Australia is an island, but what happens in the world economy matters a great deal to what happens in the Australian economy. We don’t know what the world will look like in 2050, but that doesn’t mean we shouldn’t think about it and plan for different future scenarios. We do know a few things, and one of these is that demographics is destiny – almost. Demographics drives economic growth, both within Australia and globally, but it’s not everything. Economic growth also comes from productivity growth and capital accumulation, including investments in private and infrastructure capital and human capital.

Demographic change

A key insight from thinking about future scenarios of the world to 2050 for the design of a retirement system is that the system needs to be flexible and be able to adapt as new events unfold. A system needs to be sustainable and withstand the volatility and uncertainty that the world faces. Understanding the demographics is a good place to start but productivity growth is just as important, especially in the retirement income space.

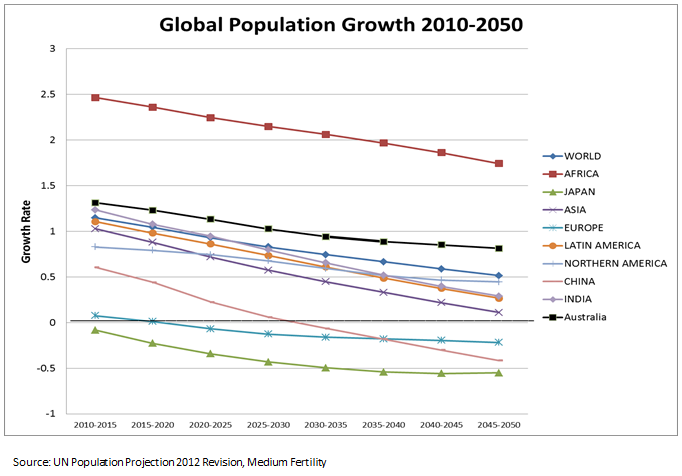

Figure 1: Global Population Growth

Figure 1 shows UN projections of population growth around the world. There is a wide range of assumptions underlying demographic projections, so these are not certain but a reasonable estimate for thinking about the future. At the lowest part of the graph is Japan, which is already shrinking. The line above that is Europe, which is also disappearing demographically. These two historically key drivers of the world economy are shrinking demographically. It is clear from Figure 1 that all lines are trending down, so while the world economy is expected to be growing, it will do so less quickly over future decades.

Changing demographics changes the rates of return on various assets. The stronger the world grows, the more likely the return on capital will be high, as well as returns on a wide range of asset classes. Now focus on China, third from the bottom. China shrinks very quickly and follows Europe and Japan into negative population growth within the next 10 to 15 years. This is mostly due to the one child policy in China. Relying on China for Australia’s growth over the next 30 or 40 years will not be coming from the demographics but it may be driven by productivity growth. Australia’s demographic trend compares favourably with the other major countries.

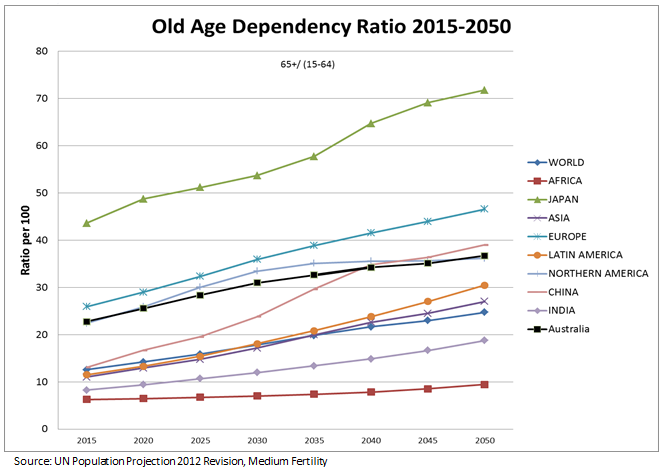

Another issue that matters from a superannuation and retirement point of view is what happens to the old age dependency ratio. This is the ratio of people aged 65 and above divided by the number of people between 15 and 64 (as a measure of working age population). These measures are not a good guide of actual dependency in the sense that people will have to work longer, as the people who will be in the 15-64 age cohort will not be financially able to support this scale of dependency. Already in Japan, for every 100 people of working age there are 44 people over 65. By 2050, it will be 70 older people per 100 workers. This will be very difficult to finance across the world.

Figure 2: Old Age Dependency

In Figure 2, Australia is the black line. Again Australia’s situation is better than many other countries, and this relative position makes a difference to how we might adjust.

China’s economy bigger than the US

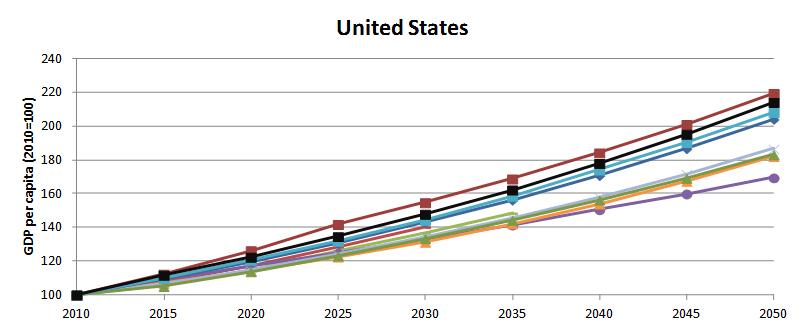

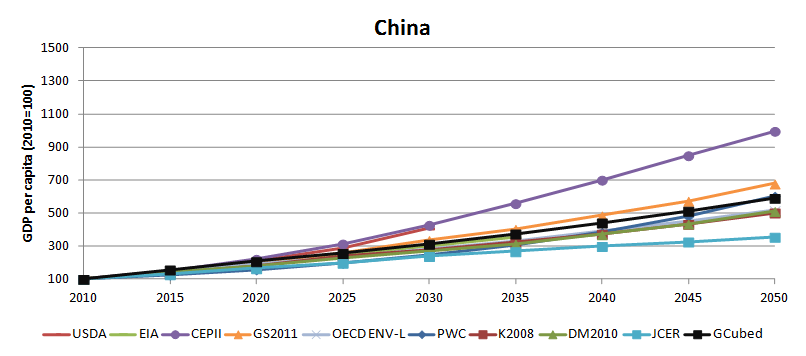

Many people have thought about the future to 2050 using large global economic models and assumptions about demographics and possible productivity growth rates. Key assumptions are how far countries are behind the technology frontier and how quickly they will close that gap. There are many different scenarios that generate very different outcomes by 2050. For example, Figure 3 shows you what the United States and China are projected to look like using many different global economic models (including my own G-Cubed model). In Figure 3 GDP per capita from each model is normalized to an index of 100 in 2010. These projections are in per capita terms so they are the outcomes or productivity growth and capital accumulation netting out the demographic effects outlined above.

Figure 3: Survey Projections of Real GDP per Capita Growth for the US and China

Source: Stegman and McKibbin (2013) “Long Term Projections of the World Economy: A Review” CAMA working paper 14/2013

Figure 3 illustrates the great deal of uncertainty in projecting to 2050. Under a wide range of assumptions, these projections suggest that the US economy in per capita terms will be between 170% and 220% bigger than it is today. That’s a big expansion in an economy that is on the technological frontier. The uncertainty is even larger for China, with the models suggesting that China will be between 300% and 950% larger than today in per capita terms by 2050. When multiplied by the population, it is clear that China is expected to be substantially larger than the US.

Focussing on the relative size of income per capita in the emerging markets in the same sets of studies, there’s an enormous difference in outcomes. But for example, the French model (CEPII) has China at 80% of US GDP per head by 2050. That’s an amazing catch up in productivity and capital accumulation when you consider China is currently 20% of US levels. Clearly even with an unfavourable demographic future in China, it is expected that the amount of productivity catch up and physical capital accumulation may be substantial and enable China to grow in per capita as well as in absolute terms.

World economy will be vastly different

Put all this together and the world economy is expected to be a vastly different place in scale and composition by 2050. Emerging markets will likely be a very large share of the global economy. This is good news, because the rates of return in emerging markets, if robust economic structures are put in place, will drive economic activity to these areas and generate wealth globally even under a scenario of stagnation in advanced economies.

These models give us important insights rather than reliable forecasts. One key issue is that given productivity gaps and the potential for catch-up, particularly in emerging economies, there is still potentially a lot of economic growth in the world economy but it may not be in the traditional regions. In fact, in the scenario of the ‘great stagnation’ where there is a long period of low economic growth in advanced economies, this certainly need not be true for the emerging world. What will matter is the extent that emerging countries can catch up to the productivity frontier that already exists.

Productivity growth in Australia is a key issue for Australia’s future prosperity and the sustainability of retirement systems. Australia has good demographics relative to many other countries which is an advantage. But also important is tapping into trade and investment opportunities in emerging economies, especially in the Asia-Pacific region. China is only part of the story of Australia’s future as the rest of the emerging economies may well dominate the global economy by 2050.

Professor Warwick McKibbin is a former Reserve Bank Board member and is currently Director, Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, ANU. He is internationally renowned for his contributions to global economic modeling. Professor McKibbin has published more than 200 academic papers as well as being a regular commentator in the popular press. He was awarded the Centenary medal in 2003 “For Service to Australian Society through Economic Policy and Tertiary Education”. His website is www.sensiblepolicy.com.