If anything has been proven over the past several years, it’s that market turbulence and unexpected events can arrive at any time. 2025 has been another volatile year with periods of uncertainty arising both domestically and globally resulting in large market moves and now more than ever, investors need to recognise the importance of a well-diversified portfolio.

A portfolio that blends growth with income – and flexibility with stability – can help investors navigate that next phase. Trying to time markets and volatility is difficult – and usually reactive. That’s why it makes sense to build a portfolio that can handle various scenarios by adding protection before markets move, rather than after. Allocating to Floating Rate Notes (FRNs) can help hedge against portfolio volatility, offer potentially stable returns and provide an attractive level of income, making them a versatile investment option during all market conditions.

FRNs pay interest that moves with the market. FRN coupons generally reset each quarter, ensuring income remains competitive while avoiding mark-to-market price changes from interest rate changes. Because the coupon resets regularly, the note’s price doesn’t need to adjust much when interest rates change. That’s why FRNs typically experience relatively smaller price swings than fixed-rate bonds, which lock in a single coupon and can rise or fall sharply as rates move.

Why adding Floating Rate Notes now makes sense

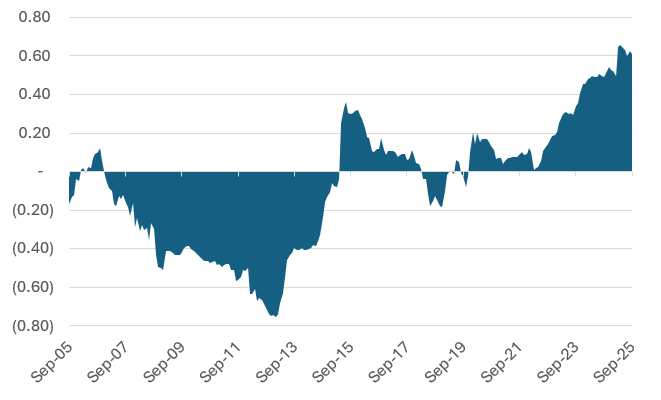

For much of the past two decades, bonds and equities tended to move in opposite directions – when equities fell, bond prices rose, helping to stabilise portfolios. That changed in 2022, when correlations turned positive and have largely remained so. The key driver was the shift in the dominant macro risk where inflation replaced growth. In response, central banks delivered aggressive rate hikes, leading to simultaneous declines in both bond and equity markets. This positive correlation weakens traditional diversification and reinforces the case for alternative sources of returns, like credit and floating rate strategies, that are less tied to interest rate risks given the additional income earned.

Figure 1: Correlation Between Australian Equities and Australian Bonds

Source: Bloomberg Finance L.P., State Street Global Advisors, as of 29 August 2025. Australian Equities = S&P/ASX 200 Index and Australian Bonds= Bloomberg AusBond Comp 0+ Yr Index are used to represent equity and bond markets, respectively. Correlations data used is monthly and have no unit.

Floating Rate Notes have generally lower levels of risks than Fixed Rate bonds

With bond-equity correlations no longer providing the same offsetting effect, credit – particularly FRNs – offers a compelling allocation. Unlike fixed-rate bonds, FRNs are less sensitive to changes in interest rates and may continue to deliver attractive income via their credit margin.

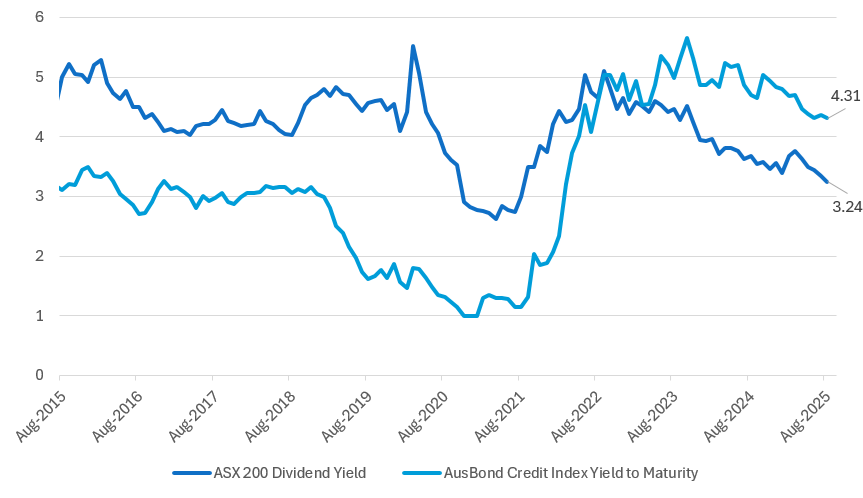

The case for credit is further strengthened by relative value. The yield to maturity on Australian Investment Grade credit is currently around ~4.4%, notably higher than the ASX 200 dividend yield of ~3.3% (see Figure 2). This relationship became inverted in second half of 2022, marking a structural shift in income leadership where credit now offers a yield advantage with different risk characteristics than equity market risk.

Figure 2: S&P ASX 200 Dividend Yield vs. Australian IG Corp Yield

Source: Bloomberg Finance L.P., as of 29 August 2025.

Capital stability in action – the resilience of Floating Rate Notes

A feature of FRNs is their resilience during periods of market stress. Unlike fixed-rate bonds, FRNs exhibit very low duration, which significantly reduces their sensitivity to interest rate movements. While FRNs are still mark-to-market instruments, their price fluctuations tend to be modest, helping shield portfolios from broader market volatility.

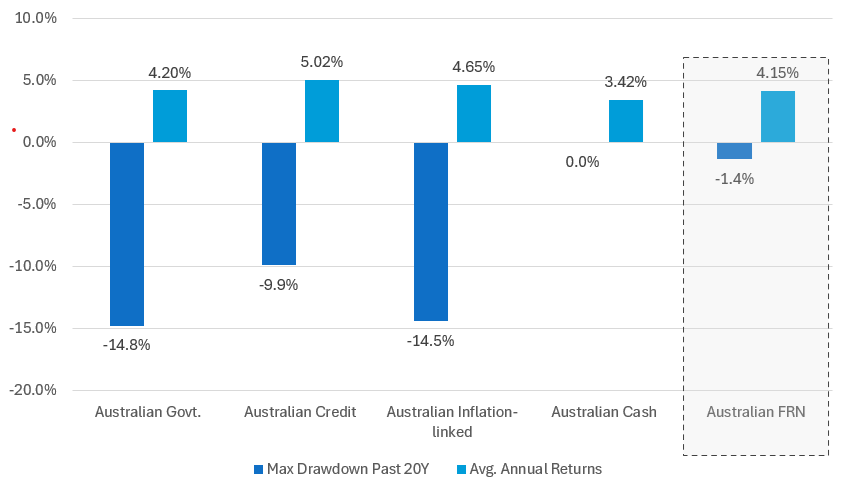

Over the past two decades, the AusBond Credit FRN 0+ index has experienced a maximum drawdown of just -1.4%, far below that of traditional government bonds (-14.8%) and inflation linked bonds (-14.5%). Despite this resilience, FRNs have historically delivered an average annual return of 4.15%, comparable to many higher volatility fixed income sectors.

This risk return balance is reflected in the following chart (Figure 3), which shows the trade-off between average return and maximum downside experienced across the main fixed income sectors since 2005.

FRNs have exhibited shallow drawdowns over time, especially during major market stress events, highlighting their capital stability compared to other fixed income sectors.

Figure 3: Average Annual Return vs. Max Drawdown from 2005–2025 (20Y)

Source: Bloomberg Finance L.P., as of 29 August 2025. Australian Govt= Ausbond Govt 0+ Index, Australian Credit = Ausbond Credit 0+ Index, Australian Inflation-linked= Bloomberg AusBond Infl 0+ Index, Australian Cash= Bloomberg AusBond Bank Bill Index, Australian FRN= Bloomberg AusBond Credit FRN 0+ Index. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

Return vs. risk: The quiet power of Floating Rate Notes

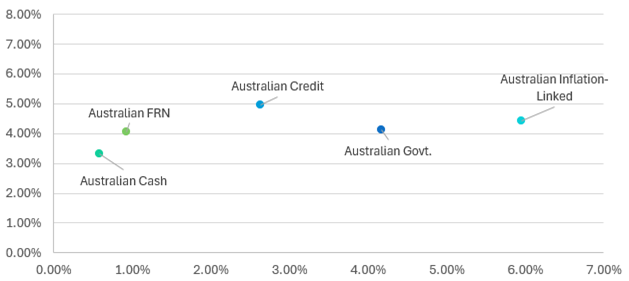

When constructing long-term portfolios, investors seek assets that deliver reliable income with minimal risk. FRNs stand out as one of the most efficient income sources in today’s market, offering a higher yield per unit of risk than many other fixed income sectors, delivering a rare combination of capital stability and income in a volatile interest rate environment.

Floating Rate Notes have historically delivered a strong balance of income and capital stability. The AusBond FRN Credit 0+ Index has produced an average annual return of 4.15% over the past 20yrs, with volatility and drawdowns far below those of traditional credit or government bonds and with just a fraction of fixed-rate bond market risk.

When comparing long-term returns against volatility, Figure 4 illustrates that FRNs are a viable option for investors seeking income without having to take excessive risk.

Figure 4: 20 Year Risk/Return of Australian Asset

Source: Bloomberg Finance L.P., as of 29 August 2025. Australian Govt= Ausbond Govt 0+ Index, Australian Credit = Ausbond Credit 0+ Index, Australian Inflation-linked= Bloomberg AusBond Infl 0+ Index, Australian Cash= Bloomberg AusBond Bank Bill Index, Australian FRN= Bloomberg AusBond Credit FRN 0+ Index. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

This balance of return and resilience makes FRNs one of the most efficient building blocks in today’s fixed income landscape. In fact, when measuring yield against volatility/risk, FRNs offer one of the higher income-per-unit-of-risk profiles across many other fixed income sectors. This underscores their value not only as a defensive holding, but as a core income generator in a diversified portfolio.

FRNs are particularly well suited to the current environment because they offer:

- Protection against interest-rate volatility, as coupons reset with benchmark rates

- Capital stability, with minimal duration risk if rate markets are volatile or rise unexpectedly

- Offer attractive income, especially through high-quality Australian dollar issuers

In short, FRNs can provide a stable, yield-focused core for portfolios and offer an anchor in uncertain times.

Jet James is a Client Portfolio Manager at State Street Investment Management. This material is general information only and does not take into account your individual objectives, financial situation or needs and you should consider whether it is appropriate for you.

Click here for full disclaimer: State Street Global Advisors, Australia, Limited (AFSL Number 238276, ABN 42 003 914 225) (“SSGA Australia”). Registered office: Level 14, 420 George Street, Sydney, NSW 2000, Australia · Telephone: +612 9240-7600 · Web: www.ssga.com.

This material is general information only and does not take into account your individual objectives, financial situation or needs and you should consider whether it is appropriate for you. Investing involves risk including the risk of loss of principal.

Past performance is not a reliable indicator of future performance.

There is no representation or warranty as to the current accuracy of this material, and SSGA Australia shall have no liability for decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA Australia’s express written consent.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Floating rate securities are often lower-quality debt securities and may involve greater risk of price changes and greater risk of default on interest and principal payments. The market for floating rate securities is largely unregulated and these assets usually do not trade on an organized exchange. As a result, floating rate bank loans can be relatively illiquid and hard to value. Diversification does not ensure a profit or guarantee against loss.

8445523.1.1.ANZ.RTL | Exp Date: 31/10/2026

© 2025 State Street Corporation - All Rights Reserved.