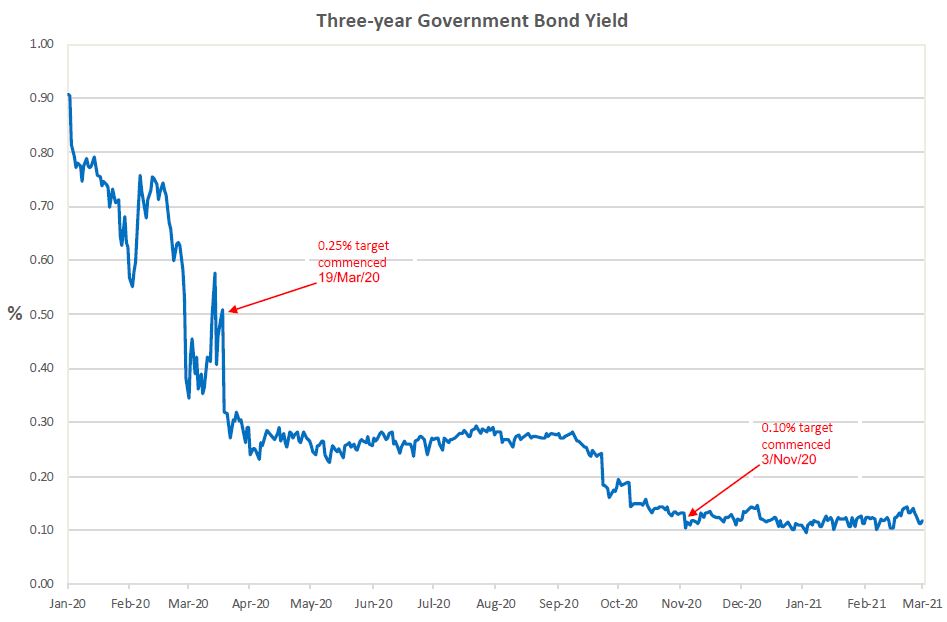

At the February 2021 Reserve Bank (RBA) Board meeting, the RBA announced it would continue its 0.1% target for the three-year Government bond yield, while committing a further $100 billion to purchase those bonds in the secondary market. This comes in addition to the $100 billion programme announced in November targeting bonds with a 5- to 10-year term.

This form of monetary policy is known as Quantitative Easing (QE). Typically, central banks resort to this when short-term interest rate targets are at or near zero, rendering conventional monetary policy no longer effective. QE may then be introduced with the aim of lowering interest rates further out on the yield curve, to encourage borrowing and spending to boost the economy.

Why do central banks target inflation of 2-3%?

When QE was put on the table by the RBA, a lot of discussion was generated and misconceptions emerged. In particular, many think that it is just a money printing exercise that will lead to high inflation.

So it’s worth exploring how such unconventional monetary policy is implemented, and what might be the effect on inflation.

We have been in a low inflation environment for some time now, well below the RBA’s preferred target range of 2 - 3%, a range considered the sweet spot by many central banks around the world. But why 2 - 3%?

If inflation was any less, then the urgency for spending would dissipate. Why spend today when it could be cheaper tomorrow? Any discretionary spending can be put on hold, which acts as a deadweight on economic growth. But any higher than the target range and consumers’ purchasing power erodes and they cut back on spending, causing businesses to reduce spending and investing, resulting in higher unemployment, even less spending, and on it goes.

QE is not money printing, but what is it?

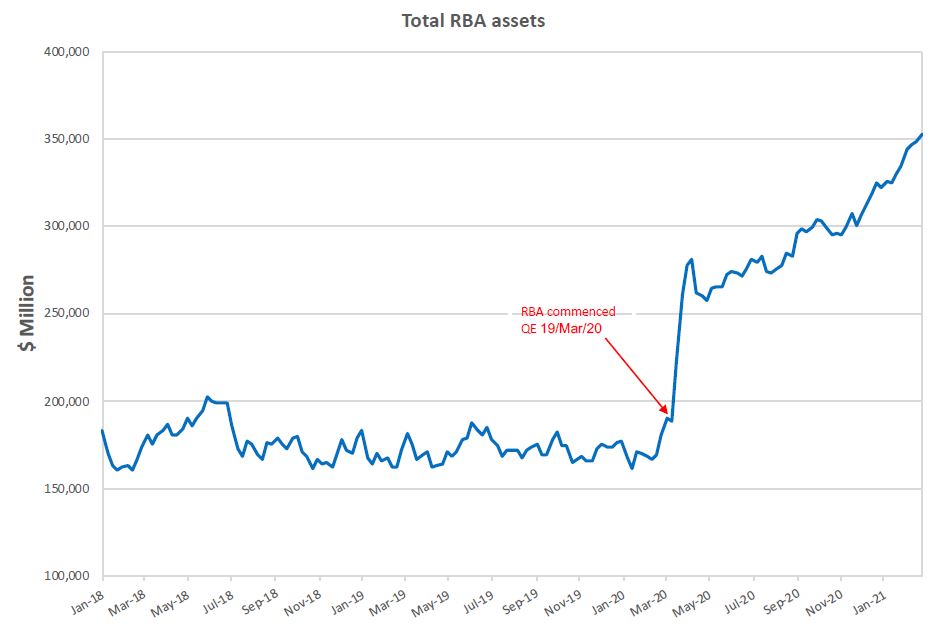

QE involves the RBA purchasing government securities in the secondary market, which may consist of both private investors and commercial banks. Any securities purchased by the RBA are recorded as assets in its balance sheet, offset by increasing exchange settlement account (ESA) balances held at the RBA by the commercial banks, by an amount in total equal to the cost of the securities.

An ESA balance is an RBA liability and a commercial bank asset. This is called 'expanding the balance sheet'. Since the start of 2020, the RBA’s balance sheet had increased by about $160 billion by the end of January 2021.

The ESAs are accounts that facilitate payment transactions between the commercial banks, the RBA, and the Australian Government, all within a closed system. It is not possible to transact with, or lend money directly to, non-banks via these accounts. As the RBA cannot trade directly with non-banks, the commercial banks act as intermediaries when the RBA purchases securities from private investors, because they can transact with investors outside the closed system.

In effect, bank ESAs (that is, the liability side of the RBA's bond purchase) are credited with the stroke of the RBA’s keyboard. At that point, base money in the system has increased, being the RBA’s money-like liabilities, including holdings of banknotes. Importantly, this does not mean free money for banks, and far less a case of money printing.

Rather, QE is more an exercise in creating reserves, seeking to increase the quantity of broad money in the system or private sector deposits.

How does this happen, and who 'creates money'?

Suppose the RBA purchases government bonds from a bank. The bank’s ESA balance increases, while its liabilities in the form of private sector bank deposits remains the same, therefore private sector money has not increased. The bank's capital adequacy has strengthened though, giving it confidence to create more private sector loans and hence customer deposits than it otherwise would have.

Or the incentive might be to rebalance its portfolio by expanding its loan portfolio, as ESA balances currently earn 0%. Either way, increased lending increases the quantity of broad money, noting banks are not compelled by the RBA to lend. The bank could also purchase new government bonds.

Suppose also that the RBA purchases government securities from a non-bank investor. The investor’s bank facilitates the sale. That bank's ESA balance is also credited by the RBA, but this time its liabilities increase by the same amount, representing an increase in its deposits held by its investor as a result of exchanging its government bonds for bank deposits. Broad money has increased, and the investor now has available funds to spend or invest.

In both instances, the process aims to lower the yield on the bonds targeted for purchase by the RBA, thereby lowering the cost of finance to stimulate borrowing and hence, the economy. Again, such activity will depend on the risk appetite of both banks and investors.

So while the RBA may increase the quantity of broad money when undertaking QE, it is not necessarily a precursor to further money creation by commercial banks, and any inflationary effects will also be indirect.

Money creation in the private sector is the preserve of commercial banks and not the RBA. Loans to the private sector are created by the banking system when they simultaneously create bank deposits for their clients. This happens independently of the RBA and will only occur when banks are motivated to lend to willing clients.

Back to the impact on inflation

QE is indeed an inflationary tool, but increasing the monetary base does not guarantee inflation. For example, money creation in the form of lending may not occur if banks want to shore up increased ESA balances in times of uncertainty such as recession or in a pandemic.

Or the private sector wants to stockpile cash or indeed even pay down loans, which has the opposite effect to lending in that it actually destroys money. It may be then overall, that the increase in base money by the RBA is saved and not spent.

Money is not necessarily circulating and therefore has little, if any, effect on inflation.

The other variable in the inflation equation is production. Ordinarily, increasing the money supply in an economy at or close to full capacity, would likely cause inflation. That is because there is no room to absorb excess money. Goods and services cannot outpace the growth in money, therefore prices must rise. If however, there is spare capacity in the economy, there is scope to increase production and soak up new money to stymie inflation.

In fact, increasing the money supply is not even necessary for inflation, because if there is a contraction in economic activity, less goods and services could drive price increases. Again, a case of too much money. And we are seeing output contract now with the pandemic, which may push prices up, money supply aside. When the pandemic subsides, utilising the spare capacity in the economy would have a deflationary effect.

Ultimately, the effect of QE in Australia coupled with a restricted economy due to the pandemic, may see temporary inflation, because increasing the money supply and curtailing output are both inflationary actions. Then as vaccines are rolled out and the threat of the pandemic subsides, output should trend back to more normal levels and use up any excess money. Also, we are coming off a sustained low base of inflation.

If however, policy did happen to overshoot, QE can be unwound by the RBA selling bonds back to the secondary market. The ability to unwind sets QE apart from true money printing, whereby central banks credit Treasury accounts electronically for the government to spend as it sees fit without needing to repay. An example is so-called 'helicopter money', where governments drop money into peoples’ accounts to stimulate economies. Central banks end up with no assets, and the effect is both irreversible and inflationary.

Importantly, QE also has a currency effect. With QE lowering interest rates, it can weaken a currency. And QE has been going on in Europe, the US, and Japan for quite some time now, causing lower exchange rates than otherwise would be the case. With the RBA now getting in on the act too, it should help our currency's competitiveness.

Finally, there has been a focus recently on the rise in bond yields globally, particularly in the US. Investors could be dumping bonds in the expectation of inflation finally taking off, perhaps due to the early unveiling of vaccines, and the thinking that central banks may have overstepped the mark with pandemic stimulus measures. Note, that it is expected inflation and not actual that influences bond yields.

The RBA says it expects to keep interest rates at low levels at least until 2024, and would buy even more government debt “if necessary”. It also says there are few signs of an inflation rise in Australia that would require higher interest rates. Perhaps for now.

Tony Dillon is a freelance writer and former actuary. This article is general information and does not consider the circumstances of any investor.