The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Who knew copper could be sexy? It is for Australia’s mining giants which are falling over themselves to get more exposure to the metal.

Recently, Rio Tinto proposed a $300 million merger with Glencore to create the world’s largest miner. It’s essentially a takeover and through it, Rio wants to increase earnings from copper and the AI data centre theme while reducing its reliance on iron ore and aluminium.

Strangely, it comes a month after new Rio chief executive Simon Trott told shareholders of his "stronger, sharper and simpler" strategy for the company. Simpler, meaning a mega merger?

The Rio news follows BHP ending its more than year-long quest to buy Anglo American and its prized copper assets.

There are lots of questions from these proposed mega deals, with a central one being: why are the mining behemoths falling over themselves to get more copper, especially after the metal’s price has already trebled this decade?

LME copper price

We’ve seen this movie before

Long time investors have been here before. In the 2000s, the rise of China was the big theme. Its infrastructure and property build-out catapulted demand for commodities. And supply couldn’t keep up.

As commodity prices skyrocketed, mining giants went on a spending spree. In 2011, BHP paid US$20 billion for US shale assets. In the same year, Rio Tinto bought Riversdale Mining in a $3.7 billion deal to get access to its Mozambique coal assets. There were many other deals like it at the time.

The problem? Commodity prices soon went south as supply exceeded demand.

Annual global mine production increased 20% annually between 2000 and 2011 in US dollar terms, with more than half of that growth coming from coal and iron ore. Iron ore production doubled over the period in volume terms. And, mining capital expenditure rose more than 5x during that time.

Meanwhile, demand cooled as the Chinese economy slowed. You may remember talk of China’s 'ghost cities' then, as whole cities popped up with millions of apartments and no one to occupy them.

Almost all the mega deals from 2010 to 2012 turned out to be duds. They resulted in billions of dollars in impairments for the companies and pain for their shareholders. For instance, Rio wrote down the value of Riversdale by 80% within a year of its purchase.

Interestingly, the one deal of the time that turned out ok was Glencore’s US$62 billion merger with Xstrata, thanks to the canny operators at Glencore.

Post boom, investors shunned miners for the best part of a decade, scared off by what the companies did with shareholder money.

Lately, that sentiment has sharply turned.

The way mining cycles work

Why do mining companies go on acquisition sprees when research shows that most merger and acquisition deals (M&A) fail? And why do they do many of these deals at, or near, the peak of commodity cycles?

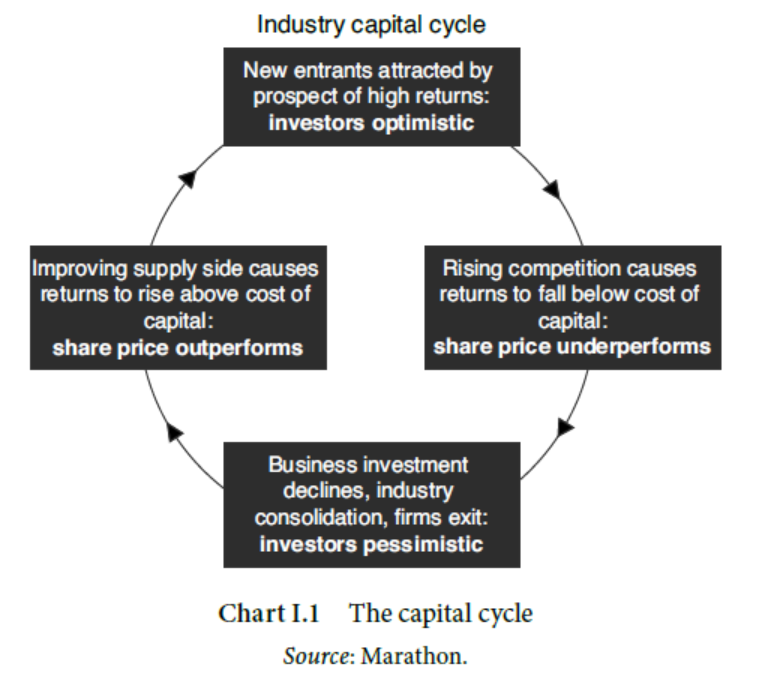

One of the best frameworks for understanding boom-bust cycles is the capital cycle concept developed by highly successful UK investment firm, Marathon Asset Management, as outlined in two books, Capital Account and Capital Returns, by Edward Chancellor.

Put simply, the capital cycle theory suggests that high profitability and returns on capital in an industry will attract a wave of fresh investment from new and existing participants. Eventually, this results in excess capacity, weaker pricing and profits, and falling returns on capital.

Conversely, an industry that has low returns on capital will see declining investment, and eventually capacity will shrink through businesses cutting back and leaving the industry.

That sets the stage for a period of higher profits and returns on capital for the companies that remain, and so the cycle can start anew.

Marathon has used the capital cycle framework to identify industries that look toppy – and as it successfully did with the telecoms boom of the 1990s – and industries which may be closer to a bottom (harder to do).

Look closely enough and you can see how the capital cycle played out in the last commodities boom and how it’s unfolding in the current one.

Where are we in this boom?

The capital cycle is a guide, without being precise. What can be said is that supply is still trailing demand for many commodities today. Despite gold prices hitting record highs, there’s been little growth in mining production. Copper supply is rising but lags booming demand from AI data centres. Aluminium prices may be reaching new highs, but a supply response hasn’t happened yet.

The only outlier is oil. The oil industry is gushing with supply despite depressed prices. Slowing demand as the world goes greener hasn’t helped its cause.

The recently proposed deals from Rio and BP are likely indicative of commodities being in the mid-cycle of a boom rather than at the end of one. Until the supply of commodities ramps up, and there is a wave of large mining deals, then we’re probably a while away from the boom turning to bust.

What should investors do?

How can investors ride the commodities boom without being burnt by companies doing bad deals? There are four main options:

- Be choosy about which mining stocks you buy – and hope they don’t make silly deals.

- Invest in an ETF of mining producers - though an eventual bust is likely to impact the whole sector.

- Royalty companies are an interesting and compelling way to play commodities as they benefit more from higher volumes rather than prices and aren’t as capital intensive as the miners.

- Invest in physical commodities rather than producers. This way, you’ll be purely exposed to commodity prices rather than commodity companies.

****

In my article this week, I explore how to build a simple ETF portfolio for the long term in a world where many assets look frothy.

James Gruber

Also in this week's edition...

David Snyder has gained fame lately after being outed as an adviser to a leading journalist at the Wall Street Journal, who outlined some of Snyder's market views in an article. David kindly agreed to us republishing a recent piece of his to clients which offers fascinating data and insights into where the US markets have been, where they are now, and why a secular bull market may be coming to an end.

Australia has a housing shortage, right? Not according to Michael Matusik, who believes that we have a housing misallocation issue rather than a shortfall. Why? Because there are 13 million spare bedrooms which could be put to use, and Michael explains some simple steps to make this happen.

It's a common investor dilemma - should you invest all your money into the market right away or stage your entry? Using 50 years of Australian data, Ophir's Andrew Mitchell reveals when staging your entry can protect you, and when it drags on returns.

Fidelity International's Niamh Brodie-Machura thinks the AI-led surge in markets will continue, but monetisation is yet to be proven and there are growing risks. She says diversification is key and a rotation out of the US will support income plays.

The US now links energy dominance directly to national security, industrial competitiveness, and technological leadership, warning that unreliable or expensive power threatens both prosperity and global influence. Tony Dillon says Europe’s recent energy crisis shows the cost of prioritising ideology over abundance, and Australia may be next if it ignores the lessons.

Venezuela - many of you may be like us and know little about the country other than Maduro was a dictator and it has oil. Well-known investment author Roger Lowenstein runs through his time working and living in Venezuela, and the surprisingly strong democratic roots of the nation. He's worried by what Trump's recent intervention may bring.

Two extra articles from Morningstar this weekend. Jon Mills raises his gold price assumptions for his company coverage and Matthew Dolgin looks at whether Netflix is a buy, hold, or sell, ahead of earnings.

Lastly, in this week's whitepaper, Yarra Capital gives its outlook for credit in 2026.

***

Weekend market update

US stocks were little changed on Friday, with all three major averages - the S&P 500, NASDAQ, and Dow Jones Industrial - losing less than 1% for the week. The Russell 2000 closed at a record high as the small-cap index extended year-to-date gains to 8%.

Stocks gave up earlier gains on Friday after President Trump expressed fresh reluctance to name Kevin Hassett as the next Fed chair, fuelling speculation that the central bank may not be as dovish as the market expected once Jerome Powell steps down in May.

Meantime, silver fell as the threat of US tariffs eased, but prices were still up more than 15% for the week.

From AAP:

Australia's share market ended the week at its highest level since October, supported by resurgent banks as a record-breaking run for materials stocks lost steam. The S&P/ASX200 rose 0.48% to 8,903.9 on Friday.

The uptick for local banks came after US investment giants Goldman Sachs and Morgan Stanley hit record highs overnight following earnings reports that outshone expectations.

Westpac led its big four competitors higher with a 1.8% gain to $39.19, while Commonwealth Bank shares traded up 0.5% to $154.30, unable to break free from a seven-day trading range.

The raw materials sector eased 0.2% on Friday, running into profit-taking after resetting its record three times during the week, ultimately securing 3.8% of gains.

BHP was down 0.8% in the final session to $48.99 as iron ore prices eased, but Rio Tinto and Fortescue edged higher as they played catch-up with their bigger rival.

Gold producers were mostly higher, as the precious metal hovered less than 1% from record highs after geopolitical uncertainty drove safe-haven buying during the week.

Catalyst Metals was the top-200's best performer on Friday, rocketing more than 14% higher to $9 after Bell Potter boosted its price target for the gold miner to $13.50 following a solid quarterly update.

Energy stocks underperformed, down 0.7% after oil prices rolled over from recent highs as US President Donald Trump played down the likelihood of US intervention in Iran after weeks of protests and a bloody crackdown by the Islamic Republic. Woodside, Santos and Ampol all slipped lower while most coal producers and uranium stocks caught a bid.

Real estate stocks jumped 1.1% on Friday, while consumer staples jumped a similar amount.

In company news, Capstone Corp shares bounced more than 7% after it posted record copper production in 2025, despite the base metal rolling over from record highs in the two recent sessions.

Shares in building materials producer James Hardie rallied more than 2% after it announced plans to close three manufacturing plants in the US.

From Shane Oliver, AMP:

Global shares were mixed over the last week. US shares fell 0.4% with an ongoing rotation out of tech shares and a reduction in Fed rate cut expectations. Chinese shares also fell 0.6%. But Eurozone and Japanese shares continued to make new highs, up 0.5% and 3.8% respectively. Australian shares also rose with a gain of 2.1% powered by resources shares on the back of higher commodity prices, retailers on the back of stronger than expected household spending and financials. After years of underperformance the Australian share market looks to be starting to play catch up to the US, having outperformed so far this year as rebounding mining sector profits help pull Australian profit growth back into positive territory. Bond yields fell in Europe but rose in the US as Fed rate cut expectations were reduced and they also rose in Japan and Australia.

The past week also saw gold and silver reach new record highs as concerns about Fed independence escalated in response to the US Department of Justice issuing a subpoena of Powell in relation to building renovations and Powell tying it to pressure from Trump for the Fed to cut rates by more. Investors are clearly still keen to buy shares given the reasonable profit outlook but at the same time want a hedge against geopolitical risks and worries that Trump will weaken the Fed risking higher inflation and so are buying gold and silver at the same time. Bitcoin also rose. Iron ore and copper prices fell back slightly but the oil price rose slightly on lingering concerns about a US strike on Iran to support protestors. The $A fell slightly as the $US rose slightly.

While a quiet start to the year would have been nice, President Trump clearly had other ideas. On the geopolitical front, there has been a US strike on Nigeria, intervention in Venezuela with Trump saying the US would “run” it, the threat of action against Iran as it cracks down on protests killing its citizens and an escalation in US claims to take over Greenland. The shooting by an ICE agent of a woman in Minneapolis has taken the US further down the path of conflict between Democratic states and the President (and even riled up Joe Rogan). And Trump has flagged a barrage of measures aimed at boosting “affordability” including: a ban on institutions from buying single houses, directing Fannie Mae and Freddie Mac to buy mortgage debt to lower mortgage rates and stepped up pressure to get control of the Fed to lower mortgage rates; announcing that data centres will have to “pay their own way” for power (whatever that means); a 10% cap on credit card interest rates; and its reported he will announce allowing homebuyers access to their retirement funds for a deposit.

Overall our assessment remains that this year will see a volatile ride for investors on the back of geopolitical threats and Trump bluster – consistent with the volatility normally seen in US midterm election years which since 1950 have seen US shares have an average intra year drawdown of 17% - but that ultimately it will turn out okay for shares with reasonable returns on the back of good global economic and profit growth, the Fed cutting rates a few more times, and profit growth turning positive in Australia after three years of falls. Relative strength in consumer discretionary and material shares along with small caps and metals are positive signs from a cyclical perspective. While tech shares are taking a relative breather the rest of the market appears to be filing the gap and this is also potentially positive for the relative performance of Australian shares which have underperformed US shares for several years. At the same time the US dollar is likely to remain in a downtrend as Trump’s policies further dent US exceptionalism and safe havens like gold are likely to continue to push higher as investors seek out a hedge to protect against risks around geopolitical conflict, high public debt levels and the threat to Fed independence.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website