The Dow Jones Industrial Average, the broader S&P 500 Index and the tech-heavy Nasdaq Composite Index have set record highs in 2017, yet we believe most of the tech giants are still attractively priced.

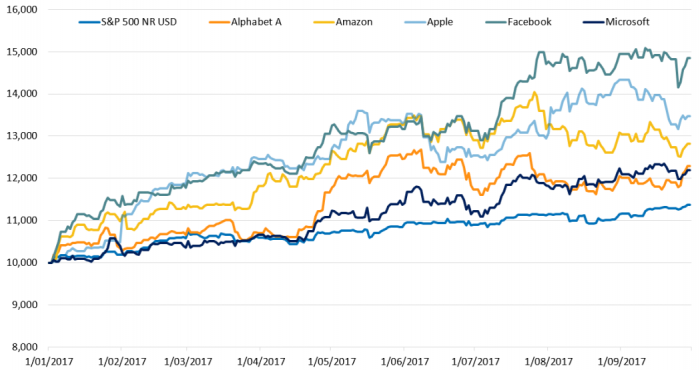

The so-called FAAMG stocks – Facebook, Amazon, Apple, Microsoft and Google (renamed Alphabet) stocks are now in the top 10 listed companies by market capitalisation. Over the first nine months of 2017, Apple rose 34%, Microsoft 22%, Amazon 28%, Facebook 48% and Alphabet (Class A) 23%. Over that time the S&P 500 Index rose 12%, with about 25% of that increase being attributable to the FAAMGs. We have discussed Amazon in other articles so this article focusses on the other four.

Tech giants outpace the S&P 500 Index over first nine months of 2017 (value of $10,000 invested)

Source: Morningstar

Such success prompts talk that we are in the midst of a tech bubble similar to the dotcom bubble that peaked in 2000, when unproven business models, many losing money, were priced on often ridiculously optimistic projections. Many caution that a tech correction, even a crash, is coming. However, while stock prices are notoriously turbulent in the short term, the global tech leaders have bright long-term futures because each dominates an expanding – and profitable – sphere of the digital world.

That said, most investments are exposed to risks. Dominant companies attract the interest of regulators and the tech giants are in the regulators’ sights. Alphabet’s second-quarter earnings, for example, were reduced by the 2.4 billion euro fine imposed by the EU’s anti-trust body in relation to Google’s shopping search service. Tech giants will face more fines and regulatory moves.

Comparing today’s share price with yesterday’s share price doesn’t say anything useful about the future. Good investment returns are available if the price paid today is a fair reflection of the future outlook. While some parts of the tech sector might be overpriced, we believe that many of the tech leaders are not overvalued even after their recent share price gains, and appropriately adjusting for regulatory risks. Thanks to sustainable competitive advantages that are deepening by the day, these companies are posting large and growing profits. That’s why their share prices are rising.

Many sustainable attributes

Apple’s iOS and Alphabet’s Android are the leaders of the global oligopoly in mobile operating systems. While Apple sells devices, its products can be better seen as ‘subscription’ payments to access Apple’s iOS platform and ecosystem of services. Already more than 500 million people are iOS users and that number is growing at a double-digit annual rate. Apple enjoys a high user retention rate, about 95%, because so many users have become Apple loyalists. iPhone sales are an annuity-like revenue stream as existing users replace their devices over time with the latest versions. Apple’s large user base gives the company the opportunity to cross-sell services and other devices such as Apple Pay, Apple Watch and AirPods. As well, Apple is poised to benefit from the growth in emerging markets, from where 30% of its sales come already.

Alphabet through its Google arm has a near-monopoly on global search advertising in many developed countries. Google Search, which now captures about 15% of global media advertising spending and is expanding by around 20% a year, provided around 70% of Alphabet’s revenue of US$89 billion in fiscal 2016 and an even higher proportion of its net earnings. But there’s more to this company than search. Alphabet invests in new, often radical, products and services in the hope it can build leading positions in other potentially massive markets.

Three of these businesses stand out. The first is Maps because Alphabet can use the site to connect people to local businesses, a drive that is still in early stages. Another is YouTube, which is poised to encroach on the US$150 billion spent on TV ads worldwide. The third is Google Cloud. Cloud infrastructure is a US$30 billion market now, but providing internet-based processing has a potential worth of US$1 trillion. The fight in this space is led by Amazon and Microsoft, but Alphabet is beginning to make its huge infrastructure available to third parties.

Facebook is similarly placed like Alphabet in terms of an outstanding core business and promising peripheral ones. Facebook’s core social platform, with its more than two billion users, is a highly-advantaged advertising business. Facebook’s knowledge of its users is crucial for building engagement and accurately targeting ads. This has driven 50% annual revenue growth in recent periods. The other businesses, especially Messenger (one billion users) and WhatsApp (1.2 billion users), are yet to be turned into money-making machines but both have vast potential.

Microsoft dominates key segments of the business-software and data-centre markets. It has high customer retention rates and enjoys sustainable earnings growth as a result. While these markets are seemingly mature, the advent of cloud computing means that the software markets are anything but standing still. The addressable revenue pools for leading software providers like Microsoft are expanding. Microsoft’s fast-growing Azure business is the second-largest public cloud services provider in the world, after Amazon Web Services.

Growth drives value

Investing comes down largely to what someone is prepared to pay for future earnings, but the headlines can often be misleading. Apple, for instance, trades at a modest discount to the price-earnings multiple of the S&P 500 Index. However, when you adjust for its large cash balance and the high-growth services and wearables business (which deserve a higher multiple on a standalone basis), the implied multiple for the ‘core’ iPhone business is a significant discount to the index. We estimate an implied one-year forward price-earnings multiple for the iPhone business of around 11.8 times currently compared with 17.9 times for the S&P 500 on September 30. This is an attractive price for what is effectively one of the world’s most successful subscription businesses and one that is still enjoying double-digit growth in users.

It’s a similar story when you delve into the valuations of Alphabet and Facebook. Both these companies have nascent businesses, such as Google Cloud Platform, Waymo (Alphabet’s driverless cars business) and WhatsApp that are currently loss making but have promising longer-term outlooks. These nascent businesses inflate the headline price-earnings multiples of these stocks because they add positively to the numerator (price) and negatively to the denominator (current earnings). When adjusting for these businesses and large cash balances, the current share prices of Alphabet and Facebook imply attractive multiples for their ‘core’ businesses, particularly when factoring in strong growth.

Speculation abounds about whether or not the US share market is overvalued. There are always risks to markets, such as an escalation in military conflict, indices trading above their long-term averages, the tightening of monetary policy or simply that it’s been eight years since the last US recession. However, we do not think investors should be overly concerned about the risk that the leading global technology stocks are vastly overvalued. The business models that underpin their share prices are sound.

Stefan Marcionetti is a Portfolio Manager at Magellan Asset Management Limited. This material has been prepared for general information purposes and must not be construed as investment advice, as it does not take into account your investment objectives, financial situation or particular needs.