Many tech investors have had a tough time figuring out markets so far in 2021. Technology stocks slumped in reaction to rising US 10-year bond yields in April, before rallying sharply through June, with the US NASDAQ market up a very respectable 14% for the half year. While ‘mega caps’ such as Google, Microsoft and Amazon have proven relatively resilient given the strength of their balance sheet and global dominance, emerging technology leaders such as Afterpay and Tesla sold off more aggressively as investors lock-in profits after strong share price gains in 2020.

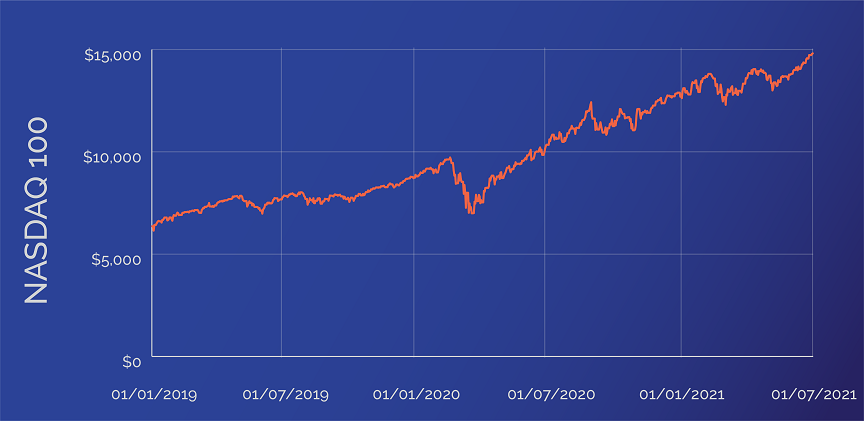

The chart below shows the strong rebound in the US tech-heavy NASDAQ 100 index off March 2020 Covid-19 lows. Continued bouts of profit taking following their stellar 2020 performance left the index up just 2% by mid-May. Bargain hunters stepped in resulting in a sharp rebound of 11% over the remaining six weeks of the half year.

Source: www.tradingview.com.

With many of the technology stocks falling by 30% or more over the first few months of 2021, many investors are wondering if the sharp rebound is only temporary and a major correction in tech companies will resume before the end of the year.

But rather than flee tech, we believe these periods of sharp selloffs offer investors windows of opportunity to allocate more of their capital into global technology stocks at more attractive prices.

The world’s leading innovators offer investors strong long-term earnings growth over the next decade as their investments into new technology platforms, including blockchain, digital money, cloud storage, artificial intelligence and autonomous transportation, become more widely adopted globally.

There are three key reasons why we believe investing in innovation remains the lowest-risk opportunity to generate excellent long-term investment returns.

1. The Covid-19 dividend drives strong earnings results

One of the main reasons for the 2020 price surge was that many tech companies were beneficiaries of the Covid-19 dividend and the accelerated shift of businesses and people into the digital world.

Technology stocks reported strong results across the board during the Q1 2021 U.S. reporting season. Google (Alphabet) for example, reported a 162% rise in Q1 earnings, while reported earnings per share (EPS) growth surged 162% over the last 12 months.

Alphabet’s low Q1 2020 results, depressed from the Covid-19 lockdown, did overinflate comparable growth rates in the last quarter, but Google’s results were substantially stronger than market analyst’s average EPS growth forecast of 66%. A beat of this size in one of the world’s largest companies is rare and indicates that most financial analysts misunderstood the acceleration of exponential growth as we all shifted more of our life online.

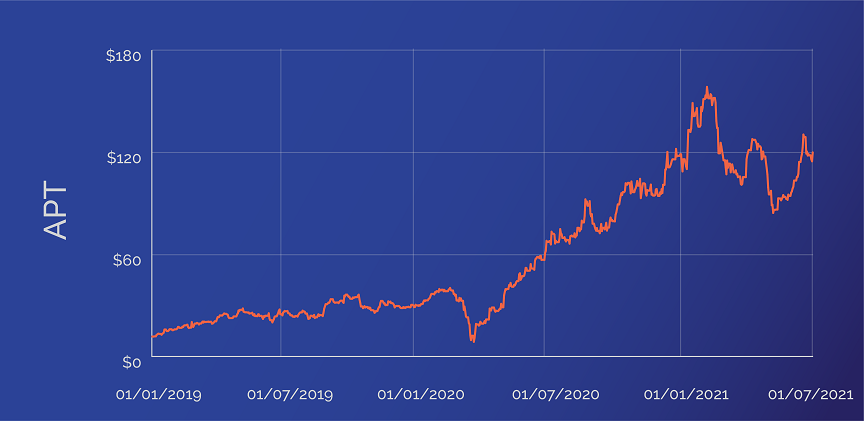

A local Australian company that continues to baffle local analysts is Afterpay, which recently reported strong sales growth in the US and UK of 211% and 277% respectively. After a stellar 2020 share price performance, Afterpay saw heavy profit taking over the March to May period, losing almost 50% of its share price. The strong rebound in global technology also resulted in a 60% rally in the last six weeks of the first half for Afterpay. Its share price is now back at December 2020 levels, although announcements of new global competitors coming to Australia create further volatility.

Source: www.tradingview.com.

We believe that Afterpay, which offers younger consumers a payment alternative to traditional credit card options, is still at the start of its adoption curve. Buy-now-pay-later service penetration reached 20% and 38% of the UK and US populations respectively in 2020. We remain confident that Afterpay’s offering can deliver robust earnings growth over the long-term as they build market share in retail markets much larger than its Australian base.

Yes, some technology companies were overpriced prior to the most recent tech sell-off, but the strong earnings growth and long-term outlook shown in their latest quarterly results should provide investors with added confidence of share price appreciation ahead.

2. Tech stocks will be the long-term winners

Investors have recently been refocussing on ‘old world’ value stocks, particularly those heavily impacted by the global shutdown, in the wake of the reopening of the economy and the ongoing vaccine rollouts across the globe. And at the same time, they have sold down some of their Covid-19 winners. Then in the last month, the sharp snap-back in technology stocks coincided with profit taking in over-extended value-type shares.

Many investors believe that over the long-term, ‘value’ stocks offer a safer investment with technology in a ‘bubble’ and global inflation fears rising.

But we think the safest way to generate sustainable, long-term returns is to invest in companies that consistently generate long-term earnings growth.

That means identifying companies that operate with long-term structural tailwinds, such as rising cloud adoption, digital payments, and Web 3.0 innovation. We identify the unique value proposition that each company offers to consumers. For example, Coinbase, one of our recent investments, offers a strong value proposition for companies using its digital infrastructure to develop Web 3.0 applications that are regulatory compliant and in an institutional grade custody environment.

By contrast, ‘old world’ business models face significant headwinds given their generally poor balance sheets, which means they don’t have enough funds to invest into the digital infrastructure needed to compete effectively in the digital global economy.

Uncertainty also remains high amongst traditional ‘old-world’ names, particularly in a rising interest rate environment that would require higher interest payments on big debt levels that would negatively impact earnings.

We believe most sectors can’t generate sufficient long-term returns in the face of rising disruption from global innovators. So, what may appear as less risky (investing into the ‘old-world’) because of lower price volatility is actually riskier over the long-term than a portfolio heavily weighted towards global technology leaders.

3. Valuations look attractive

The third reason that tech stocks are attractive now is valuation. We start by forecasting our most likely estimate for a company’s performance out at least 10 years, and then discount the value of each year’s free cash flow by 10% from the previous year. Some would argue that a global risk-free rate (US 10yr bond) below 2% could allow us to lower our discount to 7-8% (which would raise our target prices for our investment universe by 50-100%), however we remain anchored to a more conservative 9-10% range.

Following the tech sell off and rebounding during the first half of 2021, we continue to see substantial long-term price appreciation and investment value for investors.

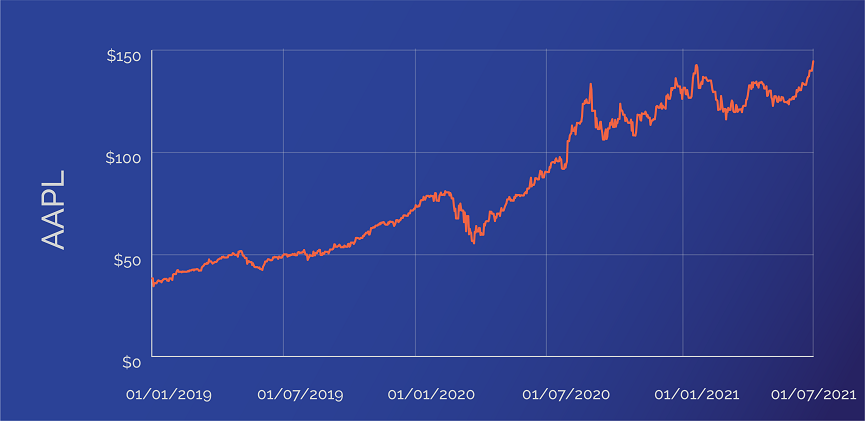

Take Apple for example. It currently trades at 20x 2021 PE multiple (ex-cash), close to the valuation of Australia’s leading banks. Apple is extremely well placed as a leading global innovator and will likely maintain over 25% annual sales and profit growth over the next decade. With US$163 billion of net cash, Apple has the immense balance sheet strength needed to fund innovations in blockchain, AI, digital payments, digital health and education.

As a key beneficiary of our accelerated shift online, Apple shares doubled within six months of the Covid-19 March 2020 lows. Apple’s share price has been volatile over the past nine months, and today remains the same price as it was in August 2020. Strong ongoing earnings announcements plus a strong catalyst around their plans to develop a digital bank are likely catalysts for a strong share price breakout in 2021.

Source: www.tradingview.com.

As a result of the Financial Services Royal Commission and regulatory measures, Australian banks were forced to raise substantially more capital to protect deposits, lowering returns and restricting their flexibility to engage with innovative customers. They face intense competition from global digital payment systems that usurp the need for banks in B2B and B2C transactions. Long-term earnings prospects look low for Australian banks over the next decade.

A rare opportunity

The recent high volatility in technology shares over the past nine months has left many investors fearing a repeat of the 2001 technology crash but we don’t expect significant share price falls for the remainder of the year.

Indeed, now is a great entry level for investors to go overweight in their exposure to innovation. This exposure would include the leading global innovation companies such as Amazon, Google, Tencent and Alibaba, alongside tomorrow’s champions in Tesla, Afterpay and Xero. Each offers a substantially better investment return horizon relative to most traditional ‘old-world’ value investments.

Tim Davies is Director of Research at Holon Global Investments. This article contains only general financial information and has not taken into account your personal circumstances.