The last fortnight has caused carnage on global markets. The S&P/ASX 200 dropped close to 20% in less than 10 days and the benchmark Australian iTraxx index (a proxy for Australian investment grade credit spreads) blew out from just 46 points on 20 February 2020 to 110 points on 9 March 2020, as shown below:

Source: Bloomberg

The circumstances evoke memories of the GFC. There were some important lessons that can be learnt from that experience for fixed income investors.

Unlike equities, the terminal value of a bond is largely a known quantity. The vast majority of bonds are issued at $100 (or par value) and they mature at $100. The value fluctuates between issue date and maturity date but the key point is that unless the company fails, bond holders will get $100 on maturity.

Five rules of thumb for assessing bonds

Failure or default is the key risk that investors need to assess but even in the most difficult economic times, the default rate of high quality, investment grade bonds is rare. However, the default risk increases significantly for sub-investment grade or high yield bonds. This makes assessing bond value far easier than valuing equities in times of severe market dislocation such as the past week.

Following the blueprint from past crises and in particular the GFC, there are a number of simple ‘rules of thumb’:

- Assess the probability of the company or issuer defaulting. If you think default is highly unlikely then all you need to assess value is the yield to expected maturity. In other words, if the company survives, you will be able to determine the expected yield to maturity, as the ‘terminal’ or maturity value will be $100 or par.

- Be patient but also be ready to act at very short notice. Short notice means as little as a few hours. Many of the best opportunities in the GFC came with very little notice and investors were rewarded handsomely for simply providing liquidity.

Single-A rated Tier 1 Hybrids from the likes of Rabobank, CBA, SwissRe, NAB and AXA all traded at less than 50c/$ in 2009 when large funds had to liquidate holdings at short notice or overnight. These highly-rated securities provided returns of circa 20-25% p.a. for a number of years for those who invested at prices below 50c/$.

Even in today’s market panic, ASX listed hybrids ANZPE, NABPD and WBCPF traded at margins over +850bps for those ready to act quickly but closed closer to +500bps. The best time to buy is when there is a forced seller (typically a fund or institution) in the market who just needs to find a buyer. If you are comfortable that the company will survive to maturity date, it is a question of what price to pay because it could go lower.

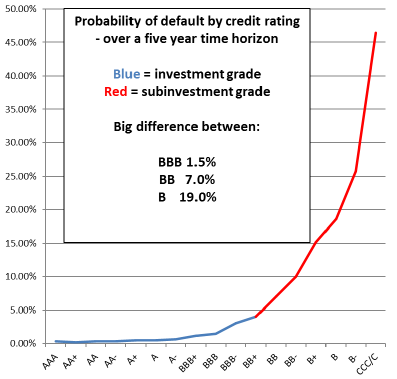

- Stick to large, high quality issues. Focus on investment grade companies that are large and have good access to equity and debt funding. We call these companies 'best of breed'. The probability of investment grade bonds defaulting is significantly less than high yield bonds. As the chart below of historical probability of default by credit rating demonstrates, credit risk past BBB- (i.e. sub-investment grade) is exponential. The price volatility of investment grade bonds versus high yield is also significantly lower. A number of oil and gas sub-investment grade bonds in the USA are down 20-30% this week alone, whereas names like BP and ExxonMobile have only fallen 2-3%.

Source: Standard and Poor’s Historical Default Rates

- Be prepared to move down the capital structure or take call risk on subordinated bonds and Tier 1/Additional Tier 1 hybrids from best of breed companies. As detailed above, many of the best returns after the GFC were Tier 1 hybrids from SwissRe, AXA, RaboBank and NAB. But also consider re-set margins. The higher the re-set margin, the higher the probability of call at first opportunity.

- Watch out for companies that have a large refinance due. In a crisis it can be very difficult and often impossible for companies to raise new debt (typically required to refinance debt coming due). Companies that have spread their debt maturity profile and even companies that are just unlucky enough to have a large refinance right in the middle of a crisis can quickly become stressed or even default. This risk is magnified as you move down the credit or rating spectrum and is typically the cause of high yield bond defaults. Companies that run a high level of cash on balance sheet are highly sought after. In a crisis, cash is king.

Opportunities in bank hybrids

The bank hybrid market is worth keeping a close eye on. Given the inefficiencies and relatively illiquidity in this market this is presenting some outstanding opportunities. Today, we have seen our favourite security in the hybrid market – the National Income Securities (NABHA) – trade as low as $85 providing a yield to expected call in excess of 10.0%. However, it recovered and closed unchanged at $92. NABPD had a range of almost $10 over the day.

We are not sure how long these opportunities will last and acknowledge that investors essentially need to be ‘watching the screens’ to take advantage. We prefer those with initial credit margins over 450bp (4.5%).

We have often written our simple rule of thumb for ASX listed hybrids are they are expensive at credit spreads under 300bps but attractive when approaching 500bps. Earlier today, the average major bank 5-year credit spread was well over 500bps and possibly 600bps. Just a month ago, that measure was just under 300bps, demonstrating how quickly the market can change.

A comment on the mining and energy sector

A number of debt securities in the mining and energy space have been caught up in the market sell-off, especially those that are non-investment grade. We remain wary of many of the companies in this sector particularly those with high debt loads given the potential for a phase of significantly lower commodity prices in the event that the world slips into a global recession which is becoming an increasingly likely proposition.

Justin McCarthy is Head of Research, and Brad Newcombe is a fixed income analyst at BGC Fixed Income Solutions, a division of BGC Brokers, and a sponsor of Firslinks. The views expressed herein are the personal views of the authors and not the views of the BGC Group. This article does not consider the circumstances of any individual investor.

For more articles from BGC, click here.