The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Weekend market update

In the US on Friday, stocks were hammered by 1.6% on the S&P 500, extending the bearish price action beginning with yesterday’s downside reversal on the blue-chip gauge.

Mr. Market provided his own 'rate cut' in response to today’s soft July payrolls report, as two-year yields dropped an even 25 basis points to 3.69% (the long bond declined eight basis points to 4.81%). WTI crude retreated to US$67 a barrel, gold jumped nearly 2% to US$3,359 per ounce, bitcoin dropped 3% to US$113,000 and change while the VIX ripped to 20.5, up nearly four points on the session.

The local share market on Friday fell even as Australia dodged being hit by higher tariffs the Trump administration said it was imposing on dozens of its trading partners. The benchmark S&P/ASX200 index dropped 0.92% to 8,662, while the broader All Ordinaries fell 0.91% to 8,917.1. For the week, the ASX200 was basically flat.

Ten of the ASX's 11 sectors finished lower, with utilities rising 0.7%.

The technology sector was the biggest mover, dropping 2.4% as Xero declined 3.5% and WiseTech Global retreated 2.6%.

In health care, ResMed rose 1% to an all-time closing high of $42.88 after the CPAP devicemaker posted better-than-expected fourth-quarter earnings including 10% revenue growth.

Elsewhere in the sector, 4D Medical soared 29.8% to a six-week high of 30.5 cents after medical imaging giant Pro Medicus invested $10 million into its much smaller respiratory imaging peer.

In the heavyweight mining sector, Syrah Resources plunged 25.3% to 27 cents after the graphite miner completed a $42 million capital raising at 26 cents a share.

The iron ore giants were mixed, with Fortescue rising 1.2% to $17.98, Rio Tinto dropping 0.7% to $110.90 and BHP edging 0.1% lower at $39.22.

Rare earth miner Lynas rose 3.3% and lithium miner Pilbara added 4.1%.

In the financial sector, three of the big four banks finished in the red.

CBA fell 1.6% to $175.06, NAB dipped 1.2% to $38.44 and Westpac dropped 1.1% to $33.45.

ANZ was the outlier, rising 0.5% to $30.87.

From Shane Oliver, AMP:

Global share markets fell over the last week on the back of concerns about the impact of US tariffs on economic growth and weak US jobs data. US shares fell sharply on Friday after jobs data showed that payroll growth is close to stalling leaving them down 2.4% for the week. Eurozone shares lost 3%, Japanese shares fell 1.6% and Chinese shares fell 1.8%. Australian shares fell on Friday in response to Trump’s latest tariff announcements leaving them down 0.1% for the week with gains in consumer discretionary, financial and industrial shares but tariff driven falls in resources shares. Bond yields fell. Oil prices rose on fears that US secondary sanctions (tariffs) on countries buying Russian oil could impact global oil supplies. Iron ore and gold prices also rose but metal prices fell. The $A and Bitcoin fell as the $US rose for the week.

The past week saw Tariff Man Trump again flooding the zone with daily tariff announcements, that are next to impossible to keep up with, ahead of his (latest) 1st August deadline but now to apply from 7 August. It wasn’t all bad news with trade deals with the EU and South Korea (both with 15% tariffs) coming after previously announced deals serving to reduce uncertainty, tariff rates in these deals coming in less than announced on Liberation Day and the baseline tariff of 10% maintained for countries with which the US has a trade surplus, including Australia. However:

- countries without deals have seen tariffs imposed on them ranging from 15% to 50% (Brazil);

- the deals that have been agreed lack detail and look grossly lopsided with countries facing 15% plus tariffs on their goods in the US, but goods from the US seeing around zero tariffs;

- and they come with silly agreements to invest in the US – eg $750bn from the EU – which can likely never be fulfilled;

- US/China trade tensions could flare up again if the current truce is not extended beyond its expiry on 12th August; and

- most importantly the latest set of country and sector tariff rates still imply a rise in the average US import tariff rate to around 20%, from 15% through the pause since April, which is way up from up from 2-3% at the start of the year resulting in higher prices (taxes) for US consumers and businesses and a disruption to the US economy (like Brexit did to the UK) and a hit to non-US exporters posing risks to global growth.

So, while things aren’t as bad as threatened on Liberation Day, the surge in US tariffs still poses a significant threat to the global economy which will likely become more evident in the months ahead. Ultimately, a combination of more trade deals for those countries without deals (some of which may come ahead of the 7 August start up) and Trump being forced to back down in the face of market volatility and or the economic impact are likely to see the tariffs settle around 15%, but this may take a while.

For Australia, confirmation that the general tariff stays at 10% is a relief. But its still up from 2% or less at the start of the year and aluminium, steel and likely pharmaceuticals are still to be tariffed at higher rates. While this remains bad for industries affected, we remain of the view that the overall direct macroeconomic impact will be minor because our exports to the US are a very small share of our total goods exports (less than 5%). Rather the main threat continues to come via the hit to global trade from the tariffs resulting in slower global growth and hence weaker demand for our exports generally. So, while worst case US trade war scenarios have been averted for now the drag from US tariffs still adds to the case for more RBA rate cuts.

Australian exports to the US as a share of GDP

A table with numbers and textDescription automatically generated

Source: ABS, AMP

****

It seems a long time ago but it was only in April that markets had a sharp correction thanks to Trump’s threats of tariffs. As concerns about these tariffs have eased, stocks have come roaring back.

It hasn’t just been a tariffs story. Economies have held up ok and inflation has continued to trend down. There’s also been significant stimulus announced in Europe, and to a lesser degree, in China.

Yet, one of the biggest drivers behind the recovery in stocks has been the expectation that interest rates will fall further and faster. That’s because Trump wants rates in the US much lower, and once he gets his own Federal Reserve Chairman appointed (by May next year at the latest), that will undoubtedly happen.

In essence, markets are frontrunning lower US rates and possible quantitative easing. Cheap and easy money is coming, and they can’t get enough of it.

13 charts highlighting the speculative frenzy

Here are some indicators of the recent exuberant risk-seeking behavior in markets:

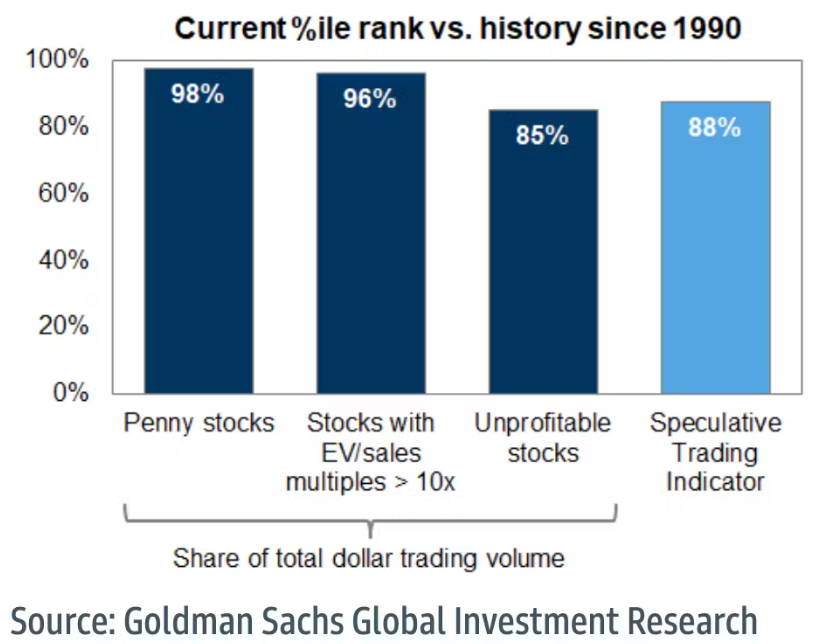

1. Trading in expensive and penny US stocks is near record highs

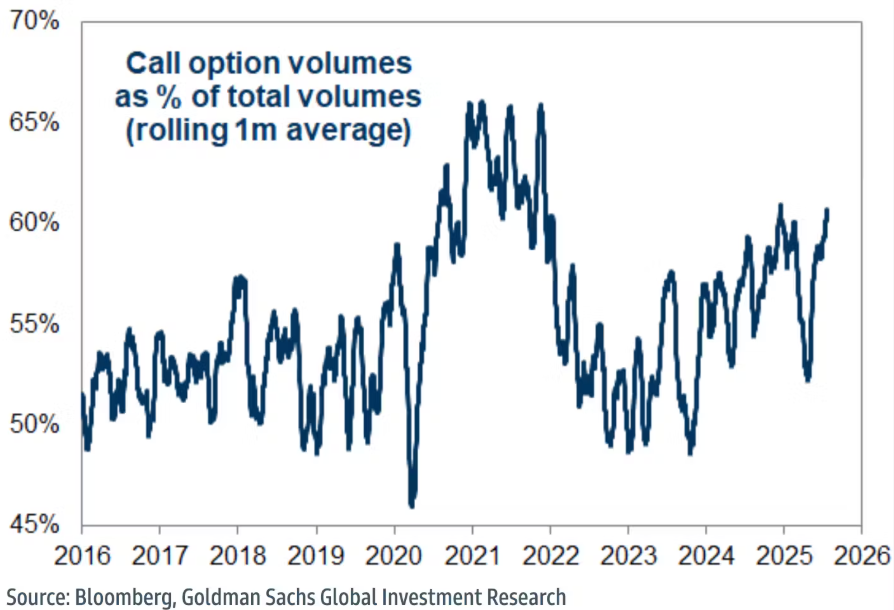

2. Leveraged bets on markets going up have soared

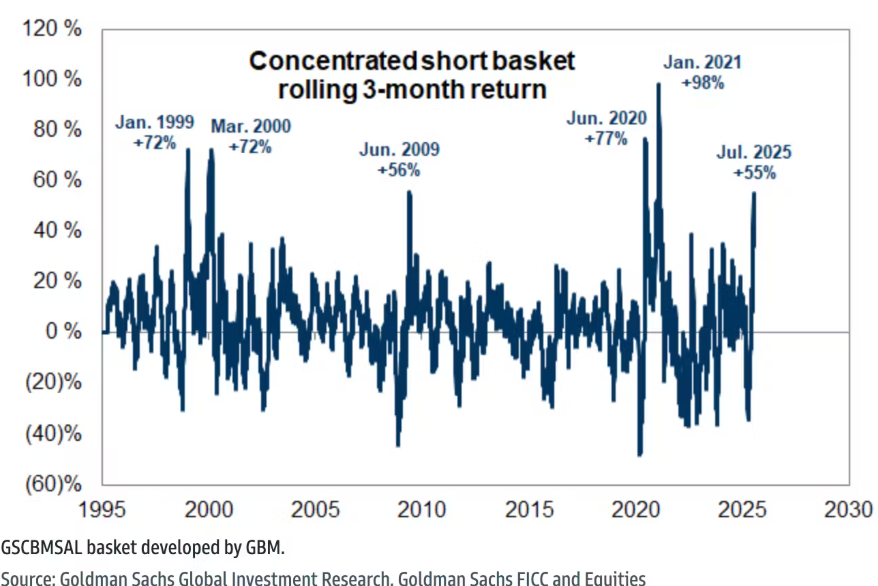

3. US stocks with elevated short interest have surged

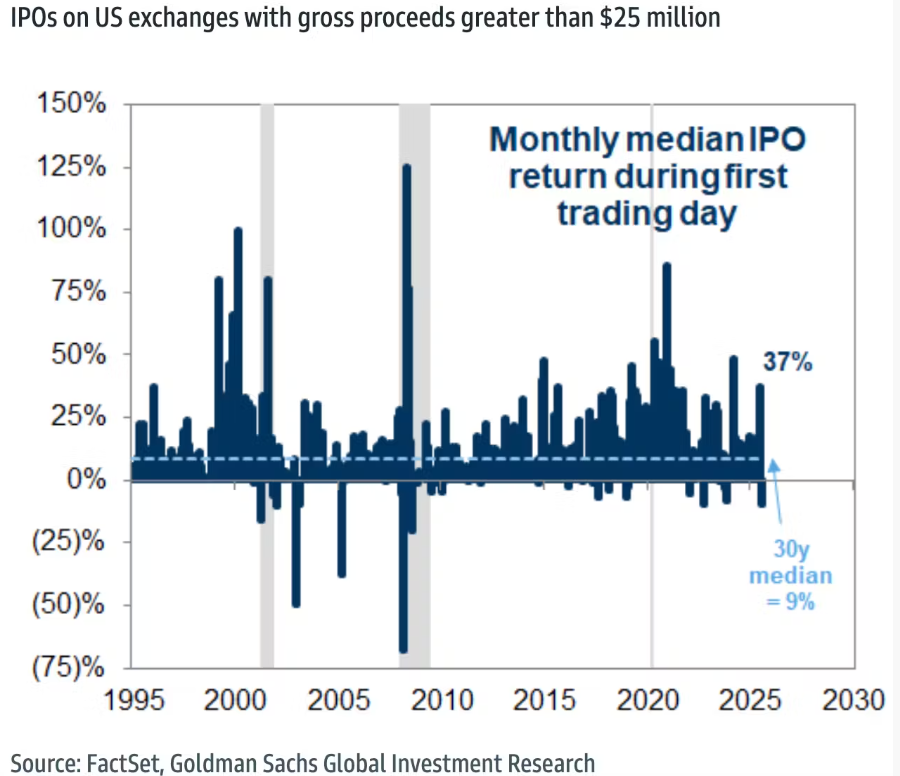

4. Recent IPOs have generated strong first-day returns

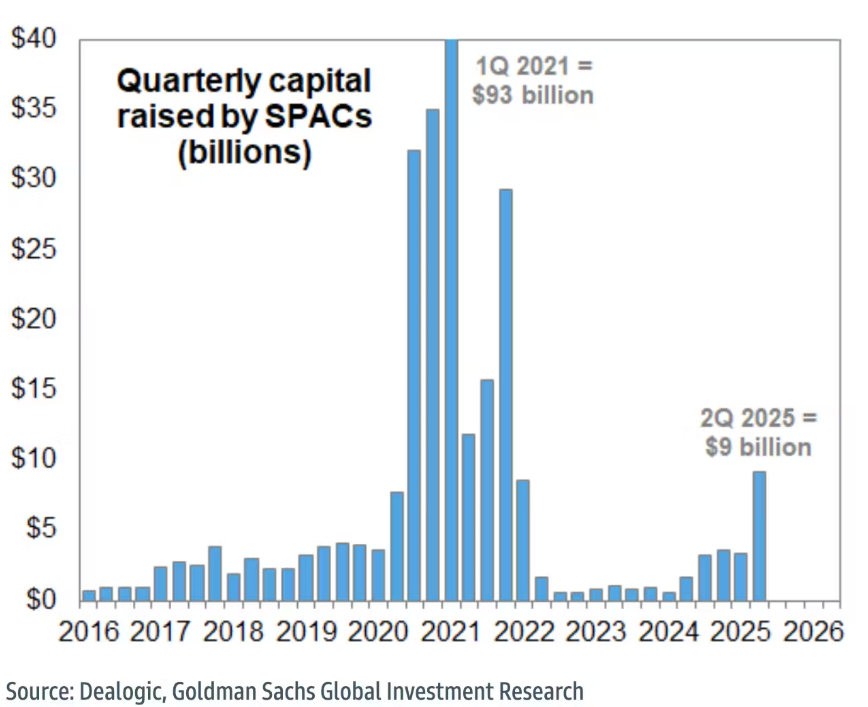

5. Special purpose acquisitive vehicles (SPACs) are back in vogue

These vehicles raise capital to acquire existing operating companies. Investors essentially give black cheques to SPACs to make acquisitions.

SPACs have raised US$12 billion this year. That’s nowhere near the heady days of 2021, though it’s still a lot of money.

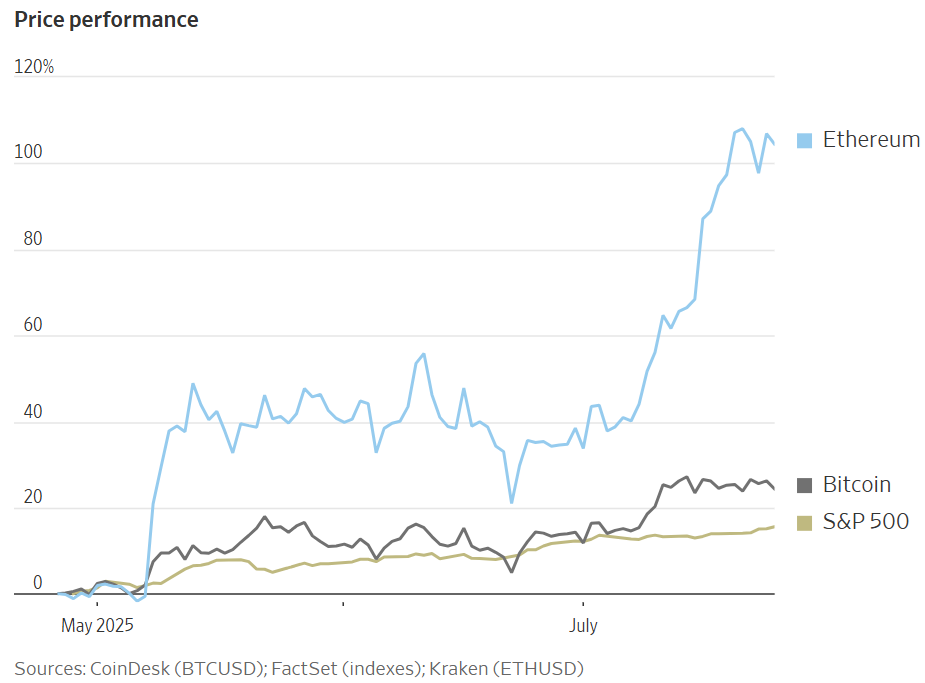

6. Cryptocurrency prices are flying

Prices of Ethereum and bitcoin have catapulted higher, helped by the Trump administration’s pro-crypto policies and growing acceptance by mainstream financial institutions.

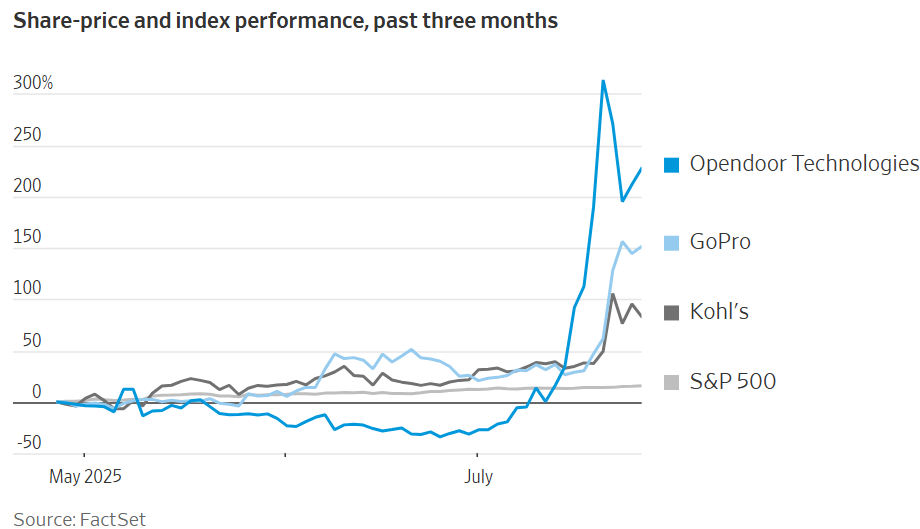

7. Meme stocks are again a thing

You might remember that in 2021, retail day traders drove US mall retailer GameStop and other so-called meme stocks to ridiculous prices.

Well, meme stocks are back. This time it’s in companies such as Kohl’s and Opendoor. The latter is an online house flipper and its stock is up 377% in the past month.

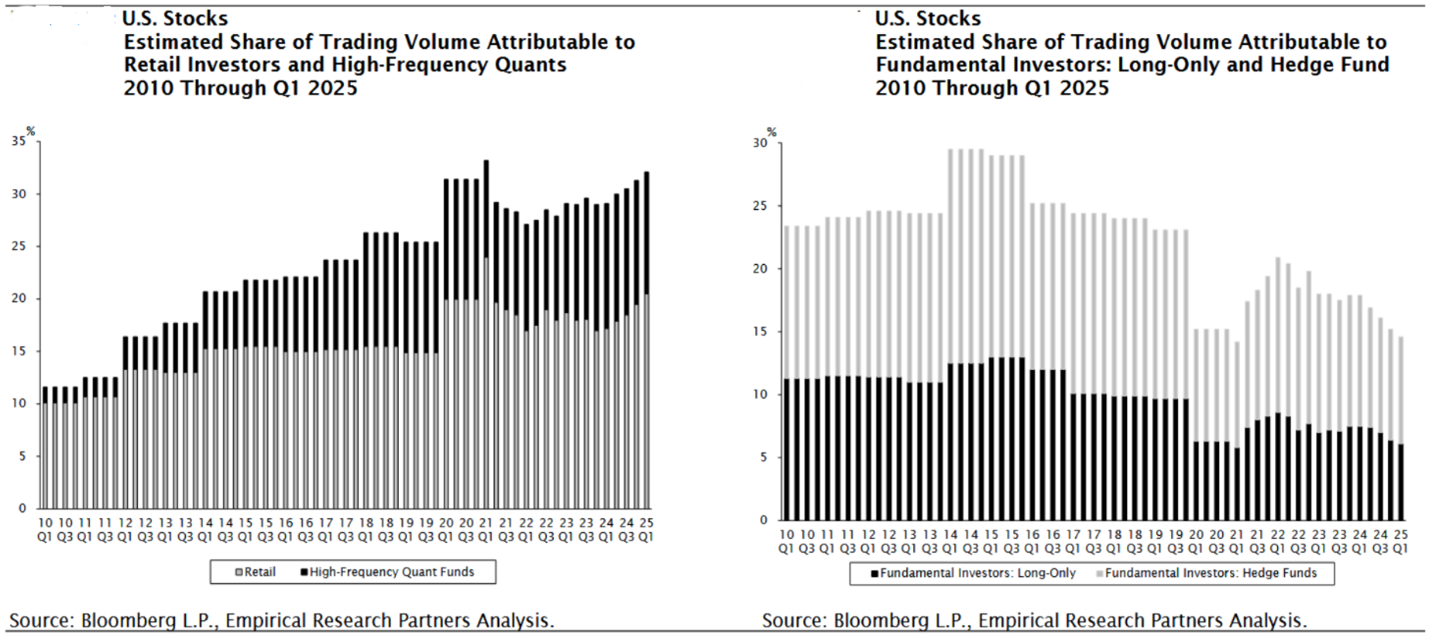

8. Retail investors have been big buyers of the rally, while institutions have been sellers

There was a similar rise in US retail investor money in 2021.

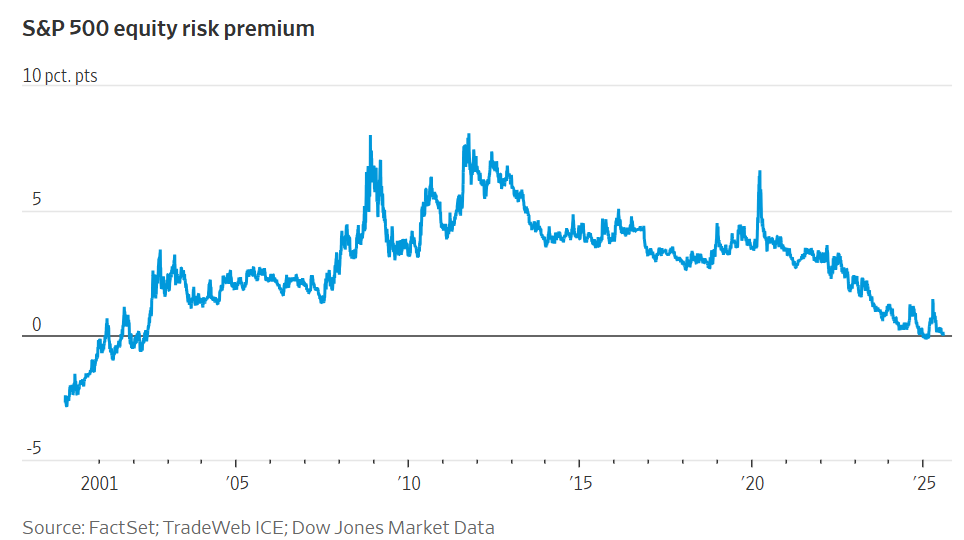

9. The equity risk premium for the S&P 500 is near zero, the lowest since 2001

The equity risk premium measures the S&P 500’s earnings yield (earnings divided by price) versus the US 10-year bond yield. It’s an indicator of valuations of stocks compared to risk-free bonds.

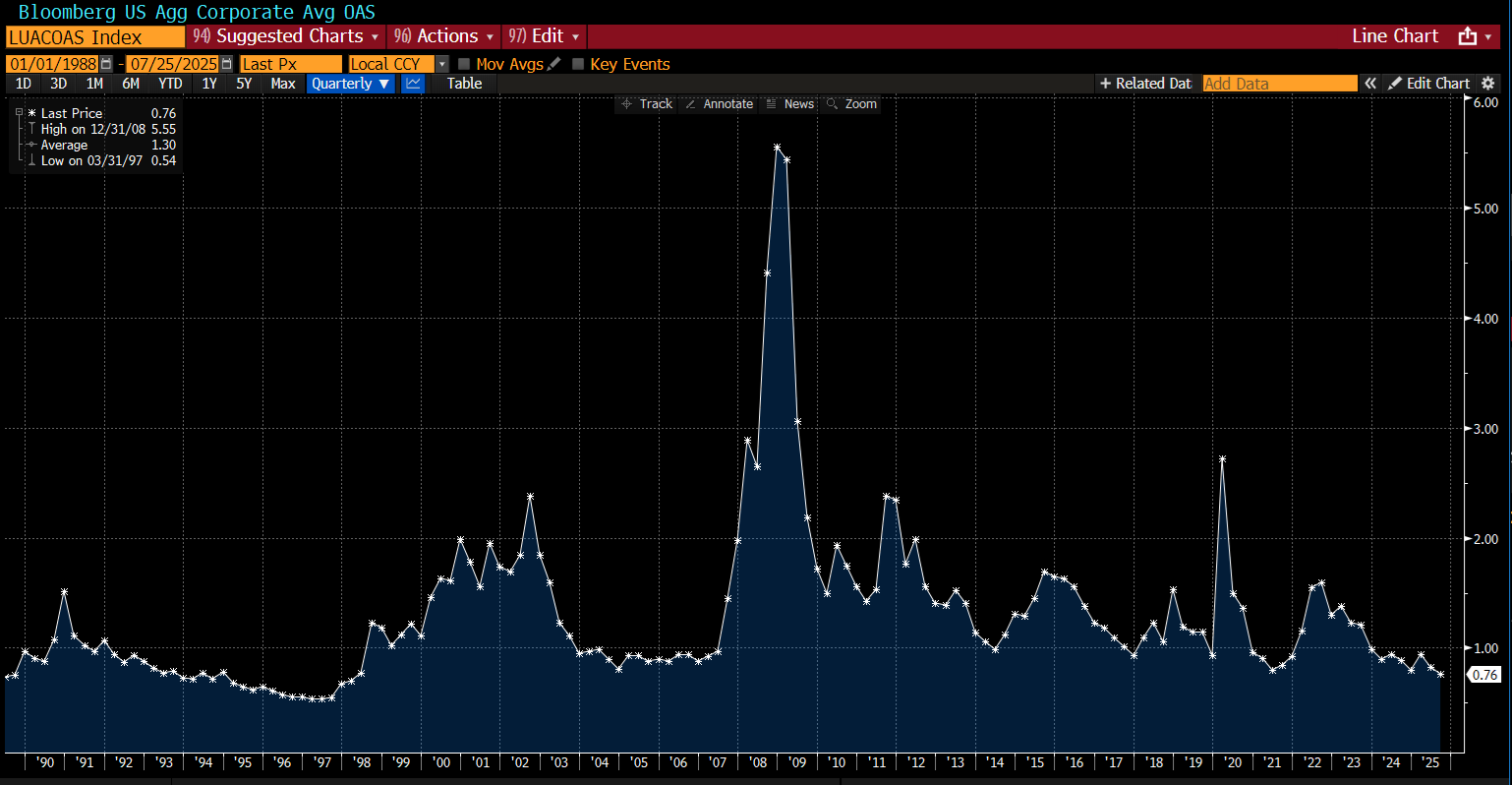

10. It’s not just stocks – credit has also found favour

Spreads on US investment-grade corporate bonds are near the tightest levels since the late 1990s.

"The theoretical minimum spread is lower today. High-quality corporate credit can now trade closer to, or in some cases even through, US Treasuries in a way that was not previously conceivable”, says Citigroup.

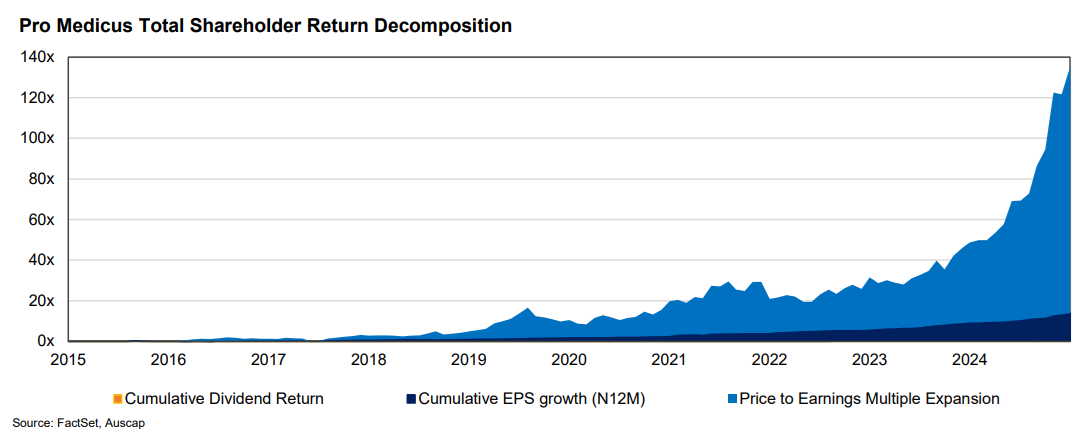

11. There’s been some speculation in ASX stocks too

It hasn’t been to the same degree as in the US, but the likes of CBA and Pro Medicus saw extraordinary gains in the first half of the year.

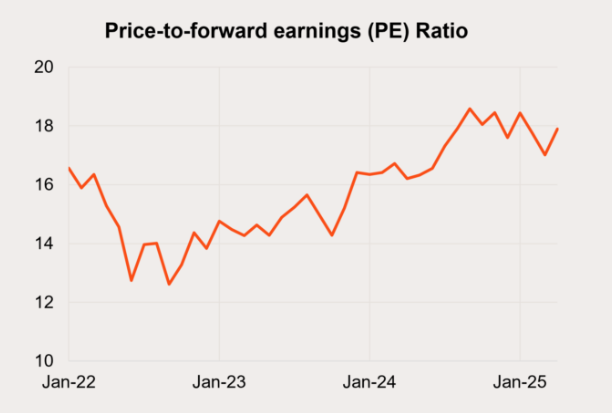

12. Valuations on the ASX 200 are now punchier than 2021

Source: Betashares

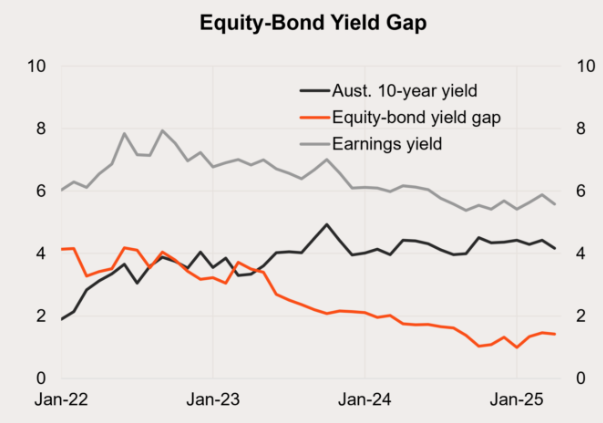

13. The equity risk premium for the ASX 200 also implies expensive valuations for stocks

Source: Betashares

Are we headed for a fall?

Are we careering towards another 2022 market reality check?

Extrapolation from recent history is a dangerous business because no two periods are ever the same. For instance, back then, the world and Australia had a serious inflation problem. Our inflation rate went from -0.3% in June 2020 to peak at 7.8% in the December quarter of 2022. That led interest rates to rise from 0.1% in April 2022 to 4.35% in November 2023.

Now it’s different because inflation is falling here and in the US. And interest rates are on the way down, not up.

We also have a US President that is committed to getting rates lower and keeping them there.

There are other differences between today and 2021-2022 too. Back then, China was still locked down. Now, China’s economy remains in the doldrums though there are at least some tentative signs that the worst of its property-led slowdown may be behind it.

And Europe has dramatically changed since Trump came into power earlier this year. Germany has reversed decades-long government debt restrictions with plans to spend tens of billions on infrastructure and defence. If EU members increase their defence budgets by 1.5% of GDP as suggested, Joachim Klement estimates that those measures in aggregate could raise the EU’s annual trend growth rate over the next 10 years from 1.6%, the current OECD estimate, to levels like the 2.1% projected for the U.S.

We also have this new thing called AI that is already leading to massive spending from US tech giants and could spur economic productivity gains in the US and elsewhere.

All of this suggests that the current rally could run further. The risk is that Trump overheats the US economy, resulting in a rebound in inflation and rates heading back up.

Markets aren’t looking that far ahead, and for now, it’s risk-on.

****

On the subject of investor exuberance, what does history tell us about the performance of markets once they reach record highs? Schroders' Duncan Lamont combs through 100 years of data to give us the answer.

****

In my article this week, as interest rates fall, it's becoming harder to find decent, sustainable sources of income. I look at the best places to hunt for yield.

James Gruber

Also in this week's edition...

Recently, the UK's Chancellor of the Exchequer, Rachel Reeves, was in tears in Parliament after her Prime Minister shelved a plan to cut disability payments. The bond market erupted as it raised the prospect of the government hiking taxes or issuing more debt to fund its welfare system. Clime's Paul Zwi recounts these events and asks if Australia risks a similar backlash if it doesn't soon address ballooning NDIS spending?

Ashley Owen is back with a fantastic piece on Chinese steel production - both its incredible feats and how much it has contributed to Australian incomes and wealth. The big question for us is whether that steel production is in danger of falling both in the short and longer terms. Ashley offers a positive take on the issue.

There's a lot of hype in the tech world about stablecoins and their potential to provide an easy and cheap way to make cross-border payments. If right, it would be bearish for payment processing giants like Visa and Mastercard. However, Magellan's Elisa Di Marco believes stablecoins have a long way to go before they can be considered as a genuine disruptor.

Is there a theme that offers assured growth for the next 30 years? It's a tough question to answer, though Sarah Shaw thinks infrastructure comes close. She outlines five tailwinds for infrastructure that make it a compelling investment.

The markets have had a volatile six months, gyrating around news about Trump, tariffs, debt ceilings, wars, bond market ructions, and the list goes on. How do you keep your head in times like this? Michael Bogoevski has taken a step back to write a note he wished he’d received earlier in his investing journey - a guide for navigating the narratives and noise.

Two extra articles from Morningstar this weekend. Dan Romanoff on why Microsoft’s earnings were so impressive, and Shaun Ler highlighting a hot ASX industry where the main players looks materially overvalued.

Finally, in this week's whitepaper, Vanguard says too few people are putting their savings to work in the financial markets, potentially reducing their long-term returns. It suggests redesigning retail investment systems to encourage more people to invest.

Curated by James Gruber, Joseph Taylor and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website