(This article was first published with the title: "Flurry of activity in primary bond markets").

Retail investors have ready access to the shares of over 2,000 companies listed on Australian securities exchanges (ASX and Chi-X) and can easily trade equities in small amounts through stockbrokers, including online execution. In contrast, most fixed interest securities are classified as ‘wholesale’ and are traded in the ‘over the counter’ (OTC) market through brokers, fixed interest dealers and institutions rather than on a listed exchange.

However, it is possible for some retail or non-professional investors to access OTC wholesale securities, which offer a wide range of credit qualities, structures, and maturities. In an era of low interest rates and uncertainty over COVID, more investors are seeking investments with a higher return. They are checking whether they are eligible to become certified as wholesale investors, as well as learning how bonds work. As investors look for greater portfolio diversity and stable fixed income options, fixed income investment solutions are more on the radar.

Generally, the definition of a wholesale investor in the Australian market is a person certified by a qualified accountant to have:

- A gross income of $250,000 or more per annum in each of the previous two years, or

- Net assets of at least $2.5 million.

Unlisted (OTC) primary issuance

October 2020 was a good example of the types of securities available in a busy month for primary markets. As well as secondary market trading in existing securities, the Bond income team was active in many initial bond offerings across a wide spectrum of fixed income, including ESG compliant/Green bonds, high-yield bonds and AAA-rated supranational and semi-government issuers. Issuers took advantage of favourable market conditions, whilst at the same time bringing forward transactions to avoid any complications around the U.S. election and typical late-November competition for capital before the holiday season lull.

Amongst the most popular for investors was the Lend Lease-certified Green Bond. The 7-year note (October 2027 maturity) priced with coupon of 3.40% was investment grade rated by both Moody’s and Fitch. The primary order book was greater $1 billion versus the total issue size of $500 million. As a result, the bonds have already appreciated in price to approximately $101.50, thus providing early capital gain performance for investors. Moreover, the large order book highlights the significant demand for ESG-compliant assets amongst a rapidly increasing pool of capital active in the ethical investment sector.

High-yield investors also took up the Bennelong Funds Management senior secured bonds with enthusiasm. The $25 million unrated deal sold quickly with investors attracted to the deal by the high 10% coupon and short term to maturity of three years. There was good brand recognition with Bennelong a highly-regarded fund manager in Australia. The high return offered to investors was a reflection of the two main risks – asset coverage and secondary market liquidity. The bonds were secured at the holding company level, not at the fund level. Thus, investors hold security over the underlying equity ownership of the funds not the assets of the fund. Moreover, given the issue size of just $25 million, liquidity before maturity will be limited.

ASX-listed diversified financial services company ClearView Wealth (ASX:CVW) issued its inaugural wholesale subordinated (Tier 2) floating rate note at 90d BBSW+6.00%. The bonds mature in November 2030 but are callable at the issuer’s discretion in November 2025. Despite the security rating below investment grade, lenders appreciated the APRA-regulated nature of the company and the relatively high initial margin, with a coupon which resets every 90 days.

Active listed hybrid issuance

The ASX-listed hybrid market was also busy with Challenger, Bendigo Bank, and Bank of Queensland all seeking regulatory capital via additional tier 1 issuance. The deeply subordinated hybrid securities offered investors franked coupons paid every 90 days. All three issues were also used to refinance existing hybrid securities.

Our research partners, BondAdviser, provides the following commentary:

- Bendigo and Adelaide Bank Limited (ASX:BEN) launched an offer for Bendigo and Adelaide Bank Capital Notes (ASX:BENPH) to raise $350 million, with the ability to raise more or less. The offer is accompanied by a Reinvestment Offer for holders of Bendigo and Adelaide Bank Convertible Preference Shares 2 (ASX:BENPE). The proceeds will be used to fund the redemption of BENPE and for general corporate purposes. It may also be used to fund the redemption of Bendigo and Adelaide Bank Convertible Preference Shares 3 (ASX:BENPF), which have a first call date on 15 June 2021. These securities are structured as unsecured, subordinated, perpetual convertible notes. Distributions are discretionary, non-cumulative, floating rate, expected to be fully franked and paid on a quarterly basis in arrears until converted or redeemed. The margin is guided at 3.80% to 4.00% p.a. above 90-day BBSW.

- Bank of Queensland Limited (ASX:BOQ) launched an offer for Bank of Queensland Capital Notes 2 (ASX:BOQPF), to raise $200 million, with the ability to raise more or less. These securities are structured as unsecured, subordinated, perpetual convertible notes. Distributions are expected to be discretionary, non-cumulative, floating rate, fully franked, and paid on a quarterly basis in arrears until converted or redeemed. The margin is guided at 3.80% to 4.00% p.a. above 90-day BBSW.

- Challenger Ltd (ASX:CGF) launched an offer for Challenger Capital Notes 3 (CCN3, ASX:CGFPC), to raise $250 million, with the ability to raise more or less. The offer is accompanied by a Reinvestment Offer and Repurchase Invitation for holders of the existing Capital Notes 1 (CCN1, ASX:CGFPA). These securities are perpetual, unsecured, convertible, redeemable, subordinated notes. The purpose of the transaction is to raise regulatory capital (Additional Tier 1) for Challenger Life Company Ltd (CLC). The margin is guided at 4.60% to 4.80% p.a. above 90-day BBSW and distributions are expected to be initially partially franked, floating rate, discretionary, non-cumulative, subject to Payment Conditions and paid on a quarterly basis in arrears.

This security has no fixed maturity date but is scheduled for mandatory conversion into CGF ordinary shares on 25 May 2028, or later when conversion conditions are satisfied. At the Issuer’s discretion, and subject to approval by APRA, the Notes may be redeemed or resold for cash or converted into CGF ordinary shares on 25 May 2026. The Notes may also be redeemed if a Tax or Regulatory Event occurs. The Notes will convert into CGF ordinary shares following an Acquisition Event, subject to conversion conditions.

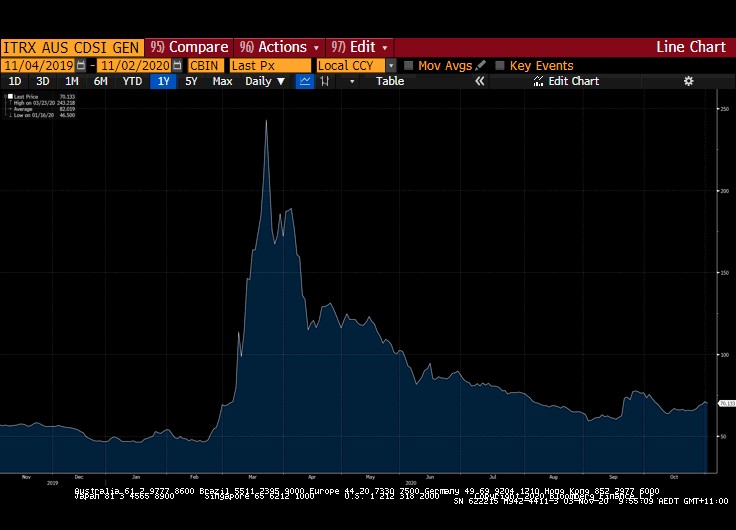

Despite the constant COVID-19 risks and potential market headwinds generated from the US election, credit markets have remained firm. The chart below is the Australian ITRAXX, an index of credit default swaps for the most liquid investment grade Australian bond issuers. The index is a proxy for the health of domestic credit or fixed income markets. The chart highlights the huge spike in perceived risk at the height of COVID-19 market panic, followed by a sustained recovery and subsequent narrowing of the average credit margins.

Moreover, Australian base interest rates are now incredibly low on a historical basis (10-year interbank swap rates range from 0.04% for 1 year to 0.77% for 10 years). The additional return provided by the credit margin in non-government bonds or floating rate notes means fixed income markets offer alternatives for eligible investors looking to boost overall portfolio returns.

Jon Lechte is Chief Executive Officer at Cashwerkz. Bond income, a sponsor of Firstlinks, provides access to fixed interest securities for wholesale investors (certified by their accountants) and eligible Australians including financial advisers with wholesale clients. Securities offered include global fixed income, OTC and listed debt securities and new issues from a broad suite of issuers (investment grade, sub-investment grade and non-rated issues).

For more articles and papers from Bond income, please click here.

Media Release

Alex Waislitz and Christian Baylis launch Fortlake Asset Management in partnership with Cashwerkz subsidiary, Fund Income

Sydney, 9 November 2020 – Former UBS senior executive, Christian Baylis and Alex Waislitz are joining forces to launch a new funds management business, Fortlake Asset Management, targeting institutions and retail investors with a range of fixed income funds. Fund Income, the fund incubation business, wholly owned by Cashwerkz (CWZ), through Trustees Australia Limited (TAL) will launch Fortlake Asset Management.

Fortlake Asset Management will be supported by J.P. Morgan, Tactical Global Management Limited (TGM) and Link Fund Solutions, amongst others, as we deliver a range of fixed income funds to market both within Australia and internationally.

Read more...