The Montgomery team has written extensively about the stunning decline in bond yields. This is occurring despite terrorist attacks, political turmoil in the UK, violence in the US and the prospect of ‘last resort’ helicopter money in Japan. Life isn’t changing, which makes one wonder, are investors frogs in a pot full of gradually heating water?

Confusing and ambiguous signals

Since the US Federal Reserve raised rates in December 2015, usually a sign that the economy is strengthening, US 10-year government bond yields have fallen from 2.3% to 1.47%.

Traditionally, a rising stock market signalled an improving economy while falling bond yields signalled deflation or disinflation, implying the virtual certainty of a recession. We have both. Tradition doesn’t apply when the source of the declining bond yields aren’t regular investors but massive, globally coordinated central banks. This then begs the question, are the signals we, as equity investors, are used to seeing being obscured by ‘official’ central bank activity?

In others words, perhaps the recent new highs in the S&P500 are anything but a sign of a strengthening economy. The reality is that the rally has been confined to ‘minimum volatility’ or defensive stocks, those that might be seen as a substitute for bonds like utilities, telcos and REITs. The same is true in Australia, with the likes of Transurban and Sydney Airport benefiting the most from investor affection. In the past, such behaviour has presaged a fall in aggregate corporate profits and a recession.

Putting aside the probability that declining bond yields will continue to fuel equity price appreciation as capital continues to pursue higher yields, it is worth considering the deeper issues that may, like rust, be now emerging through the paint on the surface of equity markets.

Some commentators took delight from the recent US jobs numbers with one TV personality writing, “the pessimists on the US economy have been proved wrong”. Such responses are simplistic. While the payroll gains of 287,000 jobs beat economists’ expectations, the trend numbers remain firmly negative. Monthly payrolls in the second quarter averaged 25% less than the first quarter and were half the average number for the fourth quarter of 2015. More importantly, the one million new jobs created in 2016 is still 33% below the total increase in working age people. In the past six-and-a-half years, the total number of new US jobs created has lagged the growth in the working age population by 1.6 million.

According to a report by Deutsche bank, $US15 trillion or 40.5% of the $US37 trillion in developed market sovereign bonds are carrying negative yields and 80% are carrying yields of less than 1%.

Think about that for a moment. If you lend CHF100,000 to Switzerland for 30 years by purchasing a 30-year Swiss bond, you will receive CHF96,172 in three decades’ time. The same thing happens if you lend money to the governments of Germany and Japan for 10 years, and the list over five years includes The Netherlands, Finland, Austria, Denmark, Belgium, France, Sweden and over two years you can add Ireland, Spain and Italy to the list. Italy’s banking system is in crisis and in need of a bailout. It is estimated it is harbouring $US400 billion of problem loans or 25% of the country’s GDP. Yet despite this, Italy can borrow at lower rates than when times were good.

All of this has been driven by heavy-handed central banks, not the weighing scales of the market’s price discovery process. The combined central bank balance sheets of Switzerland, the UK, the European Central Bank, the US and Japan have grown from $US3.5 trillion in 2007 to $US12.5 trillion today.

Faulty price signalling

The justification for many equity investors to be fully invested is that the earnings yield – the inverse of the price to earnings ratio – on equities is more attractive than bond yields. But if bond yields are an artifice created by central bank buying, should they be the benchmark against which we measure the attractiveness of stocks?

Where would bond yields really be if not for central bank buying? Where would they be if the market were allowed to adjust for risk and uncertainty, without central bank intervention? Would earnings yields of stocks trading on 25, 35 or 55 times earnings look attractive?

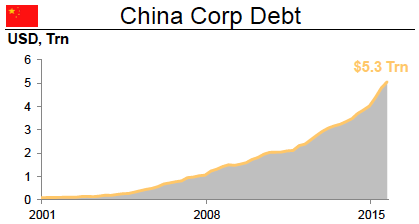

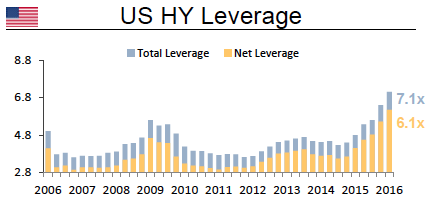

Corporate debt has expanded to epochal levels, used to drive shareholder returns through share buybacks and dividends and to fund mergers and acquisitions.

In the first half of 2016 alone, US corporates issued a record $US700 billion. As the following two charts demonstrate, the level of corporate debt puts us in unchartered territory. And don’t forget, it’s the level of gearing that ultimately determines the toxicity of a burst bubble.

Chinese corporate debt and US leverage

Source: DB Global Markets Research

Perhaps because the accumulating debt has been used for ‘financial engineering’ rather than productivity or productive capacity improvements, US business capital expenditure is at six-year lows and corporate earnings have not grown.

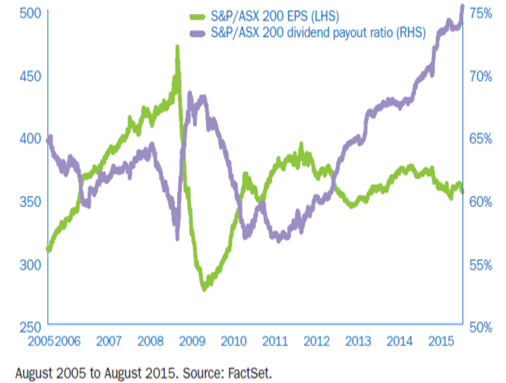

Since 2011, dividend payout ratios in the US have increased from about 25% to 37% today. In Australia, the payout ratio since 2010 has increased from 55% to approaching 80%, as shown below.

Australian payout ratio increase at expense of earnings growth

When companies don’t retain earnings to reinvest in earnings growth, the only other avenue to grow is to borrow money or raise capital. Given companies are borrowing record amounts to buy back their shares, it effectively rules out borrowing more money or issuing new shares.

Depressed earnings growth becoming entrenched

In the US, S&P500 companies have, in aggregate, posted negative earnings growth for six consecutive quarters. The S&P500’s peak earnings was in 2014, and earnings stand at 18% less today, although the fall is not as great as the 36% slumps registered in the four worst recessions. The decline is more concentrated among commodity companies, but excluding them reveals earnings growth since 2014 of just 0.2%.

Margins will come under further pressure. Wages are rising in the US, and when combined with full employment and declining productivity, it becomes very hard to maintain profit margins.

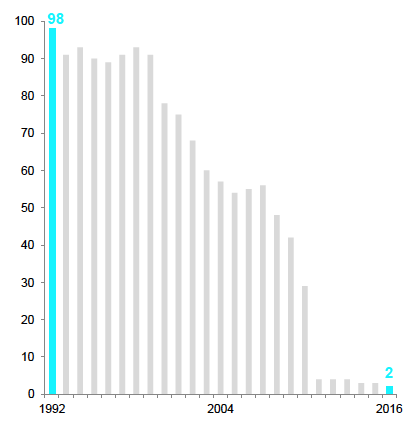

Low growth, pressure on prospects and high debt unsurprisingly has reduced the credit ratings of many companies. In the US, the number of S&P AAA-rated companies has fallen from 98 in 1992 to just two today – Microsoft and Johnson & Johnson.

Number of S&P AAA rated companies

Source: S&P, Deutsche Bank

If credit quality is low, the risks for equity investors are high. But if risks are high, why are bond rates at record lows? It doesn’t make sense and it means that bond markets have lost their ability to provide appropriate signals to investors.

Any serious break in confidence, the emergence of inflation, or even the flight to safety of US company pension funds, whose aggregate liabilities trounce their assets, could cause apathetic investors to dump their now highly profitable bond positions.

Of course equities would not be immune to such an exodus. As John Authers wrote in the Australian Financial Review on 18 July 2016,

“There is no enthusiasm, but ever-pricier bonds leave no choice but to buy stocks … Is this a secure basis on which to invest? No … anyone trying to make money or preserve capital must be calm and relaxed.”

Bill Gross the founder of the Janus Global Unconstrained Bond Fund perhaps summed it up best:

“Global yields lowest in 500 years of recorded history and $10 trillion of negative rate bonds. This is a supernova that will explode one day.”

It may be some years before there is any sign of panic by investors and in the long run, you will do best being invested in businesses able to retain profits and generate high returns on that incremental equity. In other words, you will do well if you can hold your best quality assets through thick and thin.

However, when the primary justification for the rally in most asset prices is a bond price signal that is broken, holding some cash and perhaps taking some profits on the most highly geared and overpriced assets (Australian apartments anyone?), may well turn out to be a good strategy.

Roger Montgomery is the Founder and Chief Investment Officer at The Montgomery Fund, and author of the bestseller ‘Value.able’. This article is for general educational purposes and does not consider the specific circumstances of any individual.