Studying financial markets over time can reveal interesting insights into the way investors think and behave. Renowned academics, Elroy Dimson, Paul Marsh and Mike Staunton from the London Business School, in their article, ‘The Real Value Of Money’, produced a longitudinal study, examining how equities and bonds have performed under different inflation regimes over 112 years and in 19 different countries. It’s fascinating. In 2012 (and arguably today), investors were willing to buy sovereign bonds that were expected to produce negative real yields, regarding them as ‘safe’.

Inflationary expectations play a major role in long bond yields, and the above study argues that prevailing wage growth is the key determinant in these expectations. I believe the globalisation of manufacturing, technological advances leading to productivity gains, and reduced unionisation in workforce percentage terms have led to weakened bargaining power of labour in western economies.

In my previous Cuffelinks article, ‘Premature talk of bubble trouble’, I described the germinating seeds of a bubble forming in both equities and property. I also referred to some individuals in the US, such as those gunning for Federal Reserve Bank senior posts who believe fears of bubbles are misplaced in a climate of high unemployment.

Headline inflation has been falling, but the sell-off in many countries’ bonds since mid-2012 indicates that inflationary expectations are now rising. That is, the market is arriving at the conclusion that if there is too much quantitative easing (QE) in the near term, and inflation could trend upwards in the medium term. Central banks may end up ‘behind the curve’, and they will be tightening monetary policy too late.

Ten year bond yields in a number of western economies have increased by an average 1.1% since mid-2012, as illustrated in the table below:

Recent increases in global bond rates

| Country |

Historic Low |

When |

Yield at 12/11/13 |

Change |

| US 10 Year Bonds |

1.39% |

July 2012 |

2.77% |

+1.38% |

| Australian 10 Year Bonds |

2.69% |

July 2012 |

4.23% |

+1.54% |

| UK 10 Year Gilts |

1.43% |

August 2012 |

2.64% |

+1.21% |

| German 10 Year Bunds |

1.16% |

July 2012 |

1.79% |

+0.63% |

| French 10 Year Bonds |

1.83% |

December 2012 |

2.56% |

+0.73% |

| Japanese 10 Year Bonds |

0.61% |

March 2013 |

0.60% |

-0.01% |

| AVERAGE |

|

|

|

+1.10% |

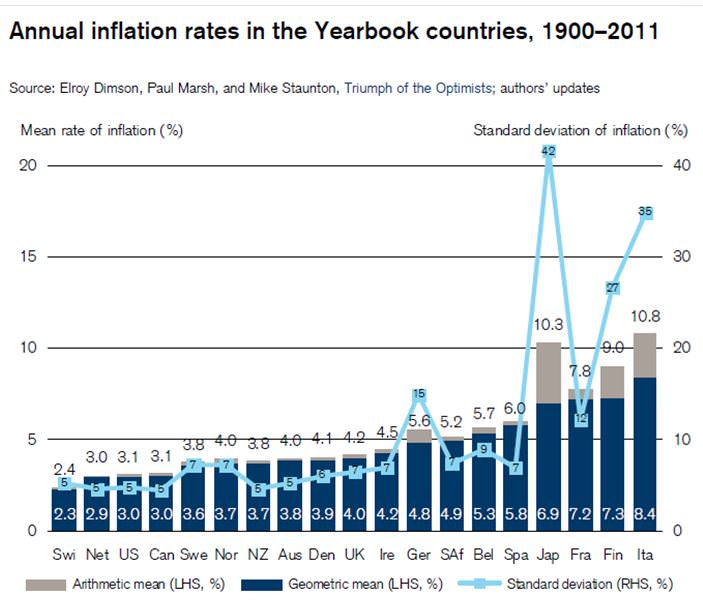

These historical low bond yields should be looked at in the context of long term rates of inflation. The following chart shows both the arithmetic mean and the geometric mean rate of inflation from 1900 to 2011. In the US, Australia and the UK, these figures have averaged 3.0%, 3.9% and 4.1% respectively (averaging the two means).

Buying a 10 year bond on a yield at somewhere near half the long-term average rate of inflation is dangerous and yet such a strategy appears to have never been more popular.

Typically, buyers demand a premium of at least 2% above inflationary expectations. Even adjusting for the weak buying power of labour in these economies and associated lower wage growth, it seems reasonable to expect in normal circumstances for US 10 year bonds to trend up to 4.5% and for 10 year bonds in Australia and the UK to trend above 5.0%.

This not only has implications for bond buyers. All assets are ultimately valued on the basis of a discount rate that is in turn influenced by interest rates. The boom in bank share and property prices can be attributed to a fad - the chase for relatively higher yields. The above analysis suggests the fad, like all passing fashions, will come to an end.

QE wisdom questioned

The former Federal Reserve official Andrew Huszar managed the first round of the Fed's QE programme, purchasing $US1.25 trillion of mortgage-backed securities in 2009 and 2010. Huszar, who is also a former Morgan Stanley Managing Director, has penned an opinion piece in The Wall Street Journal that questions the efficacy of the program that can be found here.

The executive summary to Huszar's column reads like a warning to complacent investors who believe that they can do nothing but be forced into chasing stocks and property for their relatively attractive income returns. Huszar concludes that:

- the first round of QE provided only trivial relief for Main Street, but considerable relief for Wall Street. The banks have enjoyed lower wholesale credit costs, rising values on their security holdings, and large commissions from brokering most of the Fed's QE transactions

- the first round of easing didn't make credit any more accessible for the average American, as banks were issuing fewer and fewer loans

- the massive $US4 trillion of purchases may have only generated a return of as little as a quarter of a percentage point in US GDP growth

- pumping money into financial markets has merely killed the need for urgency on Washington's part in confronting the structurally unsound nature of the US economy

- it is expected that the programme will continue next year (see my article last week), as Ben Bernanke’s likely successor, Fed Vice Chairwoman, Janet Yellen, is supportive of QE

- QE has become Wall Street’s ‘too big to fail’ policy.

Andrew Huszar became disillusioned with the (lack of) independence of the Federal Reserve and returned to the private sector after the first round of QE was completed. The apology for his role in the programme serves as a timely warning that the US economy is likely to wake up with a headache when the party inevitably ends.

Roger Montgomery is the Chief Investment Officer at The Montgomery Fund, and author of the bestseller, ‘Value.able’.