Compared to the US, where technology stocks are now the largest sector of the S&P500 at 27% of the index, Australia has a small tech component. Despite this, Australian businesses also face significant tech disruption, often by companies not traditionally associated with ‘tech’, such as Steadfast (ASX:SDF), James Hardie (ASX:JHX), CSL (ASX:CSL), Resmed (ASX:RMD) and REA Group (ASX:REA).

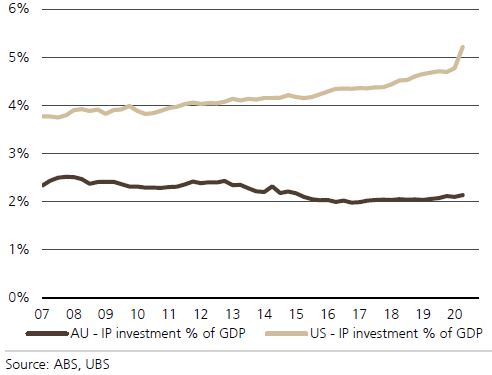

Many companies are using tech to disrupt competitors, and with intellectual property investment only 2% of Australia’s GDP compared to 5% in the US, as shown in Figure 1, tech disruption has barely started on a long journey.

Figure 1: IP investment remains much lower in Australia than in the United States

An innovative way to measure tech disruption

Equity analysts at UBS Securities in Australia embarked on innovative research to measure tech disruption. They were asked to rate which stocks are most effective in using data and technology relative to peers in their sector. They also checked which stocks use tech phrases in their stock exchange updates, including references to artificial intelligence, machine learning, natural language, deep learning and predictive analysis. UBS reports:

"Appen, Telstra, Insurance Australia Group, PRO Medicus, Seek, ASX, Flight Centre, QBE Insurance and Xero mentioned these phrases at least 100 times over the past five years."

Overall, they found that stocks identified as tech focused had Price/Earnings ratios (P/Es) that were significantly higher than their peers. UBS then back-tested to show that stocks with high tech disruption scores outperformed stocks with low disruption scores by an annualised 14% since the start of 2016.

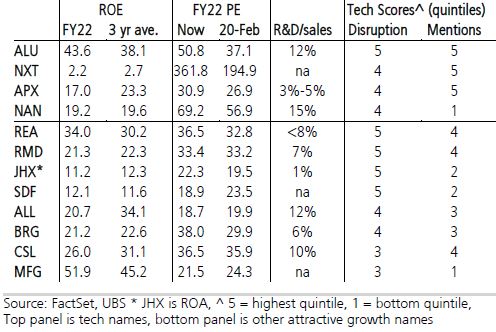

Table 1 shows the identified companies and their tech disruption and tech mention scores.

Table 1: Key growth names

Tech stocks which UBS likes include Appen, NextDC, Nanosonics, and REA. Non-tech stocks with a high-tech disruption score or lagging share prices include Aristocrat Leisure, CSL, ResMed, James Hardie, Breville and Steadfast Group. UBS thinks Altium and Magellan are worth watching, all listed above.

Tech disruption explains Growth outperforming Value

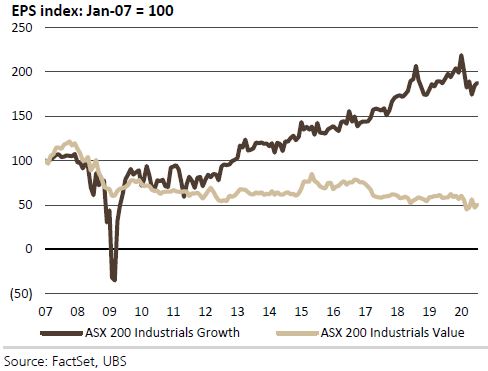

UBS also finds that tech disruption is contributing to the ongoing outperformance of Growth over Value stocks, which is a major issue for fund managers who have built their businesses on identifying 'Value' (or companies trading at below their fundamental values). The increase in the valuation gap between high and low PE stocks has, in part, been justified by high PE stocks producing significantly higher earnings growth than their low PE counterparts, as shown in Figure 2. Tech companies are usually Growth stocks.

Figure 2: Earnings of ASX200 growth stocks versus value stocks since 2007

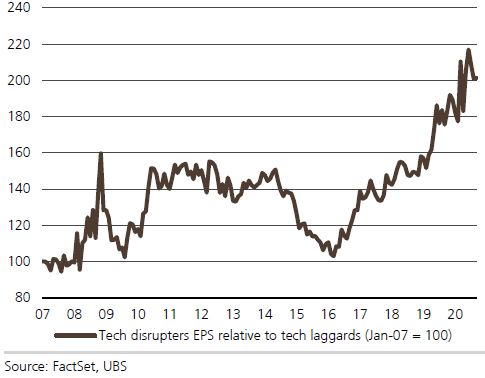

Since the start of 2007, earnings of growth firms have nearly doubled, while earnings of value stocks have halved. The high growth firms justify higher multiples due to their higher earnings growth. The earnings of tech disrupters have also consistently grown faster than tech laggards since 2016 (Figure 3).

Figure 3: Tech disrupters EPS relative to tech laggards

Tech disruptors are Growth stocks and benefit from lower rates

UBS has also written notes on how ultra-low rates are having a major impact on the prices of Australian equities:

"An additional insight from those notes is that a lower risk-free rate means that long-dated future cash flows matter more than near-term cash flows in a discounted cash-flow framework. Put differently, the terminal value component accounts for a greater proportion of the value of the equity. Growth stocks are longer duration assets (more cash flows in the future). Value stocks are shorter duration assets (less cash flows in the future).

Tech disruptors are Growth stocks and therefore benefit from lower rates due to their duration. Lower rates also mean that tech disruptors are able to finance technology at lower cost and take a longer-term view on tech-related projects. Lower overall market EPS growth is also positive for tech disruptors and other Growth stocks due to the scarcity premium that they command."

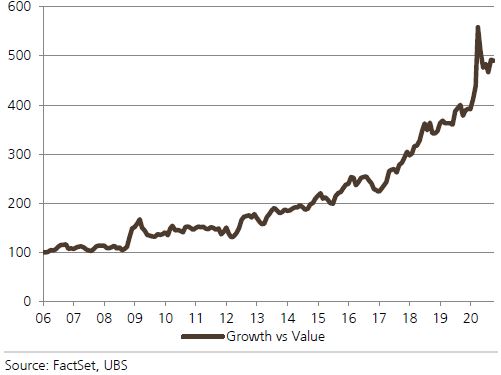

Figure 4 highlights the decade of Growth outperforming Value.

Figure 4: Growth outperforming Value since the GFC

In a note of optimism that investing is not only a tech story, UBS also notes:

"High quality industrials that are able to maintain solid earnings growth in a low interest rate environment are likely to outperform."

The market is also seeing larger stock-specific price reactions to news events, as so much of the price is determined by long-term expectations. Either a threat to or affirmation of this future potential sends investors to buy and sell and the market catches the momentum. The potential for long-term durable competitive advantages is especially valued.

Graham Hand is Managing Editor of Firstlinks. This article draws on the work of Pieter Stoltz, Jim Xu and Paul Winter, Equity Analysts at UBS Securities. This article contains general information only and does not constitute personal financial product advice. It does not consider any investor’s objectives, financial situation or needs.

More articles and papers from UBS, a sponsor of Firstlinks, can be found here.