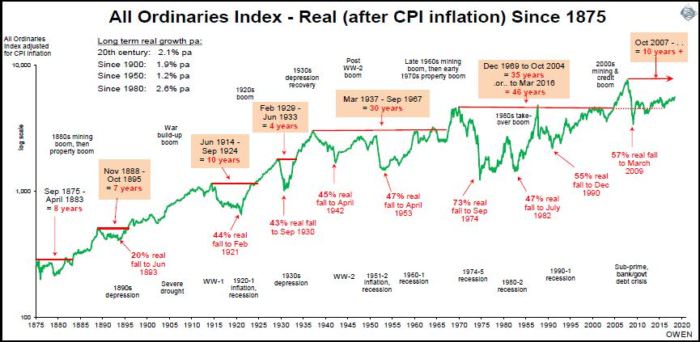

Over the past few weeks the media have been getting excited about the local stock market hitting ’10-year highs’. It is true, but only because 10 years ago the market was falling like a stone in the sub-prime crisis. The All Ordinaries index is still 7% below its pre-GFC peak. It will get there soon enough but Australia will be one of the last countries to do so.

Denmark won the gold medal for the first country to surpass its pre-GFC peak way back in January 2013. The US was second in March 2013. The UK took bronze in May 2013. Dozens of other countries have done it since then, but we are still waiting. Why? Australia has been slow to recover because our 2003-2007 boom was bigger than most. Not only did we have a credit boom like the rest of the world, we had a mining boom as well. The bigger the boom, the bigger the bust that follows it.

Need to think in real terms

More importantly, in real terms (after inflation) the All Ordinaries index is still 27% below its 2007 peak. People who bought in at the top of the boom - which unfortunately was many first-time investors lured in by frenzied media and by the ‘$1 million super contribution window’ - will have to wait a few more years to get back to square one after adjusting for inflation. Dividends add to returns, of course, but we want to see the real capital value of shares, or real wealth, rising not falling.

Am I being too negative by adjusting for inflation? No, because we need to adjust for inflation to measure the real value or spending power of our money. Inflation is everything. If I were to tell you that the Venezuelan stock market index is up by a whopping 6,976% so far this year (it is), would you race in to get some of the action, or would you run the other way? Now if I were to add that the inflation rate in Venezuela is running at 46,000% (it is), you would see that the real value after inflation is a train wreck.

Inflation can cripple real returns for decades. For people who follow the traditional ‘buy and hold’, ‘set and forget’ approach to investing, it is sobering to see that the broad market index in Australia (the All Ordinaries and its predecessors) is just 24% higher than where it was 50 years ago in August 1968. The market hit a mini-high on 16 August 1968, and then went on to peak at the end of 1969 at the top of the nickel boom, which also lured in many thousands of first-time investors. It promptly crashed and took 46 years to finally get ahead, in March 2016.

Click to enlarge

Share prices of our biggest companies have done little for 50 years

The companies that dominated the index in 1968 are mostly the same old companies that still dominate today. Let’s take the largest bank. Bank of NSW, now called Westpac, was $7.56 which is $2.18 adjusted for capital structure changes and $26.82 after inflation. It was $29.46 at the end of July 2018, a real gain of just 0.1% per year for 50 years! ANZ and NAB are still below their share prices 50 years ago, adjusted for capital structure changes and inflation. BHP is ahead by just 1.7% pa, Woodside is ahead by 1.5% pa. AGL is the best of the bunch, up by +3.6% pa over the 50 years, but CRA (now RIO), Santos, QBE and Lend Lease are all still below.

This is just the big ‘blue chip’ stocks. Unfortunately, in the booms people chase the speculative ‘hot’ stocks, which mostly end up worthless.

This is a sobering reminder of the destructive effect of inflation, and also a reminder not to get caught up in boom-time media frenzies that lure people in at the worst time. ‘Buy and hold’, ‘set and forget’ only works if you have 50 years to wait to get your money back.

It is also a reminder that GFC-type crashes are not unusual at all, contrary to the media nonsense that the GFC was a ‘once in a century’ event. The good news is that there are tremendous gains to be made by going against the herd and buying when everybody else is panic-selling in the busts.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.