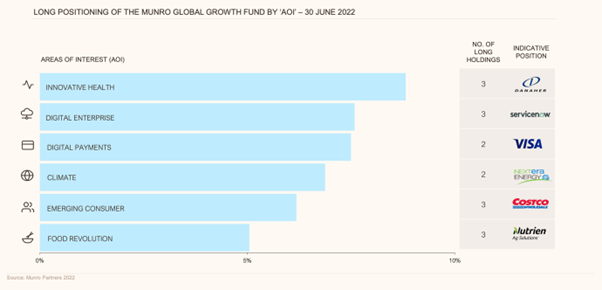

There are some areas of interest which we are constantly monitoring at Munro where we have identified long-term drivers of growth, as highlighted in the below chart.

NextEra Energy

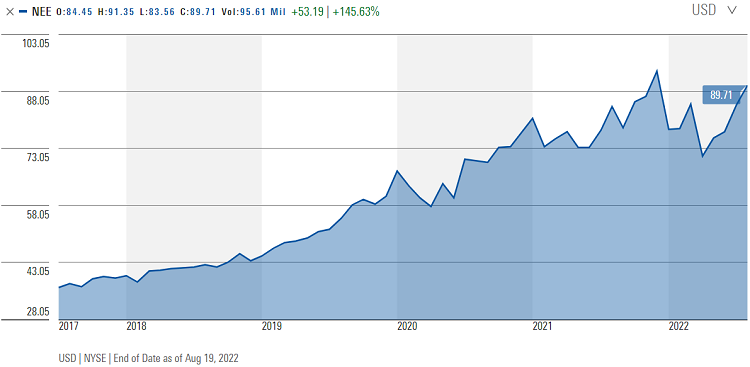

At Munro we believe decarbonisation will be one of the bigger trends over the next three decades and NextEra Energy is the largest renewable utility in the US. They are a $US200 billion company that is dominant in renewable infrastructure across the US. Following the signing of the Inflation Reduction Act in the US, which includes $US375 billion to be invested over the decade in climate-fighting initiatives, the US is now irreversibly on the path to decarbonising.

As a result of that bill, you now have 10 years’ worth of credits for wind, solar, nuclear, hydrogen, carbon capture, etc. The regulatory framework for the next decade is now in place, which should allow the earnings of NextEra to accelerate as they develop these projects. No economic slowdown is going to stop that.

Source: Morningstar

Danaher

Danaher is a US-based equipment supplier to the life sciences industry. It is also leveraged to the development of biologic drugs. Biopharmaceuticals, or biologics, differ from regular pharmaceuticals in that they are developed, derived or semi-synthesized from biological sources, rather than being completely synthesized. A simple example is the mRNA vaccine Pfizer, which worked better than the protein vaccine AstraZeneca in protecting against severe infections of Covid-19.

As more biologics come to market, they will need more of the equipment that Danaher supplies. As such, Danaher is a fairly macro insensitive company in the healthcare sector. If you think interest rates will peak at 3%, at roughly 25 times earnings and growing at 10% per annum, Danaher is a reasonably good investment. We bought the company five years ago and it has continually done what it says it is going to do.

Source: Morningstar

Glass half empty or half full

As we wait for the earnings story to play out, we have already invested around a third of the funds we had sitting on the sidelines in companies where we believe there are long-term drivers of earnings, and which will not suffer downgrades.

Market highs and lows will always have twists and turns. The market may have already bottomed, or it could still be on the way down. The market doesn't give a big 'all clear' sign when it reaches a bottom, but we believe the three factors we have outlined above provide helpful signposts for working out when the worst will be over.

Nick Griffin is Chief Investment Officer at Munro Partners. Munro is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. The information included in this article is provided for informational purposes only. Munro Partners do not represent that this information is accurate and complete, and it should not be relied upon as such. Any opinions expressed in this material reflect our judgment at this date, are subject to change and should not be relied upon as the basis of your investment decisions.

For more articles and papers from GSFM and partners, click here.