The quickest, sharpest decline in history (-35% in 23 days on the S&P500 index) was followed by the quickest, sharpest rebound (up 30% in four weeks), so the question now is: Where do we go from here?

We have seen some encouraging news of peaks in the pandemic across many Asian and European countries as well as some US states. Many governments are reopening their economies gradually. However, this process will be gradual and staggered, not a straight line.

The recovery will be slow and it is unlikely to be seamless. Moreover, fundamentals are still deteriorating rapidly, and we do not know how bad the economic picture will become.

Bear markets take time

Since their March 23 trough, most equity markets have retraced at least 50% of their losses. Is this a bear market rally or a V-shaped recovery? We believe that another leg down is likely.

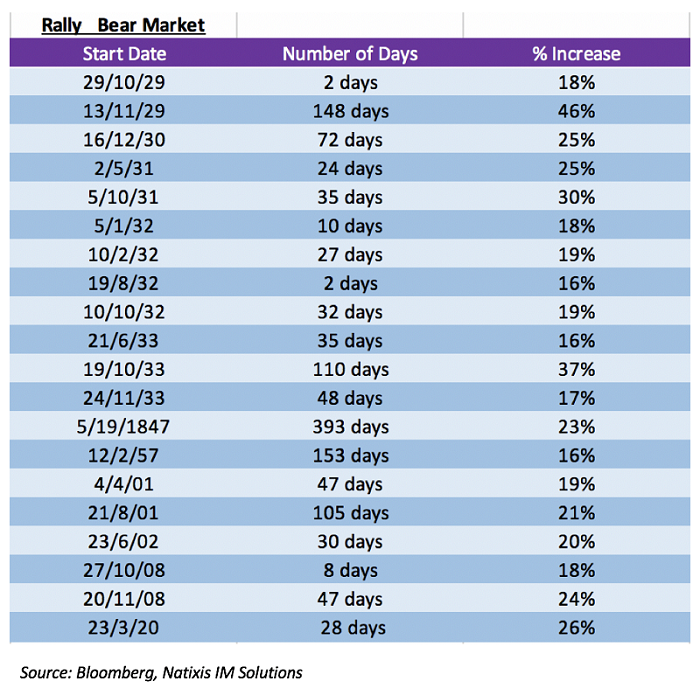

Looking back, history suggests a V-shaped market recovery is rare. Since the 1920s, the S&P500 index has experienced 14 bear markets (as defined by a 20% decline). During these periods, there were 19 bear market rallies in excess of 15% before falling again.

Only one bear market (1932-33) saw markets recover to prior peaks within a year. Historically, it has taken 15 months (on median) for the MSCI All Country World Index to recover to prior peaks after bottoming, and about 20 months for the S&P500, the MSCI Europe and the TOPIX indexes to recover to prior peaks. It took four years after the GFC for global markets to return to pre-crisis levels.

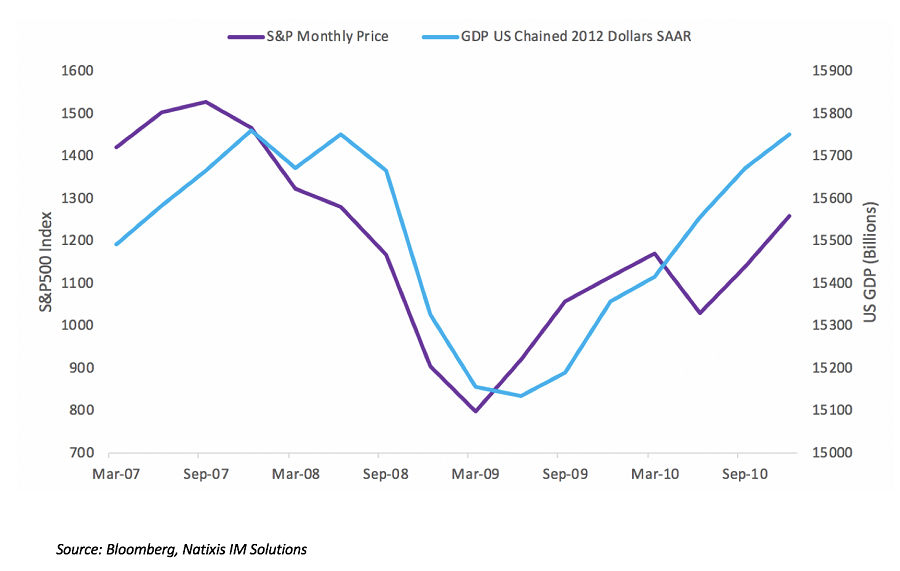

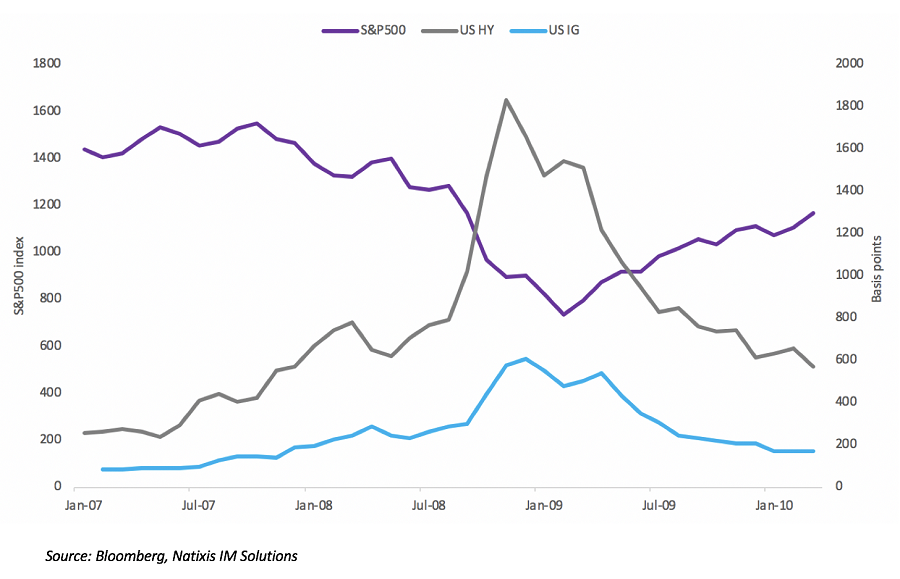

The S&P500 index retracement to about 50% of its losses acted as a ceiling during the dot com crisis and the GFC. Policymakers have been more pro-active and aggressive this time than in the past, which should help shore up confidence and limit the damage.

In our view, markets are being optimistic. The recent rebound is not pricing in the reality of the situation, the risks that still lie ahead, nor the scars left behind. Yes, markets typically front-run economic data, and fiscal and monetary support is massive, but markets cannot ignore fundamentals, both in terms of growth and earnings.

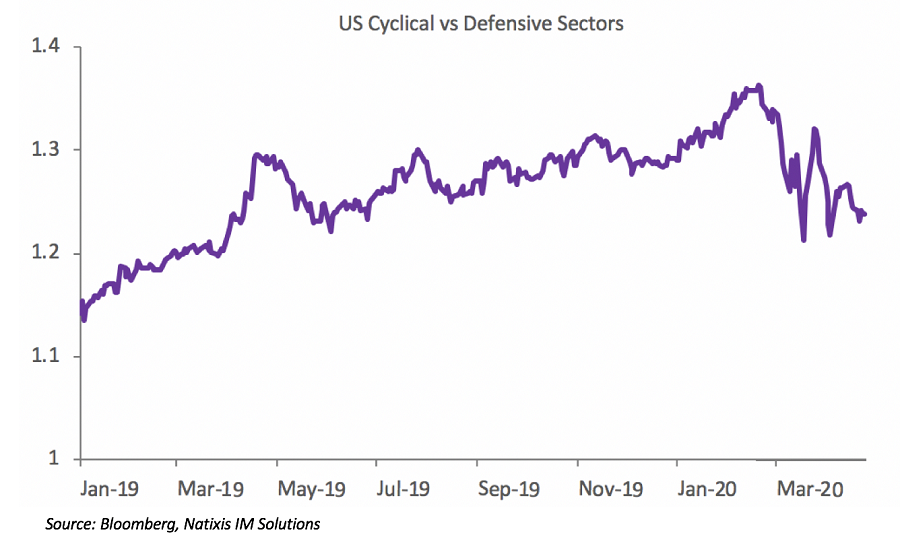

In addition, the ramp up in activity is likely to be much slower than anticipated, suggesting it will take quarters and not months to recuperate output losses. As such and given the ‘quality’ of the rebound so far, we believe that markets will likely see another leg down in the coming months.

What comes out first?

The scale and scope of central bank support makes a strong case for credit markets as a first investment allocation – “buy what the central banks are buying” is a pretty easy adage to follow. Moreover, while spreads did not reach the heights of 2008 levels, they are much more attractive than they have been for some time, offering attractive entry points. We prefer investment grade over high yield, given much more central bank support and less default risk.

Expectations that US growth will hold up and recover better than Europe means earnings should recover quicker, which also supports the US. Emerging Asia should benefit from being first-in-first-out of the crisis and should outperform other Emerging Markets regions.

We are likely to see some long-term legacy from this crisis as well. The de-globalisation trend that began even before the pandemic will be exacerbated as reliance on global supply chains has created vulnerabilities. As such, we expect the repatriation of strategic industries such as healthcare and defence to begin in earnest. Given even bigger reliance on technology, protecting this industry will become paramount.

We believe that downside risks remain and that equity markets are likely to remain volatile and see another down leg. Nonetheless, active managers have the opportunity to take advantage of market dislocations in this environment. In the current context, humility and risk management are key words.

Esty Dwek is Head of Global Market Strategy at Natixis Investment Managers Solutions. This article contains general information only as it does not take into account any individual’s personal financial circumstances.