The outlook for global economic growth for 2014 is improving, but is this a good thing for equity returns?

One of the great myths in financial markets, supported by neat textbook theories, is that economic growth somehow drives (or is accompanied by, or maybe is even caused by) corporate earnings growth, and that earnings growth drives stock prices (or at least that expectations of economic growth or expectations of earnings growth drive stock prices). Or perhaps even that expectations of economic growth drive stock prices directly.

None of these assumptions hold true very often in the real world. There is no statistical correlation between economic growth and stock market returns, either at a global level or in individual countries.

The global picture

Economies are highly interconnected and stock markets are also highly correlated.

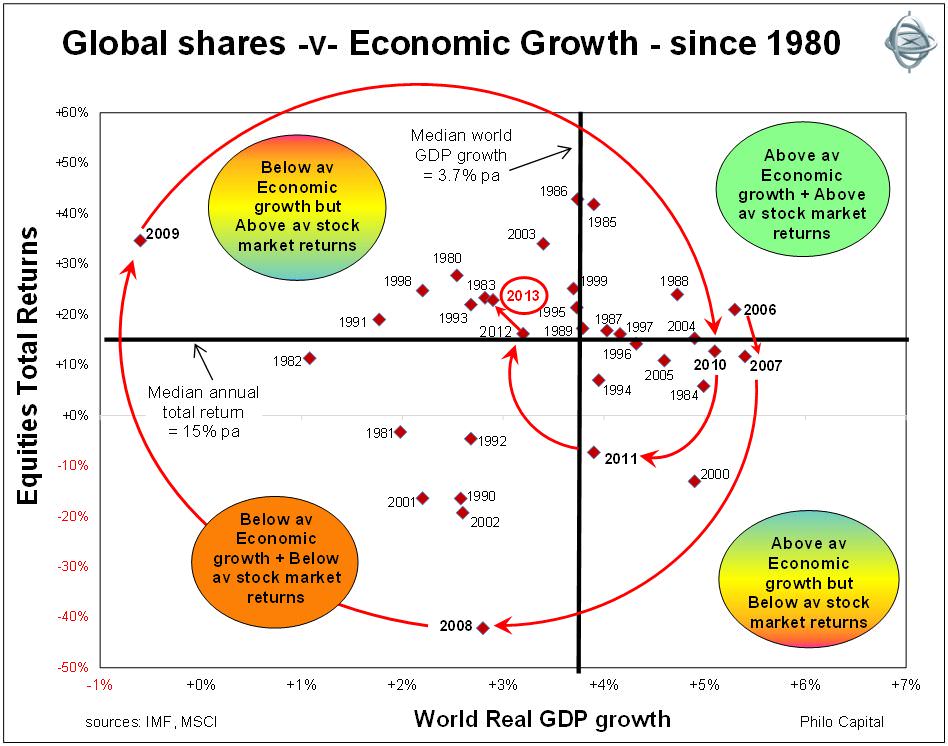

Only rarely does above average world economic growth coincide with above average stock market returns. In only two of the past 34 years since 1980 has this been the case – 1988 and 2006. Also, in only six years has below average economic growth coincided with below average stock market returns – 1981, 1990, 1992, 2001, 2002 & 2008.

In fact at least half of the time when economic growth was above average, stock market returns were below average, and at least half of the time when economic growth was below average (including in recessions), stock market returns were above average.

The following chart shows yearly world real GDP growth and world stock market total returns since 1980:

2013

Last year was similar to several other counter-intuitive years in the recent past. When economic growth slowed and was below average (and earnings growth was very weak) stock market returns were above average. This followed 2012 when economic growth also slowed and was below average, and earnings growth was very poor, but stock market returns were a very healthy 16%.

2011 was also counter-intuitive. Economic growth was above average in 2011 (3.9% compared to a 30 year average of 3.7%) but stock market returns were negative globally.

Going back further, in 2010 global economic growth was above average but stock market returns were below average, and in 2009 world economic growth contracted in the deepest contraction since the 1930s depression but shares had a great year in 2009, with the world market index returning 29%.

Individual Countries

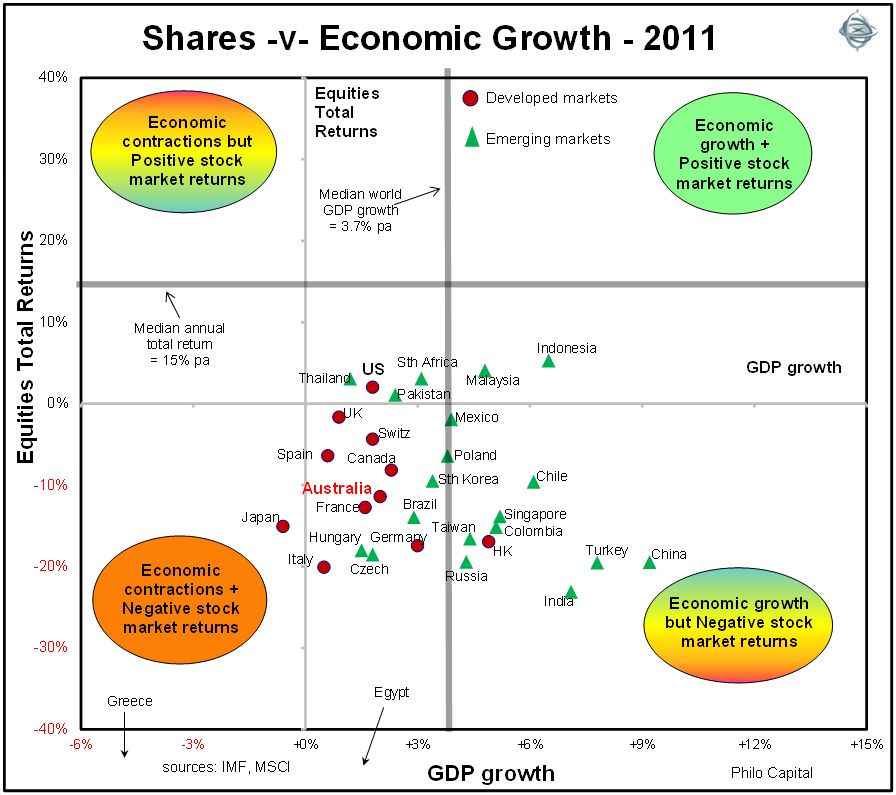

There is a similar story when looking at cross sectional returns in individual countries in any particular year. For example, in 2011 economies almost everywhere grew (except Japan with its tsunami/nuclear crisis), global economic growth was above its long term average, and earnings and dividends grew strongly, but almost all stock markets around the world were down heavily.

The highest growth economies (China, India and Turkey) had the worst stock market returns. Of the few stock markets that had positive total returns in 2011, only Indonesia posted price gains. In the others (US, Thailand, Pakistan and South Africa) the broad market price index fell, but the addition of dividends helped them scrape into positive total return territory, while Malaysia was flat.

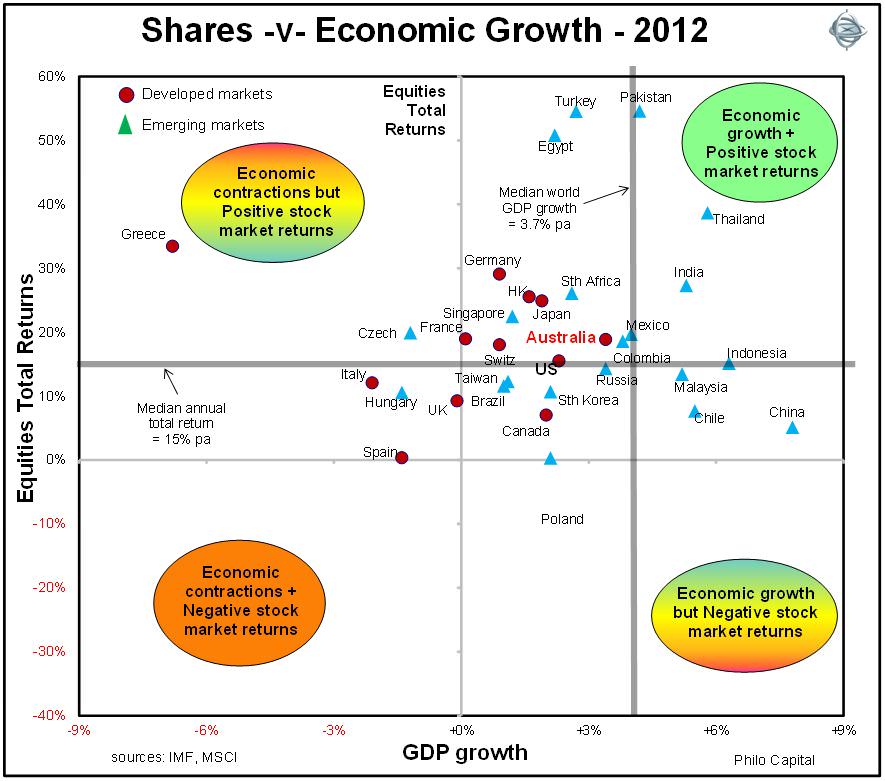

This situation reversed in 2012 when most economies slowed and earnings growth stopped, but stock markets in almost every country boomed.

Nearly all stock markets were up in 2012 while economic growth was patchy. US growth was sub-trend, and Europe drifted in and out of recession, with significant contractions in the PIIGS, but equities boomed across these markets. The highest economic growth rate was in China, which had one of the worse stock market returns. The worst economy was Greece, which had one of the best performing stock markets.

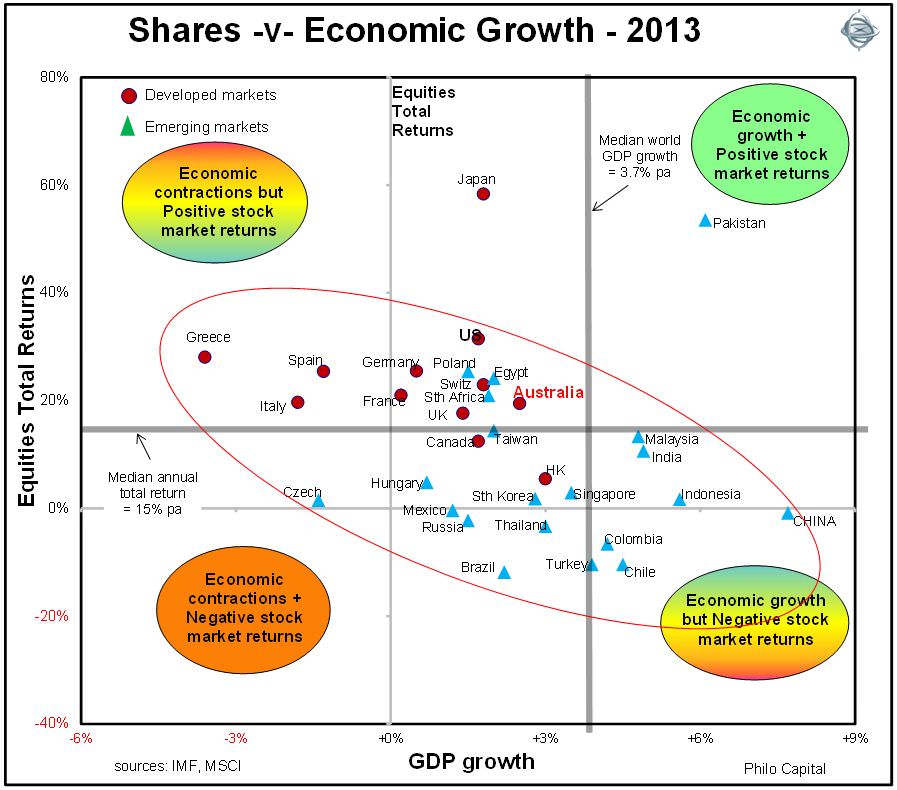

2013 was a repeat of this counter-intuitive pattern.

Aside from the two outliers, Pakistan and Japan (for peculiar local reasons), every other major country fell into a band that stretches from top left to bottom right on the chart, with poor economic growth and good stock market returns (top left segment), or good economic growth and poor stock market returns (bottom right segment).

Once again China enjoyed the highest economic growth rate but suffered negative equity returns. Greece, Spain and Italy suffered the deepest economic contractions but enjoyed high equity returns.

If economic growth and stock market returns were positively related, the band would extend from bottom left to top right, but this is not how it works in most years in the real world.

2014?

Today there is a widespread assumption that the outlook for 2014 for improving global growth to a historical average of around 3.6% should be positive for equity returns.

We do not assume that improving economic growth rates will lead to, be caused by, or accompany, good equity returns, as most market economists and equity market strategists do. Instead we view the current consensus outlooks for improving economic growth to around average or trend (ie healthy, or ‘normal’) global growth in 2014 more as a possible warning sign of poor returns.

It pays to think independently and study real world outcomes instead of blindly following convention, market myths and textbook theories.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund.