Top convictions

- The evolving artificial intelligence (AI) story will unlock more value in Asia’s technology stocks

- Reforms to improve returns will bolster the appeal of Korean and Japanese equities

- The diversification trade will benefit Asia’s local currency bonds, and a structural shift makes Asia high yield compelling in 2026

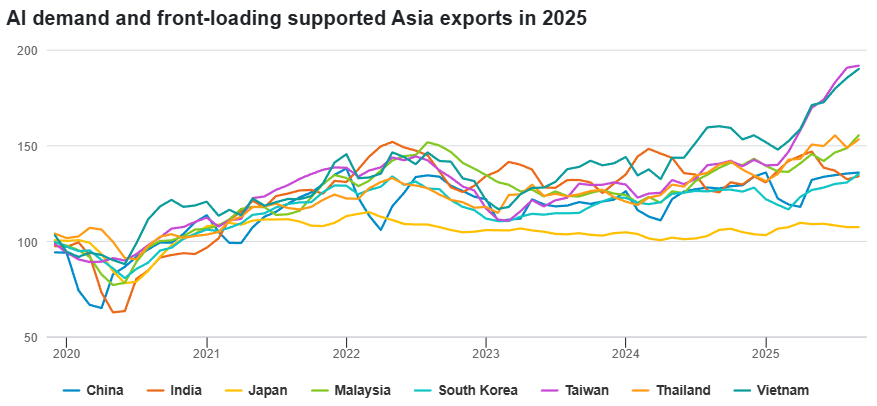

The whirl of tariff announcements from the US in April clouded the outlook for export-reliant Asia. But in the months that followed, front-loading and incremental policy support helped countries in the region withstand the stream of tariff shocks. In the meantime, a diversification trend has pushed global investors to seek alternatives to dollar assets. The weaker US dollar, a ballooning fiscal deficit in the US, and Asia’s surprising domestic strength all sharpened the appeal of the region to investors in 2025.

While Asia is set to benefit from the diversification trade in the years to come, a series of structural themes are likely to stand out in 2026.

Riding the AI wave

From China’s DeepSeek and autonomous driving to South Korea’s memory chips, Asia has proved itself a leader in the AI race. Technological prowess will become an even more important driver of revenues in 2026 after the boost provided by the front-loading of exports fades. Continued strong appetite for AI servers, chips, and datacentre equipment should partially offset the downward pressure on exports.

The excitement over China's rapid catchup in AI capabilities has seen Chinese tech stocks shine in 2025 – not just offshore internet names but also domestic shares. The country has developed its own AI ecosystem in response to trade restrictions, making it less dependent on the West. China’s vast domestic market, policy tailwinds, and increasingly tech-savvy consumers will drive broader and faster AI adoption, supporting tech stocks in 2026 and beyond.

Markets backed by a critical position in the semiconductor supply chain are having their moment too. Taiwanese and Korean chip makers, for example, should do well in 2026 thanks to a strong upcycle evidenced by the sector’s rising prices and sales volumes, driven by the AI boom.

Fidelity International’s China and Japan analysts are the most confident in the world about AI’s positive impact on corporate profitability over the next 12 months, according to the October survey of Fidelity’s research team.1

Source: Macrobond, Fidelity International November 2025. Note: Data are three-month moving averages of exports as of September 2025. Rebased to December 2019.

More accommodative

The overall policy stance in the region is likely to ease as higher effective tariffs and the fading momentum of front-loading weigh on growth. For most of Asia, inflation remains a non-issue supported by low energy prices. The resumption of cuts by the US Federal Reserve should soften concerns about interest rate differentials with the US, prompting some Asian central banks to loosen monetary policy further.

As a result, Asia’s local currency government bonds are likely to see a rise in demand, particularly high-quality sovereigns such as South Korea. They show low to moderate correlations with major global peers, making the asset class a good diversification tool.

Ongoing fiscal stimulus is expected to be rolled out across the region, as well.

Japan’s transition to higher nominal GDP growth is further reinforced by the country’s recent change of leadership. Fiscal policy is set to be pro-growth with more measures to boost domestic consumption, while the uplift in defence spending will be accelerated. We expect the Bank of Japan to continue its gradual rate hikes given inflation will be supported by both fiscal easing and a virtuous cycle of wages and prices.

The fiscal stimulus will benefit small- and mid-caps, which have a greater domestic focus than large caps and are relatively insulated from external shocks. Smaller companies, with valuations at historical lows, provide compelling opportunities to capitalise on Japan’s economic growth.

China’s campaign to rein in ferocious price competition is starting to bear fruit with deflationary pressures having eased off slightly. But without more aggressive demand-side policies, it will be hard for China to pull the economy out of deflation fully. Beijing may roll out additional measures next year, such as direct subsidies, to persuade cautious consumers to open their wallets.

India will continue with its own pro-growth plans in 2026. Despite high US tariffs on its goods, which are likely to be negotiated down, the Indian economy remains underpinned by robust domestic growth supported by its demographic dividend, as well as recent tax cuts. Benign inflation strengthens the case for further interest-rate cuts by its central bank. While the country has been eclipsed by other markets in 2025, 2026 could be a different story, especially for equities.

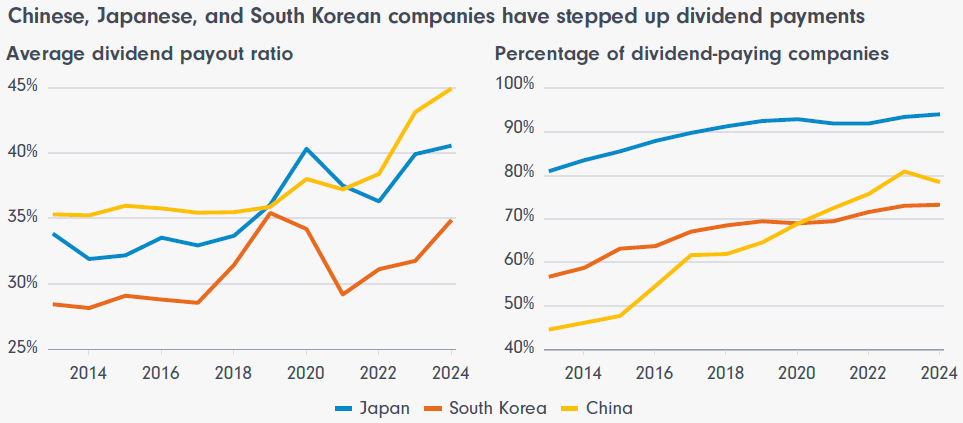

Evolving corporate reforms

From China to South Korea and Japan, where companies have long been criticised for poor corporate governance, we expect an increasing focus on shareholder returns in 2026.

Source: Bloomberg, Wind, Fidelity International, November 2025. Note: Covering 2,124 companies in the TOPIX index from 2013 to 2024, 827 companies in the KOSPI index from 2013 to 2024, and China

A-share and H-share listed Chinese companies with a market cap over 5 billion renminbi.

In Japan, ongoing regulatory reforms and the streamlining of business practices such as cross-shareholdings are further enhancing capital efficiency and investor gains.

Meanwhile, corporate fundamentals have improved, supported by de-escalating trade tensions and moderate inflation. Exporters are taking advantage of cost pass-throughs and a softer yen, while domestic sectors, particularly banks, communications, and construction, continue to deliver steady profit growth.

All eyes will be on whether South Korea can emulate Japan’s success story after the new government renewed the country’s ‘Value Up’ program. Political stability should lead to further progress in corporate governance and an improvement in Korean stocks’ valuations, which are cheaper than global and emerging market peers.

Last but not least, Asia’s high yield bonds are set to draw wider attention. The asset class appears healthier than before, with a more balanced and diversified pool of issuers. It offers attractive risk-adjusted returns, supported by low default rates, advantageous monetary and fiscal policies, and investor demand for stable carry.

Keeping watch

The region has its fair share of challenges for 2026 too. The full impact of tariffs has not been felt yet and could surface slower than many expected. “The current tariff situation is leading to depressed earnings. This could be a challenge if the final outcome is not favourable,” says Priyadarshee Dasmohapatra, an equities analyst covering textile companies in India. It’s uncertain whether the massive AI capex is built on a sound commercial footing. If we do end up in bubble territory here, capex could slow down, weighing on both Asian stocks and economic growth.

In some parts of Asia, young workers are battling stubbornly high rates of unemployment, which could threaten future growth and stability. Domestic demand is still below pre-pandemic levels in many countries.

The global economic and trade landscape is shifting rapidly. Investors will need to be nimble and attuned to further volatility or geopolitical surprises. But supportive policy measures, technological advantages, and favourable macro conditions should hold Asia in good stead for 2026.

[1] 82% of China analysts and 71% of Japan analysts say AI will have a positive impact on companies’ profitability over the next 12 months. The percentages are 48% for North America, 33% for EMEA/Latin America, and 44% for Asia Pacific (ex China, ex Japan).

Matthew Quaife is Global Head of Multi Asset Investment Management; and Peiqian Liu is an Economist (Asia) at Fidelity International, a sponsor of Firstlinks. The views are their own. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity and Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2026 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.