Against a backdrop of economic and geopolitical uncertainty, rising inflation and expectations of a rate hike, Australian investors are searching for investments that can benefit from these evolving market conditions.

With credit spreads at attractive levels, now might be the opportune time to have exposure to hybrids and credit. With minimal returns on cash continuing to underpin strong demand for hybrid securities, we anticipate demand for yield to remain robust throughout 2022, resulting in strong returns over the year for this asset class.

The upside of rising interest rates

Rising inflation, above average GDP growth and the unwinding of quantitative easing (QE) in 2022 has seen financial markets reprice interest rate expectations.

The rising rate environment will push the outright return on hybrid securities higher, without having a material impact on spreads given the strong economic backdrop. Given most hybrids are floating rate, investors will benefit via higher income from these rising short-term rates.

Strong balance sheets you can bank on

Australian banks are the largest issuers of hybrids domestically and their balance sheets are in fantastic shape, with capital ratios at historical high levels. COVID-19 provided Australian banks with access to cheap funding via the Term Funding Facility (TFF), which provided them with a degree of funding certainty and lower funding costs.

Following the withdrawal of the TFF in 2021, new bank issuance is coming to market at attractive credit margins, providing the ideal environment for active credit managers to identify the most positive risk adjusted opportunities.

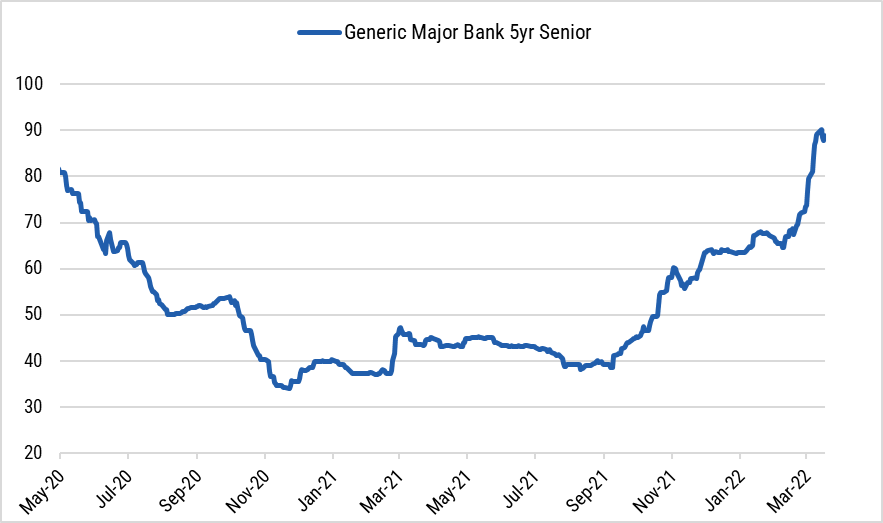

For instance, bank senior credit margins are significantly off their TFF lows, which is leading to an attractive re-pricing across all bank capital issuance (refer to Chart 1). Overvalued growth sectors are likely to lead an equity market sell off similar to 2000 – 02, but are unlikely to impact credit market returns.

Chart 1: Bank senior credit margins – Well-Off Their TFF 2021 lows

Source: YCM/NAB/BBG –March 18, 2022

Fully protected from higher interest rates with high carry protecting returns

The higher the carry (running yield of an investment), the greater the protection it offers investors from adverse movements in credit margins. The carry for the Yarra Enhanced Income Fund (“EIF”) is currently sitting at ~3.0% above cash.

Based on an average portfolio maturity of ~3 years, we’d need to see an extreme 1.0% move wider in credit margins to wipe-out the carry. However, given the robust economic backdrop in 2022, we expect credit margins to remain relatively stable throughout, adding to floating rate credit’s income generating credentials.

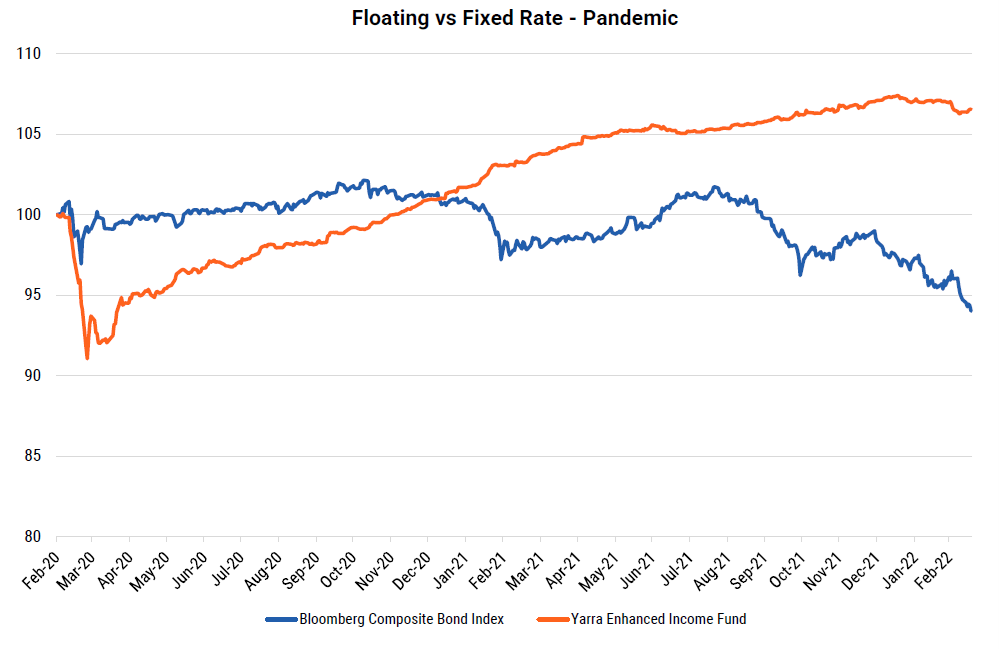

This benign outlook is in contrast to the capital losses currently being observed in traditional fixed income due to the reset in interest rates and real yields. Usually, a rise in real yields will impact the value of everything long interest rate duration, from traditional fixed income to most equities. That’s not the case with floating rate credit, since its short duration offers protection to portfolio valuations from rising interest rates. This is observable in EIF’s outperformance compared to traditional fixed income (Bloomberg Composite Index) since February 2020 (see Chart 2).

Chart 2: Floating rate credit with carry continues to outperform fixed rate with little carry

Source: Yarra Capital Management, Bloomberg. As of March 18, 2022

Making the grade

In a world that seems to be getting riskier by the minute, investment grade hybrids look to be a safe haven for investors. Here’s why:

- Investment grade hybrids appear to be fairly priced in an environment appearing increasingly more expensive, especially if real yields rise or normalise in a post QE world.

- Investment grade issuers remain well capitalised, making them more likely to be able to service their interest payments and repay debt.

- Most Australian investment grade hybrids are floating rate securities, which tend to pay higher yields if prevailing rates go up because they are based on a variable interest rate, rather than fixed. Not only does this mean more income when rates rise, but there is also no loss of capital.

Roy Keenan is Co-Head of Australian Fixed Income at Yarra Capital Management.