The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Everyone from brokers to strategists to fund managers seems to be bullish on the prospects for stocks this year. For the contrarians among us, this near-universal optimism is a red flag, or at least an amber one. Is caution warranted, though?

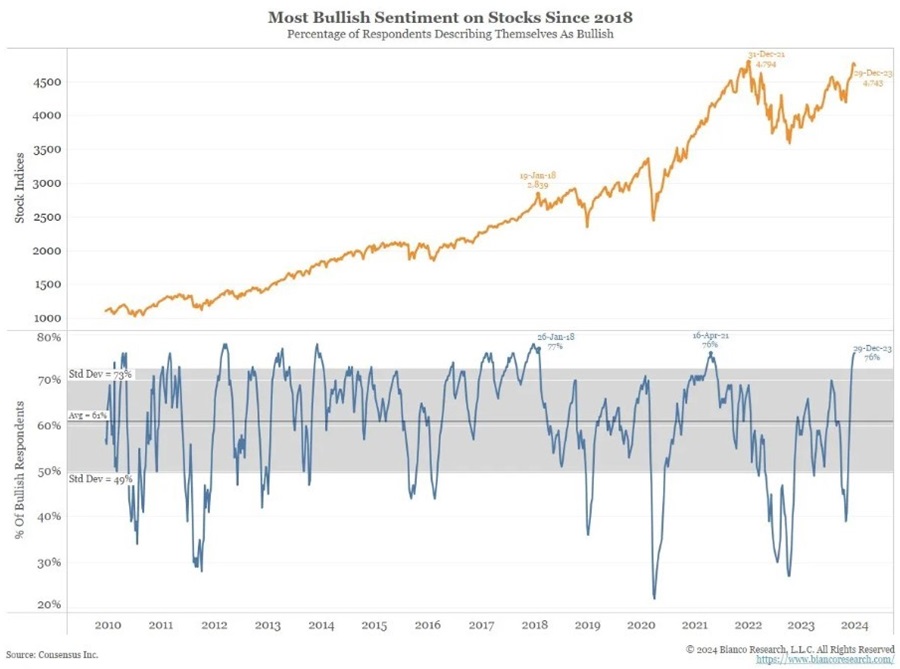

Let’s first take a closer look at investor sentiment. Consensus Inc tracks futures market newsletters and brokerage reports, and aggregates the percentage that is bullish. This stock market series is the most bullish since 2018.

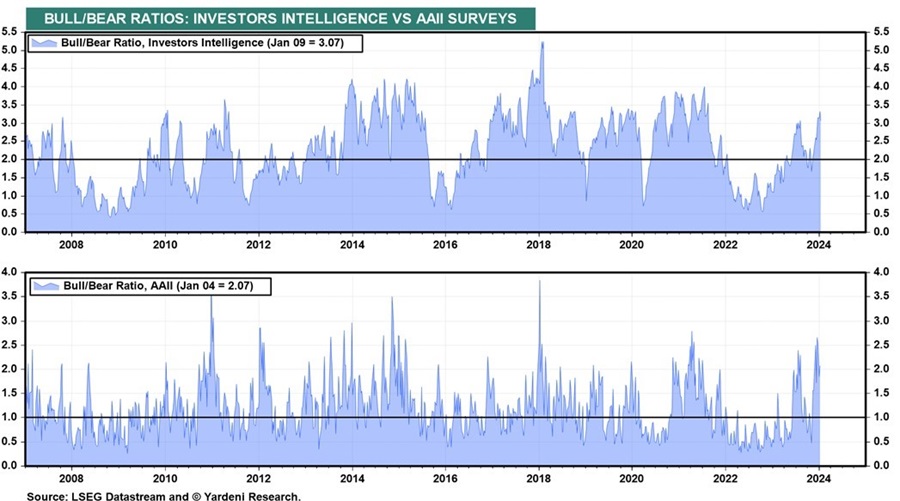

The sentiment of individual investors in the US echoes that of newsletters and brokerage reports.

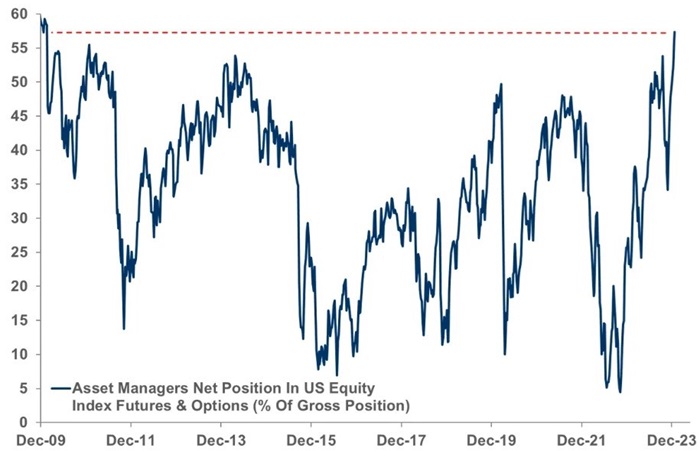

Asset managers are also optimistic. They have the largest net long position in stock index futures since 2009.

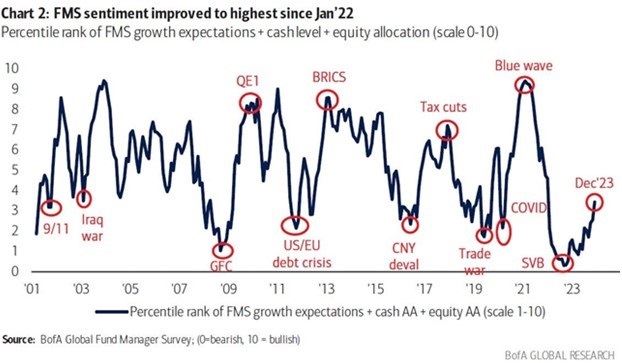

Fund managers aren’t quite as positive though sentiment is on the way up.

Most investor surveys then support anecdotal observations that there is widespread optimism on the prospects for markets.

The positives

The bulls point to several factors that will lead to higher stock markets high this year, including:

- Inflation in the West has peaked and is likely to head towards central bank targets.

- With inflation falling, interest rates are too restrictive and will soon be cut.

- Lower rates reduce the cost of capital and thereby increases the value of assets.

- That should lead to higher prices for assets, including stocks.

- Markets and sectors outside of US tech aren’t expensive and should benefit most.

Clime Investment Management’s John Abernethy has an excellent article in Firstlinks this week, outlining these arguments and more, for why he thinks 2024 and beyond will be fruitful for investors.

The risks

What could spoil the party? Here are some risks for markets this year:

- Inflation doesn’t fall as fast as expected and perhaps even bounces back up.

- Interest rates don’t fall or don’t fall as fast as investors expect.

- A recession brought about by the lag effect from higher rates and their impact on consumer spending and the economy.

- Private assets finally get properly valued and that reduces the capital of private equity and venture capital to finance deals and drive markets.

- Donald Trump gets re-elected as US President, inflaming internal divisions and consumer sentiment.

- Donald Trump doesn’t get elected US President and internal tensions boil to breaking point.

- China doesn’t recover and continues to deflate after one of the largest credit bubbles in history.

- Wars in the Middle East and Ukraine don’t stay contained.

There are always risks and reasons to worry. My experience is that markets can usually handle one or two concerns and manage them with equanimity. But when multiple concerns hit all at once, that’s when things get rocky. And it’s the risks that markets can’t see now that are the ones to most worry about – the ‘unknown unknowns’ in the words of Donald Rumsfeld.

Possible opportunities

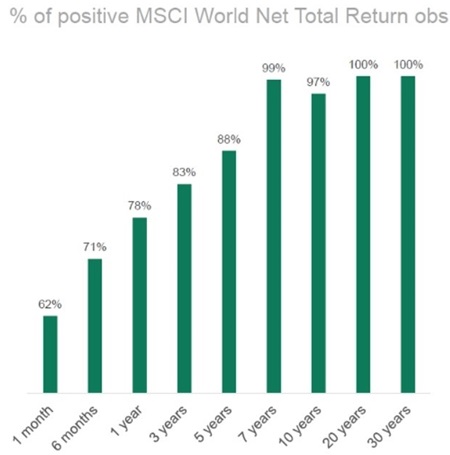

What should investors do, then? First, zoom out. Since 1900, the Australian share market has ended the year in the black 72% of the time. For global markets, that figure is 78%. And world stocks have had positive returns 99% of the time over 7-year periods.

Source: Firetrail

That means the default for investors should be optimism. Not blind optimism mind you, as there are times when markets swing to be wildly overvalued or undervalued. Though today doesn’t seem to be one of these periods.

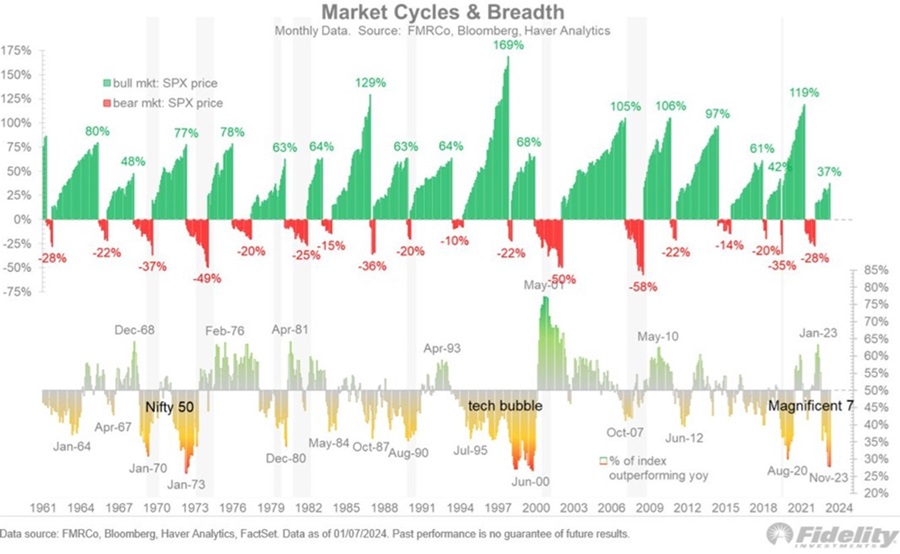

In fact, history suggests that the current upturn in markets may have a way to go.

Famed investor Howard Marks also thinks market valuations don’t look out of whack. Yes, the US market appears mildly overvalued and US tech looks stretched, but there are large pockets of opportunity outside of that.

Where are these pockets? I don’t think you need to look far to find them. Tech and large cap stocks, especially in the US, have sucked an extraordinary amount of money over the past decade. The reasons for this include the rise of software-as-a-service, artificial intelligence, inflows into passive ETFs that automatically flow to larger stocks, phenomenal earnings growth especially among the ‘Magnificent Seven’ and great returns which in turn attracts even more capital.

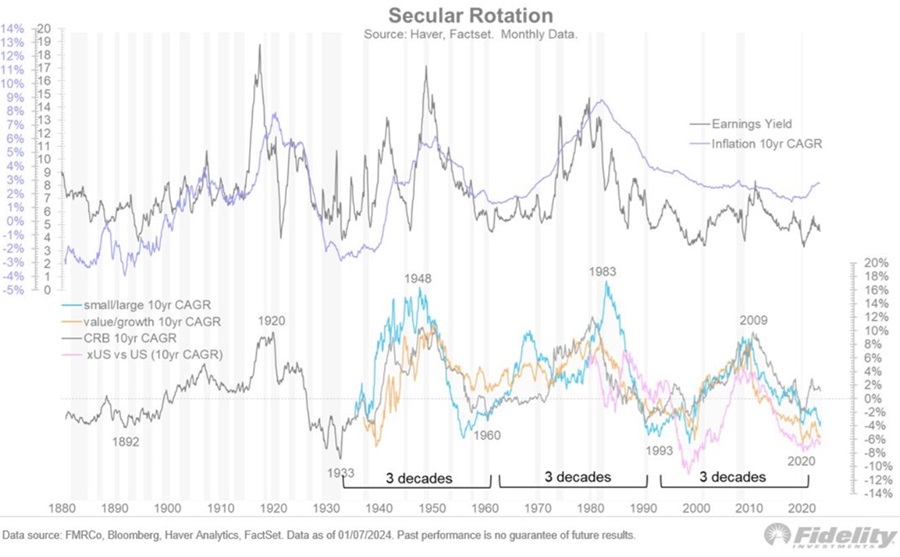

Yet the love for large caps and tech has meant that other sectors have been left behind and forgotten. The following chart illustrates four areas where returns have lagged.

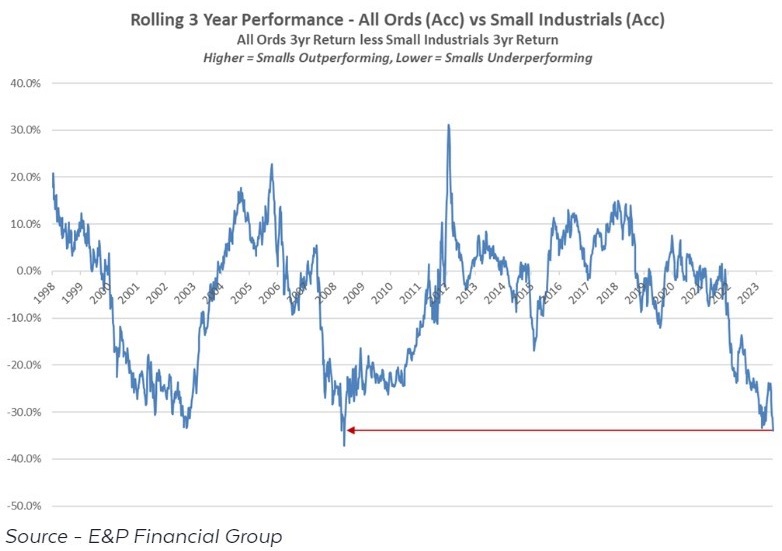

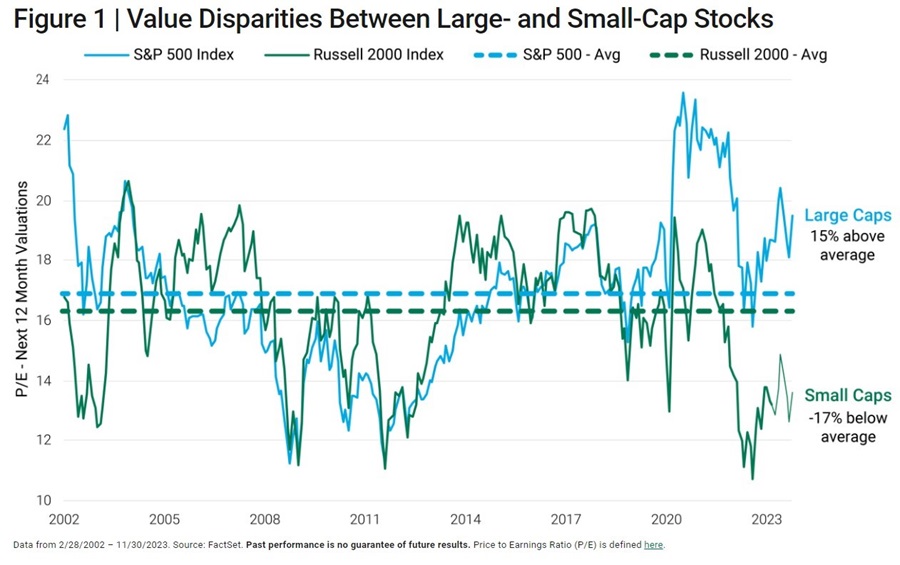

1. Small caps

Small caps stocks, including in Australia and the US, have trailed large caps for the past 15 years and now look cheap.

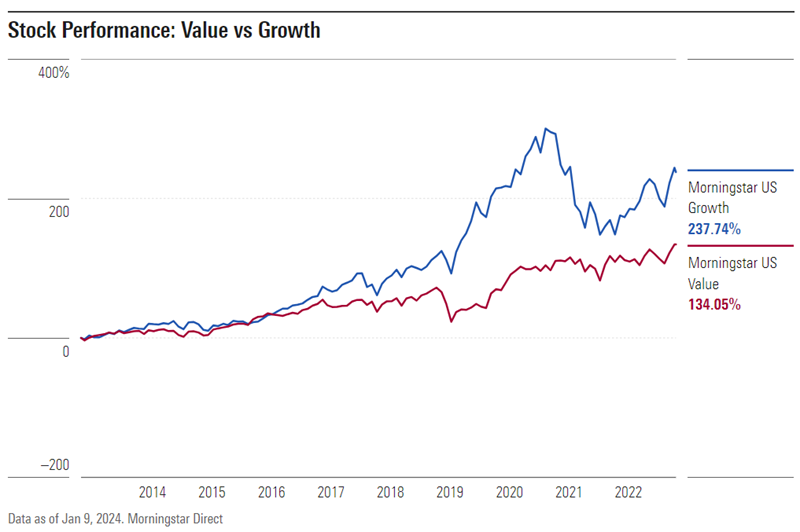

2. Value stocks

Growth stocks have obliterated value stocks since 2008. After value outperformed during the downturn of 2022, growth again got its measure last year. Value again looks cheap.

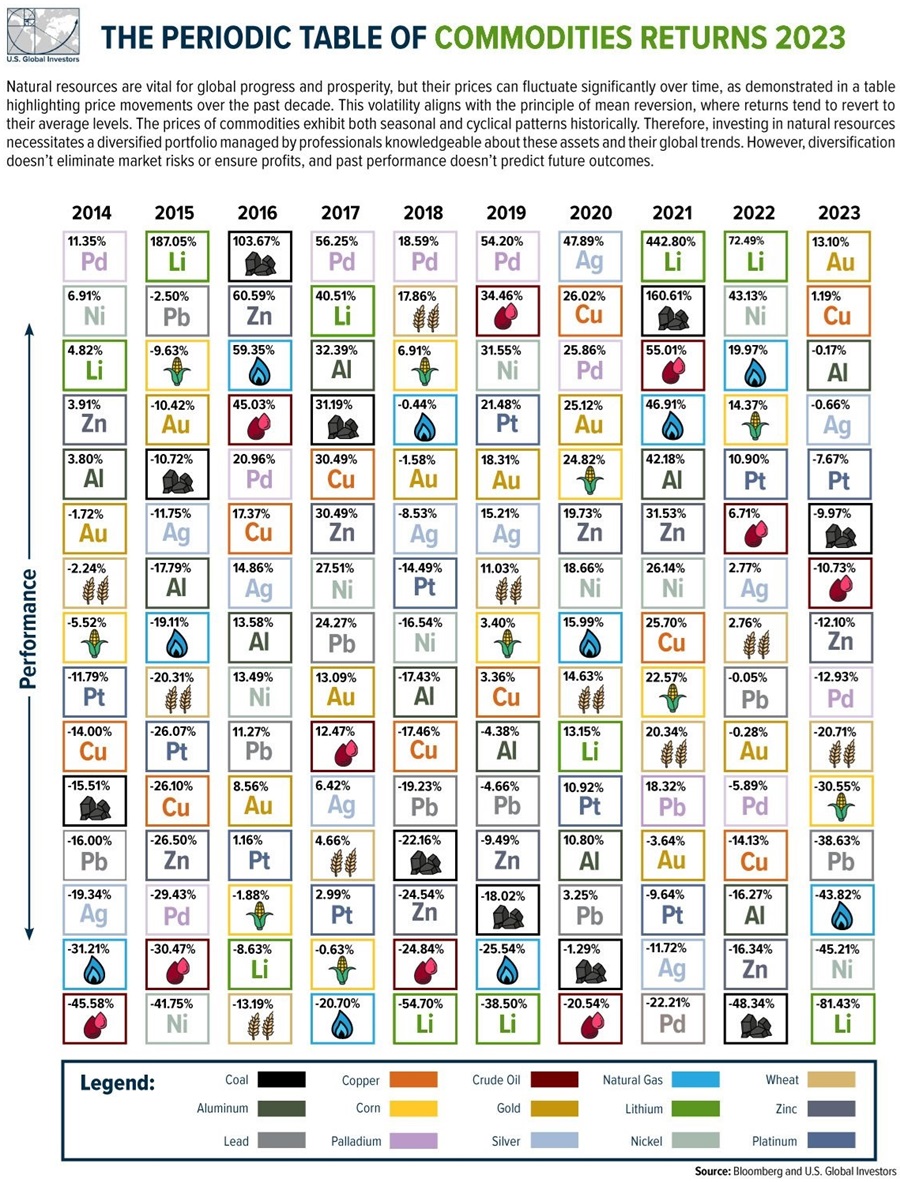

3. Commodities

Commodities have lagged, dragged down by the prolonged economic slowdown in China. It’s been a mixed bag though. Last year, iron ore ripped, and gold prices increased 13% while at the other extreme, nickel and lithium plummeted by 45% and 81% respectively.

Could the energy transition and increased infrastructure spend globally lead to a rebound in this sector over the next year and beyond?

4. World ex-US

There’s plenty of value outside of the US. Markets such as the UK, China, and broader emerging markets look especially cheap.

The ASX 200 is trading close to its long-term average price-to-earnings ratio, though that disguises the huge disparities in valuations for industrials versus miners and the banks.

***

In my article this week, I look at nine investing lessons that I've learned from owning a small business. In 2016, I took a large bet and bought a motel on the outskirts of Sydney. Since then, I've ridden the highs of a motel on the rise, to the lows of Covid, and back again. Along the way, owning a business has made me a better investor, and being an investor has made me a better businessperson.

James Gruber

Also in this week's edition...

The Australian stock market performed reasonably well in 2023 but how did its performance compare to history? Ashley Owen does a deep dive into the data back to 1900 and shows where last year sits, as well as what to possibly expect from the ASX this year.

Most of us want to age at home where we can remain close to our communities and neighbourhoods. But some of us don't always get that choice, especially renters. As more older Australians are forced into the rental market given the exorbitant prices for purchasing homes, Christopher Phelps and colleagues suggest the issue is becoming an important one for both individuals and governments.

Japan had one of the best performing stock markets in the developed world last year. The resurgence comes after long overdue corporate governance changes, which are lifting returns on equity. Platinum Asset Management's Charles Brooks asks whether this is a new dawn for Japan or a false start?

Jeremy Siegel's book, Stocks for the Long Run, became an instant classic in the 1990s by popularising the view that stocks outperform bonds in the long-term, and that it isn't even close. Yet a new academic study raises questions about Siegel's data and conclusions, with potentially radical implications. Morningstar's John Rekenthaler assesses the new claims.

Just when you thought that China's stock market couldn't go much lower, 2023 delivered another poor year, dragged down by a deflationary bust in the property market and slowing economic growth. Could this year be different? Dr Joseph Lai thinks so as he believes the country's problems are manageable and many blue chips are at bargain basement levels.

Two extra articles from Morningstar for the weekend. Jon Mills outlines the cheapest opportunity in the ASX mining sector, while Shani Jayamanne looks at a stock that ticks all the boxes.

Lastly, in this week's whitepaper, VanEck thinks markets are prematurely pricing in rate cuts this year, and investors need to be selective in where they put their cash.

***

Weekend market update

On Friday in the US, stocks broke through to fresh highs on the S&P 500 with a 1.25% advance, marking the broad index’s first new record finish in more than two years. Treasurys had another mixed showing with two-year yields climbing five basis points to 4.39% and the long bond ticking to 4.36% from 4.37% Thursday. Meanwhile, WTI crude edged back below US$74 a barrel and gold finished little changed at US$2,029 per ounce. The VIX settled a bit north of 13.

From AAP Netdesk:

The local bourse on Friday snapped a five-day losing streak, clawing back about half its recent losses with its best performance in five weeks.

The benchmark S&P/ASX200 index on Friday finished up 74.7 points, or 1.02%, to 7,421.2, while the broader All Ordinaries added 76.7 points, or 1.01%, to 7,652.3. For the week, the ASX200 finished down 1%, however.

Every sector except utilities finished in the green, with technology the biggest gainer, rising 2.5%.

Xero rose 4.8%, Wisetech Global added 2.9% and Audinate climbed 2.2%.

The energy sector rose 1.2%, with Whitehaven Coal climbing 3.8% to an 11-month high of $8.11 as the coalminer said it was on track to meet 2023/24 production guidance.

Elsewhere in the sector, Yancoal closed up 4.9%, New Hope advanced 2.9% and Woodside rose 1.6%.

In the heavyweight mining sector, Fortescue rose 2% to $27.58 and Rio Tinto added 0.9% to $128, while BHP was flat at $45.73.

All Big Four banks were up as well, with Westpac adding 1.5% to $23.20, CBA advancing 0.7% to $113.28 and NAB and ANZ both climbing 1.3%, to $31.28 and $26.13, respectively.

The Lottery Corp was the biggest gainer in the ASX200, up 6% to a four-month high of $4.93.

In the health care sector, Mesoblast rose 13.2% to 30c after receiving a rare pediatric disease designation from US regulators for its stem cell therapy, Revascor.

Also, Imugene gained 5% to 10.5c as a small clinical trial evaluating its novel cancer-killing virus progressed into higher doses, with 38 patients treated so far.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website