Weekend market update

A few months ago, the prospect of a Biden Presidential victory was supposed to be bad for stock markets, due to higher taxes and more regulations. But with Biden having a clear poll lead, the markets are now taking comfort from the expectation of more fiscal stimulus. Whatever the market does, we find a way to justify it after the event. Despite rising COVID cases worldwide (now 350,000 a day), the S&P/ASX200 finished the week up 1.2% to its highest level since March. On Friday, the tech NASDAQ in the US lost a little ground, down 0.4%, while the S&P500 was steady.

***

It is trite and obvious to say the future is uncertain, and while COVID-19 brings extra risks, markets are always unpredictable. However, it's fair to argue that investing conditions are more difficult than ever, mainly because the defensive options for portfolios produce little income. Moving beyond cash, term deposits and investment-grade bonds introduces risk. In his latest memo to clients, Oaktree's Howard Marks says:

"In my view, the low interest rates represent the dominant characteristic of the current financial environment, creating the dominant consideration for investors: the lowest prospective returns in history ... when uncertainty is high, asset prices should be low, creating prospective returns that are compensatory. But because the Fed has set the rates so low, returns are just the opposite. Thus the odds aren't on the investor's side, and the market is vulnerable to negative surprises."

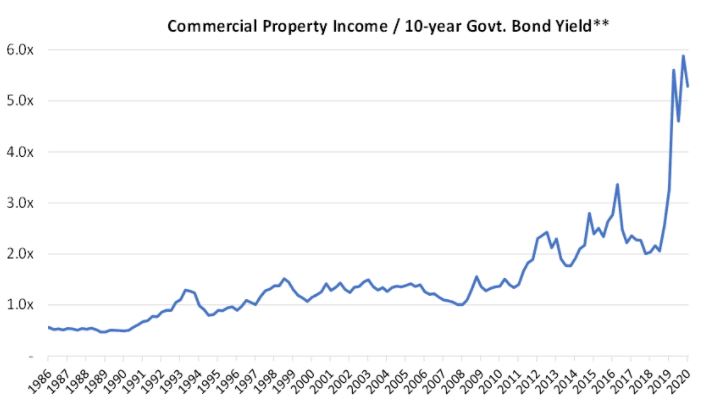

Overwhelmingly, low interest rates and ready liquidity are driving demand for other assets, and reconciling these values is our major focus this week. For example, at a time when office rents are facing downward forces and some sections of retail are facing online disruption, cap rates (that is, income divided by purchase price) on commercial property remain robust. The chart below shows that in the past, say from 1995 to 2010, cap rates were far less than double 10-year bonds. Now, with earning yields on commercial property at about 5.8% and bonds at 0.8%, the multiple is around seven times. Such returns sustain demand for property notwithstanding COVID.

Our articles start with veteran consultant to the superannuation industry, Don Ezra, who asks whether the rules of investing have changed. He takes us through seven logical steps to show where he has settled with his own retirement thinking.

Complementing this approach, in the White Paper section, Vanguard explains its 'Total Return Investing' concept. It ensures alignment with risk tolerances instead of taking unwanted market and credit exposure in the search for income.

(See also the exchanges on growth/defensive in my article on YourSuper last week which drew a strong response from Hostplus' CIO Sam Sicilia).

Then we have different perspectives on the major company successes of COVID-19, the tech stocks. There is no hint of a recession for the Amazons, Afterpays, Googles and Kogans of the world when they are enjoying such strong growth. Ashley Owen's charts to show how local and overseas tech stocks have performed in 2020. Then Benjamin Chong makes the case that, contrary to popular categorisation, many of the best tech stocks now have the defensive characterics investors crave. Even if Chong is correct, stock selection remains important. For example, Tesla is up 425% in 2020 versus the S&P500's 9%, with little in earnings updates but plenty of retail investors living the dream on the back of Elon Musk's hero status.

Returning to Howard Marks for a comment on this, surprisingly for someone who says investing opportunities are scarce, he says:

"Current profits severely understate the tech leaders' potential. They currently choose to spend aggressively on new product development to expand (market) share and head off competition, voluntarily suppressing margins. This enormous potential exists for tech companies to increase profit margins in the future ... For these reasons, a large differential in terms of P/E ratios is warranted."

But it's never obvious when valuations are too high. Trent Masters says it is incompatible to assume strong growth at the same time as low interest rates, and he provides worked examples of how this is inflating stock prices. And Michael Collins provides 10 reasons why low rates can actually be counterproductive for economic growth, including the 'liquidity trap'.

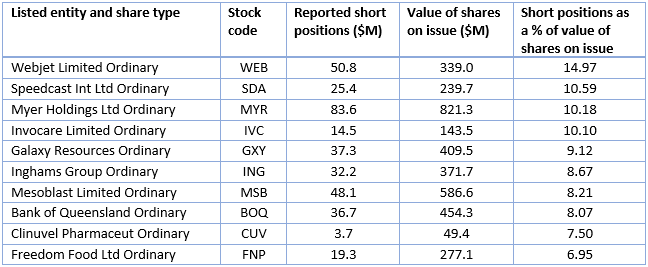

It's useful to remind ourselves when markets are at highs, there are plenty of stocks investors are wary about. ASIC produces data each week on the extent to which stocks are shorted, and Leisa Bell has extracted the Top 10 in Australia. There's a lot of hoping that prices of these stocks will fall.

As more Australian investors acquire global assets, Raewyn Williams detects a move from hedging currency exposure or taking a default 50/50 approach to using the risk as a source of added return.

And amid all this investing, we still have the rest of our lives to manage, including aged care for ourselves, parents or grandparents. Rachel Lane explains the latest developments from the Budget and Aged Care Royal Commission. We would all like to live happily and healthily in our own homes until we are tapped on the shoulder, but a more likely reality is declining health and later-life challenges.

It's also worth checking BetaShares ETF Report for September 2020 (in our Education Centre) with net flows exceeding $2 billion in a month for the first time, with the strongest demand for Australian equities. ETFs are at a record high of over $71 billion.

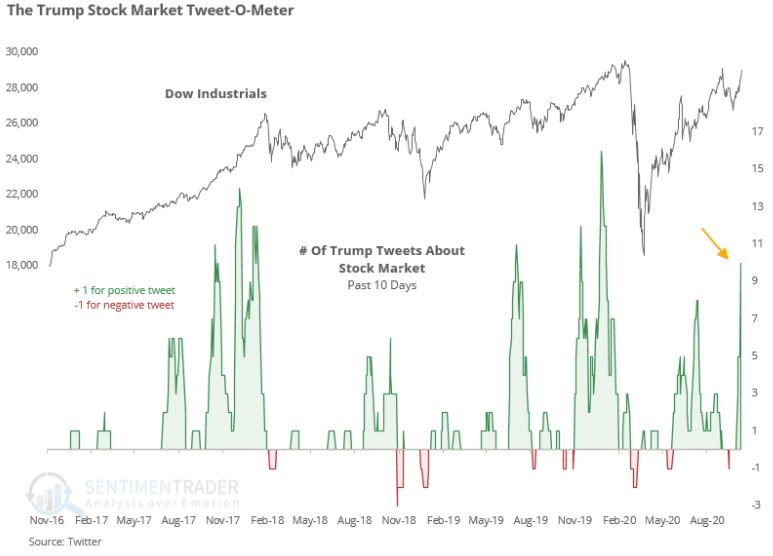

Finally, as the US Presidential election edges ever closer, expect Donald Trump to renew his rampant Twitter activity after a lull during his COVID treatment, sending those who watch them into a lather for the impact on the market. Here's his favourable and unfavourable stock market mentions plotted against the Dow Jones.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website