The Weekend Edition is updated with a market summary and Morningstar adds two of its most popular articles from the week including stock-specific ideas. It's also a chance for a catch up on articles and previous editions are here and contributors are here.

***

From AAP Netdesk: The best performing shares on Friday were in health, consumer staples and technology. The ASX gained 0.15% on Friday and was little better for the week, largely due to declining materials and energy shares.

The ASX200 gained 0.23% for the week after on Wednesday having its greatest loss since February. Investors remain vigilant for signs of inflation due to economies rapidly recovering from the pandemic. Kogan was one of Friday's biggest losers and slumped 14.3% to $8.70. The company warned of lower earnings after wrongly assuming the pandemic sales surge would continue in 2021. Excess stock led to higher warehousing costs.

From Shane Oliver, AMP Capital: Share markets had a bit of a rough ride over the last week with inflation fears continuing to impact along with taper talk in the US and maybe some impact from the fall in crypto currencies forcing speculators in them to sell shares to help cover margin calls on their crypto losses. This left US shares down 0.4% for the week, but Eurozone shares still gained 0.3%, Japanese shares rose 0.8% and Chinese shares gained 0.5%. Bond yields actually fell, and commodity prices were soft with metal and iron ore prices down and oil prices down on reports of progress in US/Iranian talks to return to the nuclear deal and end sanctions on Iran. The $A fell despite a further fall in the $US.

***

There are no better examples of Australia's recovery from the pandemic than the fortunes of our major banks and the changing forecasts of our leading economists. For example, in May 2020, NAB reduced its dividend and undertook a Share Purchase Plan (SPP) at $14.15 to build up its capital:

"... in light of the uncertain economic outlook due to the COVID-19 pandemic. These actions are intended to provide NAB with sufficient capacity to continue supporting our customers through the challenging times ahead, as well as increasing NAB’s capital level to assist with managing through a range of possible scenarios, including a prolonged and severe economic downturn."

If you look back on the last year and feel bad about selling or not buying in March or April 2020 for your own portfolio, then consider where NAB 'sold' (that is, raised capital).

Source: Morningstar Direct

In hindsight, it is easy to be critical and overlook that the outlook was bleak, and no doubt APRA was on the phone, but banking is so good now that NAB is contemplating a share buyback. There is no finance textbook advising companies should issue at $14.15 and buy back at $26 within a year. NAB CEO Ross McEwan was showing a touch of remorse when he said this week:

"At the time I said we wanted to be a very safe bank, that's the positioning I took. If I got it wrong, well I'm happy to be in a very strong position now going forward for customers and shareholders."

Don't worry, Ross, it's unlikely to affect your bonus although you did get it wrong, like many of us. Good to know you're happy after you increased the size of the SPP from its original target of $500 million to $1.25 billion during the offer period.

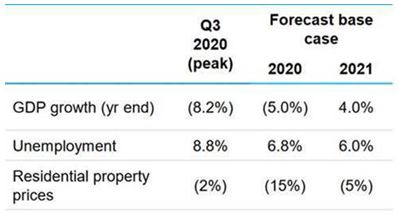

NAB was far from alone in its dire expectation. Check the changing forecasts of Westpac from May 2020 (when it took a $1.8 billion provision against expected Covid-19 losses) to the latest for March 2021. A year ago, Westpac was expecting a 22% fall in residential property prices over 2020 and 2021 and a 2020 fall in GDP of 5%. Now it sees residential property rising 20% over two years and GDP growth of 4% in 2021.

Thanks to Hugh Dive for these numbers, as Hugh runs a ruler over the latest bank results to check who is doing the best on his well-known bank scorecard.

The banks are also enjoying access to the Term Funding Facility, where the RBA lends to them at 0.1% for three years. An additional $4.4 billion was drawn last week taking total outstandings to $104 billion. However, the banks are so liquid from retail deposits that they have not taken up the $200 billion on offer and only five weeks remain until the end of the TFF on 30 June 2021. Will fixed rate loan rates begin to rise as banks return to bond markets for term debt?

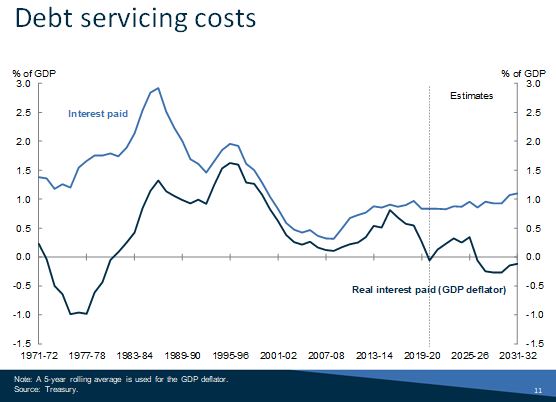

While the 2021/2022 Budget refocused attention on a trillion dollars of debt, Dr Stephen Kennedy, Secretary to the Treasury, gave a speech this week to Australian Business Economists where he showed estimates of the real interest payments on the debt as a % of GDP. Low interest rates are making the Government's spending to stimulate the economy easier to justify, even for a supposedly debt-conscious Coalition Government. At these rates, the debt servicing costs are easy to manage while everyone enjoys the stimulus.

Still on the Budget, Noel Whittaker drills into two of the 1 July 2022 changes to find they are over-hyped versus their practical implications, and he also reveals some of his winning investments and one he has given up on.

Then we look at an emerging investment trend Nick Griffin is following, as consumer demand for a wide range of desirable and expensive products in the luxury sector is driving global company profits.

Rajiv Jain examines the quickest market fall and recovery in recent history in 2020 for six quick lessons on how to invest in a crisis. They're worth remembering as the market will dish out a few more collapses in most of our lifetimes.

Then we uncover a surprising demographic change in Australia. Ashton Reid argues it will go some way to offsetting the fall in immigration many economists have been worried about. First we had domestic holidays compensating for the loss of foreign tourists, now we have thousands of people confident enough in the economy to expand their families.

A couple of weeks ago, we published an article on why the leading tech stocks remain wonderful businesses at reasonable prices, while this week, David Walsh justifies the rotation from tech and communications into value-style industrials. Differences make a market as each article makes a strong case.

And we publish the second half on the risks of buying property off-the-plan with another five potential headaches. It's worth checking the comments from last week where many readers confirmed the shock of fixing defects. Here is an edited version of our Comment of the Week from Robert:

"An excellent article which is spot-on regarding the conflicts of interest and the lack of recourse for remedy. As a retired civil engineer (not previously involved in the building industry) I am dismayed by the state of affairs. Just about every apartment structure and new house construction I have inspected (often for family and friends) has had significant issues - water leaks involving balconies, or windows, roof designs unlikely to handle downpours, plumbing issues including leaks from shower areas, unknown party wall construction which results in the crying baby next door appearing to be in your bedroom etc. Why as a society we accept this state of affairs I cannot fathom."

Thanks also to Scott Whiddett of Pitcher Partners for his comprehensive response to a reader comment on last week's dividends and franking for LICs. It's a complex subject and there's far more to the LIC claim about sustainability of dividends due to transfers to a profit reserve.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Lex Hall examines the Morningstar Dividend Yield Index, a cross-section of the Australian economy featuring wide and narrow moat names. Meanwhile, Lewis Jackson says investors will soon have to pick a side in the inflation debate - dove or hawk?

This week's White Paper from BetaShares shows the latest research with Investment Trends on who is using ETFs and why. As ETFs rush to $110 billion on issue, there are no signs of demand easing.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website