The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Weekend market update

US stocks were mixed on Friday as Wall Street tempered its rate-cut hopes amid economic data this week that showed higher-than-expected wholesale inflation and a rise in July retail sales. The Dow industrials end slightly up and just shy of its record high, while the S&P 500 and Nasdaq fell 0.3% and 0.4% respectively. The Dow was helped by an after-hours filing Thursday from Warren Buffett's Berkshire Hathaway showing it added UnitedHealth to its portfolio, taking a roughly US$1.6 billion position last quarter. UnitedHealth shares jumped 12% Friday, though they remain down 40% for the year.

From AAP:

The local bourse ended the week on its highest ever note, locking in a record close after hitting new intraday peaks for five straight sessions.

The S&P/ASX200 shrugged off a midday wobble to charge higher by 0.73% to a best-ever close of 8,938.6, a 1.4 per cent gain for the week.

Nine of 11 local sectors finished higher, led by 1.1% gains in financials, mining stocks and the energy sector.

All big four banks finished in the green, Westpac up more than 8% in two days to $36.18, while CBA snapped its post-earnings slump to reclaim 0.6% to $168.17.

Large cap miners forged a path for the materials sector, with BHP, Fortescue and Rio Tinto all up more than 1.1% after weak economic figures out of China prompted hopes of future stimulus.

Gold miners edged higher as the Australian dollar lost ground against the greenback, while gold futures hovered at August lows.

Energy stocks also outperformed the broader market, thanks to a more than 7% rally in Ampol shares after it confirmed a $1.1 billion buyout of EG Group's Australian service station portfolio.

Cochlear finished the day 1% higher to $309.03 per share, shaking off an early morning sell-off after its $392 million underlying net profit underwhelmed investors.

Next week, sector giants such as BHP, Woodside, Goodman Group and CSL are among the names reporting to shareholders.

The government's Economic Reform Roundtable and summit will run from Tuesday to Thursday.

From Shane Oliver, AMP:

Global shares, led by the US share market, pushed further into record territory over the last week helped by solid US earnings growth, okay economic data and expectations for the Fed to start cutting rates next month. For the week US shares rose 0.9%, Eurozone shares gained 1.6%, Japanese shares rose 3.7% and Chinese shares rose 2.4%. The positive global lead, the RBA cutting rates and signalling more cuts to come along with a reasonable start to the earnings reporting season also saw the Australian share market rise to a record high with a 1.5% gain for the week led by materials, consumer staples, utilities and healthcare shares. Bond yields rose except in Australia where they fell but are basically range bound. Oil prices fell on hopes of progress towards a ceasefire in the Russia/Ukraine war, but with the Trump/Putin talks not reaching a deal yet. Metal prices rose slightly with the iron ore price flat around $US102/tonne. The $A was little changed around $US0.65 with the $US down. Bitcoin rose making it to a new high during the week.

In Australia, the RBA cut its cash rate again with more rate cuts likely. The cut was no surprise and reflected confirmation that inflation is on track to settle around the mid-point of the 2-3% target range in line with the RBA’s forecasts – see the next chart. Surprisingly though the RBA actually revised down its growth forecasts and were it not for its assumption that the cash rate would fall another two or three times into next year its forecasts for growth, unemployment and inflation would be weaker. So, while still low unemployment for now and the RBA’s concerns about poor productivity growth mean that the RBA will remain cautious and gradual in cutting rates, and they will assess the situation from meeting to meeting, we continue to see the RBA cutting rates again in November, February and May taking the cash rate down to 2.85%. Jobs and wages data released after the RBA meeting were roughly in line with RBA forecasts and so do nothing to alter the outlook for interest rates.

****

Unless you’re under a rock, you’ll know that the RBA delivered an expected 25 basis point cut to cash rates to 3.6%. A typical headline read: “A belated boost for homeowners”. It certainly was a boost for those with plenty of debt, and the media was at pains to highlight the plight of homeowners (property gets clicks and are big advertisers, after all), while focusing less on the ‘losers’, such as savers, both young and retirees.

And the rate cut came with a sting in the tail: the RBA downgraded its expectations for medium-term productivity growth from 1% to 0.7%. That’s a big cut, though the trend had been down for some time – the government’s 2023 Intergenerational Report pegged productivity growth at 1.2% over the next 40 years, down from its previous estimate of 1.5%.

So, the RBA is cutting because our economy remains in the doldrums. The problem is that it knows interest rates aren’t likely to revive our economic fortunes.

Instead, the heavy lifting will have to come from government policy and the private sector. On that front, the government is ruling out every potential economic reform, and none in, at present.

If Mr. Chalmers is looking for fresh ideas, he should read a new paper from the Australian National University, ‘How ready is Australia to improve productivity’.

Unlike so much of the economic claptrap that’s been written about turning around our economy, this paper provides an easy-to-understand framework of the key drivers of productivity and where Australia is doing well and where it can improve.

The authors, Robert Breunig and Dean Parham, first define what productivity is and why it’s important:

“Productivity is a measure of the rate at which inputs are transformed into outputs. More national productivity means a country is leveraging more and higher-value goods and services from its inputs and endeavours. National productivity growth reflects the ability of a nation to generate additional income from the same inputs. That is why productivity growth is central to lifting living standards.”

The authors then outline the key drivers for the economy:

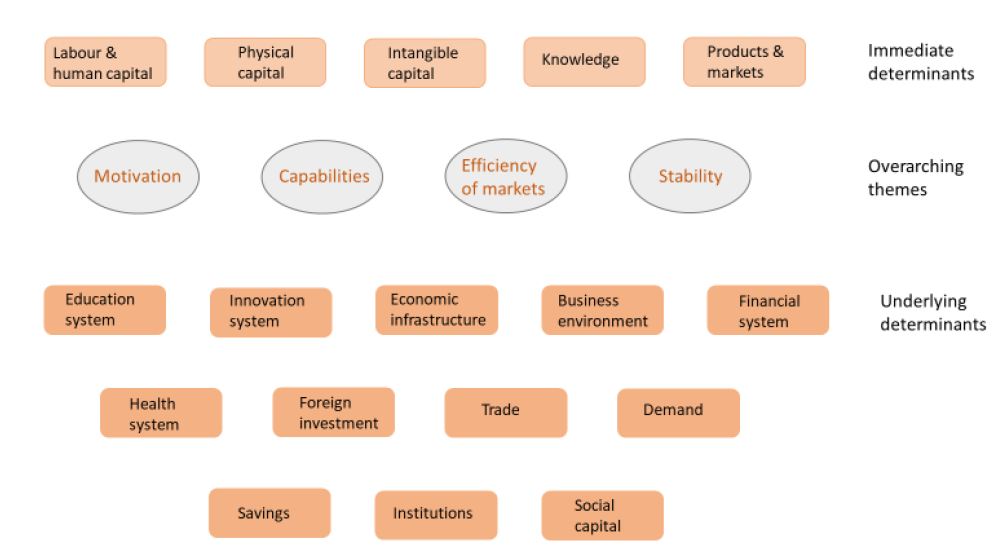

Key determinants of national productivity performance

Source: ‘How ready is Australia to improve productivity’, Robert Breunig and Dean Parham.

The four over-arching themes are:

Motivation: people must be motivated to improve productivity. Competition motivates individuals and businesses to do more. On the other hand, burdensome regulations can sap the incentive to be more productive.

Capabilities: Individuals and businesses must have access to the resources they need to improve productivity. Skills, technology, and infrastructure are critical here.

Efficiency of markets: Markets need to operate in a way that encourages investment in skills, capital and knowledge, and the productive allocation of resources.

Stability: Investments that lead to strong and sustained productivity growth are underpinned by economic, social, and political stability.

The paper makes that great point that governments can’t directly affect national productivity – except for improving their own productivity. However, what they can do is to influence the key drivers to improve living standards.

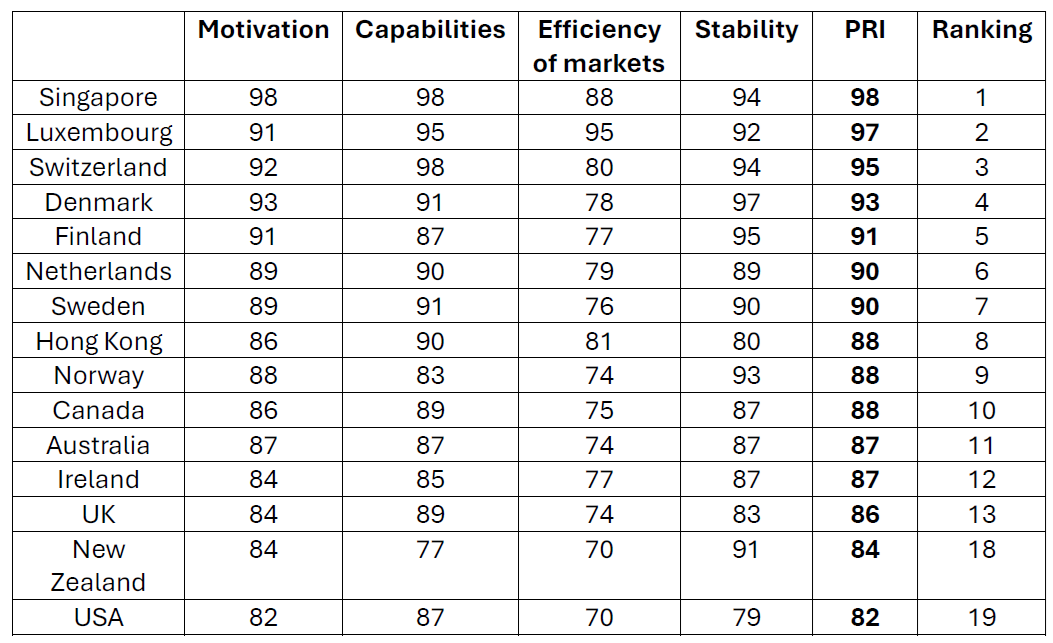

The authors have measured ‘productivity readiness’, via various quantitative metrics, across 118 countries, including Australia. So, where does Australia rank?

Well, it comes in at 11th for productivity readiness, with Singapore, Luxembourg, and Switzerland topping the table. The US lags, ranking 19th.

Values of productivity indices

Source: ‘How ready is Australia to improve productivity’, Robert Breunig and Dean Parham.

Australia does well on scores for motivation, capabilities, and stability, though not as well for efficiency of markets. The latter reflects “relatively stringent labour regulation environment and increasing government involvement in the economy.”

I’m surprised by Australia’s high score for motivation given the large number of industries operating as duopolies and oligopolies, especially versus the likes of the US.

Nonetheless, Australia’s scores well overall, though the authors suggest the following to boost our economy:

- Our biggest weakness is efficiency of markets, which means improving the regulatory environment and labor market flexibility stand out as areas ripe for reform.

- Improving competition, investment freedom and government effectiveness could lift the motivation score.

- Reducing barriers to trade and foreign investment could boost the motivation and efficiency of market scores.

- The capabilities score has fallen over time, suggesting opportunities for improvement in education and R&D spending.

- The stability score has declined in Australia and globally, indicating more can be done to bolster the rule of law and government effectiveness.

****

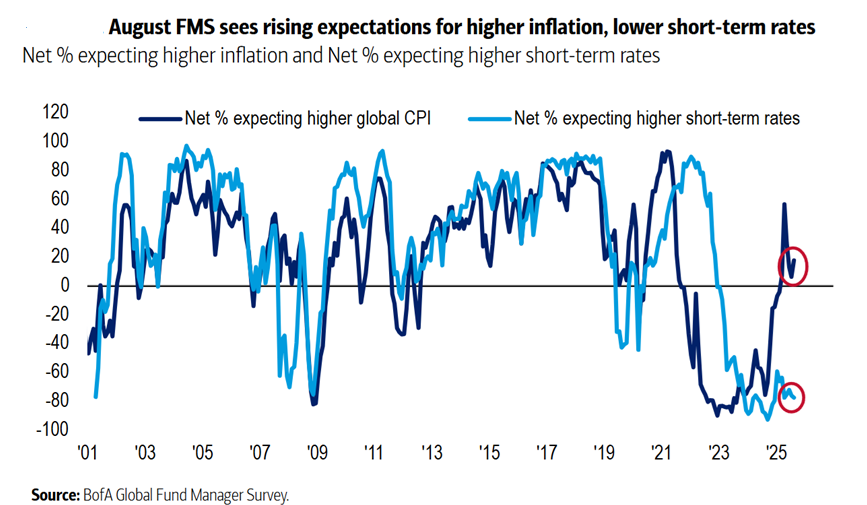

Bank of America’s latest survey of institutional fund managers has let slip what has been obvious for months: fundies have been front running Trump and the new Fed Chairman, sending markets roaring higher.

The Trump playbook is clear: he wants a new Fed Chairman who will slash rates. Why does he want this? Because he wants to spur economic growth and lower the hefty interest rate bill for his heavily indebted government. And he is prepared to overheat the US economy and inflation if necessary.

Fund managers have taken Trump at his word. 68% of those surveyed expect a soft economic landing in the US.

Most see higher inflation, yet lower short-term rates. While seemingly contradictory, it makes sense given Trump’s pronouncements.

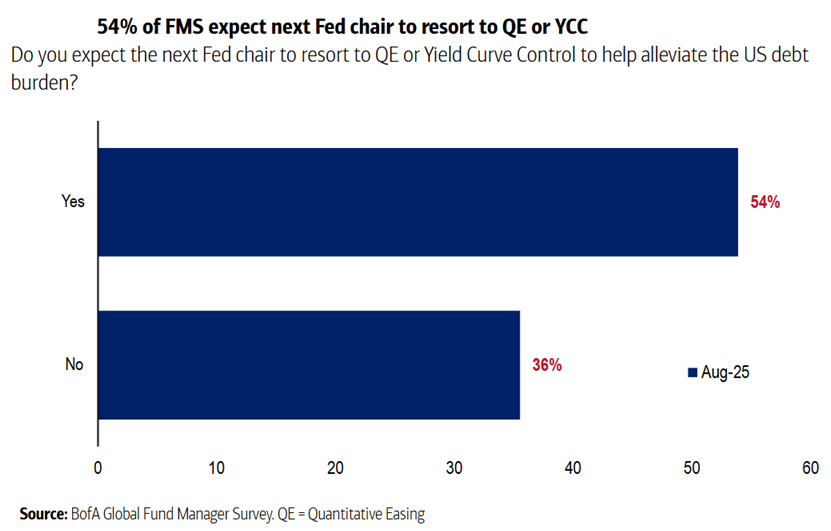

And an amazing 54% of fund managers survey think quantitative easing or yield curve control is coming to the US.

So the fund managers are indicating that the US debt situation is out of control and Trump running the economy hot is likely to increase inflation and long-term rates. While the Fed influences short-term rates, they don’t control long-term rates, and to keep a lid on the latter, QE or yield curve control will be necessary.

This type of scenario would be bullish for equities and risk assets and explains why these assets have already run hard.

Whether it’s positive for the long-term is the big question.

Either way, it appears we’re headed for a new regime of ‘national capitalism’ that investment strategist Russell Napier alluded to in a Firstlinks article early this year.

****

In my article this week, I look at a new book by Bill Bengen - the creator of the 4% rule for retirement withdrawals - which offers fresh strategies to outlive your money, including holding fewer stocks in early retirement before increasing allocations.

****

On the topic of retirement, the association representing super funds, ASFA, has released research that a home owning couple needs just $690,000 in super, as a minimum, to have a 'comfortable' retirement. Clime's John Abernethy explains why that number looks light and how it highlights broader problems with our superannuation system.

James Gruber

Also in this week's edition...

Are franking credits factored into share prices? Geoff Warren says the data suggests they're probably not, and there are certain types of stocks that offer higher franking credits as well as the prospect for higher returns.

18th century Scottish economist Adam Smith is best known as an advocate for free markets and the 'invisible hand'. Less known is that he also wrote extensively on morals and moral conduct. In a new book, Judo Bank co-founder Joseph Healy says that Smith would despair at many aspects of modern Australia, which has let materialism override basic human values such as kindness, compassion, and having a fair go.

Despite the perception that successful investors nimbly navigate each zig and zag in the market, the evidence suggests otherwise, says Duncan Burns of Vanguard. He believes a long-term approach can help an investor avoid self-harming their returns.

As the world's largest ETF manager, Blackrock has a treasure trove of data on where people are investing and how. The firm's Tamara Haban-Beer Stats outlines the four ways that global investors are currently reshaping their US exposure.

Two extra stories from Morningstar this week. Roy Van Keulen highlights an ASX tech darling where investor hopes are too high, and Nathan Zaia reacts to CBA’s reporting season wobble.

As the hybrid market starts to wind down, high yield bonds are becoming more popular. Macquarie Asset Management's Blair Hannon has a useful primer on these bonds and the opportunities available.

In this week's whitepaper, Heffron, provides an SMSF facts and figures guide for 2025/2026.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website