Inside the University of Technology in Sydney is the Paul Woolley Centre for the Study of Capital Markets Dysfunctionality (that name is quite a mouthful, Paul). It is gaining a global reputation, and its annual conference held last week was attended by bankers and academics from around the world. Its main role is to evaluate the extent to which the financial services industry does an efficient job for clients and the economy.

At the conference, the presentation by Dr Luci Ellis, Head of Financial Stability Department at Reserve Bank of Australia, was particularly interesting for anyone looking at Basel III, and the relationship between regulations and market efficiency. The speech is on the RBA website, here.

My interest was on superannuation and SMSFs, and I asked Dr Ellis this question:

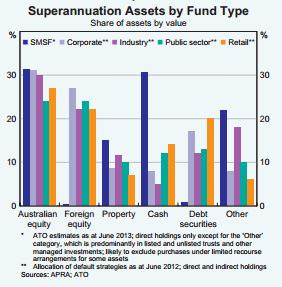

At the moment, there is an extraordinary coincidence in Australia that three macro statistics are all approximately the same at about $1.6 trillion: total assets in superannuation, market capitalisation of the ASX and the GDP of Australia. However, all forecasts are that superannuation will grow far quicker than the other two. Do you see any implications for financial stability, and particularly, that too much superannuation money will chase too few Australian assets in future (SMSFs hold 30% of their assets in direct Australian equities but a tiny amount of their assets in international shares, in which institutional funds place about 25% of their assets).

Source: Reserve Bank of Australia, Financial Stability Review, September 2013.

Dr Ellis: I think that’s a really interesting question and as you look at the Financial Stability Review that we put out last month you'll notice that actually we beefed up our superannuation section, not just about self-managed but about funds management more generally. The growth of superannuation in Australia is a development that we did not fail to notice, and consequently we're very alert to what that might mean for different responses of asset dynamics and what that might mean for credit growth and so forth.

I'm not sure I buy that the fact that there's only so much ASX will mean that somehow everyone's constrained because other things will adjust. Firstly there isn't actually an investment mandate to superannuation funds that they must only invest in the ASX rather than equity in other countries, and you know we're a small part of the world.

So I think the important issue there is the capacity of superannuation funds to manage FX risk. And so you need a deep and liquid hedging market to make that happen, you need an FX swap to make that happen. Now the good news is Australia has a very deep and liquid two-sided FX swap market, because you've got banks borrowing offshore in foreign currency, they don't want foreign currency, they want Aussie dollars. So they want a swap one way, and you've got a combination of Kangaroo bond issuers and Australian funds managers investing off shore so the fund managers have got a foreign currency asset and they want an Australian dollar asset. And so there's a natural two-sided market for these swaps.

And the global investment banks are involved, they're sitting in the middle intermediating this risk transfer and you know it's a very stabilising system to be able to do this. A lot of countries do not have the privilege of being able to access global capital markets without it blowing up in their face from FX risk, which is what we saw in the Asian crisis.

So I guess my answer is other things will adjust and part of that will be the investment mandate of super funds will be more diverse, and that's probably a good thing. There will still need to be deep and liquid FX swap markets, there will need to be good risk management in super funds.

One of the interesting points - and this comes down to the box we wrote on self managed super in the Financial Stability Review - where we noted that self-managed super had about the same allocation to domestic equities as other kinds of super funds, but they've got almost no allocation to foreign equities. In some sense, maybe one of the issues is there's going to be a trade-off between managing your fund and having more control and actually having a diversity of allocation.

But that's kind of in the realm of speculation; I think that the answer to your question is other things will adjust.

What to watch when you’re focussed on financial stability

Dr Ellis was also asked about the risks to financial stability at the moment, and she highlighted SMSFs and property. It was fascinating to hear her rules-of-thumb on what the regulator watches.

Dr Ellis. We have explicitly said in the Financial Stability Review that self-managed super funds are not a near term risk to financial stability. What I would emphasise here is if you want two rules-of-thumb to know what to do about financial stability analysis:

- one is take a closer look at things that are growing quickly

- second is follow the spruikers.

And the fact is that self-managed super funds have certainly been a target for a lot of advertising at the moment, promoting what is essentially a very concentrated and leveraged asset in their super funds. You could end up with quite a deal of asset concentration, that's certainly a sort of investor protection issue. I've learnt over the years that investor protection issues are often a signal of a potential but not definite financial stability risk further down the track.

Our observation … is that most of the property that's in self-managed super is actually in commercial real estate, there's a number of tax reasons for that, but the residential side is growing quickly from a very low base. So what we said in the Financial Stability Review is this is a new source of demand that wasn't previously there, self-managed super funds didn't have scope to contribute to demand for residential property. It's an additional source of demand dynamic that we're going to keep a good eye on in the future.