Investors’ desire for growth outside of the suffering Australian economy was a major theme to emerge in the February 2019 Reporting Season, particularly in the small-to-mid-cap segment of the market.

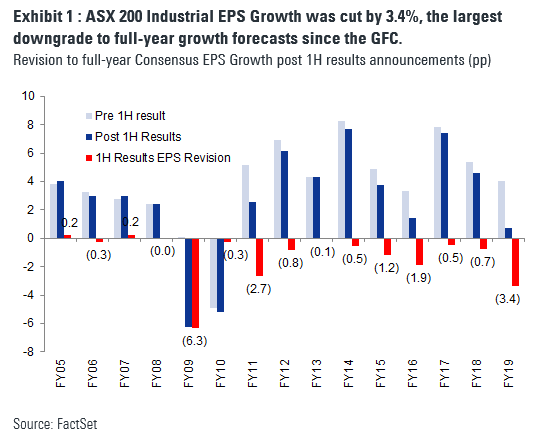

Since around September 2018, economic data in Australia has weakened, largely due to the flow-on effect of falling house prices on consumers. Key data points such as retail sales, business confidence and consumer sentiment have all weakened as a result. The downward trend in business confidence has continued with the February 2019 NAB Business Survey confirming that business conditions decreased to the lowest levels since 2013. As shown below, Consensus Earnings per Share growth forecasts were cut after the Reporting Season results by more than anytime since the GFC.

Widespread impact of slowing

In addition to retail, the weakening economic data has impacted automotive, media and building materials contributing to the recent February reporting season being the weakest since the global financial crisis. According to Goldman Sachs' strategy team, housing-related cyclical companies have underperformed their industrial peers within the S&P/ASX200 by more than 80% over the last five years. Domestic cyclical companies such as Costa Group (ASX:CGC), Boral (ASX:BLD) and Bingo (ASX:BIN) disappointed expectations prior to the February reporting season, with these companies highlighting patchy demand over the December quarter.

With investors shying away from domestically-exposed cyclical companies, the divergence between value and growth companies has never been greater, with Goldman Sachs showing that the differential between value and growth is now at highs not seen since the ‘tech bubble’ in the early 2000s. According to Goldman Sachs, the bucket of ‘high price-to-earnings’ firms or growth companies are trading at a 70% premium to the market’s valuation which is 21% above the long-term average.

On our estimates, sectors exposed to the domestic economy represent approximately 31% of the S&P/ASX Small Industrials Index. Given the uncertainty associated with these sectors at present, investors have been looking for growth companies offering greater certainty to earnings, which has driven up valuations as a result.

With consensus now assuming that the RBA may cut the cash rate in the second half of the year, expectations are for the Australian dollar to continue to decline. This expectation has driven companies with strong offshore franchises, to outperform strongly.

Which companies are still doing well?

Companies such as IPH Limited (ASX:IPH), Breville (ASX:BRG), Lovisa (ASX:LOV), Appen (ASX:APX) and Altium (ASX:ALU) reported solid results and have seen their valuations increase to all-time highs. Following the lead of the FAANG (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), Google (NASDAQ:GOOGL)) stocks in the US, the Australian technology sector (what we call the WAAAX sector: Wisetech (ASX:WTC), Afterpay (ASX:APT), Altium (ASX:ALU), Appen (ASX:APX) and Xero (ASX:XRO)) has seen valuations increase to extraordinary levels with the average 12 months forward price to earnings multiple for these four companies a whopping 70x (excluding APT which is loss making) compared to the ASX Small Industrials Index which currently trades on 19x.

At Wilson Asset Management, we focus on undervalued growth companies in the market and like to invest in strong brands that have the potential to grow strongly in offshore markets. Two examples are Austal (ASX:ASB) and Infomedia (ASX:IFM).

ASB is a shipbuilding company with the vast majority of its earnings (92%) derived from its US business which has a contract to build Literal Combat Ships (LCS) for the US Navy until 2025. With the company currently outperforming its competitors, we see the opportunity for ASB to take market share and win large maintenance contracts on offer for the LCS fleet once it becomes operational over the next few years. The recent expansion of its low-cost Philippines shipyard has the ability to shift work away from Austal’s high-cost Australian operations. ASB is well placed to grow earnings above expectations, with its growing support business providing a scope for a rerating of Austal’s valuation.

IFM is a technology company which does not have a ‘sky high’ valuation such as its WAAAX peers. The company is a leader in parts and services software to the automotive industry and has a strong exposure to Europe and the United States, representing 75% of its revenue. The recent first-half result is a breakthrough result for the company, with the previous 12 months of investment paving the way for the business to achieve double digit growth over the medium-term. The recent acquisition of Nidasu and other bolt-on acquisitions will further boost Infomedia's product suite going forward. IFM is trading on a price to earnings multiple of 32x which is less than half the valuation of other technology companies mentioned previously and is well placed to beat earnings expectations going forward.

Despite a number of domestic cyclical companies currently offering investors value, we believe the attraction to offshore growth companies will continue. This reflects a highly uncertain domestic environment in Australia, fuelled by falling house prices and exacerbated by the upcoming NSW and Federal elections and the fallout from the Royal Commission into Misconduct in Banking, Superannuation and Financial Services Industry.

Oscar Oberg is a Lead Portfolio Manager with Wilson Asset Management. Listed investment companies managed by Wilson Asset Management were invested in ASB and IFM. This article is for general information purposes only and does not consider the circumstances of any investor.